Pay Illinois Income Tax Online

Are you a resident of Illinois looking to pay your income taxes online? This guide will walk you through the process, providing you with the necessary steps and information to ensure a smooth and efficient payment experience. Illinois offers a convenient online platform to manage your tax obligations, and we'll explore how to navigate this system effectively.

Understanding Illinois Income Tax

Illinois, like many other states, imposes an income tax on its residents. This tax is a percentage of your income, and it contributes to the state's revenue, which is then used to fund various public services and infrastructure projects. Understanding the Illinois income tax system is crucial for complying with your financial obligations and ensuring you receive any applicable deductions or credits.

The Illinois income tax rate for the 2023 tax year is 4.95%, which is applied to your taxable income. This rate is subject to change, so it's essential to stay updated with the latest tax information to avoid any surprises during filing season.

Before diving into the online payment process, let's cover some essential terms and concepts to ensure you have a comprehensive understanding of Illinois income tax.

Taxable Income

Your taxable income is the amount of money you earn that is subject to income tax. It includes income from various sources such as wages, salaries, bonuses, tips, and investments. However, not all income is taxable, and there are deductions and exemptions that can reduce your taxable income.

Deductions and Exemptions

Deductions and exemptions are reductions in your taxable income that can lower the amount of tax you owe. Illinois offers several deductions and exemptions, including standard deductions, personal exemptions, and itemized deductions. These can vary based on your individual circumstances, such as your filing status, income level, and family size.

Filing Status

Your filing status determines the tax rates and deductions you're eligible for. The common filing statuses in Illinois include single, married filing jointly, married filing separately, head of household, and qualifying widow(er). Your filing status is influenced by your marital status and the number of dependents you support.

Tax Credits

Tax credits are reductions in the amount of tax you owe. They can be claimed for various reasons, such as having children, owning a home, or making charitable contributions. Illinois offers a range of tax credits, including the Earned Income Tax Credit (EITC), Child and Dependent Care Credit, and the Illinois Property Tax Credit.

Paying Illinois Income Tax Online

Paying your Illinois income tax online is a straightforward process that offers convenience and efficiency. Here's a step-by-step guide to help you navigate the online payment system:

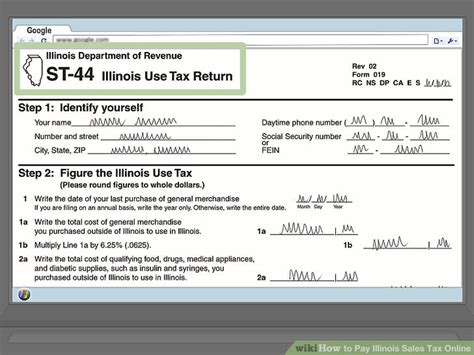

Step 1: Access the Illinois Income Tax Website

Begin by visiting the official Illinois Department of Revenue website at https://www.illinois.gov/revenue. This is the trusted source for all your tax-related needs, ensuring a secure and reliable experience.

Step 2: Create an Account

If you're a first-time user, you'll need to create an account. Click on the "Register" or "Create Account" button, typically found in the top-right corner of the homepage. Follow the on-screen instructions to provide your personal information, including your name, address, and contact details. You'll also need to create a secure password.

Step 3: Log In to Your Account

Once you've created your account, log in using your credentials. This will give you access to your personal tax information and allow you to manage your tax obligations securely.

Step 4: Navigate to the Payment Portal

After logging in, locate the "Pay Taxes" or "Online Payment" section on the website. This portal is designed specifically for making tax payments and managing your tax liabilities.

Step 5: Select the "Income Tax" Option

Within the payment portal, you'll find various tax categories. Select the "Income Tax" option to proceed with your payment. This will direct you to a dedicated page for income tax payments.

Step 6: Enter Your Tax Information

On the income tax payment page, you'll be prompted to enter your tax information. This includes your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), your filing status, and the amount you owe. Ensure that all information is accurate to avoid any processing delays.

