Tarrant County Tx Tax Collector

The Tarrant County Tax Office in Texas plays a crucial role in the financial management and governance of the county. This office is responsible for collecting various taxes and fees, ensuring efficient revenue generation, and providing essential services to the residents and businesses within Tarrant County.

Overview of Tarrant County Tax Office

The Tarrant County Tax Office is a key administrative body that facilitates the collection of taxes and the distribution of funds to support various public services. It is headed by an elected Tax Assessor-Collector, who oversees the operations and ensures compliance with state and local tax regulations.

The office is responsible for assessing and collecting property taxes, which form a significant portion of the county's revenue. Additionally, it handles motor vehicle registration and titling, boat registration, and the collection of various fees and special taxes.

With a dedicated team of professionals, the Tarrant County Tax Office aims to provide efficient and convenient services to taxpayers. They offer both in-person and online options for tax payment, registration, and other related transactions.

Property Taxes in Tarrant County

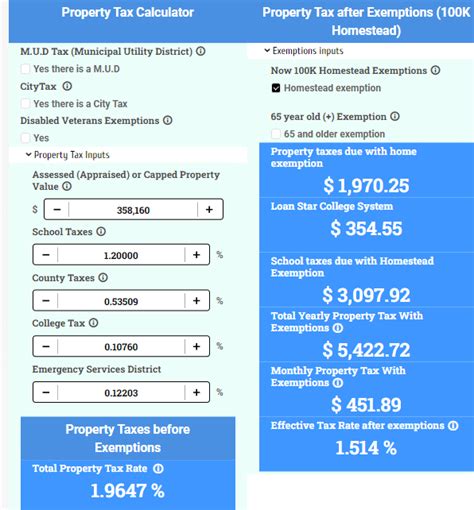

Property taxes are a vital source of revenue for Tarrant County, contributing to the funding of essential services such as education, public safety, and infrastructure development. The Tax Office is responsible for determining the assessed value of properties, which forms the basis for tax calculations.

| Property Type | Average Tax Rate (per $100 of Assessed Value) |

|---|---|

| Residential | $1.80 |

| Commercial | $2.00 |

| Agricultural | $0.80 |

Property owners in Tarrant County receive their tax bills annually, typically in October. The tax bills detail the assessed value of the property, the applicable tax rates, and the total amount due. Taxpayers have the option to pay their taxes in full or opt for a payment plan.

The Tarrant County Tax Office provides resources and assistance to property owners, including information on tax exemptions, homestead designations, and tax relief programs. These initiatives aim to ensure that property owners are aware of their rights and responsibilities and to provide support for those who may face financial challenges.

Motor Vehicle and Boat Registration

In addition to property taxes, the Tarrant County Tax Office handles motor vehicle and boat registration. This includes issuing titles, registering vehicles, and collecting applicable fees and taxes.

| Service | Fee |

|---|---|

| Vehicle Registration (1-year) | $52.00 |

| Vehicle Title Transfer | $29.00 |

| Boat Registration (3-year) | $20.00 |

The office provides convenient online services for vehicle registration renewals, allowing residents to complete the process without visiting a physical location. However, certain transactions, such as title transfers, still require in-person visits to the Tax Office or its designated branches.

Tarrant County also offers specialized services for disabled individuals, providing disabled parking placards and license plates. These services aim to enhance accessibility and mobility for individuals with disabilities.

Online Services and Payment Options

The Tarrant County Tax Office recognizes the importance of digital services in modern tax administration. The office’s website offers a user-friendly platform for taxpayers to access a range of services, including:

- Property tax payment and billing information

- Vehicle registration renewal

- Boat registration and titling

- Tax certificate requests

- Exemption application status

Taxpayers can also sign up for e-notices, which provide electronic notifications for important deadlines and updates. This service helps taxpayers stay informed and ensures timely tax compliance.

The office accepts various payment methods, including credit cards, e-checks, and online payment platforms. It also offers a convenient payment plan option for taxpayers who may require more flexibility in managing their tax obligations.

Conclusion: A Dedicated Public Service

The Tarrant County Tax Office is a critical component of the county’s governance and financial management. Through its efficient tax collection processes and diverse range of services, the office ensures the county’s financial stability and supports the delivery of essential public services.

By providing convenient digital services, transparent tax information, and accessible support, the Tarrant County Tax Office demonstrates its commitment to serving the community. Its efforts contribute to the overall well-being and development of Tarrant County.

FAQ

How often do property taxes need to be paid in Tarrant County?

+Property taxes in Tarrant County are due annually. Tax bills are typically mailed out in October, and taxpayers have until January 31st of the following year to pay their taxes without incurring penalties.

Can I renew my vehicle registration online?

+Yes, Tarrant County offers online vehicle registration renewal services. Taxpayers can renew their registration through the county’s official website. However, certain transactions, like title transfers, still require an in-person visit.

What happens if I miss the property tax payment deadline?

+Missing the property tax payment deadline can result in penalties and interest charges. It’s important to stay informed about tax deadlines and to take advantage of the online payment options or payment plans offered by the Tarrant County Tax Office.

Are there any tax exemptions available for seniors in Tarrant County?

+Yes, Tarrant County offers various tax exemptions, including the Over-65 Homestead Exemption. This exemption can significantly reduce the taxable value of a senior’s primary residence. It’s advisable to check with the Tax Office or consult their website for detailed information on available exemptions.