Arizona Sales Tax Automobiles

The state of Arizona imposes sales tax on various goods and services, including the purchase of automobiles. This sales tax applies to both new and used vehicles, ensuring that every vehicle purchase contributes to the state's revenue. The Arizona Department of Revenue is responsible for administering and collecting these taxes, which play a crucial role in funding public services and infrastructure projects across the state.

Understanding Arizona’s Sales Tax on Automobiles

In Arizona, the sales tax rate for automobiles is determined by the location of the vehicle’s delivery or the location of the seller, whichever is applicable. The tax rate is a percentage of the purchase price, including any optional equipment, sales, and advertising fees, but excluding trade-in allowances and other discounts. It’s important to note that the sales tax rate can vary depending on the specific county or city where the vehicle is purchased.

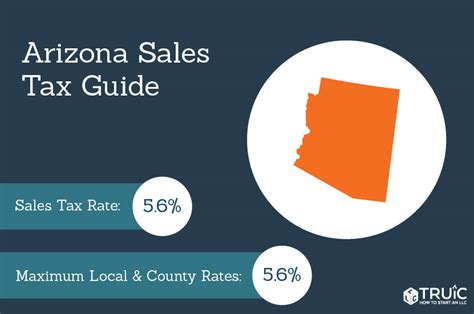

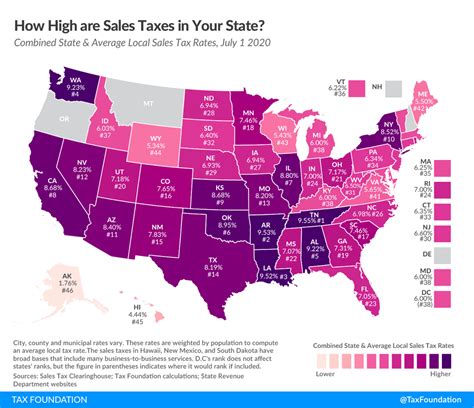

For instance, the state sales tax rate in Arizona is currently set at 5.6%, but when combined with additional local taxes, the total sales tax rate can range from approximately 6.6% to 10.75% depending on the location. These local taxes often include county taxes, municipal taxes, and other special district taxes. As a result, the sales tax rate on automobiles can significantly impact the final purchase price.

Here's a breakdown of the sales tax rates in some major cities in Arizona:

| City | Total Sales Tax Rate |

|---|---|

| Phoenix | 8.1% |

| Tucson | 7.1% |

| Mesa | 7.1% |

| Scottsdale | 8.1% |

| Tempe | 8.1% |

These rates are subject to change, so it's advisable to check the latest tax rates before making a significant vehicle purchase. The state of Arizona provides an online Tax Rate Finder tool, which can be utilized to determine the applicable sales tax rate for a specific location.

Exemptions and Special Cases

While most automobile purchases in Arizona are subject to sales tax, there are certain exemptions and special cases to be aware of. For instance, purchases made by qualified tax-exempt organizations, such as government entities, charitable organizations, and certain educational institutions, may be exempt from sales tax.

Additionally, Arizona offers a Military Exemption for active-duty military personnel stationed in the state. This exemption applies to the purchase of a new vehicle, provided the vehicle is registered in Arizona and the active-duty service member presents a valid military ID. However, it's important to note that this exemption does not cover sales tax on used vehicles or lease transactions.

Another special case involves the Trade-In Allowance. When trading in an old vehicle as part of a new purchase, the trade-in allowance is deducted from the total purchase price before calculating the sales tax. This can significantly reduce the overall sales tax liability.

Sales Tax on Out-of-State Purchases

For Arizona residents who purchase a vehicle out of state, the state’s Use Tax comes into play. The use tax is designed to ensure that Arizona residents pay taxes on vehicles purchased in another state but registered and used in Arizona. The use tax rate is the same as the sales tax rate in the county where the vehicle is registered.

