Capital Gains Tax Oregon

Capital gains tax is a significant aspect of personal finance and investment strategies, and it varies from state to state in the United States. In Oregon, the capital gains tax landscape is unique and offers some intriguing opportunities and considerations for investors and taxpayers alike. This comprehensive guide will delve into the specifics of capital gains tax in Oregon, providing an in-depth analysis of the laws, rates, exemptions, and strategies to help individuals make informed decisions regarding their investments and tax planning.

Understanding Capital Gains Tax in Oregon

Capital gains tax refers to the tax levied on the profits made from the sale of capital assets, such as stocks, bonds, real estate, or other investments. In Oregon, the treatment of capital gains differs from that of many other states, creating a unique tax environment for investors. Let’s explore the key aspects of capital gains tax in the Beaver State.

Capital Gains Tax Rates in Oregon

Oregon’s tax structure for capital gains is progressive, meaning the tax rate increases as the amount of capital gains rises. The state of Oregon currently has three tax brackets for capital gains, as outlined below:

| Tax Bracket | Tax Rate |

|---|---|

| Up to 6,950</td> <td>5.0%</td> </tr> <tr> <td>6,951 to 13,900</td> <td>6.0%</td> </tr> <tr> <td>Above 13,900 | 9.9% |

These rates are applied to the net capital gains, which are calculated by subtracting any eligible deductions and losses from the total capital gains. It's important to note that Oregon's capital gains tax brackets are separate from its regular income tax brackets, which can be found on the Oregon Department of Revenue website.

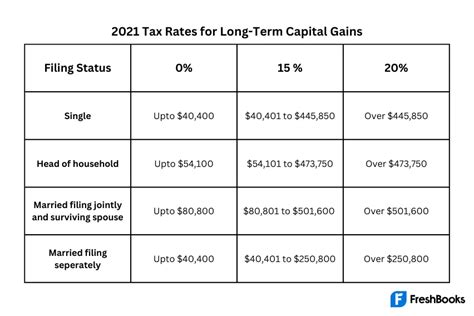

Long-Term vs. Short-Term Capital Gains

Similar to the federal tax system, Oregon distinguishes between long-term and short-term capital gains. Long-term capital gains are profits from assets held for over a year, while short-term capital gains are those from assets held for a year or less. The tax treatment for these two types of gains differs:

- Long-term capital gains benefit from a lower tax rate, which can make holding investments for the long term a more tax-efficient strategy.

- Short-term capital gains are taxed at the taxpayer’s regular income tax rate, which can be higher than the long-term capital gains rate.

Exemptions and Special Considerations

Oregon offers some exemptions and special provisions for certain types of capital gains. These include:

- Home Sales Exemption: Oregon allows a one-time exclusion of up to 250,000 in capital gains from the sale of a primary residence for single filers and 500,000 for married couples filing jointly. This exemption can provide significant tax savings for homeowners.

- Small Business Exemption: Capital gains from the sale of a small business may be exempt from tax if certain conditions are met. This exemption encourages entrepreneurship and supports small business owners.

- Farmland Exemption: Capital gains from the sale of farmland used for agricultural purposes can be exempt from tax under specific circumstances, promoting Oregon’s agricultural industry.

Strategies for Minimizing Capital Gains Tax in Oregon

Given the progressive nature of Oregon’s capital gains tax, investors can employ various strategies to minimize their tax liability. Here are some tactics to consider:

- Long-Term Holding: Holding investments for over a year can qualify for the lower long-term capital gains tax rate. This strategy is particularly beneficial for those with higher-value investments.

- Strategic Timing: Coordinating the timing of asset sales can help manage tax liability. Selling assets with lower gains when income is lower can reduce the overall tax rate.

- Tax Loss Harvesting: Offsetting capital gains with capital losses can reduce the overall tax liability. This strategy involves selling losing investments to balance out gains and minimize taxes.

- Retirement Account Strategies: Contributions to certain retirement accounts, such as IRAs or 401(k)s, can provide tax advantages. Gains within these accounts are typically tax-deferred or tax-free upon withdrawal, offering a significant tax benefit.

Real-World Example: Tax Implications of Investing in Oregon

Let’s consider a hypothetical scenario to illustrate the impact of Oregon’s capital gains tax. Imagine an investor, Jane, who purchased stocks worth 50,000 in 2020. Over the next three years, the stocks increased in value to 75,000. If Jane decides to sell the stocks in 2023, here’s how her capital gains tax would be calculated:

- Capital Gain: 75,000 (sale price) - 50,000 (purchase price) = 25,000.</li> <li>Tax Bracket: Jane's capital gain of 25,000 falls within the second tax bracket, which has a rate of 6.0%.

- Capital Gains Tax: 25,000 x 0.06 = 1,500.

So, Jane would owe $1,500 in capital gains tax on her investment profits. This example demonstrates how understanding the tax brackets and strategies can help investors manage their tax liability effectively.

Future Implications and Considerations

The capital gains tax landscape in Oregon is subject to change, influenced by political and economic factors. While the current tax structure provides certain advantages, it’s essential for investors to stay informed about potential tax law modifications. Here are some future considerations:

- Legislative Changes: Oregon’s legislature has the power to adjust tax rates and brackets, which could impact capital gains taxation. Staying updated on legislative discussions is crucial for tax planning.

- Inflation and Asset Values: Inflation can affect the value of investments over time. As asset values increase, so might the capital gains, which could push investors into higher tax brackets.

- Retirement Planning: For those approaching retirement, the tax implications of selling investments should be carefully considered. Strategies like tax-efficient withdrawal plans can help optimize retirement income.

Conclusion

Capital gains tax in Oregon presents a unique set of opportunities and challenges for investors. By understanding the tax rates, exemptions, and strategies, individuals can make informed decisions to minimize their tax liability and maximize their investment returns. Staying informed about tax laws and seeking professional advice can further enhance one’s financial planning and investment strategies in the dynamic world of Oregon’s capital gains taxation.

What is the difference between capital gains tax and regular income tax in Oregon?

+

Capital gains tax is specifically applied to profits from the sale of capital assets, while regular income tax is levied on various forms of income, including wages, salaries, and other earnings. Capital gains tax rates in Oregon are separate from regular income tax rates and are progressive, meaning they increase as the amount of capital gains rises.

Are there any strategies to reduce capital gains tax in Oregon?

+

Yes, several strategies can help reduce capital gains tax liability in Oregon. These include holding investments for over a year to qualify for the lower long-term capital gains tax rate, strategically timing asset sales, harvesting tax losses to offset gains, and utilizing tax-advantaged retirement accounts. Consulting a tax professional can provide tailored advice based on individual circumstances.

What are the current capital gains tax rates in Oregon for 2023?

+

As of 2023, Oregon has three tax brackets for capital gains: up to 6,950 (5.0% tax rate), 6,951 to 13,900 (6.0% tax rate), and above 13,900 (9.9% tax rate). These rates are subject to change, so it’s advisable to check the Oregon Department of Revenue website for the most current information.

Are there any exemptions or special provisions for capital gains in Oregon?

+

Yes, Oregon offers several exemptions and special provisions. These include a one-time exclusion for capital gains from the sale of a primary residence, an exemption for small business sales, and an exemption for the sale of farmland used for agricultural purposes. These provisions can significantly reduce tax liability for eligible taxpayers.

How does Oregon’s capital gains tax compare to other states?

+

Oregon’s capital gains tax structure is unique compared to many other states. While some states, like Washington, do not have a state-level capital gains tax, others have flat rates or more complex tax structures. Oregon’s progressive tax brackets and exemptions set it apart, offering both opportunities and challenges for investors.