Austin Texas Real Estate Taxes

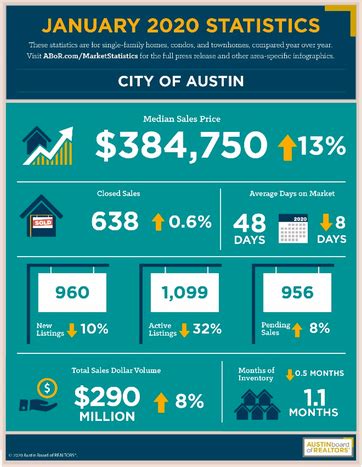

Welcome to the vibrant city of Austin, Texas, a thriving hub known for its unique blend of music, technology, and a laid-back lifestyle. As one of the fastest-growing cities in the United States, Austin has become an attractive destination for businesses, entrepreneurs, and individuals seeking a high quality of life. With its vibrant culture, thriving economy, and diverse range of neighborhoods, Austin offers something for everyone. However, as the city continues to grow, so does the importance of understanding the real estate landscape, particularly when it comes to taxes.

Real estate taxes in Austin play a crucial role in shaping the city's financial framework and contributing to the overall development of the community. These taxes are an essential component of the city's revenue stream, funding essential services, infrastructure, and initiatives that enhance the quality of life for residents and businesses alike. In this comprehensive guide, we will delve into the intricacies of Austin's real estate taxes, providing you with an in-depth understanding of the tax system, its impact, and its implications for property owners and prospective buyers.

Understanding Austin's Real Estate Tax Structure

The real estate tax system in Austin operates on a comprehensive and transparent framework, ensuring fairness and consistency for property owners. This system is designed to generate revenue for the city and its various entities, including the local government, schools, and other essential services.

Real estate taxes in Austin are calculated based on the appraised value of a property, which is determined by the Travis County Appraisal District (TCAD) or the Central Appraisal District of Hays County (CADHC), depending on the location of the property. These appraisal districts are responsible for assessing the market value of properties within their respective jurisdictions, considering factors such as location, size, improvements, and market trends.

The appraised value serves as the basis for calculating the tax liability for each property. The tax rate, which is set by the local taxing authorities, is applied to the appraised value to determine the annual tax amount. It's important to note that the tax rate can vary depending on the specific taxing entity and the services it provides. Austin, being situated in both Travis and Hays counties, may have slightly different tax rates for properties within these counties.

Key Taxing Entities in Austin

Austin is served by various taxing entities, each with its own role and responsibility in providing essential services to the community. These entities include:

- City of Austin: The city government collects taxes to fund a wide range of services, such as public safety, transportation, parks and recreation, and economic development initiatives.

- Travis County: Travis County taxes support county-wide services like law enforcement, courts, and road maintenance.

- Independent School Districts (ISDs): Each ISD, such as the Austin Independent School District (AISD) or Hays Consolidated Independent School District (HCISD), levies taxes to fund public education within their respective boundaries.

- Special Districts: These entities provide specialized services like water, wastewater, or utility services, and their taxes support the maintenance and operation of these infrastructure projects.

Each of these taxing entities has its own tax rate, which is determined through a public budgeting process. The tax rates are set annually and are subject to public scrutiny and approval. Property owners can find the specific tax rates for their property by referring to their annual tax statement or by contacting the respective taxing authority.

Tax Rates and Calculations

The tax rates in Austin vary depending on the taxing entity and the services they provide. As of the most recent tax year, the effective tax rates for different entities within Austin were as follows:

| Taxing Entity | Effective Tax Rate (per $100 of Appraised Value) |

|---|---|

| City of Austin | 0.3780 |

| Travis County | 0.3299 |

| Austin Independent School District (AISD) | 1.4529 |

| Hays Consolidated Independent School District (HCISD) | 1.3469 |

| Other Special Districts (e.g., Water, Utility) | Varies based on the specific district |

It's important to note that these tax rates are subject to change each year, and property owners should refer to the official tax rates published by the respective taxing authorities for the most up-to-date information.

To calculate the annual real estate tax liability for a property, the following formula is used:

Annual Tax Amount = Appraised Value x Tax Rate

For example, let's consider a residential property in Austin with an appraised value of $400,000. Using the effective tax rates mentioned above, we can calculate the annual tax liability as follows:

- City of Austin: $400,000 x 0.3780 = $151,200

- Travis County: $400,000 x 0.3299 = $131,960

- Austin Independent School District (AISD): $400,000 x 1.4529 = $581,160

- Total Annual Tax Liability: $151,200 + $131,960 + $581,160 = $864,320

Please note that this is a simplified example, and in reality, the calculation may involve additional factors such as exemptions, special assessments, or other tax incentives. Property owners should consult with their tax professionals or the respective taxing authorities for a precise understanding of their tax liability.

