Ventura County Ca Tax Collector

Welcome to a comprehensive guide on the Ventura County Tax Collector's office, an essential entity in the county's administration and governance. The tax collector plays a pivotal role in the local government's financial management, ensuring efficient and transparent collection of taxes to fund vital public services and infrastructure. This article will delve into the various aspects of the Ventura County Tax Collector's operations, responsibilities, and services, providing an insightful look into the financial backbone of this vibrant Southern California community.

Ventura County Tax Collector: An Overview

The Ventura County Tax Collector’s office is a key component of the county’s administrative framework, responsible for a wide range of financial and tax-related services. The office is headed by the County Tax Collector, an elected official who serves as the chief tax administrator for the county.

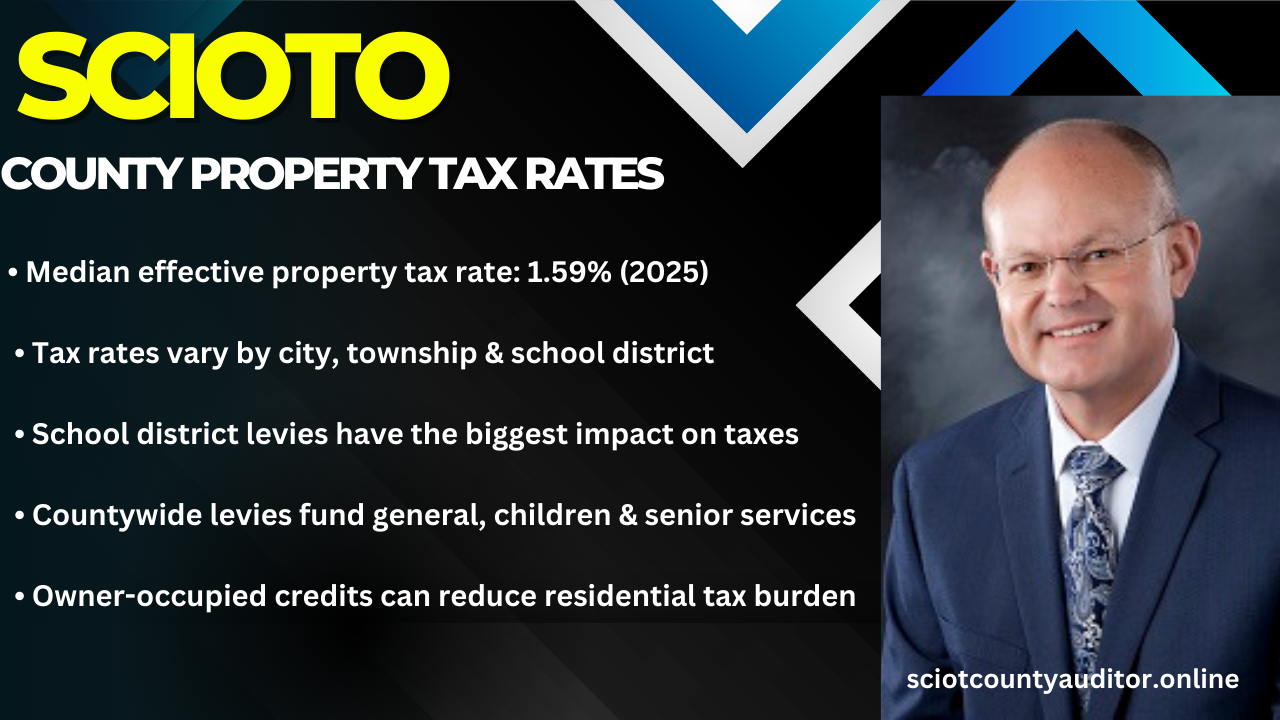

The primary role of the Ventura County Tax Collector is to efficiently collect and manage various taxes and assessments within the county. This includes property taxes, which are a significant source of revenue for the county, and various other taxes and fees such as vehicle registration fees, business taxes, and special assessments.

Key Responsibilities and Services

- Property Tax Collection: The tax collector is responsible for the annual collection of property taxes, which are a major source of revenue for the county. This involves sending out tax bills, collecting payments, and ensuring accurate assessments for all properties within the county.

- Vehicle Registration and Taxes: The office handles vehicle registration renewals, title transfers, and the collection of vehicle registration taxes. It provides online and in-person services to make these processes convenient for county residents.

- Business Taxes: The tax collector’s office administers and collects business taxes, including business license fees and various other taxes related to business operations within the county.

- Special Assessments: The office manages special assessments for services like flood control, street lighting, and other community services. These assessments are levied on specific properties and are collected by the tax collector.

- Delinquent Tax Enforcement: In cases of delinquent tax payments, the tax collector’s office takes appropriate enforcement actions, which may include liens, penalties, and, ultimately, tax sales.

- Taxpayer Assistance: The office provides assistance to taxpayers, offering guidance on tax payments, assessments, and resolving any issues or concerns taxpayers may have.

Ventura County Tax Collector’s Office: In-Depth Analysis

The Ventura County Tax Collector’s office operates with a mission to provide efficient, effective, and equitable tax administration while maintaining the highest standards of integrity and public service.

Property Tax Collection Process

Property tax collection is a critical function of the tax collector’s office. The process involves several key steps:

- Assessment: The county assessor’s office determines the assessed value of each property based on various factors, including market value and improvements.

