What Is Production Tax Credit

In the realm of renewable energy and sustainable development, financial incentives play a pivotal role in fostering innovation and driving the transition towards a greener future. Among these incentives, the Production Tax Credit (PTC) stands out as a critical tool, offering substantial economic benefits to qualifying projects and technologies. This article delves into the intricacies of the Production Tax Credit, exploring its origins, mechanisms, and impact on the renewable energy sector, while also highlighting real-world examples and the broader implications for a sustainable future.

Understanding the Production Tax Credit

The Production Tax Credit, a cornerstone of renewable energy policy, is a federal tax incentive designed to promote the development and deployment of renewable energy technologies. Introduced in the United States through the Energy Policy Act of 1992, the PTC has evolved into a powerful mechanism to stimulate investment and innovation in the renewable energy industry. It provides a direct financial incentive to eligible projects, reducing their tax liability and thus enhancing their economic viability.

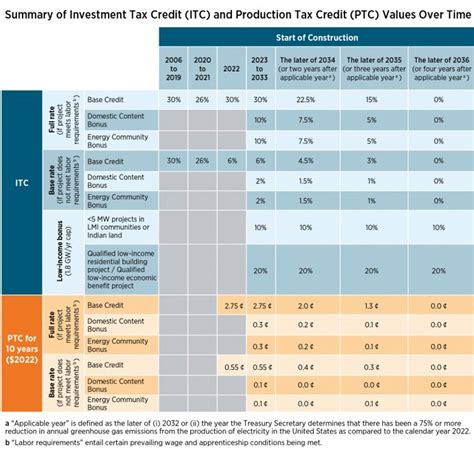

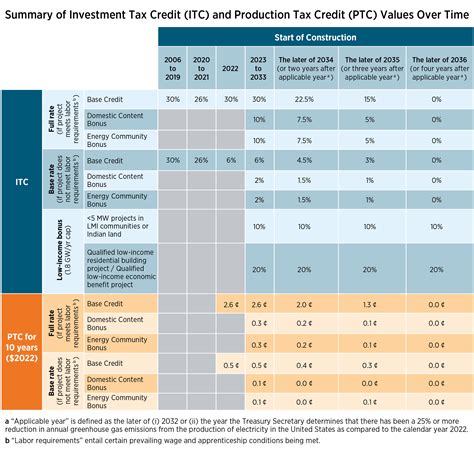

At its core, the PTC functions as a performance-based incentive, rewarding projects based on their actual electricity generation. For each kilowatt-hour (kWh) of electricity produced, qualifying projects can claim a specified credit amount. This credit is then applied against the project's federal income tax liability, providing a direct reduction in taxes owed. For projects with limited tax liability, the credit can be carried forward to offset future taxes, ensuring a long-term financial benefit.

Eligibility and Qualifying Technologies

The Production Tax Credit is open to a range of renewable energy technologies, including wind, geothermal, biomass, and hydropower. Each technology has specific eligibility criteria, ensuring that the incentive is targeted towards technologies with high potential for environmental and economic benefits. For instance, wind projects must meet certain capacity and efficiency standards, while geothermal projects must demonstrate a commitment to environmental stewardship and resource conservation.

To qualify for the PTC, projects must meet several key criteria. These include commencing construction within specified timelines, maintaining a certain level of domestic content in their equipment and materials, and achieving commercial operation within a defined period. These criteria are designed to encourage timely project development, support domestic manufacturing and supply chains, and ensure that projects deliver tangible benefits to the local community.

| Renewable Energy Technology | Eligibility Criteria |

|---|---|

| Wind | Minimum capacity, efficiency standards, and domestic content requirements. |

| Geothermal | Environmental and resource conservation measures, along with domestic content considerations. |

| Biomass | Sustainable feedstock sourcing and emission reduction targets. |

| Hydropower | Minimum capacity and environmental impact assessments. |

Real-World Impact and Success Stories

The Production Tax Credit has had a profound impact on the growth and success of renewable energy projects across the United States. One notable example is the Altamont Pass Wind Farm in California. This wind farm, consisting of over 5,000 turbines, has been a beneficiary of the PTC, allowing it to expand its capacity and enhance its efficiency. As a result, the Altamont Pass Wind Farm has become a symbol of the wind energy industry’s potential and a testament to the PTC’s effectiveness in driving large-scale renewable energy projects.

Another success story is the Geothermal Energy Association (GEA), which has utilized the PTC to support the development of geothermal projects across the country. GEA's members have leveraged the tax credit to invest in advanced geothermal technologies, enhance their resource exploration and development capabilities, and reduce the cost of geothermal energy production. This has led to a significant increase in the deployment of geothermal energy systems, contributing to a more sustainable and diversified energy mix.

Mechanics and Administration

The Production Tax Credit is administered by the Internal Revenue Service (IRS) and is claimed on federal income tax returns. Projects must maintain meticulous records and documentation to substantiate their eligibility and the quantity of electricity produced. The IRS conducts rigorous audits to ensure compliance with the PTC’s complex rules and regulations.

The PTC is a non-refundable tax credit, meaning it can only offset a taxpayer's income tax liability. Any excess credit not used in the current year can be carried forward to future years, providing a long-term financial benefit. This carryforward provision is particularly beneficial for projects with fluctuating electricity generation or those facing initial start-up costs.

Phasing Out and Extension

The Production Tax Credit has historically been subject to periodic phasing out and extensions. While this creates uncertainty for project developers and investors, it also encourages a sense of urgency, leading to more efficient project development and innovation. The PTC’s status is closely monitored by industry stakeholders, as its extension or renewal can significantly impact the viability of future projects.

Broader Implications and Future Outlook

The Production Tax Credit has played a pivotal role in the growth and maturation of the renewable energy sector. It has incentivized the development of innovative technologies, fostered competition, and driven down the cost of renewable energy production. As a result, renewable energy sources have become increasingly cost-competitive with traditional fossil fuels, making them a more attractive option for investors and energy consumers alike.

Looking ahead, the future of the PTC is closely tied to the broader energy and climate policy landscape. With increasing recognition of the urgency of addressing climate change and the need for a sustainable energy transition, the PTC is likely to remain a critical tool in the policy arsenal. However, its design and scope may evolve to address new technologies, changing market dynamics, and emerging environmental priorities.

In conclusion, the Production Tax Credit is a powerful mechanism that has driven significant growth and innovation in the renewable energy sector. By offering direct financial incentives to qualifying projects, the PTC has encouraged the development and deployment of clean energy technologies, contributing to a more sustainable and resilient energy future. As the world transitions towards a low-carbon economy, the lessons learned from the PTC's success will be invaluable in shaping future policy and accelerating the global energy transformation.

How does the Production Tax Credit impact the cost of renewable energy projects?

+The PTC directly reduces the tax liability of qualifying projects, providing a financial incentive that can offset a significant portion of project costs. This reduction in costs can make renewable energy projects more economically viable, leading to increased investment and deployment.

What are the key criteria for a project to qualify for the PTC?

+Projects must meet criteria such as commencing construction within specified timelines, maintaining a certain level of domestic content, and achieving commercial operation within a defined period. These criteria are designed to encourage timely project development and support domestic industries.

How has the PTC influenced the growth of the renewable energy sector in the US?

+The PTC has been a key driver of growth in the renewable energy sector, encouraging investment and innovation. It has led to the development of large-scale projects, such as the Altamont Pass Wind Farm, and supported the expansion of renewable energy technologies, making them more cost-competitive with traditional fossil fuels.