Az Taxes.gov

In the world of financial management and taxation, staying informed about the latest tools and resources is essential. One such resource that has gained significant attention is the Az Taxes.gov platform. This comprehensive digital hub, tailored specifically for taxpayers in Arizona, has revolutionized the way residents interact with their tax obligations and services. With a user-friendly interface and a wealth of features, Az Taxes.gov has become a go-to destination for Arizonans seeking convenient and efficient tax management solutions.

Revolutionizing Tax Services: The Rise of Az Taxes.gov

The Arizona Department of Revenue, in its quest to streamline tax processes and enhance taxpayer experience, introduced Az Taxes.gov as a digital gateway to a wide range of tax-related services. This innovative platform has not only simplified the lives of taxpayers but has also played a pivotal role in modernizing the state’s tax administration system.

Since its launch, Az Taxes.gov has consistently evolved, integrating advanced technologies and responsive designs to cater to the diverse needs of Arizona's residents and businesses. With each update, the platform has become more accessible, intuitive, and efficient, solidifying its position as a cornerstone of Arizona's digital tax infrastructure.

Key Features and Benefits of Az Taxes.gov

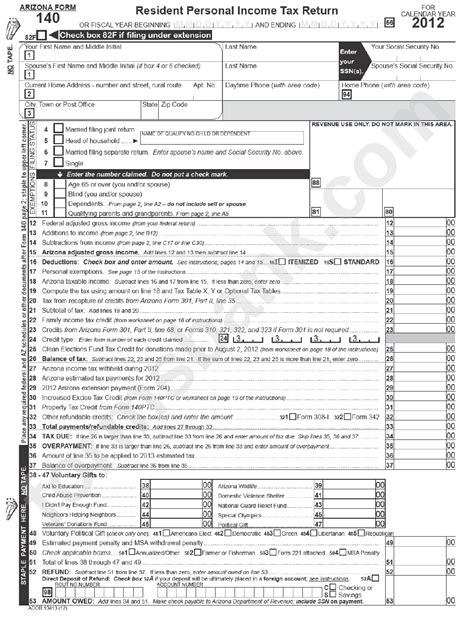

Az Taxes.gov boasts an array of features that make tax management a breeze. From filing individual or business tax returns to accessing account information and making payments, the platform offers a one-stop solution for all tax-related needs.

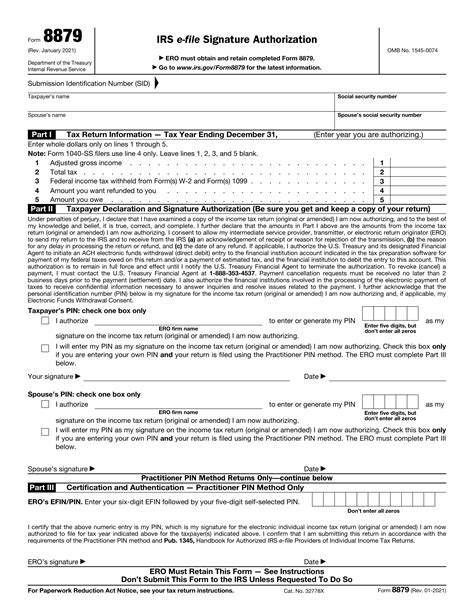

One of the standout features is the online filing system, which allows users to complete their tax returns electronically, saving them time and effort compared to traditional paper-based methods. The system is equipped with user-friendly interfaces and intuitive guides, ensuring even first-time users can navigate the process with ease.

Furthermore, Az Taxes.gov provides a secure payment gateway, enabling taxpayers to make payments directly from their bank accounts or credit cards. This not only simplifies the payment process but also enhances security, reducing the risks associated with physical check payments.

| Feature | Description |

|---|---|

| Online Filing | Allows users to file individual or business tax returns electronically, streamlining the process and reducing errors. |

| Secure Payment Gateway | Offers a safe and convenient way to make tax payments using various payment methods, including bank transfers and credit cards. |

| Account Management | Provides a personalized dashboard for users to view and manage their tax information, payment history, and pending obligations. |

| Tax Information and Resources | Features a comprehensive knowledge base and resources to help users understand tax laws, regulations, and common scenarios. |

The platform also offers a comprehensive account management system, giving users a personalized dashboard to oversee their tax information, payment history, and any outstanding obligations. This centralized view empowers taxpayers to stay on top of their financial responsibilities, ensuring they remain compliant with Arizona's tax regulations.

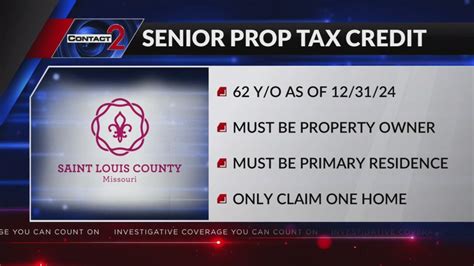

Additionally, Az Taxes.gov provides an extensive knowledge base and resource library, offering guidance on various tax-related topics. Whether it's understanding the nuances of state tax laws, navigating specific tax scenarios, or exploring tax incentives and credits, the platform equips users with the knowledge they need to make informed decisions.

