Ct State Income Tax Calculator

Welcome to this comprehensive guide on the Connecticut State Income Tax Calculator, an essential tool for residents and taxpayers in the Nutmeg State. In this article, we will delve into the intricacies of Connecticut's income tax system, providing you with an in-depth understanding of how to calculate your state income tax liability accurately. Whether you're a new resident or a seasoned taxpayer, this guide will equip you with the knowledge and tools to navigate the tax landscape with confidence.

Understanding Connecticut’s Income Tax Structure

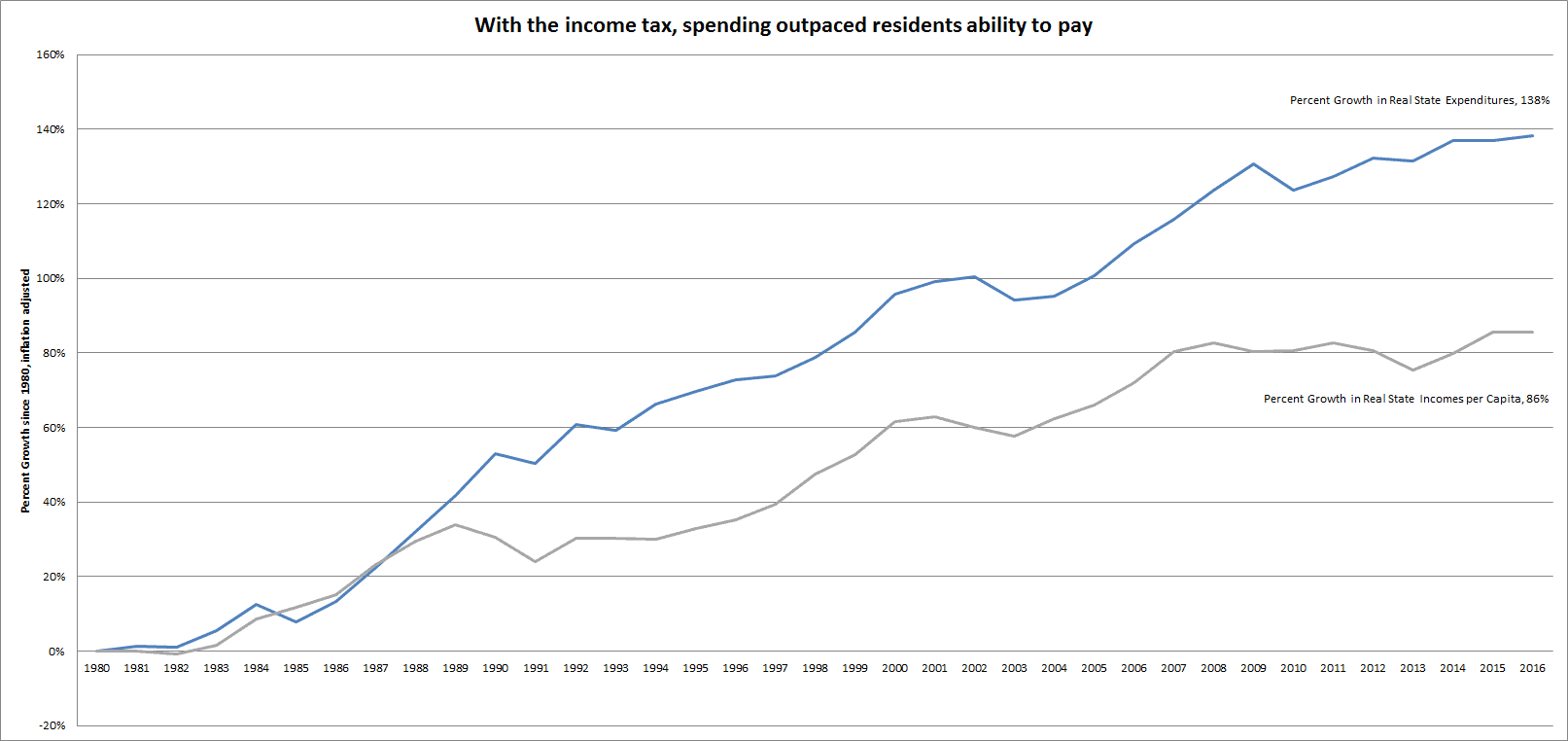

Connecticut’s income tax system is designed to generate revenue for the state’s operations and services. It is a progressive tax system, meaning that as your income increases, so does your tax rate. This ensures that higher-income earners contribute a larger share of their income to the state’s coffers.

The state income tax is levied on various sources of income, including wages, salaries, bonuses, commissions, interest, dividends, and capital gains. Connecticut residents are required to file an annual income tax return and pay any taxes owed by the deadline. Non-residents who earn income within the state also have tax obligations, which we will explore in detail.

To calculate your Connecticut state income tax, you need to consider several factors, including your filing status, income level, deductions, and credits. Let's break down each of these components to ensure a thorough understanding.

Determining Your Filing Status

Your filing status is a crucial factor in determining your tax liability. Connecticut recognizes the following filing statuses:

- Single: Applicable to individuals who are not married or legally separated.

