Property Tax Online

In today's fast-paced digital era, the convenience of managing financial obligations online has become increasingly crucial. One such obligation that many homeowners and property owners grapple with is property tax. Paying property taxes can be a complex and time-consuming process, often involving paperwork, long queues, and visits to government offices. However, with the advent of online property tax payment systems, this process has become more streamlined and accessible.

This article aims to delve into the world of Property Tax Online, exploring its benefits, how it works, and its impact on the lives of property owners. By understanding the intricacies of this digital transformation, we can appreciate the efficiency and ease it brings to an otherwise tedious task.

Revolutionizing Property Tax Payment: The Online Advantage

The traditional method of paying property taxes often involved a series of manual steps, from calculating the tax amount to making the payment physically. This process not only consumed valuable time but also left room for errors and delays. However, the introduction of online property tax payment platforms has revolutionized the entire experience, offering a range of advantages that cater to the modern, tech-savvy property owner.

Convenience and Accessibility

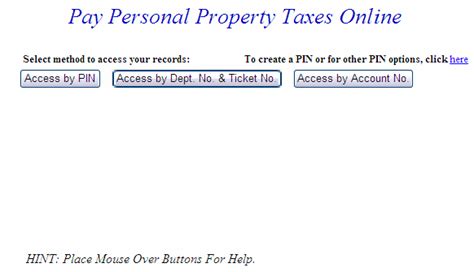

One of the most significant benefits of Property Tax Online is the convenience it provides. Property owners can now access their tax-related information and make payments from the comfort of their homes or offices, eliminating the need for physical visits to government offices. This is particularly advantageous for those with busy schedules or those who live far from these offices.

The accessibility of online property tax platforms extends to various devices, allowing users to manage their taxes on their smartphones, tablets, or computers. This flexibility ensures that property owners can stay on top of their tax obligations regardless of their location or the time of day.

Streamlined Process and Reduced Errors

The online system is designed to simplify the property tax payment process. Users can easily access their property details, including the assessed value, applicable tax rates, and any applicable exemptions. This transparency reduces the chances of errors and ensures that property owners have a clear understanding of their tax liabilities.

Furthermore, the online platform often provides tools and calculators to assist in tax calculations, ensuring accuracy and reducing the risk of overpayment or underpayment. This not only saves time but also minimizes the chances of errors that could lead to legal complications.

Secure and Efficient Payment Methods

Property Tax Online platforms offer a range of secure and efficient payment options. Users can choose from various methods, including credit/debit card payments, online banking transfers, or even digital wallets. These options provide flexibility and cater to different preferences and needs.

The use of secure payment gateways ensures that transactions are protected, minimizing the risk of fraud or identity theft. Additionally, the efficiency of these payment methods reduces the processing time, allowing property owners to receive confirmation of their payments promptly.

| Payment Method | Description |

|---|---|

| Credit/Debit Card | Secure online payment using major credit/debit cards. |

| Online Banking | Direct transfer from user's bank account to the government's account. |

| Digital Wallets | Payment using digital wallets like PayPal, Apple Pay, or Google Pay. |

Real-Time Updates and Transparency

One of the key advantages of Property Tax Online is the real-time updates it provides. Property owners can access their account information instantly, checking the status of their payments, pending dues, and any changes to their property details. This transparency fosters a sense of trust and allows for better financial planning.

Additionally, the online platform often includes a history of past payments, receipts, and other relevant documents. This digital record-keeping simplifies the process of retrieving tax-related information and can be beneficial during audits or for future reference.

The Impact on Property Owners and Communities

The introduction of Property Tax Online has had a significant impact on the lives of property owners and the communities they reside in. By streamlining the tax payment process, these online platforms have brought about a range of positive changes, improving efficiency, transparency, and overall satisfaction.

Improved Efficiency and Reduced Administrative Burden

Property Tax Online has significantly reduced the administrative burden on both property owners and government agencies. The online system automates many manual tasks, such as data entry, calculation, and record-keeping. This efficiency allows government offices to manage a larger volume of transactions with fewer resources, improving overall productivity.

For property owners, the streamlined process saves time and effort. They no longer need to spend hours calculating taxes, gathering paperwork, or standing in long queues. Instead, they can dedicate this time to other productive tasks, improving their overall work-life balance.

Enhanced Transparency and Trust

The transparency provided by Property Tax Online platforms has fostered a greater sense of trust between property owners and the government. With real-time access to tax-related information, property owners can easily verify the accuracy of their assessments and payments. This transparency reduces the potential for misunderstandings and disputes, leading to a more harmonious relationship.

