Orlando Sales Tax

Welcome to the comprehensive guide to the Orlando Sales Tax, an essential topic for both residents and visitors of the vibrant city of Orlando, Florida. In this expert-level journal-style article, we will delve into the intricacies of sales tax regulations, providing you with a thorough understanding of this crucial aspect of financial planning and budgeting. As an informed consumer or business owner, it is crucial to navigate the complexities of sales tax to make the most of your financial decisions. Let's explore the world of Orlando sales tax, uncovering the rates, exemptions, and implications that impact your everyday life and business operations.

Understanding the Orlando Sales Tax Landscape

The city of Orlando, nestled in the heart of Florida, boasts a dynamic economy fueled by tourism, entertainment, and diverse industries. As such, the sales tax structure in Orlando plays a pivotal role in funding public services, infrastructure development, and local initiatives. Delving into the specifics of the Orlando sales tax is essential for making informed financial choices, whether you’re a local resident, a visitor planning a trip, or a business considering expansion in the region.

The Orlando Sales Tax Rates: A Detailed Breakdown

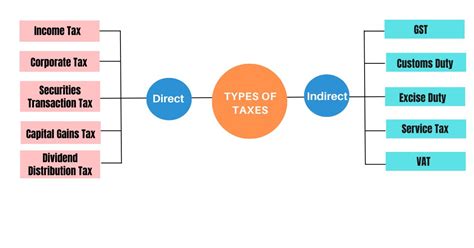

Orlando’s sales tax is comprised of a combination of state, county, and municipal taxes, each with its own rate and purpose. Understanding these rates is crucial for calculating the total sales tax on various transactions. Here’s a breakdown of the sales tax rates in Orlando, Florida:

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of Florida | 6% |

| Orange County | 1.5% |

| Orlando Municipal Tax | 1.5% |

| Total Orlando Sales Tax | 9% |

The total sales tax rate in Orlando stands at 9%, which is applied to most tangible goods and certain services. This rate is a cumulative result of the state, county, and municipal taxes, each contributing to the overall tax burden.

Sales Tax Exemptions and Special Considerations

While the 9% sales tax rate is a standard for most transactions, it’s important to note that certain goods and services are exempt from sales tax or may be subject to reduced rates. These exemptions and special considerations are outlined in Florida’s sales tax laws and can significantly impact your financial planning. Here are some key exemptions and special cases to be aware of:

- Groceries and Food Items: Certain food items, including staple groceries, are exempt from sales tax in Orlando. This exemption provides relief to consumers by reducing the tax burden on essential food purchases.

- Prescription Medications: Sales tax is not applied to prescription medications, making healthcare more accessible and affordable for Orlando residents.

- Certain Services: Some services, such as professional services like legal and accounting, are exempt from sales tax. This distinction can impact the pricing structure for businesses in these industries.

- Manufacturing and Resale: Manufacturers and retailers engaged in wholesale transactions are often eligible for sales tax exemptions or reduced rates. This incentive promotes economic growth and encourages business expansion in Orlando.

The Impact of Sales Tax on Orlando’s Economy

Sales tax is a critical component of Orlando’s economic ecosystem, contributing to the city’s financial stability and development. The revenue generated from sales tax is allocated to various public services and infrastructure projects, shaping the city’s growth and prosperity. Let’s explore how sales tax influences Orlando’s economy and the lives of its residents and visitors.

Funding Public Services and Infrastructure

The sales tax revenue collected in Orlando plays a vital role in funding essential public services and infrastructure initiatives. Here’s a glimpse at how sales tax impacts the city’s development:

- Education: A portion of the sales tax revenue is allocated to support public schools, ensuring access to quality education for Orlando's youth.

- Healthcare: Sales tax funds contribute to the maintenance and improvement of public healthcare facilities, benefiting residents' well-being.

- Transportation: Sales tax revenue is utilized to enhance the city's transportation network, including road maintenance, public transit, and infrastructure projects.

- Public Safety: The police department, fire services, and emergency response teams receive funding from sales tax, ensuring the safety and security of Orlando's residents and visitors.

By allocating sales tax revenue to these critical areas, Orlando is able to provide a high quality of life for its residents and create an attractive environment for businesses and tourists alike.