Tax Exemptions and Incentives

Austin, like many other cities, offers various tax exemptions and incentives to eligible property owners. These exemptions and incentives are designed to provide relief to certain segments of the population or to encourage specific types of development.

Common Tax Exemptions in Austin

- Homestead Exemption: Property owners who use their property as their primary residence can apply for a homestead exemption, which reduces the taxable value of their property. The exemption amount varies depending on the taxing entity, but it typically ranges from $25,000 to $50,000.

- Senior Citizen Exemption: Senior citizens aged 65 or older who meet certain income and residency requirements may qualify for a partial or total exemption from real estate taxes. The exemption amount is determined by the taxing authority and can significantly reduce the tax burden for eligible seniors.

- Disability Exemption: Individuals with disabilities may be eligible for a disability exemption, which reduces the taxable value of their property. The criteria and exemption amount vary depending on the taxing entity.

- Veterans' Exemption: Qualified veterans and their surviving spouses may be entitled to a veterans' exemption, which provides a reduction in the taxable value of their property. The exemption amount and eligibility criteria are set by the state and local taxing authorities.

To claim these exemptions, property owners must complete the necessary paperwork and provide the required documentation to the respective taxing authority. It's important to note that exemptions are not automatic, and property owners must apply for them annually or as required by the taxing entity.

Incentive Programs

In addition to exemptions, Austin offers various incentive programs to encourage specific types of development and support economic growth. These programs may include tax abatements, tax increment financing (TIF), or other incentives aimed at attracting businesses, promoting affordable housing, or revitalizing specific areas of the city.

For example, the City of Austin has implemented the Property Tax Abatement Program, which offers reduced tax rates to qualifying businesses that create new jobs, invest in capital improvements, or develop within targeted areas of the city. This program aims to stimulate economic development and encourage business growth.

Similarly, the Affordable Housing Program provides tax incentives to developers who create or preserve affordable housing units. This program helps address the city's housing needs and promotes equitable development.

Property owners and businesses interested in these incentive programs should consult with the relevant taxing authorities or economic development offices to understand the eligibility criteria and application process.

Impact of Real Estate Taxes on Property Owners

Real estate taxes in Austin can have a significant impact on property owners, both financially and in terms of their overall property ownership experience. Understanding the tax implications is crucial for making informed decisions about purchasing, owning, and managing real estate in the city.

Financial Considerations

The annual real estate tax liability can represent a substantial expense for property owners. It's essential to factor in these taxes when budgeting for property ownership. For example, a homeowner with a mortgage may need to include the annual tax amount in their monthly mortgage payment, as many lenders require property taxes to be escrowed.

Additionally, property owners should be aware of any changes in tax rates or appraised values, as these can impact their tax liability from year to year. Staying informed about tax assessments and understanding the appeal process can help property owners manage their tax obligations effectively.

Property Ownership Experience

Real estate taxes in Austin can influence various aspects of the property ownership experience. For instance, the tax burden can affect the affordability of owning a home or investing in real estate. Higher tax rates may make it more challenging for first-time homebuyers or investors to enter the market.

On the other hand, tax incentives and exemptions can make property ownership more accessible and appealing. Programs like the homestead exemption or senior citizen exemption can provide significant savings for eligible property owners, making it more feasible to own a home in Austin.

Furthermore, real estate taxes can impact the overall financial health of a property. For investors, the tax liability can influence the profitability of their real estate ventures. It's crucial to consider the tax implications when evaluating investment opportunities and creating financial projections.

Real Estate Taxes and the Austin Market

Real estate taxes in Austin are closely intertwined with the city's vibrant real estate market. As Austin continues to experience rapid growth and development, the tax landscape plays a vital role in shaping the market dynamics and influencing property values.

Impact on Property Values

Real estate taxes can have a direct impact on property values in Austin. When tax rates are relatively low and stable, it can contribute to a more favorable environment for property appreciation. Buyers and investors may perceive lower tax burdens as an advantage, making properties more attractive and potentially driving up demand.

Conversely, significant increases in tax rates or unexpected changes in appraised values can impact property values negatively. High tax liabilities may deter potential buyers or investors, especially in a competitive market where affordability is a key consideration.

