Pay Illinois Taxes Online

The Complete Guide to Paying Illinois Taxes Online

Paying taxes is an essential responsibility for all residents and businesses in Illinois, and the process has become more streamlined and convenient with the introduction of online payment options. In this comprehensive guide, we will explore the various methods available to pay your Illinois taxes electronically, offering a step-by-step breakdown to ensure a seamless and efficient experience. Whether you are an individual taxpayer or a business owner, this article will provide you with the knowledge and tools to navigate the online tax payment process with ease.

Understanding Illinois Tax Obligations

Before we delve into the online payment methods, it’s crucial to understand the different types of taxes levied by the state of Illinois and the entities responsible for their collection. Illinois imposes a range of taxes, including:

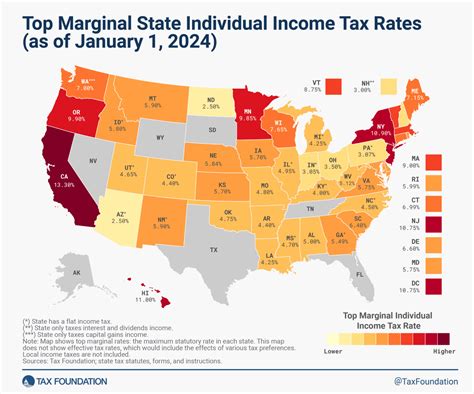

- Individual Income Tax: Residents of Illinois are required to pay income tax on their earnings. The tax rates vary based on income brackets and filing status.

- Corporate Income Tax: Businesses operating in Illinois are subject to corporate income tax, which is calculated based on their profits.

- Sales and Use Tax: This tax is applied to the sale of goods and certain services within the state. It is typically included in the final price paid by consumers.

- Property Tax: Property taxes are levied on real estate and personal property within Illinois. These taxes are usually paid to local government entities.

- Excise Taxes: Illinois imposes excise taxes on specific goods and activities, such as tobacco products, fuel, and certain business transactions.

Each of these taxes has its own set of regulations and deadlines, and it is the responsibility of taxpayers to ensure compliance. The Illinois Department of Revenue (IDOR) is the primary agency responsible for administering and collecting these taxes.

Online Payment Options for Illinois Taxes

The IDOR has implemented several online platforms and payment systems to facilitate tax payments, making the process more accessible and efficient for taxpayers. Here are the key methods available:

Illinois Taxpayer Portal

The Illinois Taxpayer Portal is a centralized online platform that allows individuals and businesses to manage their tax obligations, including filing tax returns and making payments. This portal offers a secure and user-friendly interface, making it a popular choice for many taxpayers. To use the Taxpayer Portal, you will need to create an account by providing your personal or business information.

Once logged in, you can access various features, including:

- Individual Income Tax Payments: Make payments for your individual income tax liabilities, including estimated tax payments and final tax payments.

- Corporate Income Tax Payments: Businesses can pay their corporate income tax liabilities and manage their tax accounts online.

- Sales and Use Tax Payments: Retailers and other businesses responsible for collecting sales tax can remit their sales and use tax payments through the portal.

- Payment History: View your payment history, including past transactions and any outstanding balances.

- Account Management: Update your personal or business information, manage your tax forms, and access helpful resources and guides.

Illinois Electronic Funds Transfer (EFT)

The Electronic Funds Transfer (EFT) system is another convenient method to pay your Illinois taxes online. EFT allows you to transfer funds directly from your bank account to the IDOR’s account, ensuring a secure and timely payment. To use EFT, you will need to provide your bank’s routing number and account details.

Here are the key steps to using EFT:

- Log in to your IDOR account or access the EFT payment portal.

- Select the tax type and amount you wish to pay.

- Provide your bank account information, including the routing number and account number.

- Review and confirm the payment details.

- The IDOR will process the payment, and you will receive a confirmation number for your records.

Credit Card Payments

For added convenience, Illinois taxpayers can also pay their taxes using a credit card. This method is particularly useful for those who prefer to pay with a credit card for rewards or to avoid carrying large sums of cash. However, it’s important to note that credit card payments often incur a processing fee, which is typically a percentage of the total tax amount.

To pay by credit card, you can:

- Access the IDOR's credit card payment portal or use a third-party payment service provider authorized by the state.

- Enter your tax information, including the tax type and amount.

- Provide your credit card details, including the card number, expiration date, and CVV.

- Review the transaction and confirm the payment.

- You will receive a confirmation number and an email receipt for your records.

Other Online Payment Methods

In addition to the methods mentioned above, Illinois offers several other online payment options:

- Direct Debit: Some taxpayers can set up direct debit arrangements with the IDOR, allowing automatic deductions from their bank accounts on specified dates.

- Online Banking Bill Pay: You can use your online banking platform to schedule tax payments, which will be deducted from your account and sent to the IDOR.

- Mobile Apps: Several mobile apps, such as tax payment apps or personal finance apps, offer the ability to make Illinois tax payments.