Furthermore, the availability of historical data and digital records ensures that property owners can easily track their tax history, providing them with a clear understanding of their financial obligations over time.

Community Engagement and Education

The introduction of Property Tax Online has also led to increased community engagement and education. Online platforms often provide resources and educational materials, helping property owners understand the tax system, their rights, and their responsibilities. This knowledge empowers them to make informed decisions and actively participate in community discussions related to property taxes.

Additionally, the ease of access to tax-related information encourages property owners to stay informed and engaged. They can discuss tax-related matters with their peers, share experiences, and collectively advocate for improvements or changes in the system.

Efficient Dispute Resolution

In cases where disputes arise regarding property tax assessments, the online platform can facilitate a more efficient resolution process. Property owners can easily access relevant documents, such as previous assessments, payment histories, and official correspondence. This accessibility simplifies the dispute resolution process, allowing for quicker and more accurate decisions.

Moreover, the online system often provides a platform for direct communication with tax authorities, enabling property owners to clarify doubts, seek explanations, or provide additional information without the need for physical meetings.

The Future of Property Tax Online: Innovations and Possibilities

As technology continues to advance, the future of Property Tax Online holds exciting possibilities. Here’s a glimpse into what we can expect in the coming years:

Integration with Smart City Initiatives

As cities embrace smart city initiatives, Property Tax Online platforms can integrate with other digital services. For instance, they can connect with smart meters to automatically calculate taxes based on real-time energy consumption data. This integration enhances accuracy and ensures that taxes are calculated fairly, based on actual usage.

AI-Assisted Tax Calculations

Artificial Intelligence (AI) can play a significant role in improving the accuracy and efficiency of tax calculations. AI algorithms can analyze historical data, property values, and market trends to provide more precise assessments. This not only benefits property owners but also ensures that governments receive the appropriate revenue.

Blockchain for Secure Transactions

Blockchain technology can revolutionize the security and transparency of property tax transactions. By utilizing blockchain, all tax-related information, including assessments, payments, and ownership records, can be stored securely and immutably. This ensures that data cannot be tampered with, enhancing trust and reducing the risk of fraud.

Personalized Tax Planning Tools

Online platforms can offer personalized tax planning tools tailored to individual property owners. These tools can provide insights into tax strategies, exemptions, and deductions, helping property owners optimize their financial planning. By offering these tools, Property Tax Online platforms can become a one-stop solution for all tax-related needs.

Seamless Integration with Financial Institutions

In the future, Property Tax Online platforms can integrate directly with financial institutions, such as banks and mortgage lenders. This integration can streamline the process of tax payments, especially for those with mortgages. It can also facilitate the transfer of tax-related data, ensuring that financial institutions have accurate information for loan applications and other financial processes.

Conclusion: Embracing the Digital Transformation

Property Tax Online has transformed the way property owners manage their tax obligations, offering convenience, efficiency, and transparency. The benefits extend beyond individual property owners, positively impacting government agencies, communities, and the overall economy. As technology continues to advance, we can expect even more innovative solutions that will further streamline the property tax process.

Embracing this digital transformation is not just about convenience; it's about embracing a more efficient, transparent, and secure way of managing our financial obligations. With Property Tax Online, property owners can focus on what truly matters - their homes, businesses, and communities - while leaving the tax management to a system that works for them.

How secure is Property Tax Online?

+

Property Tax Online platforms utilize advanced security measures, including encryption and secure payment gateways, to protect user data and transactions. These platforms prioritize data security to ensure a safe and reliable experience for users.

Can I access my property tax records online anytime?

+

Yes, Property Tax Online platforms typically provide 24⁄7 access to property tax records. Users can log in to their accounts at any time to view past payments, assessments, and other relevant information, ensuring convenient access to their tax-related data.

Are there any additional fees for using Property Tax Online?

+

While some jurisdictions may impose nominal fees for online tax payments, many platforms offer this service free of charge. It’s essential to check with your local government or the specific Property Tax Online platform to understand any associated fees.

What if I encounter technical issues while using Property Tax Online?

+

Most Property Tax Online platforms have dedicated support teams to assist users with technical issues. They provide helpdesk services, troubleshooting guides, and sometimes even live chat support to ensure a smooth experience for users.

Can I pay my property taxes in installments using Property Tax Online?

+

The availability of installment payment options varies depending on the jurisdiction and the Property Tax Online platform. Some platforms offer this feature, allowing users to spread their tax payments over a specified period. It’s advisable to check with your local government or the platform’s terms and conditions for more information.