What Is A Salt Tax

The Salt Tax, a historical economic measure, has left an indelible mark on the annals of fiscal policy, particularly in the context of colonial rule. This tax, while seemingly mundane, played a pivotal role in shaping societal dynamics and triggering significant political movements. In this comprehensive article, we delve into the intricacies of the Salt Tax, exploring its origins, global impact, and enduring legacy.

The Salt Tax: A Historical Overview

The imposition of a tax on salt, a commodity essential for human survival and food preservation, dates back centuries. This tax was implemented by various empires and governments to generate revenue and exert control over their subjects. The Salt Tax, however, gained particular prominence during the colonial era, especially in the Indian subcontinent.

The British Salt Tax in India

One of the most renowned and impactful Salt Taxes was levied by the British Empire in India. Introduced in the early 19th century, the British Salt Tax, or the Salt Act of 1835, had far-reaching consequences for the Indian populace. The Act prohibited the production and sale of salt by locals, forcing them to purchase the commodity from the British-controlled monopoly. This tax, though seemingly insignificant, sparked a movement that would forever alter the course of Indian history.

The Salt Tax was part of a broader system of revenue generation and control implemented by the British. It was designed to maximize profits for the Empire while suppressing local industries and ensuring dependence on British goods. The tax was especially burdensome for the poor, who constituted a significant portion of the Indian population, as salt was an essential ingredient in their daily diet and cultural practices.

The Salt March: A Symbol of Resistance

The Salt Tax, and the subsequent Salt March led by Mahatma Gandhi in 1930, became a powerful symbol of resistance against colonial rule. Gandhi’s non-violent protest against the Salt Tax, known as the Dandi March, inspired millions and brought global attention to the Indian independence movement. The march, which covered over 240 miles, culminated in Gandhi and his followers breaking the Salt Law by producing salt from seawater, a defiant act that challenged the very foundation of British authority.

The Salt March not only highlighted the oppressive nature of the Salt Tax but also galvanized support for the Indian National Congress and the broader freedom struggle. It served as a catalyst for future civil disobedience movements and played a pivotal role in shaping India's path towards independence.

Global Perspectives on Salt Taxation

The Salt Tax, while most famously associated with India, has been a part of various fiscal policies worldwide. In different historical contexts, governments have leveraged salt taxation to fund wars, expand empires, or stabilize economies.

The French Gabelle

In France, the gabelle, a system of salt taxation, was implemented as early as the 13th century. The gabelle was notorious for its complexity and regional variations, often leading to widespread discontent and protests. The tax, which varied significantly across different regions of France, was a major source of revenue for the monarchy but also a cause of social unrest.

The gabelle was abolished during the French Revolution, but its legacy continued to influence French fiscal policies. The salt tax, along with other oppressive measures, contributed to the rising discontent that fueled the Revolution.

Salt Taxes in Ancient Civilizations

The practice of taxing salt is not limited to the colonial era. Ancient civilizations, such as the Roman Empire and the Chinese dynasties, also levied taxes on salt. In China, the salt tax, known as the yanxuan, was a crucial source of revenue for the imperial court. The tax, imposed on both the production and sale of salt, played a significant role in funding various state projects and maintaining the empire’s power.

Impact and Legacy of Salt Taxation

The Salt Tax, in its various manifestations, has had a profound impact on societies and economies. Its historical significance lies not only in the revenue it generated but also in the social, political, and cultural upheavals it triggered.

Economic Effects

Salt taxation often led to economic disparities, as the poor bore the brunt of the tax burden. The taxes not only affected the purchasing power of individuals but also impacted local industries and trade networks. The disruption of salt production and trade could lead to shortages and inflated prices, further exacerbating economic inequalities.

Social and Political Consequences

The imposition of a Salt Tax frequently ignited social unrest and political movements. The tax, by targeting a basic necessity, struck at the heart of societal structures. Resistance against salt taxation often became a rallying cry for broader social and political reform, as was the case in India and France. The tax’s symbolic value, as seen in the Salt March, underscored its power to mobilize populations and challenge authority.

Environmental and Health Considerations

The Salt Tax also had environmental and health implications. In regions where salt production was a traditional practice, the tax could lead to the depletion of natural resources and environmental degradation. Additionally, the tax often resulted in reduced access to salt, a critical nutrient, leading to potential health issues, particularly in vulnerable populations.

Modern-Day Relevance

While the Salt Tax may seem like a relic of the past, its legacy continues to influence modern fiscal policies and societal attitudes. The tax’s historical significance serves as a reminder of the intricate relationship between taxation, social justice, and political power.

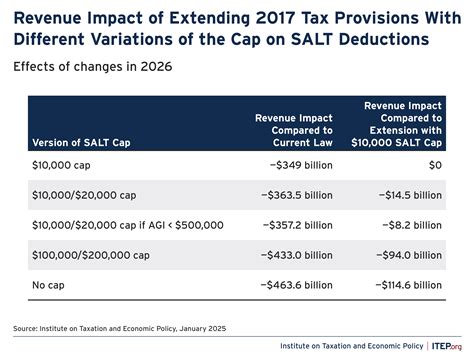

In the contemporary world, salt taxation still exists in various forms, albeit under different names and with varying levels of impact. Some countries impose taxes on processed foods, including those with high salt content, as a measure to combat obesity and promote public health. These modern-day salt taxes, while different in context, echo the historical struggles against oppressive fiscal policies.

| Country | Salt Tax Implementation |

|---|---|

| France | Salt taxes were abolished during the French Revolution but re-emerged in the 19th century as an excise tax on salt. |

| India | The Salt Act of 1835 was repealed in 1947, but India continues to levy taxes on salt production and imports. |

| China | The yanxuan tax was abolished in 1930, but salt remains a state-controlled commodity with various taxes and regulations. |

Frequently Asked Questions

What was the primary purpose of the Salt Tax in India under British rule?

+

The British Salt Tax, or the Salt Act of 1835, was primarily aimed at generating revenue for the Empire and suppressing local industries. It was part of a broader system of control and exploitation implemented by the British in India.

How did the Salt March impact the Indian independence movement?

+

The Salt March, led by Mahatma Gandhi, became a powerful symbol of resistance against British rule. It inspired millions, brought global attention to the Indian independence movement, and served as a catalyst for future civil disobedience campaigns.

What were the environmental and health implications of the Salt Tax in historical contexts?

+

The Salt Tax could lead to environmental degradation in regions where salt production was a traditional practice. Additionally, reduced access to salt, a crucial nutrient, could result in health issues, particularly among vulnerable populations.

How does the legacy of the Salt Tax influence modern fiscal policies and societal attitudes?

+

The historical Salt Tax serves as a reminder of the complex relationship between taxation, social justice, and political power. In modern times, salt taxation, though different in form, continues to shape public health policies and societal attitudes towards taxation.