6 Capital Gains Tax

Capital gains tax is a significant aspect of personal finance and investing, impacting individuals' financial decisions and long-term wealth management. This comprehensive guide aims to provide an in-depth understanding of capital gains tax, offering insights and strategies to navigate this complex yet crucial area of taxation.

Understanding Capital Gains Tax

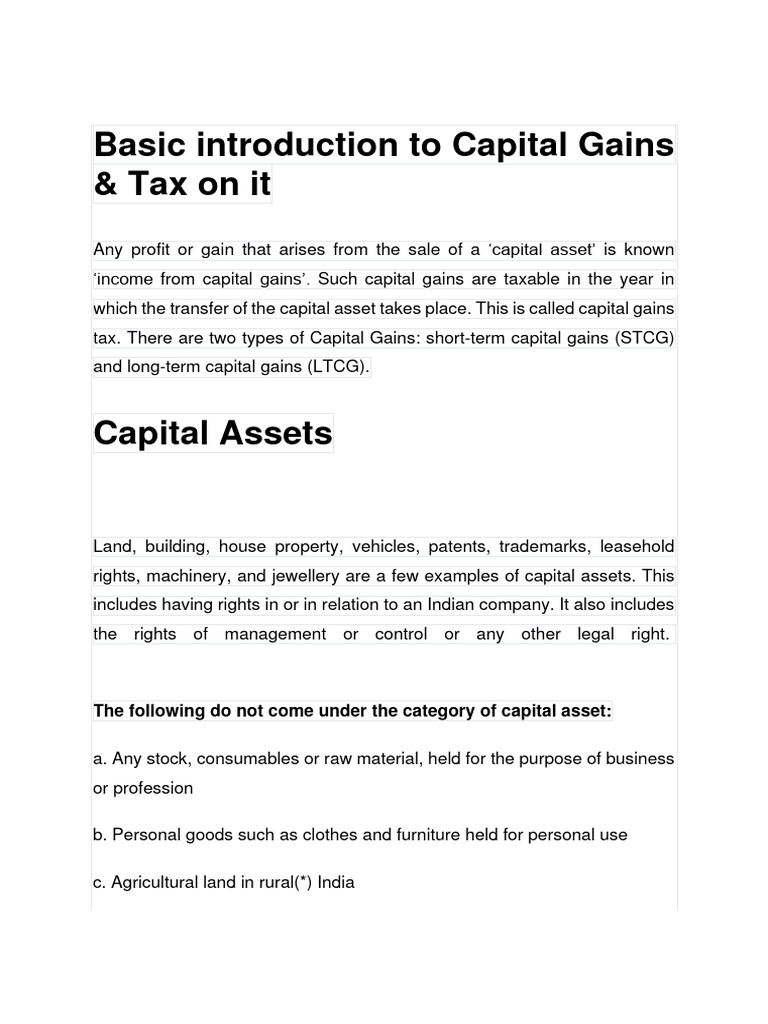

Capital gains tax refers to the levy imposed on profits arising from the sale of capital assets, which encompass a broad range of investments and property. These assets include stocks, bonds, real estate, collectibles, and even certain types of personal property. When an individual sells a capital asset at a price higher than their original purchase price, the resulting profit is subject to capital gains tax.

The tax implications can vary significantly depending on the asset type, holding period, and an individual's tax bracket. Generally, capital gains are categorized into two types: short-term and long-term. Short-term capital gains result from assets held for a year or less and are taxed at the individual's ordinary income tax rate. Long-term capital gains, arising from assets held for over a year, benefit from more favorable tax rates, which are often lower than the individual's ordinary income tax rate.

Tax Rates and Calculations

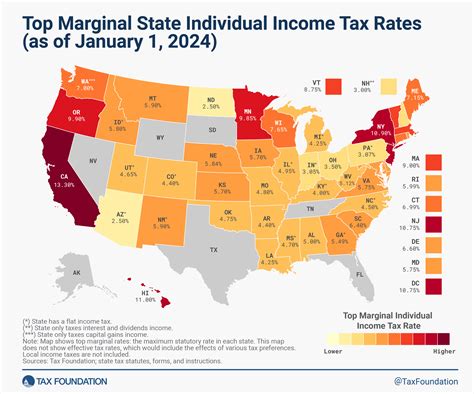

The tax rate for capital gains is influenced by the individual’s income tax bracket and the type of asset. For long-term capital gains, the tax rates can be as low as 0% for certain taxpayers in the lowest tax brackets. The rates gradually increase with higher income levels, reaching a maximum of 20% for high-income earners. Short-term capital gains, however, are taxed at the individual’s ordinary income tax rate, which can be as high as 37% for the highest earners.