Benefits of Online Tax Payments

Paying your Illinois taxes online offers numerous advantages over traditional methods, such as mailing paper checks or visiting tax offices. Here are some key benefits:

- Convenience: Online payment methods can be accessed from anywhere with an internet connection, allowing you to pay your taxes at your convenience without visiting physical locations.

- Security: Online platforms use advanced security measures to protect your financial information, ensuring that your payments are safe and secure.

- Speed: Electronic payments are processed quickly, often within a few business days, ensuring timely payment and avoiding penalties for late payments.

- Account Management: Online portals provide a centralized location to manage your tax obligations, allowing you to view payment history, update personal information, and access important resources.

- Flexibility: With multiple payment options available, you can choose the method that best suits your needs, whether it's a one-time payment, recurring payments, or automatic deductions.

Step-by-Step Guide: Paying Illinois Taxes Online

Now that we have explored the various online payment methods, let’s walk through a step-by-step process to pay your Illinois taxes electronically:

- Choose Your Payment Method: Decide which online payment method suits your preferences and requirements. Consider factors such as fees, security, and convenience.

- Gather Required Information: Collect the necessary information, including your tax identification number, tax amount, and, for some methods, your bank account or credit card details.

- Access the Payment Platform: Log in to your IDOR account or visit the official Illinois tax payment portal for your chosen method.

- Select Tax Type: Choose the type of tax you wish to pay, such as individual income tax, corporate tax, or sales tax.

- Enter Payment Details: Provide the required information, including the tax amount, your personal or business details, and, if applicable, your bank or credit card details.

- Review and Confirm: Carefully review all the payment details, including the tax type, amount, and payment method. Ensure that all information is accurate before proceeding.

- Make the Payment: Click the "Pay Now" or similar button to initiate the payment process. You may be redirected to a secure payment gateway or asked to confirm the transaction.

- Receive Confirmation: Once the payment is processed, you will receive a confirmation number and an email receipt (if applicable) for your records. Keep these for future reference.

- Check Payment Status: After making the payment, you can log in to your IDOR account or access the payment portal to check the status of your payment and ensure it has been successfully processed.

Tips for a Smooth Online Payment Experience

To ensure a seamless and successful online tax payment experience, consider the following tips:

- Ensure you have a stable internet connection and use a secure browser to protect your financial information.

- Gather all the necessary documents and information before starting the payment process to avoid delays.

- Double-check all the payment details, especially the tax amount and personal or business information, to prevent errors.

- If paying by credit card, be aware of any processing fees and ensure you have sufficient credit available.

- Keep a record of your payment confirmation number, email receipts, and any other relevant documents for future reference and tax record-keeping.

- Stay informed about any changes or updates to online payment systems and tax regulations by regularly checking the IDOR's website or subscribing to their newsletters.

Frequently Asked Questions (FAQ)

How long does it take for an online tax payment to be processed and reflected on my account?

+Online tax payments are typically processed within 2-3 business days. However, the exact processing time may vary depending on the payment method and the volume of transactions. It's recommended to allow sufficient time before the payment due date to ensure timely processing.

Are there any penalties for late online tax payments?

+Yes, late payments may result in penalties and interest charges. It's crucial to make your tax payments on time to avoid these additional costs. The IDOR website provides information on late payment penalties and interest rates, which can vary based on the type of tax and the duration of the delay.

Can I schedule recurring payments for my Illinois taxes online?

+Yes, certain online payment methods, such as the Illinois Taxpayer Portal and Electronic Funds Transfer (EFT), offer the option to set up recurring payments. This feature is particularly useful for taxpayers who have consistent tax liabilities, such as estimated tax payments. By scheduling recurring payments, you can ensure timely payments without the need for manual interventions.

What security measures are in place for online tax payments in Illinois?

+The IDOR takes data security seriously and employs various security measures to protect taxpayers' information. This includes encryption protocols, secure servers, and robust authentication processes. Additionally, taxpayers can further enhance security by using strong passwords, enabling two-factor authentication, and regularly updating their devices and browsers.

Can I pay my Illinois taxes online if I owe taxes in multiple states?

+Yes, you can pay your Illinois taxes online even if you have tax obligations in other states. The online payment platforms in Illinois are designed to handle payments for various tax types, including those levied by other states. However, it's important to ensure that you are using the correct payment platform for each state's taxes to avoid confusion and ensure accurate payments.

Conclusion

Paying Illinois taxes online has revolutionized the way taxpayers manage their obligations, offering convenience, security, and efficiency. With a range of online payment methods available, taxpayers can choose the option that best suits their needs and preferences. Whether you opt for the Illinois Taxpayer Portal, Electronic Funds Transfer, or credit card payments, the process is designed to be user-friendly and secure. By following the step-by-step guide and implementing the tips provided, you can navigate the online tax payment process with confidence and ensure timely compliance with your Illinois tax obligations. Remember to stay informed about any updates and changes to ensure a smooth and successful tax payment experience.