- Married Filing Jointly: For married couples who choose to file a joint return.

- Married Filing Separately: When married couples choose to file separate returns.

- Head of Household: For taxpayers who maintain a household for a qualifying person, such as a dependent child or relative.

- Qualifying Widow(er): A status for individuals who have lost their spouse and have a dependent child or relative.

The filing status you choose can significantly impact your tax liability, as it determines your tax rates and standard deductions. It's essential to understand the qualifications for each status and choose the one that best reflects your personal situation.

Income Tax Rates and Brackets

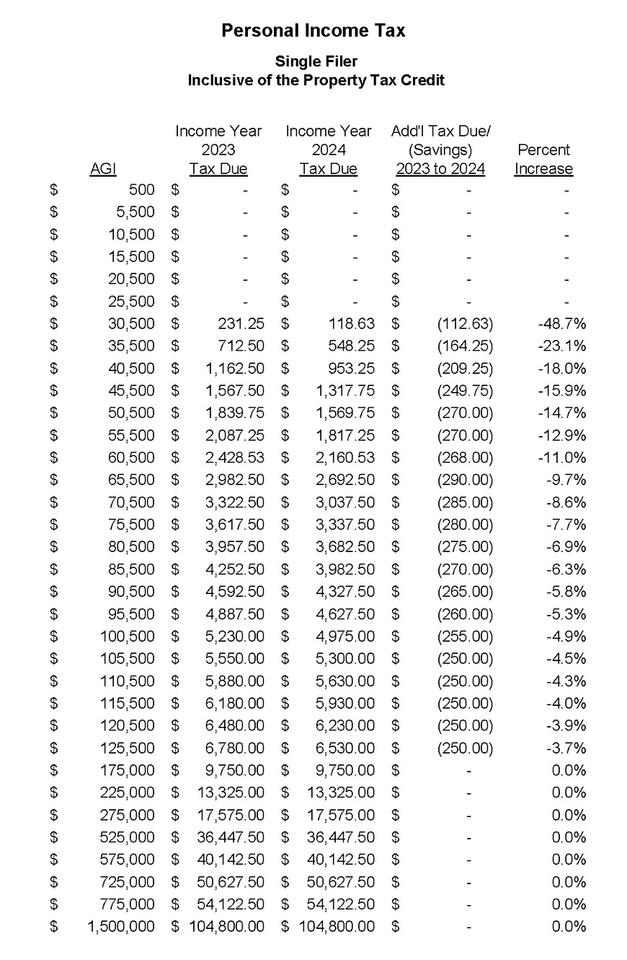

Connecticut has a progressive income tax structure with six tax brackets, each corresponding to a specific range of taxable income. The tax rates increase as your income rises, ensuring a fair and equitable tax system. As of the 2023 tax year, the income tax rates are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| Up to $10,000 | 3.07% |

| $10,001 - $50,000 | 5.00% |

| $50,001 - $100,000 | 5.50% |

| $100,001 - $200,000 | 6.35% |

| $200,001 - $250,000 | 6.70% |

| Over $250,000 | 6.99% |

These tax rates are applied to your taxable income, which is your total income minus any applicable deductions and exemptions.

Calculating Taxable Income

To determine your taxable income, you need to subtract certain deductions and exemptions from your gross income. Connecticut offers various deductions and credits that can reduce your taxable income, thereby lowering your tax liability.

Some common deductions include:

- Standard Deduction: This is a fixed amount that you can deduct from your taxable income based on your filing status. For the 2023 tax year, the standard deductions are as follows:

- Single: $2,800

- Married Filing Jointly: $5,600

- Married Filing Separately: $2,800

- Head of Household: $4,200

- Itemized Deductions: You may choose to itemize your deductions if they exceed the standard deduction. Itemized deductions include expenses such as mortgage interest, charitable contributions, state and local taxes, and medical expenses.

- Personal Exemptions: Connecticut allows personal exemptions for yourself and each dependent you claim. The personal exemption amount for the 2023 tax year is $2,200 per person.

By subtracting these deductions and exemptions from your gross income, you arrive at your taxable income, which is then subject to the applicable tax rates based on the tax brackets.

Calculating Your Connecticut State Income Tax

Now that we’ve covered the essential components of Connecticut’s income tax system, let’s walk through the steps to calculate your state income tax liability:

- Determine Your Gross Income: Start by calculating your total income from all sources, including wages, salaries, business income, interest, dividends, and capital gains.

- Subtract Deductions and Exemptions: Deduct the standard deduction or itemized deductions (whichever is greater), as well as personal exemptions, from your gross income to arrive at your taxable income.

- Apply Tax Rates: Use the tax rates and brackets mentioned earlier to calculate the tax amount for each bracket your income falls into. Add these amounts together to determine your total tax liability.

- Consider Tax Credits: Connecticut offers various tax credits that can further reduce your tax liability. These credits may be based on factors such as income level, dependency status, or specific circumstances. Common credits include the Low-Income Earned Income Tax Credit, Property Tax Credit, and Child and Dependent Care Credit.

