Town Of Huntington Property Taxes

Property taxes are an essential component of municipal finance, funding vital services and infrastructure within a community. In the Town of Huntington, New York, property taxes play a significant role in shaping the local economy and the lives of residents. This article delves into the intricacies of property taxes in Huntington, exploring their calculation, impact, and management.

Understanding Property Taxes in Huntington

Property taxes in Huntington, like in many other municipalities, are assessed based on the value of real estate properties. These taxes are a primary source of revenue for the town, contributing to the maintenance and improvement of public facilities, schools, emergency services, and other essential community services.

The tax rate in Huntington is determined by the Town Board, which sets the tax levy based on the projected budget needs and the assessed value of all taxable properties in the town. The tax rate is expressed as a percentage or a fixed amount per thousand dollars of assessed value.

Assessment Process

Property assessments in Huntington are conducted by the Office of the Assessor, an independent agency responsible for determining the market value of each taxable property. This value is based on a comprehensive evaluation of the property’s characteristics, including its size, location, condition, and recent sales data of comparable properties.

The assessment process aims to ensure that each property owner pays their fair share of taxes based on the property's value. However, it is not uncommon for property owners to dispute their assessments, especially if they believe the value assigned is inaccurate or unfair.

Tax Rate Calculation

The tax rate is calculated by dividing the total tax levy by the total assessed value of all taxable properties in the town. This rate is then applied to each property’s assessed value to determine the individual tax liability.

For example, if the total assessed value of taxable properties in Huntington is $1 billion, and the tax levy for the year is set at $50 million, the tax rate would be 5%. So, a property with an assessed value of $200,000 would have a tax liability of $10,000 for that year.

Impact of Property Taxes on Residents

Property taxes have a significant impact on the financial well-being of Huntington’s residents. While these taxes fund vital services, they also represent a substantial expense for property owners, especially those with high-value properties.

Tax Burden and Affordability

The tax burden can vary significantly depending on the assessed value of the property and the tax rate. For instance, a homeowner with a modestly valued property might find their tax liability manageable, while those with high-value properties could face a substantial financial burden.

This disparity has led to discussions about tax fairness and the potential need for tax relief programs or reassessment strategies to ensure that the tax burden is distributed equitably among residents.

Property Tax Grievances

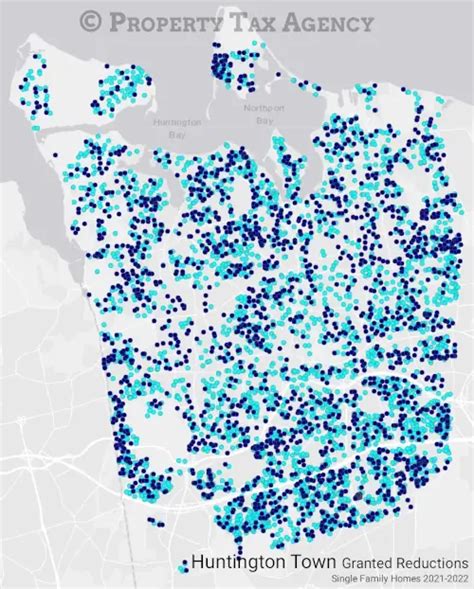

Property owners in Huntington have the right to challenge their property assessments if they believe the value assigned is incorrect. This process, known as a property tax grievance, allows homeowners to present evidence and arguments to support their claim for a lower assessment.

Successful grievances can lead to a reduction in the assessed value, which subsequently lowers the tax liability for the property owner. However, the grievance process can be complex and often requires professional assistance or representation.

Managing Property Taxes: Strategies and Solutions

The Town of Huntington recognizes the importance of effective property tax management to ensure financial stability and fairness for its residents. Here are some strategies employed to manage property taxes effectively:

Regular Assessments and Reevaluations

The Office of the Assessor conducts regular assessments to ensure that property values remain accurate and up-to-date. This process helps to maintain a fair and equitable tax system, as it accounts for changes in the property market and ensures that tax liabilities are based on current values.

Tax Relief Programs

The town offers various tax relief programs to assist certain groups of residents. These programs aim to reduce the tax burden for eligible individuals, such as senior citizens, veterans, and low-income homeowners. Some of these programs include tax exemptions, tax credits, and assessments caps.

Budget Transparency and Public Engagement

The Town of Huntington prioritizes transparency in its budgeting process. Town officials engage with the community to discuss budget proposals, allowing residents to provide input and understand how their tax dollars are allocated. This transparency fosters trust and ensures that the tax levy is set with the community’s best interests in mind.

Tax Incentives for Development

To encourage economic growth and development, the town may offer tax incentives to businesses and developers. These incentives can take the form of tax abatements, tax increment financing, or other creative strategies to attract investments and create jobs, ultimately benefiting the entire community.

| Program | Description |

|---|---|

| Senior Citizen Exemption | Provides a partial exemption from property taxes for eligible senior citizens. |

| Veteran's Exemption | Offers a tax reduction for veterans based on their length of service. |

| Star Exemption | Provides a basic and enhanced exemption for primary residences to encourage homeownership. |

Future Implications and Conclusion

As the Town of Huntington continues to evolve, the management of property taxes will remain a critical aspect of local governance. The town’s commitment to transparency, fairness, and community engagement in tax matters is commendable and sets a positive example for other municipalities.

Looking ahead, the town may explore innovative strategies to further enhance tax fairness and efficiency. This could involve adopting new technologies for more accurate assessments, expanding tax relief programs, or finding ways to reduce the administrative burden of property taxes for both residents and the municipality.

In conclusion, property taxes in Huntington are a complex but essential part of the town's financial ecosystem. By understanding the assessment process, tax rate calculations, and the impact on residents, we can appreciate the challenges and opportunities presented by this vital revenue stream. Effective management and ongoing dialogue with the community will ensure that property taxes continue to serve the town's best interests.

How often are property assessments conducted in Huntington?

+Property assessments are conducted every two years in Huntington. This regular cycle ensures that property values remain up-to-date and allows for a more accurate assessment of tax liabilities.

Can I appeal my property assessment if I disagree with the value assigned?

+Yes, property owners have the right to appeal their assessments if they believe the value is inaccurate. The process involves submitting a formal grievance with supporting evidence to the Office of the Assessor. It is advisable to seek professional guidance for a successful appeal.

What happens if I don’t pay my property taxes in Huntington?

+Unpaid property taxes can lead to significant penalties, interest charges, and potential legal consequences. The town may also place a lien on the property, which could impact the owner’s ability to sell or refinance the property. It is crucial to stay current with tax payments to avoid these issues.

Are there any tax breaks or incentives for green initiatives or energy-efficient homes in Huntington?

+Yes, the town offers tax incentives for properties that implement green initiatives or energy-efficient improvements. These incentives can reduce the assessed value of the property, leading to lower tax liabilities. Contact the Office of the Assessor for more information on these programs.