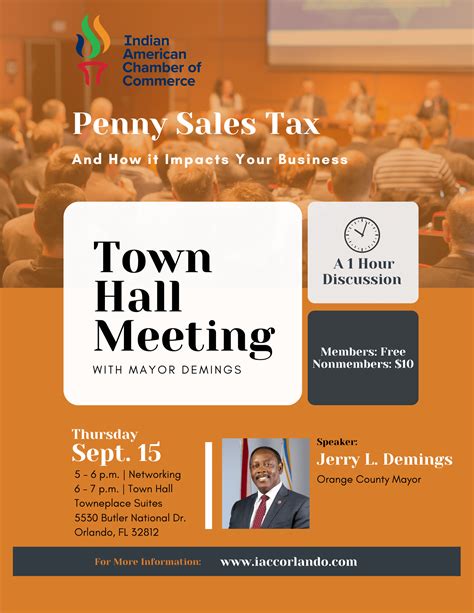

Attracting Tourism and Business Opportunities

Orlando’s vibrant economy is fueled by tourism and a diverse range of industries. The sales tax structure plays a pivotal role in attracting visitors and businesses to the region. Here’s how sales tax impacts Orlando’s tourism and business landscape:

- Tourism Boost: The city's sales tax rate is a factor in the decision-making process for tourists considering a trip to Orlando. A competitive sales tax rate can encourage visitors to choose Orlando as their destination, benefiting the local economy.

- Business Incentives: Sales tax exemptions and reduced rates for certain industries, such as manufacturing and technology, can attract businesses to set up operations in Orlando. This, in turn, creates job opportunities and drives economic growth.

- Retail and Hospitality: The sales tax revenue generated from retail and hospitality businesses contributes significantly to the city's financial health, supporting the vibrant tourism industry that Orlando is renowned for.

Navigating Sales Tax Compliance for Businesses

For businesses operating in Orlando, understanding and complying with sales tax regulations is paramount. Sales tax compliance ensures that businesses operate within the legal framework, avoid penalties, and maintain a positive relationship with tax authorities. Let’s explore the key considerations for businesses navigating sales tax in Orlando.