Market Dynamics and Tax Considerations

When evaluating the Austin real estate market, prospective buyers and investors should consider the tax implications alongside other market factors. Understanding the tax landscape can provide valuable insights into the overall affordability and long-term prospects of a property.

For instance, properties located in areas with lower tax rates or eligible for tax incentives may offer better value propositions. On the other hand, properties in high-demand neighborhoods with higher tax rates may require a more careful analysis of the tax liability to ensure it aligns with the buyer's financial goals.

Additionally, the tax implications can influence the timing of real estate transactions. Buyers and investors may consider the tax year when making purchase decisions, especially if they are eligible for exemptions or tax incentives. Planning purchases around tax deadlines or taking advantage of tax benefits can be a strategic move in the Austin real estate market.

Future Outlook and Implications

As Austin continues to evolve and grow, the real estate tax landscape is likely to experience changes and adaptations. Understanding the future implications of real estate taxes is essential for property owners, buyers, and investors to make informed decisions and navigate the market effectively.

Potential Changes and Adjustments

The real estate tax system in Austin is subject to ongoing review and adjustments. As the city's needs and priorities evolve, taxing authorities may propose changes to tax rates, exemptions, or incentive programs. These changes can be driven by various factors, including economic conditions, infrastructure development, or shifts in the housing market.

For instance, if the city faces budget constraints or increased demand for services, taxing authorities may consider raising tax rates to generate additional revenue. Conversely, if the city aims to stimulate economic growth or address specific development goals, it may introduce new incentive programs or expand existing ones.

Property owners and market participants should stay informed about any proposed changes to the tax system. Monitoring local news, attending public hearings, and engaging with community leaders can provide valuable insights into the potential future directions of real estate taxes in Austin.

Long-Term Implications for Property Owners

The long-term implications of real estate taxes can significantly impact property ownership in Austin. Property owners should consider the potential for tax rate increases, changes in tax incentives, or shifts in the tax assessment process when making long-term plans.

For example, if tax rates were to increase significantly over time, it could impact the affordability of owning a home or managing investment properties. Property owners may need to adjust their financial strategies or consider alternative options to mitigate the impact of higher tax liabilities.

On the other hand, stable or decreasing tax rates, coupled with effective tax incentive programs, can create a more favorable environment for property ownership. This can encourage long-term investment, promote homeownership, and support the overall stability of the real estate market.

Conclusion

Understanding Austin's real estate tax system is crucial for property owners, buyers, and investors alike. The tax landscape in Austin plays a pivotal role in shaping the city's financial framework, influencing property values, and impacting the overall real estate market dynamics.

By comprehending the tax structure, rates, and exemptions, individuals can make informed decisions about purchasing, owning, and managing real estate in Austin. Whether it's calculating tax liabilities, exploring tax incentives, or considering the long-term implications, a thorough understanding of real estate taxes is essential for success in the Austin market.

As Austin continues to thrive and evolve, staying informed about the tax landscape will remain a key factor in navigating the real estate market with confidence and making strategic decisions that align with personal and financial goals.

How often do real estate tax rates change in Austin?

+

Real estate tax rates in Austin can change annually. Each taxing entity, such as the City of Austin or the Independent School Districts, sets its tax rate through a public budgeting process. Property owners should refer to the official tax rates published by the respective taxing authorities for the most current information.

Are there any tax incentives for new construction or renovations in Austin?

+

Yes, Austin offers various tax incentive programs to encourage economic development and specific types of projects. For instance, the Property Tax Abatement Program provides reduced tax rates for qualifying businesses that create new jobs or invest in capital improvements. Property owners and developers should consult with the relevant taxing authorities or economic development offices to explore these incentives.

How can I appeal my property’s appraised value if I disagree with it?

+

If you believe your property’s appraised value is inaccurate, you have the right to appeal. The process typically involves submitting an appeal to the appropriate appraisal district (TCAD or CADHC) within a specified timeframe. It’s important to gather evidence and documentation to support your case. The appraisal district will review your appeal and make a determination.

What happens if I don’t pay my real estate taxes on time in Austin?

+

Failure to pay real estate taxes on time in Austin can result in penalties, interest, and potential legal consequences. Taxing authorities may impose late fees, and if the taxes remain unpaid, the property could be subject to a tax lien or even foreclosure. It’s crucial to stay on top of your tax obligations and seek assistance if you encounter financial difficulties.