Virginia State Income Tax Rate 2025

Planning your financial strategy for the future often involves considering the impact of taxes on your income. For residents of Virginia, understanding the state income tax rates is crucial when it comes to budgeting and financial planning. As we look ahead to 2025, let's delve into the specifics of Virginia's state income tax rate and explore how it might affect your financial decisions.

Virginia’s Progressive Income Tax System

Virginia operates a progressive income tax system, which means that the state income tax rate you pay depends on your taxable income. This system ensures that individuals with higher incomes contribute a larger proportion of their income to state revenues. As of my last update in January 2023, Virginia had five tax brackets, each with its own tax rate. Let’s take a closer look at these brackets and the corresponding tax rates for the year 2025.

Tax Brackets and Rates for 2025

Here are the projected tax brackets and rates for Virginia state income tax in 2025, based on the current tax structure and assuming no significant legislative changes:

| Tax Bracket (Taxable Income) | Tax Rate |

|---|---|

| Up to $3,000 | 2.0% |

| $3,001 to $5,000 | 3.0% |

| $5,001 to $17,000 | 5.0% |

| $17,001 to $100,000 | 5.75% |

| Over $100,000 | 5.75% |

These tax rates are applicable to Virginia residents' taxable income, which includes wages, salaries, tips, bonuses, and other forms of compensation. It's important to note that these rates may be subject to change based on legislative decisions and economic factors.

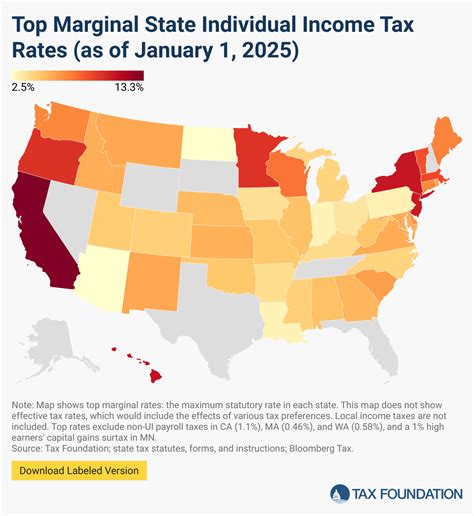

How Virginia’s Income Tax Rates Compare

When comparing Virginia’s state income tax rates to those of other states, it’s clear that Virginia has a relatively competitive tax structure. Many states have similar or even higher tax rates, especially for higher-income earners. However, it’s important to consider the overall cost of living and the benefits and services provided by the state when evaluating the impact of taxes on your financial well-being.

State-by-State Comparison

Here’s a glimpse at how Virginia’s 2025 projected tax rates compare to a few other states:

- California: With a progressive tax system similar to Virginia's, California's top tax rate of 13.3% applies to incomes over $1 million, making it significantly higher than Virginia's 5.75% rate for incomes over $100,000.

- New York: New York's tax rates vary by county, with the highest rate reaching 8.82%. While this is higher than Virginia's top rate, the state offers various deductions and credits that can reduce the overall tax burden.

- Florida: Florida is known for its lack of a state income tax, making it an attractive destination for tax-conscious individuals. However, the state makes up for this through other taxes, such as sales and property taxes.

It's essential to consider the overall tax landscape, including local and municipal taxes, when making financial decisions and planning your move or business expansion.

Strategies for Minimizing Your Tax Burden

Understanding the state income tax rates is just the first step in effective financial planning. Here are some strategies to consider to minimize your tax burden and maximize your after-tax income:

- Maximize Deductions and Credits: Virginia offers various deductions and credits, such as the Virginia Earned Income Tax Credit and deductions for contributions to college savings plans. Take advantage of these to reduce your taxable income and lower your tax liability.

- Consider Retirement Accounts: Contributions to certain retirement accounts, like 401(k)s and IRAs, can reduce your taxable income. Consult a financial advisor to determine the best retirement savings strategy for your situation.

- Optimize Your Business Structure: If you own a business, the legal structure you choose can impact your tax liability. Consider working with a tax professional to find the structure that best suits your needs and minimizes taxes.

- Strategic Timing of Income: For high-income earners, strategic timing of income and expenses can help smooth out your taxable income across years, potentially reducing your overall tax burden.

Conclusion

Virginia’s state income tax rates for 2025, while subject to change, provide a glimpse into the future of your financial obligations. By understanding these rates and exploring strategies to minimize your tax burden, you can make more informed financial decisions and ensure your hard-earned income goes further. Stay tuned for any legislative updates that may impact these rates, and consult financial professionals for personalized advice tailored to your specific circumstances.

How often are Virginia’s income tax rates updated?

+Virginia’s income tax rates are typically reviewed and updated annually by the Virginia General Assembly. The rates can change based on various factors, including economic conditions and legislative decisions.

Are there any plans to change the tax brackets for 2025?

+As of my knowledge cutoff in January 2023, there were no specific plans to make significant changes to the tax brackets for 2025. However, it’s important to stay updated with any legislative developments, as tax policies can evolve rapidly.

What are the potential impacts of tax rate changes on the state’s economy?

+Changes in tax rates can have both positive and negative impacts on the state’s economy. Lower tax rates may encourage business growth and investment, while higher rates can impact disposable income and consumer spending. The ideal tax structure strikes a balance between revenue generation and economic growth.