Property Tax Austin Travis County

Property taxes in Austin, Travis County, are an important topic for homeowners and property owners in the area. Understanding the property tax system, its assessment process, and the factors influencing tax rates is crucial for managing one's financial obligations and planning effectively. In this comprehensive guide, we will delve into the intricacies of property taxes in Austin, Travis County, providing an in-depth analysis and practical insights for residents.

The Austin-Travis County Property Tax Landscape

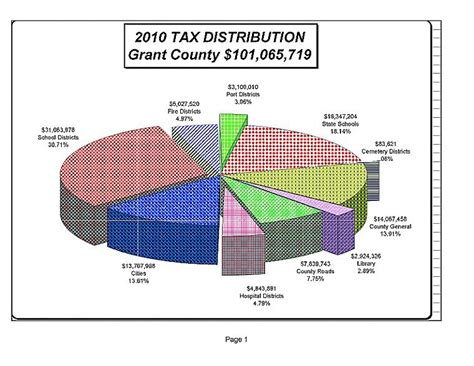

Property taxes in Texas, including Austin and Travis County, are primarily levied by local governments to fund essential services and infrastructure. These taxes contribute significantly to the funding of schools, fire departments, police departments, and other vital community services. As such, property owners in Austin and Travis County have a direct impact on the local community’s growth and development through their tax contributions.

Tax Assessment Process

The property tax assessment process in Austin and Travis County is overseen by the Travis Central Appraisal District (TCAD). TCAD is responsible for determining the market value of each property within the county, which serves as the basis for calculating property taxes.

Here’s a simplified breakdown of the tax assessment process:

- Property Valuation: TCAD conducts an annual appraisal of all taxable properties within the county. This includes residential, commercial, and agricultural properties. Appraisers consider various factors such as location, size, improvements, and recent sales data to estimate the market value of each property.

- Notice of Appraised Value: Once the appraisal is complete, TCAD sends a Notice of Appraised Value to each property owner, informing them of the appraised value of their property. This notice typically arrives by May 1st.

- Protest Period: Property owners have the right to protest their appraised value if they believe it is inaccurate or excessive. The protest period usually begins in late May and lasts for a limited time. During this period, owners can file a protest with TCAD, providing evidence to support their claim.

- Protest Resolution: TCAD reviews all protests and makes a determination. If the protest is upheld, the appraised value may be adjusted. Property owners will receive a revised notice reflecting the changes.

- Tax Rate Adoption: After the protest period, local taxing units (such as the city of Austin, Travis County, and school districts) adopt their tax rates for the year. These tax rates, along with the appraised value, determine the final property tax bill.

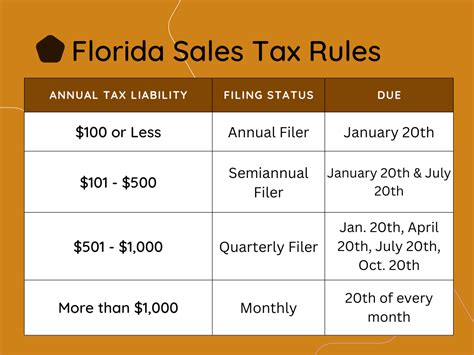

- Tax Bill Issuance: Property owners receive their tax bills, which detail the appraised value, tax rate, and the amount owed. The tax bill is typically due by January 31st of the following year.

| Property Type | Average Appraised Value (2023) |

|---|---|

| Residential | $539,500 |

| Commercial | $2,350,000 |

| Agricultural | Varies |

Factors Influencing Property Taxes

Several key factors impact property taxes in Austin and Travis County:

- Property Value: As mentioned, the appraised value of a property is a significant determinant of property taxes. Higher-valued properties generally incur higher taxes.

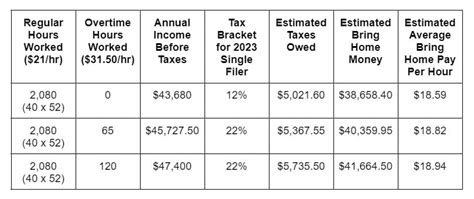

- Tax Rates: Local taxing units set their tax rates annually. These rates are expressed in dollars per 100 of assessed value</em>. For instance, a tax rate of 1.00 per 100 means that for every 100 of assessed value, $1.00 is owed in taxes. The sum of all tax rates applied to a property determines the total tax bill.