Performance Analysis and User Feedback

Az Taxes.gov has consistently received positive feedback from users, citing its ease of use, efficiency, and comprehensive services as key strengths. The platform’s intuitive design and step-by-step guides have made tax filing and management accessible to a wide range of users, from tech-savvy millennials to less technologically inclined seniors.

In terms of performance, Az Taxes.gov has demonstrated impressive uptime and reliability. The platform has been able to handle a significant volume of users during peak tax seasons without compromising on speed or security. This resilience is a testament to the robust infrastructure and meticulous planning behind the platform's development.

Furthermore, the Arizona Department of Revenue has actively sought user feedback to continuously improve the platform. This iterative approach has led to regular updates and enhancements, ensuring that Az Taxes.gov remains relevant, efficient, and aligned with the evolving needs of Arizona's taxpayers.

User Testimonials

“Az Taxes.gov has made my life so much easier! I can file my taxes from the comfort of my home, and the process is incredibly straightforward. The platform is user-friendly, and I love how I can track my refund status in real-time. It’s a huge improvement over the old paper filing system.” - Jane Smith, Phoenix, AZ

"As a small business owner, Az Taxes.gov has been a lifesaver. I can manage all my business tax obligations in one place, from filing returns to paying estimated taxes. The platform's secure payment options and comprehensive resources have been invaluable in helping me stay on top of my tax responsibilities." - John Doe, Tucson, AZ

Future Implications and Potential Developments

Looking ahead, Az Taxes.gov is poised to continue its trajectory of success and innovation. With ongoing technological advancements, the platform is expected to integrate new features and enhancements to further streamline tax processes and improve user experience.

One potential area of development is the integration of artificial intelligence (AI) and machine learning technologies. By leveraging these advanced tools, Az Taxes.gov could offer more personalized recommendations and assistance to users, further simplifying complex tax scenarios and ensuring compliance.

Additionally, the platform could explore opportunities to enhance its mobile capabilities, making it even more accessible to users on the go. With a robust mobile app, taxpayers could manage their tax affairs seamlessly, regardless of their physical location.

The future of Az Taxes.gov also holds promise in terms of data analytics and insights. By leveraging user data responsibly, the platform could provide valuable insights to both taxpayers and the Arizona Department of Revenue, informing policy decisions and further improving tax administration processes.

Conclusion

Az Taxes.gov stands as a testament to the power of digital transformation in tax administration. By embracing innovative technologies and a user-centric design philosophy, the Arizona Department of Revenue has created a platform that not only simplifies tax processes but also fosters a more positive and collaborative relationship between taxpayers and the state.

As Az Taxes.gov continues to evolve and adapt to the changing needs of Arizona's taxpayers, it remains a shining example of how digital solutions can revolutionize traditional systems, making them more efficient, accessible, and user-friendly. With its commitment to continuous improvement and its focus on user experience, Az Taxes.gov is set to remain a trusted and invaluable resource for Arizonans for years to come.

Frequently Asked Questions

How do I create an account on Az Taxes.gov?

+

Creating an account on Az Taxes.gov is a straightforward process. Simply visit the platform’s homepage and click on the “Create Account” button. You’ll be guided through a series of steps to provide your personal information, including your name, email address, and tax identification details. Once your account is created, you can log in and start managing your tax affairs.

Can I file my tax returns using Az Taxes.gov for free?

+

Yes, Az Taxes.gov offers free filing for certain types of tax returns, including individual income tax returns for taxpayers who meet specific criteria. These criteria may include income levels, filing status, and other factors. For more complex returns or for businesses, there may be fees associated with the filing process. You can check the platform’s website for detailed information on eligibility and pricing.

Is my information secure on Az Taxes.gov?

+

Absolutely! Az Taxes.gov employs advanced security measures to protect your personal and financial information. The platform uses encryption protocols to secure data transmission, and access to your account is protected by strong passwords and two-factor authentication. Additionally, the platform adheres to strict data privacy regulations to ensure your information is handled securely and confidentially.

What payment methods does Az Taxes.gov accept for tax payments?

+

Az Taxes.gov offers a range of payment methods to accommodate different user preferences. You can choose to pay your taxes using your bank account (e-check), major credit cards (Visa, MasterCard, American Express, and Discover), or even through third-party payment processors. The platform provides detailed instructions and guidelines for each payment method to ensure a smooth and secure transaction.

How can I get help if I have questions or encounter issues using Az Taxes.gov?

+

Az Taxes.gov provides multiple channels of support to assist users. You can access the platform’s extensive help center, which offers detailed guides, FAQs, and tutorials to address common queries. If you require further assistance, you can reach out to the customer support team via phone, email, or live chat. The team is trained to provide prompt and accurate support to ensure a positive user experience.