Step 7: Choose Your Payment Method

Illinois offers multiple payment methods to cater to different preferences. You can choose to pay by credit or debit card, electronic check (e-check), or direct deposit from your bank account. Each method has its own fees and processing times, so select the option that best suits your needs.

| Payment Method | Description | Fees | Processing Time |

|---|---|---|---|

| Credit/Debit Card | Secure online payment using your card details. | 2.5% of the payment amount | Immediate |

| Electronic Check (e-check) | Electronic payment using your bank account details. | Free | 3-5 business days |

| Direct Deposit | Automatic transfer from your bank account to the state's account. | Free | 1-2 business days |

Step 8: Review and Confirm Your Payment

Before finalizing your payment, carefully review all the details, including the amount, payment method, and any applicable fees. Ensure that the information is accurate and complete. If you need to make any changes, you can do so before confirming the payment.

Step 9: Receive Confirmation

Once you've confirmed your payment, you'll receive an immediate confirmation message on the website. This message will include a unique transaction ID or reference number that you can use to track your payment status. Additionally, you'll receive an email confirmation with all the payment details.

Step 10: Track Your Payment

To ensure your payment has been successfully processed, you can track its status online. Log in to your account and navigate to the "Payment History" or "Transaction History" section. Here, you'll find a record of all your payments, including the date, amount, and status. If any issues arise, you can contact the Illinois Department of Revenue for assistance.

Benefits of Paying Illinois Income Tax Online

Paying your Illinois income tax online offers several advantages, making the process more convenient and efficient. Here are some key benefits to consider:

Convenience and Accessibility

The online payment system is accessible 24/7, allowing you to pay your taxes at your convenience. You can access the portal from anywhere with an internet connection, eliminating the need to visit a physical tax office or wait in line.

Secure and Reliable

The Illinois Department of Revenue's online platform is designed with robust security measures to protect your personal and financial information. Your data is encrypted, and the website is regularly monitored to ensure a safe and secure experience.

Real-Time Payment Processing

When you pay online, your payment is processed in real-time. This means you receive immediate confirmation, and your payment is credited to your tax account promptly. There's no need to wait for checks to clear or for manual processing, which can be time-consuming.

Paperless and Eco-Friendly

Online payments eliminate the need for paper forms and checks, reducing the environmental impact of the tax payment process. This not only benefits the environment but also simplifies your record-keeping, as all your payment information is available digitally.

Flexible Payment Options

Illinois offers a range of payment methods, allowing you to choose the option that best suits your financial situation. Whether you prefer to pay with a credit card, electronic check, or direct deposit, the online platform accommodates various preferences.

Automatic Payment Reminders

When you set up your online account, you can opt to receive automatic payment reminders. This feature ensures you don't miss any payment deadlines, helping you stay on top of your tax obligations.

Common Questions and Concerns

Can I pay my Illinois income tax in installments?

+Yes, Illinois offers an installment payment plan for individuals who are unable to pay their tax liability in full. You can apply for this plan through the Illinois Department of Revenue's website. The plan allows you to make monthly payments over a specified period, helping you manage your tax obligations more flexibly.

What if I need assistance with my online payment process?

+The Illinois Department of Revenue provides comprehensive support for online payments. If you encounter any issues or have questions, you can contact their customer support team via phone, email, or live chat. They are available to assist you and guide you through the payment process.

Are there any penalties for late payments?

+Yes, Illinois imposes penalties and interest on late payments. The penalty for late filing is 5% of the tax due, and an additional 0.5% per month (up to a maximum of 25%) is charged for late payment. It's important to make your payments on time to avoid these additional charges.

Can I pay my taxes with a credit card without incurring fees?

+No, when you pay your Illinois income tax with a credit card, a convenience fee of 2.5% is applied to your payment. This fee is charged by the credit card processing company and is not part of your tax obligation. You can avoid this fee by using alternative payment methods such as electronic checks or direct deposit.

Is my online payment information secure?

+Absolutely! The Illinois Department of Revenue prioritizes data security. All your personal and financial information is encrypted and protected using advanced security measures. Additionally, the website is regularly audited to ensure compliance with data privacy regulations.

Conclusion

Paying your Illinois income tax online is a simple and secure process that offers numerous benefits. By following the steps outlined in this guide, you can efficiently manage your tax obligations and take advantage of the convenience and flexibility provided by the online payment system. Remember to stay informed about tax rates, deductions, and deadlines to ensure a smooth and stress-free tax experience.