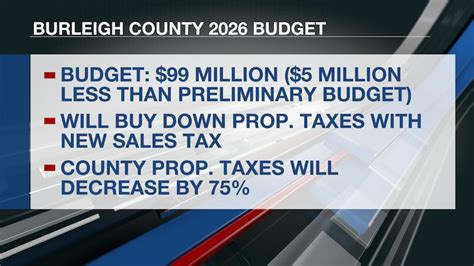

Burleigh County Property Tax

Property taxes are an essential component of local government revenue in the United States, playing a vital role in funding various public services and infrastructure. In Burleigh County, North Dakota, the property tax system is an intricate part of the county's financial framework. This article aims to provide a comprehensive understanding of Burleigh County's property tax system, its calculation, assessment, and the factors influencing property tax rates. We will delve into the processes, explore the latest data, and offer insights into the implications for property owners.

Understanding Burleigh County’s Property Tax Landscape

Burleigh County, located in the heart of North Dakota, boasts a diverse real estate market, ranging from rural properties to urban developments. The county’s property tax system is designed to ensure a fair and equitable distribution of tax burdens among its residents. Understanding this system is crucial for property owners, as it directly impacts their financial obligations and contributes to the county’s economic landscape.

The Role of Assessment and Taxation

Property taxes in Burleigh County are based on the assessed value of real estate properties. The process involves two key steps: assessment and taxation. Assessment is the first step, where the county’s tax assessor’s office determines the fair market value of each property. This value is then used as the basis for calculating the property tax.

The taxation process follows, where the assessed value is multiplied by the applicable tax rate. This tax rate is set by the county commission and is influenced by various factors, including the budget needs of the county and its various departments, such as education, public safety, and infrastructure development.

Tax Rates and Assessment Data

As of the latest tax year, Burleigh County’s residential properties are taxed at a rate of 1.34% of their assessed value. This rate is slightly lower than the statewide average, providing some relief to homeowners in the county. However, it’s important to note that the tax rate can vary depending on the property’s classification and location within the county.

For commercial properties, the tax rate stands at 1.85%, reflecting the higher value and revenue potential of these properties. The assessment data for the latest tax year shows a total assessed value of $3.2 billion for residential properties and $1.6 billion for commercial properties in Burleigh County.

| Property Type | Assessed Value (Billions) | Tax Rate (%) |

|---|---|---|

| Residential | 3.2 | 1.34 |

| Commercial | 1.6 | 1.85 |

The Assessment Process: A Step-by-Step Guide

The assessment process in Burleigh County is meticulous and involves several key steps to ensure accuracy and fairness. Here’s an overview:

- Data Collection: The tax assessor's office collects data on recent sales, property characteristics, and market trends to establish a comprehensive database.

- Property Inspection: Trained assessors conduct physical inspections of properties to verify their features and condition. This step ensures an accurate assessment of the property's value.

- Valuation Methods: Assessors use various valuation methods, such as the cost approach, income approach, and sales comparison approach, to determine the property's fair market value. These methods consider factors like replacement cost, rental income potential, and recent sales of comparable properties.

- Notice of Assessment: Property owners receive a notice of assessment, detailing the estimated value of their property. This notice provides an opportunity for property owners to review and appeal the assessment if they believe it is inaccurate.

- Appeal Process: Property owners can appeal their assessment if they have evidence that the value is incorrect. The appeal process involves a formal hearing where the property owner presents their case to an independent review board.

- Final Assessment: After the appeal process, the tax assessor's office issues a final assessment, which forms the basis for calculating the property tax.

Factors Influencing Property Tax Rates

Several factors contribute to the determination of property tax rates in Burleigh County. Understanding these factors provides insight into the economic and budgetary considerations of the county:

- Budget Requirements: The county commission sets the tax rate based on the county's budget needs. If the county requires additional funding for services or infrastructure projects, the tax rate may increase.

