Why Do I Owe State Taxes

Taxes are an essential part of any functioning society, and while they may be a necessary evil, understanding the reasons behind them can help us appreciate their role in maintaining the social fabric. One often overlooked aspect of taxation is the state taxes, which are levied by individual states in addition to federal taxes. These state-level taxes contribute significantly to the overall tax burden on individuals and businesses, and their implications can be far-reaching. This article aims to shed light on why one might owe state taxes, exploring the various factors and considerations that come into play.

Understanding State Taxation

State taxes are a crucial component of a state’s revenue generation strategy, providing funds for essential services, infrastructure development, and public welfare programs. Each state has its own set of tax laws and regulations, which can vary significantly from one state to another. This variation in tax structures and rates is a result of the decentralized nature of taxation in the United States, where states are given a considerable degree of autonomy in determining their tax policies.

The primary reason for the existence of state taxes is to finance state-level operations and services. States require substantial financial resources to maintain their own infrastructure, manage public utilities, provide education and healthcare services, and ensure law and order. While some states rely heavily on federal grants and aid, a significant portion of their revenue comes from state taxes. These taxes are, therefore, an essential tool for states to maintain their financial independence and meet their unique needs.

Types of State Taxes

State taxes can take various forms, and individuals may owe different types of taxes depending on their circumstances and the state they reside in. Here are some of the most common types of state taxes:

- Income Tax: This is a tax levied on an individual's income, similar to federal income tax. The tax rate and brackets can vary widely between states, with some states having no income tax at all. States with income tax often offer various deductions and credits to reduce the tax burden on residents.

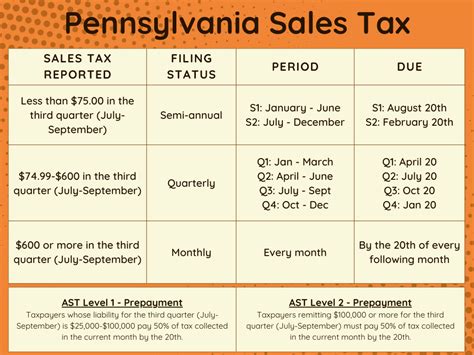

- Sales Tax: Sales tax is imposed on the sale of goods and services within a state. The rate can vary between states, and sometimes even within different regions of the same state. Sales tax is a significant revenue generator for states and is often used to fund specific projects or services.

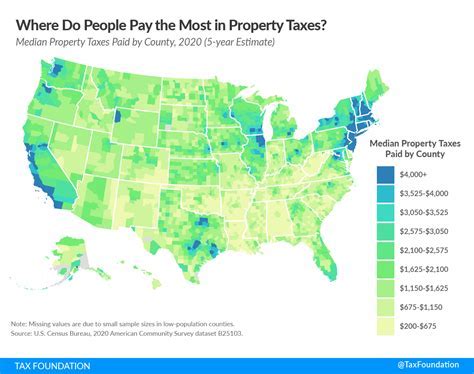

- Property Tax: Property tax is assessed on real estate and personal property owned by individuals or businesses. The tax rate is typically determined based on the assessed value of the property and is used to fund local services like schools, fire departments, and public works.

- Excise Taxes: These are taxes imposed on specific goods, such as gasoline, tobacco, and alcohol. Excise taxes are often used to regulate and control the consumption of certain products while also generating revenue for the state.

- Corporate Taxes: States also levy taxes on corporations and businesses operating within their borders. These taxes can include income taxes, franchise taxes, and other fees, which contribute to the state's overall revenue.

Factors Influencing State Tax Liability

Several factors come into play when determining an individual’s or business’s state tax liability. These factors can be complex and often require a thorough understanding of state tax laws and regulations. Here are some key considerations:

- State of Residence: The state in which an individual resides plays a crucial role in determining their tax liability. States have different tax laws, and an individual's residence status can significantly impact their tax obligations. For instance, some states do not have an income tax, which can be a significant advantage for taxpayers.

- Income Sources: The sources of an individual's income can also influence their state tax liability. Income earned within the state, such as wages, salaries, or business profits, is generally subject to state income tax. However, income earned outside the state may not be taxable in the state of residence.

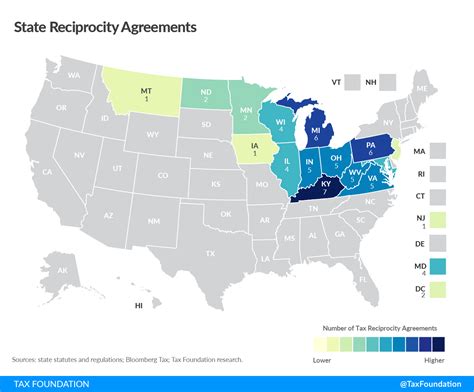

- Tax Residency Status: An individual's tax residency status can be a complex matter, especially for those who spend time in multiple states. Some states have specific rules regarding part-year residency and non-resident status, which can impact tax liability.

