Taxes Montgomery County

Welcome to our comprehensive guide on the intricacies of taxes in Montgomery County, an essential aspect of understanding the financial landscape for residents and businesses alike. In this article, we will delve into the specifics of Montgomery County's tax structure, providing you with an expert analysis and valuable insights.

Understanding Montgomery County’s Tax System

Montgomery County, located in the heart of Maryland, boasts a robust economy and a thriving community. The county’s tax system plays a crucial role in supporting its development and infrastructure. With a diverse range of tax categories, it is important to navigate these waters with precision.

The tax structure in Montgomery County encompasses various types of taxes, each serving a unique purpose. From property taxes to income taxes, and even special assessments, the county's tax system ensures the equitable distribution of financial responsibilities among its residents and businesses.

Property Taxes: A Key Component

Property taxes are a significant aspect of Montgomery County’s tax landscape. These taxes are levied on real estate properties within the county, including residential homes, commercial buildings, and even vacant land. The revenue generated from property taxes contributes to the maintenance and improvement of local infrastructure, schools, and public services.

The assessment process for property taxes involves evaluating the value of each property based on factors such as location, size, and recent sales data. This ensures fairness and consistency in the taxation system. Property owners receive annual tax assessments, detailing the calculated value of their property and the corresponding tax amount.

| Property Type | Average Tax Rate |

|---|---|

| Residential | $0.97 per $100 of assessed value |

| Commercial | $1.17 per $100 of assessed value |

| Vacant Land | $1.37 per $100 of assessed value |

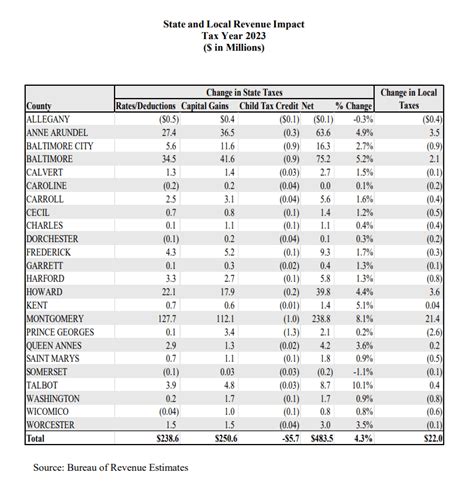

Income Taxes: Individual and Business Perspectives

Montgomery County also imposes income taxes on individuals and businesses operating within its boundaries. These taxes contribute to the county’s overall revenue stream and fund essential services.

For individuals, the county's income tax rate is 3.25%, which applies to taxable income earned within the county. This rate is in addition to the state income tax, creating a cumulative tax burden for residents. The county's tax system ensures that income tax payments are accurately reported and filed through annual tax returns.

In the case of businesses, Montgomery County imposes a Business and Occupation (B&O) tax on various business activities. The B&O tax is a privilege tax that businesses must pay for the right to conduct their operations within the county. The tax rate varies depending on the nature of the business and its specific activities, with rates ranging from 0.0025% to 0.005% of gross receipts.

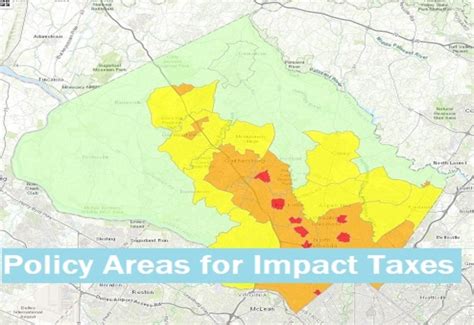

Special Assessments: Targeted Funding

Montgomery County employs special assessments as a tool to fund specific projects or improvements that benefit certain areas or communities. These assessments are typically levied on properties within the targeted area and are used to finance projects such as road improvements, stormwater management, or public facility enhancements.

Special assessments are calculated based on the benefit received by each property. Property owners are notified of these assessments and have the opportunity to review and appeal the proposed amount if they believe it is unfair or inaccurate.

Tax Relief Programs and Incentives

Recognizing the financial burden that taxes can impose, Montgomery County offers various tax relief programs and incentives to support its residents and businesses.

Homestead Tax Credit

The Homestead Tax Credit is a valuable program that provides property tax relief to eligible homeowners in Montgomery County. To qualify, homeowners must meet certain income requirements and must occupy the property as their primary residence. The credit reduces the taxable value of the property, resulting in lower property tax bills.

The Homestead Tax Credit is just one example of the county's commitment to supporting its residents. Other programs, such as the Property Tax Credit for Elderly or Disabled Homeowners, further demonstrate Montgomery County's dedication to easing the tax burden on its most vulnerable citizens.

Business Incentives and Tax Credits

To attract and support businesses, Montgomery County offers a range of incentives and tax credits. These initiatives aim to foster economic growth and create a business-friendly environment.

For instance, the Montgomery County Economic Development Incentive Program provides grants, loans, and tax credits to eligible businesses that meet specific criteria. These incentives can offset the cost of doing business in the county, making it more attractive for companies to establish or expand their operations.

The Future of Taxes in Montgomery County

As Montgomery County continues to evolve and grow, its tax system will also undergo changes and adaptations. The county’s tax policies are regularly reviewed and updated to ensure they remain fair, effective, and aligned with the needs of its residents and businesses.

With an eye on economic development and community well-being, Montgomery County strives to maintain a balanced tax system. This approach ensures that the county can continue to provide essential services, invest in infrastructure, and support its thriving economy.

Stay tuned for further updates and insights as Montgomery County navigates the ever-changing landscape of taxation, always prioritizing the interests of its constituents.

What is the average property tax rate in Montgomery County?

+The average property tax rate in Montgomery County is approximately 0.97 per 100 of assessed value for residential properties, 1.17 for commercial properties, and 1.37 for vacant land.

How often are property tax assessments conducted in Montgomery County?

+Property tax assessments in Montgomery County are typically conducted every three years, ensuring that property values remain up-to-date and fair.

Are there any tax relief programs for businesses in Montgomery County?

+Yes, Montgomery County offers various tax relief programs and incentives for businesses, such as the Montgomery County Economic Development Incentive Program, which provides grants, loans, and tax credits to eligible businesses.

How can I appeal my property tax assessment in Montgomery County?

+If you believe your property tax assessment is inaccurate or unfair, you can file an appeal with the Montgomery County Department of Finance. The process involves submitting documentation and attending a hearing to present your case.

Are there any exemptions or reductions available for property taxes in Montgomery County?

+Yes, Montgomery County offers several exemptions and reductions for property taxes. These include the Homestead Tax Credit, the Property Tax Credit for Elderly or Disabled Homeowners, and exemptions for certain types of properties, such as religious or charitable organizations.