When registering an out-of-state vehicle in Arizona, the owner must declare the purchase price and any applicable taxes paid in the other state. If the out-of-state taxes paid are less than the Arizona sales tax rate, the difference is due as use tax. This process helps to ensure fairness and consistency in tax collection, regardless of where the vehicle is purchased.

Calculating Use Tax

To calculate the use tax, the purchaser must determine the Vehicle’s Base Price, which includes the cost of the vehicle, any optional equipment, and sales or advertising fees. Trade-in allowances and discounts are excluded from the base price. The use tax is then calculated as a percentage of this base price, using the applicable sales tax rate for the county of registration.

For example, if an Arizona resident purchases a vehicle in California for $30,000, and the base price (after trade-in and discounts) is $28,000, the use tax would be calculated as follows:

- Base Price: $28,000

- Sales Tax Rate (for the county of registration): 7.1%

- Use Tax: $28,000 x 7.1% = $1,968

In this scenario, the Arizona resident would owe $1,968 in use tax when registering the vehicle in Arizona.

Impact of Sales Tax on Automobile Transactions

The sales tax on automobile purchases in Arizona can have a significant impact on both buyers and sellers. For buyers, the tax can represent a substantial addition to the purchase price, especially in counties with higher tax rates. It’s important for buyers to factor in the sales tax when budgeting for a vehicle purchase.

For sellers, the sales tax is an essential consideration when pricing vehicles. Including the sales tax in the advertised price can make the vehicle more appealing to buyers who may not be familiar with the local tax rates. Additionally, sellers should ensure that they accurately collect and remit the sales tax to the Arizona Department of Revenue to avoid penalties and legal issues.

Strategies for Buyers

When purchasing a vehicle in Arizona, buyers can employ several strategies to navigate the sales tax landscape. Firstly, it’s beneficial to research the applicable sales tax rate in the county or city where the purchase will be made. This information can be obtained from the Arizona Department of Revenue’s website or by contacting the local tax office.

Additionally, buyers can negotiate the sales price of the vehicle to account for the sales tax. By discussing the tax as a separate item in the transaction, buyers can potentially secure a better deal on the vehicle's base price, which can offset the impact of the sales tax. It's important to note, however, that dealers have some flexibility in pricing, but they must still charge the correct sales tax rate.

Sellers’ Responsibilities

Sellers of automobiles in Arizona have a responsibility to collect and remit the correct sales tax. This process involves obtaining the buyer’s information, including their name, address, and driver’s license number, as well as calculating the sales tax based on the vehicle’s purchase price and the applicable tax rate.

Sellers should provide a clear breakdown of the sales tax on the purchase invoice or contract. This transparency helps to build trust with the buyer and ensures that both parties understand the final cost of the transaction. It's also crucial for sellers to stay informed about any changes in tax rates or regulations to avoid non-compliance issues.

Conclusion

Arizona’s sales tax on automobiles is a significant aspect of vehicle purchases in the state. Buyers and sellers must understand the applicable tax rates and regulations to ensure a smooth and compliant transaction. By staying informed and employing strategic approaches, individuals can navigate the sales tax landscape effectively, whether they are purchasing or selling a vehicle in Arizona.

Are there any additional fees or taxes associated with vehicle purchases in Arizona besides sales tax?

+Yes, there are other fees and taxes associated with vehicle purchases in Arizona. These may include title fees, registration fees, and emissions testing fees. It’s important to research and understand these additional costs to budget effectively for your vehicle purchase.

Can I negotiate the sales tax rate when purchasing a vehicle in Arizona?

+No, the sales tax rate is set by the state and local governments, and it is not negotiable. However, you can negotiate the sales price of the vehicle, which can indirectly impact the amount of sales tax you pay.

What happens if I don’t pay the sales tax on my vehicle purchase in Arizona?

+Failing to pay the sales tax on your vehicle purchase in Arizona can result in significant penalties and legal consequences. The Arizona Department of Revenue may assess penalties, interest, and even initiate collection actions. It’s crucial to pay the sales tax as required by law to avoid these issues.