- Business Activities: Businesses operating in multiple states face a unique challenge when it comes to state taxes. They must comply with the tax laws of each state in which they conduct business, which can lead to a complex web of tax obligations and potential audits.

- Tax Deductions and Credits: Many states offer tax deductions and credits to reduce the tax burden on individuals and businesses. These incentives can be based on various factors, such as income level, family size, or specific investments or activities. Understanding and utilizing these deductions and credits can help reduce state tax liability.

| State | Income Tax Rate | Sales Tax Rate |

|---|---|---|

| California | 1-13.3% | 7.25% |

| New York | 4-8.82% | 4% |

| Texas | 0% | 6.25% |

| Florida | 0% | 6% |

State Tax Obligations and Compliance

Meeting state tax obligations is a crucial aspect of financial responsibility and compliance with the law. Failing to pay state taxes can result in severe penalties, including fines, interest, and even criminal charges in extreme cases. It is, therefore, essential to understand one’s tax obligations and take proactive measures to ensure compliance.

Common Reasons for Owed State Taxes

There are several reasons why an individual or business might owe state taxes. Understanding these reasons can help taxpayers take preventive measures and avoid unnecessary penalties. Here are some common scenarios:

- Underpayment of Estimated Taxes: Individuals who have variable income or receive income from sources other than wages (such as self-employment or investments) may be required to make estimated tax payments throughout the year. Failure to make these payments or underestimating the tax liability can result in owed taxes at the end of the year.

- Non-Compliance with Tax Laws: Ignorance of state tax laws or deliberate non-compliance can lead to tax liabilities. This can include failing to register a business with the state, not filing tax returns, or underreporting income or sales.

- Business Tax Obligations: Businesses, especially those operating in multiple states, face a complex web of tax obligations. Failure to comply with state tax laws, such as not registering for a sales tax permit or not remitting sales tax collected, can result in owed taxes and penalties.

- Audit and Tax Assessment: Taxpayers who are audited by the state may find themselves owing taxes if the audit reveals discrepancies or errors in their tax returns. Audits can be triggered by various factors, including random selection, suspicious activities, or tip-offs.

- Late Filing and Payment: Filing tax returns late or failing to pay taxes by the due date can result in penalties and interest. States often impose penalties for late filing and late payment, which can accumulate over time.

Strategies for Managing State Tax Obligations

Managing state tax obligations requires a proactive approach and a thorough understanding of state tax laws. Here are some strategies to consider:

- Stay Informed: Keep up-to-date with state tax laws and regulations. Subscribe to tax newsletters or follow reputable tax blogs to stay informed about any changes or updates that may impact your tax obligations.

- Seek Professional Help: Consult with a tax professional, such as a Certified Public Accountant (CPA) or an Enrolled Agent (EA), who can provide expert advice tailored to your specific circumstances. They can help you navigate the complexities of state taxes and ensure compliance.

- Use Reliable Tax Software: Invest in reliable tax software that can assist with state tax calculations and filings. These tools can help you stay organized, ensure accuracy, and reduce the risk of errors.

- Make Timely Payments: Pay your state taxes on time to avoid penalties and interest. Set up reminders or automatic payments to ensure you meet the due dates.

- Utilize Tax Deductions and Credits: Research and take advantage of any tax deductions or credits offered by your state. These incentives can significantly reduce your tax liability and should be considered when planning your finances.

- Keep Detailed Records: Maintain organized records of your income, expenses, and other financial transactions. Good record-keeping can help you prepare accurate tax returns and support your financial decisions.

The Impact of State Taxes on Individuals and Businesses

State taxes can have a significant impact on both individuals and businesses, affecting their financial planning, decision-making, and overall financial well-being. Understanding these impacts can help taxpayers make informed choices and navigate the complex world of state taxation.

Financial Planning Considerations

State taxes play a crucial role in financial planning, as they can significantly impact an individual’s or business’s disposable income. When planning for the future, taxpayers must consider the following:

- Tax Rates and Brackets: Understanding the state's tax rates and brackets is essential for estimating tax liability. This information can help individuals and businesses plan their income and expenses accordingly.

- Taxable Income: Determining the portion of income that is subject to state taxes is crucial. Taxable income can vary based on factors such as deductions, credits, and income sources.

- Tax Planning Strategies: Tax planning is a strategic approach to managing tax obligations. It involves optimizing income, deductions, and credits to minimize tax liability. Tax professionals can provide guidance on effective tax planning strategies.