- Calculate Final Tax Liability: Subtract any applicable tax credits from your total tax liability to determine your final state income tax amount. This is the amount you will owe to the Connecticut Department of Revenue Services (CT DRS) by the tax filing deadline.

Using the Connecticut State Income Tax Calculator

To simplify the process of calculating your state income tax, you can utilize the official Connecticut State Income Tax Calculator provided by the CT DRS. This online tool allows you to input your personal information, income details, deductions, and credits to estimate your tax liability accurately. Here’s how to use it:

- Visit the Connecticut State Income Tax Calculator on the CT DRS website.

- Enter your filing status, gross income, and any applicable deductions and credits.

- The calculator will automatically apply the appropriate tax rates and calculate your estimated tax liability.

- Review the results and ensure that all information is accurate and up-to-date.

- Use the estimated tax amount as a guide for planning your tax payments or refunds.

The Connecticut State Income Tax Calculator is a valuable resource for taxpayers, providing an efficient and accurate way to estimate their tax obligations. However, it's essential to note that this calculator is an estimation tool, and your actual tax liability may vary based on your specific circumstances and any changes in tax laws.

Tax Planning and Strategies

Understanding how to calculate your Connecticut state income tax is the first step toward effective tax planning. By being aware of your tax obligations and utilizing available deductions and credits, you can minimize your tax liability and maximize your financial well-being.

Here are some tax planning strategies to consider:

- Maximize Deductions: Review your expenses and deductions to ensure you're taking advantage of all eligible deductions. Consider contributing to tax-deductible retirement accounts, such as a 401(k) or IRA, to reduce your taxable income.

- Explore Tax Credits: Research and understand the various tax credits offered by Connecticut. Some credits, like the Low-Income Earned Income Tax Credit, can provide significant tax savings for eligible taxpayers.

- Optimize Your Filing Status: Choose the filing status that best suits your situation. If you're married, consider the benefits of filing jointly or separately based on your income and deductions.

- Stay Informed: Keep up-to-date with changes in Connecticut's tax laws and regulations. The state may introduce new deductions, credits, or tax breaks that can impact your tax liability.

By staying proactive and informed, you can make strategic decisions to optimize your tax situation and potentially reduce your state income tax burden.

Filing Your Connecticut State Income Tax Return

Once you’ve calculated your state income tax liability, it’s time to file your tax return with the CT DRS. Here’s a step-by-step guide to ensure a smooth filing process:

- Gather Your Documents: Collect all necessary documents, including W-2 forms, 1099 forms, receipts for deductions and credits, and any other relevant income and expense records.

- Choose Your Filing Method: Connecticut offers various filing options, including paper returns, e-filing through the CT DRS website, or using tax preparation software. Select the method that suits your preferences and comfort level.

- Complete Your Return: Fill out your tax return accurately and completely. Double-check all calculations and ensure that your income, deductions, and credits are correctly reported.

- Review and Sign: Carefully review your completed return to ensure there are no errors or omissions. Sign and date the return as required.

- Submit Your Return: If filing a paper return, mail it to the address provided by the CT DRS. If e-filing, follow the instructions on the CT DRS website or tax software. Ensure you meet the filing deadline to avoid penalties.

- Pay Any Taxes Owed: If you owe taxes, include payment with your return or set up a payment plan with the CT DRS. Consider using electronic payment methods for convenience and accuracy.

Filing your state income tax return accurately and on time is essential to maintain compliance with Connecticut's tax laws. By following these steps and utilizing the resources provided by the CT DRS, you can navigate the filing process with confidence.

Conclusion: Empowering Connecticut Taxpayers

The Connecticut State Income Tax Calculator is a powerful tool that empowers taxpayers to understand and manage their state income tax obligations. By providing an in-depth guide to calculating your tax liability, this article aims to demystify the process and equip you with the knowledge to make informed financial decisions.

Remember, effective tax planning involves staying informed, maximizing deductions and credits, and seeking professional advice when needed. By leveraging the insights and strategies outlined in this guide, you can optimize your tax situation and ensure compliance with Connecticut's tax laws.

As you navigate the complexities of state income taxes, keep in mind that knowledge is power. With a clear understanding of Connecticut's tax system and the tools at your disposal, you can make the most of your financial situation and plan for a secure future.

How often do I need to update my state income tax calculations?

+It’s recommended to update your state income tax calculations annually, as tax laws and regulations may change from year to year. By staying up-to-date, you can ensure accurate tax planning and filing.

Can I claim dependents on my Connecticut state income tax return?

+Yes, you can claim dependents on your Connecticut state income tax return. Dependents can include qualifying children, parents, or other relatives who meet the dependency criteria. Claiming dependents may provide tax benefits, such as personal exemptions and tax credits.

What happens if I overpay my state income taxes?

+If you overpay your state income taxes, you are entitled to a refund. The CT DRS will process your refund and issue it to you via your preferred method of payment, such as direct deposit or a check.

Are there any tax incentives for investing in Connecticut businesses?

+Connecticut offers various tax incentives to encourage business investment and growth. These incentives may include tax credits, deductions, or reduced tax rates for specific industries or business activities. It’s recommended to consult with a tax professional or refer to the CT DRS website for the latest information on business tax incentives.