- Economic Factors: The state's economic health, including factors like employment rates, business growth, and population trends, can influence property values and, consequently, tax rates.

- Public Services: The cost of providing public services, such as education, public safety, and social services, plays a significant role in determining tax rates. These services require adequate funding to maintain their quality.

- Infrastructure Development: Investment in infrastructure, such as roads, bridges, and public facilities, is often funded through property taxes. Higher infrastructure development needs may result in higher tax rates.

- Tax Base Distribution: The distribution of the tax base across different property types and locations within the county can impact tax rates. If a significant portion of the tax base is concentrated in a specific area, that area may experience higher tax rates.

The Impact of Property Taxes on Residents

Property taxes are a significant financial obligation for residents of Burleigh County. The amount of property tax owed can impact a household’s budget and financial planning. Here’s how property taxes affect residents:

- Budget Planning: Property taxes are a recurring expense, typically due annually. Residents must consider these taxes when planning their household budgets and financial goals.

- Homeownership Costs: Property taxes are an additional cost of homeownership, alongside mortgage payments, maintenance, and insurance. These taxes contribute to the overall cost of owning a home.

- Tax Relief Programs: Burleigh County offers tax relief programs for eligible residents, such as the Property Tax Relief Program. These programs provide financial assistance to homeowners, reducing their tax burden.

- Community Investment: Property taxes contribute to the funding of essential community services and infrastructure. Residents can take pride in knowing that their taxes support the development and maintenance of their local community.

- Impact on Real Estate Market: Property taxes can influence the real estate market. High tax rates may deter potential buyers, while lower rates can make properties more attractive, impacting property values and the overall market.

Future Implications and Trends

Looking ahead, several factors could influence the future of property taxes in Burleigh County:

- Economic Growth: As the county experiences economic growth, property values may increase, leading to higher tax revenues. This growth could support the funding of additional public services and infrastructure projects.

- Population Trends: Population growth or decline can impact the tax base and, consequently, tax rates. A growing population may require increased funding for services, while a declining population could result in budget adjustments.

- Infrastructure Needs: The county's infrastructure requirements will continue to evolve. As new projects are proposed and existing infrastructure ages, property taxes may be adjusted to meet these needs.

- Tax Policy Changes: Changes in state or local tax policies could impact the calculation and distribution of property taxes. Property owners should stay informed about any potential policy changes that may affect their tax obligations.

Conclusion

Burleigh County’s property tax system is a complex yet essential mechanism for funding the county’s operations and services. Understanding this system, from assessment to taxation, empowers property owners to navigate their financial obligations and contribute to the county’s economic vitality. As the county continues to evolve, property taxes will remain a critical component of its financial framework, shaping the future of the community.

How often are property assessments conducted in Burleigh County?

+Property assessments in Burleigh County are conducted annually to ensure an up-to-date valuation of properties. This allows for accurate tax calculations and reflects any changes in the real estate market.

Can property owners appeal their assessment if they disagree with the value assigned to their property?

+Absolutely! Property owners have the right to appeal their assessment if they believe it is incorrect or inaccurate. The appeal process involves a formal hearing where they can present their case to an independent review board.

What are the potential consequences of not paying property taxes in Burleigh County?

+Failure to pay property taxes can result in significant penalties and interest. In extreme cases, it may lead to a tax lien being placed on the property, which could impact the owner’s ability to sell or transfer the property.

Are there any tax relief programs available for senior citizens or low-income residents in Burleigh County?

+Yes, Burleigh County offers tax relief programs to eligible residents, including the Property Tax Relief Program, which provides financial assistance to senior citizens and low-income homeowners. These programs aim to reduce the tax burden for vulnerable residents.

How can property owners stay informed about changes in tax rates and policies in Burleigh County?

+Property owners can stay informed by regularly checking the county’s official website, where updates and announcements regarding tax rates, assessment processes, and policy changes are posted. Additionally, local news outlets often cover tax-related matters.