- Retirement Planning: State taxes can impact retirement planning, as they may affect the amount of disposable income available for savings and investments. Understanding the state's tax laws regarding retirement accounts and benefits is essential for effective retirement planning.

Business Implications

State taxes can have a significant impact on businesses, especially those operating in multiple states. Here are some key considerations for businesses:

- State Tax Registration: Businesses must register with the state tax authority to obtain the necessary permits and licenses. Failure to register can result in penalties and legal consequences.

- Nexus and Sales Tax Collection: Businesses with a physical presence or significant economic activity in a state may have nexus, which requires them to collect and remit sales tax on transactions within that state. Failing to comply with nexus requirements can lead to significant liabilities.

- State Tax Obligations for Remote Sellers: With the rise of e-commerce, remote sellers must understand their state tax obligations. Even if a business does not have a physical presence in a state, it may still have tax obligations if it meets certain criteria, such as exceeding sales thresholds.

- Tax Compliance and Reporting: Businesses must maintain accurate records and file tax returns on time. Failure to comply with tax reporting requirements can result in penalties and interest.

- Economic Impact of State Taxes: State taxes can influence a business's decision-making process, including where to locate facilities, hire employees, and conduct business operations. High state tax rates may deter businesses from operating in certain states, while competitive tax structures can attract investment and economic growth.

The Future of State Taxation

The landscape of state taxation is constantly evolving, influenced by various factors such as economic trends, political decisions, and technological advancements. As states continue to adapt to changing circumstances, taxpayers can expect the following trends and developments:

- Tax Reform and Simplification: Many states are considering tax reform initiatives to simplify their tax codes and make them more transparent and understandable for taxpayers. This can include consolidating tax brackets, eliminating certain taxes, or introducing flat tax rates.

- Digitalization of Tax Processes: States are increasingly adopting digital technologies to streamline tax administration. This includes online filing systems, electronic payment options, and data-driven tax enforcement. Taxpayers can expect more efficient and user-friendly tax processes in the future.

- Enhanced Tax Enforcement: With the help of advanced data analytics and artificial intelligence, states are improving their tax enforcement capabilities. This can lead to more effective identification and prosecution of tax evasion and fraud, ensuring a fair and equitable tax system.

- State Tax Competition: States often compete with each other to attract businesses and residents by offering competitive tax rates and incentives. This competition can lead to lower tax burdens for taxpayers, but it can also create complexities for businesses operating in multiple states.

- International Tax Considerations: For businesses with international operations, state taxes can interact with international tax laws, creating a complex web of tax obligations. Staying informed about international tax developments and seeking professional advice is crucial for navigating these complexities.

Conclusion

State taxes are an integral part of the tax system in the United States, and understanding their implications is crucial for individuals and businesses alike. By comprehending the reasons behind state tax obligations, taxpayers can take proactive measures to ensure compliance and minimize their tax liability. With the right strategies and professional guidance, managing state taxes can become a seamless part of financial planning and decision-making.

What happens if I owe state taxes but cannot afford to pay them?

+

If you find yourself in a situation where you owe state taxes but cannot afford to pay them, it’s important to take immediate action. Contact your state’s tax authority and explain your circumstances. They may offer payment plans or waivers for penalties and interest if you can demonstrate financial hardship. It’s crucial to communicate with the tax authorities to avoid further penalties and find a resolution.

Can I deduct state taxes from my federal tax return?

+

Whether you can deduct state taxes from your federal tax return depends on your specific circumstances and the tax laws in effect for the tax year in question. Generally, state income taxes paid are deductible on your federal tax return as an itemized deduction. However, there are limitations and restrictions, such as the standard deduction, which may impact your ability to claim this deduction. It’s advisable to consult a tax professional or refer to the latest IRS guidelines for accurate information.

Are there any tax incentives or credits available for specific industries or individuals?

+

Yes, many states offer tax incentives and credits to encourage specific economic activities or support certain industries. These incentives can include tax credits for research and development, renewable energy projects, job creation, or investments in certain sectors. Additionally, states may provide tax credits for individuals with low incomes, dependent care expenses, or education-related costs. It’s important to research the specific tax incentives and credits offered by your state to determine your eligibility.

How can I stay updated with changes in state tax laws and regulations?

+

Staying informed about changes in state tax laws is crucial to ensure compliance and take advantage of any new tax benefits. You can subscribe to tax newsletters, follow reputable tax blogs, or utilize tax software that provides updates on tax law changes. Additionally, you can visit your state’s official tax website or contact the tax authority directly to obtain the latest information on tax laws and regulations.