- Taxing Units: In Austin and Travis County, multiple taxing units, such as the city, county, and school districts, levy taxes on properties. Each unit sets its own tax rate, and the combined rates impact the overall tax burden.

- Homestead Exemptions: Texas offers homestead exemptions, which reduce the taxable value of a property for homeowners who qualify. These exemptions provide significant savings on property taxes.

- Special Assessments: In some cases, local governments may impose special assessments to fund specific projects or improvements. These assessments are in addition to regular property taxes and are often tied to the benefit received by the property.

Property Tax Rates and Calculations

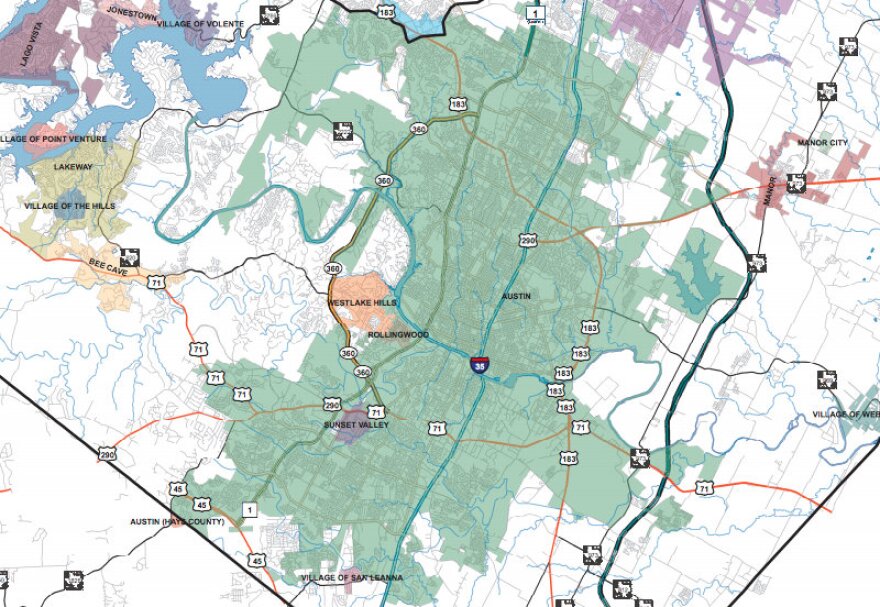

Property tax rates in Austin and Travis County can vary significantly depending on the taxing unit and the property’s location. As of 2023, the effective tax rates for various areas within the county are as follows:

| Taxing Unit | Effective Tax Rate (per $100) |

|---|---|

| City of Austin | $0.4775 |

| Travis County | $0.3888 |

| Austin ISD | $1.1396 |

| Round Rock ISD | $1.2966 |

| Eanes ISD | $1.3374 |

| Lake Travis ISD | $1.2562 |

| Other School Districts | Varies |

To calculate the total property tax bill, multiply the appraised value of the property by the sum of the effective tax rates for all applicable taxing units. For example, a residential property with an appraised value of $500,000 located within the Austin ISD boundaries would have the following tax calculation:

Appraised Value: $500,000

Effective Tax Rates: City of Austin ($0.4775) + Travis County ($0.3888) + Austin ISD ($1.1396) = $1.9969 per $100

Total Tax Bill: $500,000 x $1.9969 per $100 = $9,984.50

Property Tax Trends and Insights

Historical Tax Rate Trends

Over the past decade, property tax rates in Austin and Travis County have exhibited a generally upward trend. This is primarily due to the rapid growth and development experienced by the region, which has led to increased demand for services and infrastructure. As a result, local taxing units have had to adapt their budgets to accommodate these growing needs.

| Year | City of Austin Tax Rate (per $100) | Travis County Tax Rate (per $100) |

|---|---|---|

| 2015 | $0.4468 | $0.3764 |

| 2016 | $0.4573 | $0.3764 |

| 2017 | $0.4677 | $0.3764 |

| 2018 | $0.4775 | $0.3764 |

| 2019 | $0.4775 | $0.3888 |

| 2020 | $0.4775 | $0.3888 |

| 2021 | $0.4775 | $0.3888 |

| 2022 | $0.4775 | $0.3888 |

| 2023 | $0.4775 | $0.3888 |

Impact of Growth and Development

Austin’s reputation as a thriving tech hub and its attractive quality of life have fueled a significant population influx in recent years. This rapid growth has placed increasing pressure on local infrastructure and services, prompting taxing units to raise tax rates to meet the rising demands.