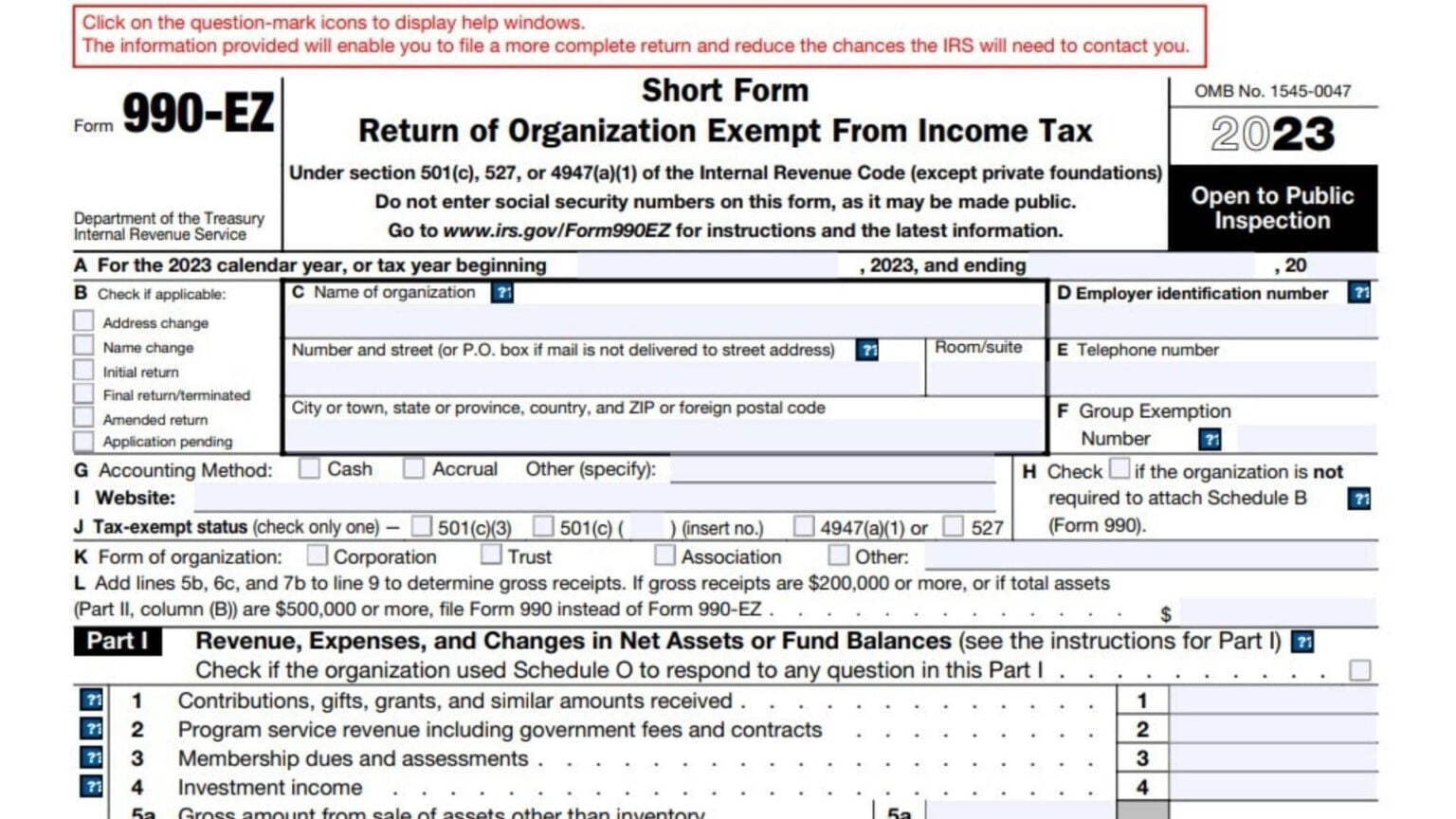

Sales Tax Registration and Remittance

Businesses in Orlando are required to register for sales tax with the Florida Department of Revenue. This registration process involves obtaining a sales tax permit, which authorizes the business to collect and remit sales tax on behalf of the state, county, and municipality. Here’s a simplified guide to sales tax registration and remittance:

- Obtain a Sales Tax Permit: Apply for a sales tax permit online through the Florida Department of Revenue's website. Provide accurate business information and select the appropriate tax jurisdiction (state, county, and city) for registration.

- Collect Sales Tax: Once registered, businesses must collect sales tax from customers at the point of sale. The collected tax should be calculated based on the applicable tax rates and itemized on the sales receipt.

- Remit Sales Tax: Businesses are responsible for remitting the collected sales tax to the appropriate tax authorities on a regular basis. The frequency of remittance (monthly, quarterly, or annually) depends on the business's sales volume and tax jurisdiction.

It's essential for businesses to maintain accurate records of sales transactions and tax remittances to ensure compliance and avoid penalties.

Sales Tax Calculation and Reporting

Calculating sales tax accurately is a critical aspect of sales tax compliance. Businesses must apply the appropriate tax rates to transactions and ensure that sales tax is correctly calculated and reported. Here’s a breakdown of the sales tax calculation and reporting process:

- Determine Taxable Sales: Identify the sales transactions that are subject to sales tax. Examine the nature of the goods or services sold and apply the relevant tax exemptions or special considerations.

- Calculate Sales Tax: Apply the appropriate tax rates to the taxable sales. For example, if the total taxable sale amount is $100, and the sales tax rate is 9%, the sales tax due would be $9.

- Record Sales Tax: Keep detailed records of sales transactions, including the sales tax amount, to facilitate accurate reporting and audit processes.

- File Sales Tax Returns: Businesses must file sales tax returns with the Florida Department of Revenue on a regular basis. These returns provide a summary of the sales tax collected and remitted during the reporting period.

Businesses should stay informed about sales tax regulations, seek professional guidance when needed, and utilize accounting software or services to streamline sales tax calculations and reporting.

Sales Tax Planning for Consumers

For consumers in Orlando, understanding sales tax is essential for making informed purchasing decisions and budgeting effectively. Sales tax can significantly impact the overall cost of goods and services, influencing consumer behavior and spending patterns. Let’s explore how consumers can navigate sales tax and make the most of their financial resources.

Budgeting with Sales Tax in Mind

Incorporating sales tax into your budgeting process is crucial for accurate financial planning. Here are some tips for budgeting with sales tax considerations:

- Estimate Sales Tax: When creating a budget, factor in the 9% sales tax rate for most goods and services in Orlando. This helps in calculating the total cost of purchases and avoiding unexpected expenses.

- Utilize Sales Tax Calculators: Online sales tax calculators can provide quick estimates of the sales tax on specific purchases. These tools are particularly useful when planning large purchases or comparing prices across different retailers.

- Research Exemptions: Stay informed about sales tax exemptions and special considerations. Understanding which items are exempt from sales tax can help you maximize your savings and make more strategic purchasing decisions.

Maximizing Savings with Sales Tax Strategies

While sales tax is an unavoidable expense for most transactions, there are strategies consumers can employ to minimize their tax burden. Here are some tips for maximizing savings and making the most of your financial resources:

- Shop during Sales Tax Holidays: Florida occasionally offers sales tax holidays, during which certain categories of goods are exempt from sales tax for a limited time. Planning your purchases during these periods can result in significant savings.

- Explore Discounts and Promotions: Retailers often offer discounts and promotions that can help offset the impact of sales tax. Keep an eye out for sales, coupons, and loyalty programs that can reduce the overall cost of your purchases.

- Consider Online Shopping: Online retailers may offer competitive pricing and shipping options, providing an alternative to in-store purchases. