Sales Tax Roseville Ca

Welcome to our comprehensive guide on sales tax in Roseville, California. As a business owner or consumer in this vibrant city, understanding the sales tax landscape is crucial for compliance and financial planning. In this article, we will delve into the specifics of sales tax in Roseville, providing you with the knowledge and insights needed to navigate this complex but essential aspect of commerce.

Understanding Sales Tax in Roseville, CA

Sales tax in Roseville, like in many other jurisdictions, is a vital revenue source for the city and the state. It is a consumption tax imposed on the sale of goods and services, with the primary aim of funding public services and infrastructure. The sales tax rate is determined by a combination of state, county, and city tax rates, resulting in a composite rate that applies to all taxable transactions within the city limits.

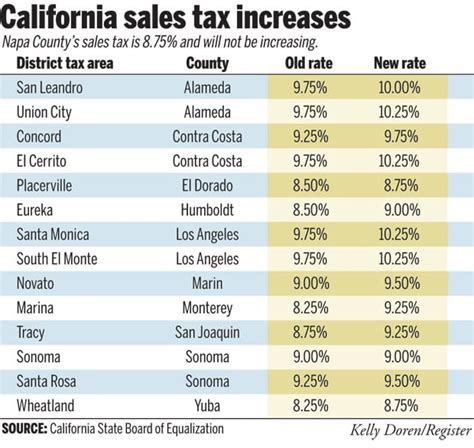

In Roseville, the sales tax rate is influenced by several factors, including the type of product or service being sold and the specific location of the transaction. The city's proximity to major metropolitan areas and its vibrant business environment make it a key player in California's economy, with a robust sales tax system that contributes significantly to the state's revenue.

The Composition of Roseville’s Sales Tax

Roseville’s sales tax rate is made up of several components, each contributing to the overall tax burden on consumers and businesses. Let’s break down these components to understand the composition of the city’s sales tax:

| Tax Component | Rate | Description |

|---|---|---|

| California State Sales Tax | 7.25% | The state-wide sales tax rate, applicable to all counties in California. |

| Placer County Sales Tax | 0.50% | A county-wide sales tax imposed by Placer County, where Roseville is located. |

| Roseville City Sales Tax | 1.00% | A city-specific sales tax imposed by the City of Roseville to fund local projects and services. |

| Special District Sales Tax | Varies | Some areas within Roseville may have additional special district sales taxes, depending on the specific district and its funding needs. |

By adding these components together, we arrive at the total sales tax rate for Roseville. As of our last update, the composite sales tax rate in Roseville is 8.75%, which includes the state, county, city, and potential special district taxes.

Taxable and Exempt Items in Roseville

Understanding what is taxable and what is exempt from sales tax in Roseville is crucial for businesses and consumers alike. While the general rule is that most retail sales of tangible personal property and certain services are taxable, there are specific exemptions and exclusions that can impact the taxability of certain items or transactions.

Taxable Items

In Roseville, the following items are generally subject to sales tax:

- Clothing and apparel

- Electronics and appliances

- Furniture and home furnishings

- Grocery items (excluding certain staple foods)

- Vehicles (including cars, motorcycles, and boats)

- Construction materials

- Entertainment services (e.g., movie tickets, amusement park admissions)

- And many more...

The list of taxable items is extensive, and it's important to consult official sources or tax professionals for a comprehensive understanding of what is taxable in your specific situation.

Exempt Items

On the other hand, there are certain items and transactions that are exempt from sales tax in Roseville. These exemptions can vary depending on state and local laws, as well as specific circumstances. Some common examples of exempt items include:

- Prescription medications

- Certain medical devices and supplies

- Food for home consumption (excluding prepared meals and restaurant meals)

- Non-prepared groceries (e.g., raw produce, unprocessed meats)

- Certain educational materials and supplies

- Nonprofit organizations' sales (under certain conditions)

- Government entities' purchases

- And more, depending on specific circumstances.

Again, it's crucial to consult official resources or seek professional advice to ensure you are accurately applying sales tax exemptions in your business or personal transactions.

Sales Tax Registration and Compliance

If you are a business owner in Roseville, it is essential to understand your obligations regarding sales tax registration and compliance. The California Department of Tax and Fee Administration (CDTFA) is the primary agency responsible for administering sales and use taxes in the state.

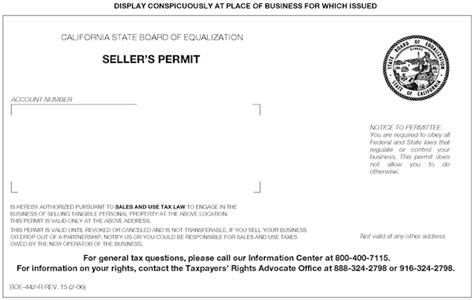

Registering for Sales Tax

Businesses in Roseville that meet certain criteria are required to register for a Seller’s Permit with the CDTFA. This permit allows you to collect and remit sales tax on behalf of the state and local jurisdictions. The registration process typically involves providing business information, tax identification numbers, and details about the types of products or services you sell.

It's important to register promptly to avoid penalties and ensure compliance with tax laws. The CDTFA website provides detailed instructions and resources to guide you through the registration process.

Sales Tax Collection and Remittance

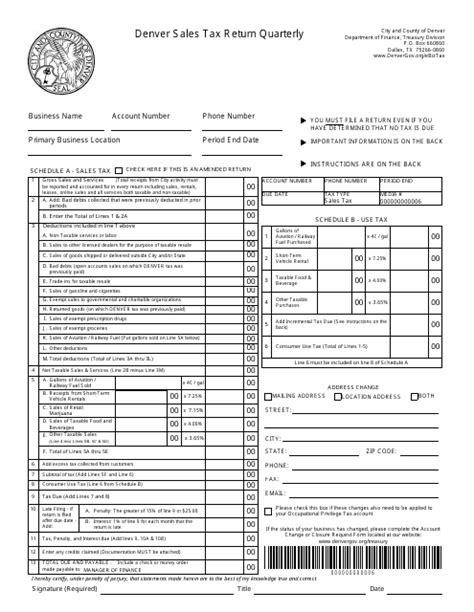

Once registered, businesses are responsible for collecting sales tax from customers at the point of sale. The collected tax must be remitted to the CDTFA on a regular basis, typically quarterly or monthly, depending on your business’s sales volume. The remittance process involves filing sales tax returns and submitting the collected tax amounts to the state.

It's crucial to accurately calculate and remit sales tax to avoid penalties and maintain good standing with the CDTFA. The agency provides resources and tools to assist businesses in calculating and filing their sales tax returns.

Sales Tax for Consumers

As a consumer in Roseville, it’s important to understand your role in the sales tax process. When you purchase goods or services that are subject to sales tax, the tax is typically included in the advertised price. This means that you, as the consumer, are indirectly paying the sales tax to the retailer, who is then responsible for remitting it to the appropriate tax authorities.

Understanding Sales Tax on Receipts

When you receive a sales receipt, you’ll typically see a line item for sales tax. This amount represents the tax you paid on your purchase. It’s important to review your receipts to ensure that the sales tax calculation is accurate and aligns with the applicable tax rates for your location.

If you have any concerns about the sales tax calculation on your receipt, you can reach out to the retailer or consult official tax resources to verify the accuracy of the tax amount.

Sales Tax Refunds and Exemptions for Consumers

In some cases, consumers may be eligible for sales tax refunds or exemptions. For example, if you are a California resident and purchase eligible items for use in another state, you may be entitled to a refund of the sales tax paid in California. Similarly, certain purchases made by government entities or nonprofit organizations may be exempt from sales tax.

To claim a sales tax refund or apply for an exemption, you'll need to follow specific procedures outlined by the CDTFA. It's important to keep accurate records of your purchases and consult official resources to ensure you are eligible for any potential refunds or exemptions.

The Impact of Sales Tax on the Roseville Economy

Sales tax plays a significant role in the economic landscape of Roseville, contributing to the city’s financial stability and funding essential public services. The revenue generated from sales tax supports a wide range of municipal projects, including infrastructure development, public safety initiatives, education, and more.

Infrastructure and Community Development

Sales tax revenue is often used to fund infrastructure improvements in Roseville. This can include road and transportation projects, public parks and recreational facilities, and other community development initiatives. By investing in infrastructure, the city can enhance its economic competitiveness and attract new businesses and residents.

Public Safety and Emergency Services

Sales tax revenue also contributes to the funding of public safety services, such as police and fire departments. These essential services ensure the safety and well-being of Roseville’s residents and businesses. By providing adequate funding for public safety, the city can maintain a high quality of life and promote economic growth.

Education and Social Services

Education is a critical aspect of any community, and sales tax revenue plays a role in supporting local schools and educational initiatives. This funding can be used to improve school facilities, provide resources for teachers and students, and enhance educational programs. Additionally, sales tax revenue may also be allocated to social services, such as healthcare, housing assistance, and community support programs.

The Future of Sales Tax in Roseville

As the economic landscape continues to evolve, so too does the role of sales tax in Roseville. The city’s dynamic business environment and growing population present both challenges and opportunities for the sales tax system. Here are some key considerations for the future of sales tax in Roseville:

Online Sales and E-Commerce

The rise of online sales and e-commerce platforms has presented new challenges for sales tax collection and compliance. With the increasing popularity of online shopping, ensuring that sales tax is accurately collected and remitted for these transactions is crucial. Roseville, like many other jurisdictions, is navigating the complexities of taxing online sales to ensure a level playing field for local businesses and maintain revenue streams.

Economic Development and Business Incentives

Roseville’s commitment to economic development and attracting new businesses may involve considering sales tax incentives or abatements. By offering competitive tax rates or targeted incentives, the city can encourage business growth and investment, ultimately boosting the local economy and creating jobs.

Community Engagement and Transparency

Transparency and community engagement are essential aspects of any effective tax system. Roseville can foster trust and understanding by providing clear and accessible information about sales tax rates, collection processes, and how the revenue is allocated. Engaging with the community through public forums, educational initiatives, and feedback mechanisms can help ensure that sales tax policies align with the needs and values of Roseville’s residents and businesses.

Staying Informed and Engaged

As a resident or business owner in Roseville, staying informed about sales tax policies and changes is crucial. The city and state regularly update tax laws and regulations, and it’s essential to keep up-to-date with these changes to ensure compliance and take advantage of any available incentives or exemptions. Subscribing to official tax newsletters, following relevant government agencies on social media, and consulting trusted tax professionals can help you stay informed and navigate the sales tax landscape effectively.

Conclusion

Sales tax in Roseville, California, is a complex but essential aspect of the city’s economic landscape. Understanding the sales tax rates, taxable items, and compliance requirements is crucial for both businesses and consumers. By navigating the sales tax system effectively, Roseville can continue to thrive economically, fund vital public services, and support the well-being of its residents and businesses.

Stay informed, engage with the community, and embrace the opportunities presented by a robust sales tax system in Roseville. Together, we can ensure a prosperous and sustainable future for this vibrant city.

How often do sales tax rates change in Roseville, CA?

+Sales tax rates in Roseville, CA, can change periodically. While the state sales tax rate remains consistent, local jurisdictions like Roseville may propose and enact changes to their sales tax rates. These changes typically occur through local ballot measures or legislative actions. It’s important to stay updated on any proposed or enacted changes by monitoring official sources or consulting tax professionals.

Are there any online tools to help calculate sales tax in Roseville?

+Yes, there are several online tools and calculators available to help you estimate sales tax in Roseville. These tools typically consider the composite sales tax rate, including state, county, and city taxes. However, it’s important to note that these calculators provide estimates, and for precise calculations, you should refer to official tax resources or consult tax professionals.

How can I stay updated on sales tax changes and compliance requirements in Roseville?

+To stay informed about sales tax changes and compliance requirements in Roseville, you can subscribe to official tax newsletters and alerts provided by the California Department of Tax and Fee Administration (CDTFA). Additionally, follow reputable tax news sources, consult tax professionals, and regularly check the CDTFA website for updates and guidance.