- Tax Calculation: Once the assessed value is determined, the tax collector calculates the tax amount based on the assessed value and the applicable tax rate. This rate is set by the county and various taxing authorities, such as the school district and special districts.

- Tax Billing: The tax collector’s office sends out tax bills to all property owners. These bills detail the assessed value, the tax rate, and the total tax amount due.

- Payment Options: Taxpayers have several payment options, including online payments, payments by mail, and in-person payments at the tax collector’s office or designated drop-off locations.

- Payment Due Dates: Property taxes in Ventura County are due in two installments. The first installment is typically due in November, and the second installment is due in April. Late payments incur penalties.

- Delinquent Tax Enforcement: If property taxes remain unpaid, the tax collector’s office takes steps to enforce payment. This may involve placing a lien on the property, selling the property at a tax sale, or other legal actions as per California tax laws.

Vehicle Registration and Taxes

The tax collector’s office is also responsible for vehicle registration and the associated taxes. This includes:

- Vehicle Registration Renewal: Residents can renew their vehicle registrations online or in-person at the tax collector’s office. The office also processes title transfers and issues new titles.

- Vehicle Registration Fees: The tax collector collects vehicle registration fees, which are based on the vehicle’s weight and use. These fees contribute to the county’s general fund and are used to maintain roads and provide other public services.

- Smog Check: The office also verifies smog check certificates, ensuring that vehicles registered in Ventura County meet air quality standards.

Business Taxes

The tax collector’s office administers and collects business taxes, including:

- Business License Fees: All businesses operating within Ventura County are required to obtain a business license and pay the associated fees. The tax collector’s office processes these applications and collects the fees.

- Transitory Occupancy Tax (TOT): The office collects TOT, which is a tax on the rental of short-term accommodations, such as hotels and vacation rentals. This tax contributes to the county’s general fund and supports tourism-related initiatives.

- Other Business Taxes: The tax collector also collects various other taxes related to business operations, such as sales tax and use tax. These taxes are distributed to different taxing authorities, including the state and local governments.

Special Assessments

Special assessments are levied on specific properties to fund community services like flood control, street lighting, and infrastructure improvements. The tax collector’s office manages these assessments, which are typically collected annually along with property taxes.

Taxpayer Assistance and Support

The Ventura County Tax Collector’s office is committed to providing excellent customer service and support to taxpayers. The office offers a variety of resources and assistance, including:

- Online tax payment portal for convenient and secure tax payments.

- Detailed tax bill information, including assessment values, tax rates, and due dates.

- Taxpayer assistance centers for in-person support and guidance.

- Phone and email support for tax-related inquiries.

- Online resources and guides to help taxpayers understand their tax obligations and rights.

Performance and Transparency

The Ventura County Tax Collector’s office operates with a strong focus on performance and transparency. The office regularly publishes reports and data on its website, providing taxpayers with information on revenue collection, tax delinquency rates, and other key performance indicators.

The office also maintains a high level of financial accountability, with regular audits and reviews to ensure accurate and efficient tax collection and administration. The tax collector's office is committed to continuously improving its processes and services to better serve the residents of Ventura County.

Future Implications and Innovations

Looking ahead, the Ventura County Tax Collector’s office is poised to embrace innovative technologies and practices to enhance its services and improve the taxpayer experience. The office is exploring the use of digital tools and platforms to make tax payment and compliance processes more efficient and accessible.

Additionally, the tax collector's office is committed to fostering a culture of continuous improvement and learning. This includes staying abreast of changes in tax laws and regulations, both at the state and federal levels, to ensure compliance and provide accurate guidance to taxpayers.

Furthermore, the office is dedicated to promoting financial literacy and awareness among county residents. This involves providing educational resources and initiatives to help taxpayers better understand their tax obligations and the importance of timely tax payments in supporting essential public services.

| Metric | Data |

|---|---|

| Total Property Tax Revenue (2022) | $450 million |

| Vehicle Registration Taxes (2022) | $25 million |

| Business Tax Revenue (2022) | $15 million |

| Special Assessments (2022) | $10 million |

| Tax Delinquency Rate (2022) | 2.5% |

What is the role of the Ventura County Tax Collector’s office?

+The Ventura County Tax Collector’s office is responsible for collecting and managing various taxes and assessments within the county, including property taxes, vehicle registration fees, business taxes, and special assessments. They ensure efficient tax administration and provide assistance to taxpayers.

How can I pay my property taxes in Ventura County?

+You can pay your property taxes online through the Ventura County Tax Collector’s website, by mail, or in person at the tax collector’s office or designated drop-off locations. Payments can be made in two installments, with due dates typically in November and April.

What happens if I don’t pay my property taxes on time?

+Late payment of property taxes incurs penalties. If taxes remain unpaid, the tax collector’s office may place a lien on the property and, ultimately, sell the property at a tax sale to enforce payment.

How can I renew my vehicle registration in Ventura County?

+You can renew your vehicle registration online or in person at the Ventura County Tax Collector’s office. The office also processes title transfers and issues new titles.

What business taxes does the Ventura County Tax Collector collect?

+The tax collector collects business license fees, transitory occupancy tax (TOT), and various other taxes related to business operations, such as sales tax and use tax.