Homestead Exemptions and Tax Relief

Texas offers various homestead exemptions to provide tax relief to qualifying homeowners. The most common exemptions include the General Homestead Exemption, which reduces the taxable value of a property by $25,000, and the Over-65 Homestead Exemption, which provides an additional exemption based on income level.

These exemptions can result in substantial savings on property taxes. For example, a homeowner with a property valued at $500,000 and eligible for both the General and Over-65 Homestead Exemptions could reduce their taxable value to $450,000, potentially saving thousands of dollars annually.

Tax Rate Compression

In response to rising property values, some taxing units in Austin and Travis County have implemented tax rate compression strategies. This involves lowering the tax rate while still generating sufficient revenue due to the increased property values. Tax rate compression aims to alleviate the tax burden on homeowners and promote fiscal responsibility.

Navigating the Property Tax Landscape

Protest and Appeal Process

If a property owner believes their appraised value is excessive or inaccurate, they have the right to protest and appeal. The protest process typically involves the following steps:

- Review the Notice of Appraised Value and identify any discrepancies or errors.

- Gather supporting evidence, such as recent sales data, appraisals, or market analysis reports.

- File a protest with TCAD within the designated protest period.

- Attend a hearing or provide written evidence to support the protest.

- TCAD will issue a decision, and if the protest is upheld, the appraised value will be adjusted.

Property Tax Planning and Strategies

Property tax planning is essential for managing financial obligations and ensuring compliance. Here are some strategies for property tax management:

- Stay Informed: Keep up-to-date with tax assessment timelines, protest periods, and tax rate changes. TCAD provides valuable resources and information on their website.

- Monitor Property Value: Regularly review property values to ensure accuracy. Consider obtaining independent appraisals or utilizing online tools to estimate market value.

- Utilize Homestead Exemptions: If eligible, apply for homestead exemptions to reduce the taxable value of your property. These exemptions can provide significant savings.

- Review Tax Bills: Carefully examine tax bills to ensure accuracy. Verify the appraised value, tax rates, and any applicable exemptions.

- Consider Tax-Efficient Strategies: Explore options like deferring property improvements until after the appraisal period or timing the purchase or sale of a property to optimize tax benefits.

Property Tax and Real Estate Market Dynamics

Property taxes are closely intertwined with the real estate market. Rising property values often lead to higher tax assessments, which can impact the affordability and desirability of certain areas. Conversely, tax-friendly areas may become more attractive to homebuyers.

It's essential for homebuyers and investors to consider property taxes when making real estate decisions. Areas with lower tax rates or generous exemptions may offer more attractive long-term financial prospects.

Conclusion

Understanding the property tax landscape in Austin and Travis County is vital for property owners and homebuyers. By staying informed about tax assessment processes, rates, and exemptions, individuals can effectively manage their financial obligations and contribute to the vibrant community of Austin. As the region continues to grow and evolve, property taxes will remain a crucial aspect of local governance and community development.

How often are property taxes assessed in Austin and Travis County?

+Property taxes are assessed annually in Austin and Travis County. The Travis Central Appraisal District (TCAD) conducts an appraisal of all taxable properties each year, typically resulting in a new appraised value and tax bill for property owners.

Can I appeal my property’s appraised value if I disagree with it?

+Yes, property owners have the right to protest their appraised value if they believe it is inaccurate or excessive. The protest period usually begins in late May, and property owners can file a protest with TCAD, providing evidence to support their claim.

What are the benefits of homestead exemptions in Texas?

+Homestead exemptions in Texas reduce the taxable value of a property for homeowners who qualify. The most common exemptions include the General Homestead Exemption, which reduces the taxable value by $25,000, and the Over-65 Homestead Exemption, which provides additional savings based on income level. These exemptions can result in substantial savings on property taxes.

How can I estimate my property tax bill before receiving the official tax bill?

+To estimate your property tax bill, you can use the effective tax rates for your area and multiply them by the appraised value of your property. You can find the effective tax rates for various taxing units on the TCAD website or through local government resources. This estimation provides a rough idea of your tax liability.

Are there any tax incentives or programs for certain types of properties in Austin and Travis County?

+Yes, Austin and Travis County offer various tax incentives and programs for specific property types. For example, agricultural properties may be eligible for agricultural valuation or productivity credits. Additionally, certain improvements or renovations may qualify for tax abatements or incentives. It’s recommended to consult with local authorities or tax professionals for specific details.