Calculating capital gains tax involves determining the difference between the selling price and the purchase price of the asset, known as the capital gain. This gain is then adjusted for any expenses related to the sale, such as brokerage fees or legal costs. The resulting net capital gain is then subject to the applicable tax rate, which can be further impacted by factors like tax credits and deductions.

| Tax Rate | Capital Gains Type | Income Bracket |

|---|---|---|

| 0% | Long-Term | Up to $41,775 (single) or $83,550 (married filing jointly) |

| 15% | Long-Term | $41,776 - $459,750 (single) or $83,551 - $523,600 (married filing jointly) |

| 20% | Long-Term | Above $459,750 (single) or $523,600 (married filing jointly) |

| Ordinary Income Tax Rate | Short-Term | Varies based on individual income |

Maximizing Tax Efficiency

Understanding capital gains tax is crucial for effective wealth management and tax planning. Here are some strategies to consider when managing capital gains:

Long-Term Investing

Holding assets for the long term can offer significant tax advantages. By qualifying for long-term capital gains tax rates, investors can reduce their tax liability compared to short-term gains. This strategy is particularly beneficial for high-income earners who can save substantially by avoiding higher ordinary income tax rates.

Tax Loss Harvesting

Tax loss harvesting is a strategy where investors sell assets at a loss to offset capital gains. This technique can reduce the overall tax burden by utilizing capital losses to counteract capital gains. It’s a complex strategy that requires careful planning and consideration of potential tax implications.

Tax-Efficient Investing

Some investments are more tax-efficient than others. For instance, municipal bonds often provide tax-exempt income, making them an attractive option for investors in higher tax brackets. Additionally, certain types of retirement accounts, like traditional IRAs or 401(k)s, offer tax advantages by deferring taxes until withdrawal.

Tax-Loss Carryover

If an investor’s capital losses exceed their capital gains in a given year, they can utilize a tax-loss carryover. This strategy allows them to carry over the excess losses to future tax years, offsetting gains in those years. It’s a valuable tool for managing tax liability over multiple years.

Case Study: Real Estate Capital Gains

Consider the case of Mr. Johnson, who purchased a vacation home for 250,000 ten years ago. He recently decided to sell the property for 400,000. Mr. Johnson’s capital gain on the sale is 150,000 (400,000 - $250,000). Since he held the property for over a year, this gain is considered long-term.

Given Mr. Johnson's income bracket, he would qualify for a 15% tax rate on long-term capital gains. His tax liability on the sale would be $22,500 (15% of $150,000). This example illustrates how capital gains tax can significantly impact the proceeds from an investment.

Future Implications and Considerations

Capital gains tax policies are subject to change, influenced by economic conditions and political landscapes. As such, it’s crucial for investors to stay informed about potential changes and how they might impact their financial strategies. Additionally, understanding the interplay between capital gains tax and other investment-related taxes, such as estate taxes or gift taxes, is essential for comprehensive financial planning.

In conclusion, capital gains tax is a critical component of investing and wealth management. By understanding the tax implications and employing strategic tax planning, individuals can optimize their financial outcomes and navigate the complex world of taxation with confidence.

How often do capital gains tax rates change?

+Capital gains tax rates can change periodically, typically in response to economic conditions or political decisions. It’s essential to stay updated with tax laws to ensure compliance and optimize tax strategies.

Are there any exceptions or special cases for capital gains tax?

+Yes, there are various exceptions and special cases. For instance, certain types of assets, like qualified small business stock or farmland, may have specific tax treatments. Additionally, capital gains on the sale of a primary residence may be exempt up to a certain limit.

How does capital gains tax impact retirement planning?

+Capital gains tax can significantly impact retirement planning. Tax-efficient investing strategies, such as utilizing tax-advantaged retirement accounts, can help minimize tax liability and maximize retirement savings. Understanding the tax implications of different investment vehicles is crucial for effective retirement planning.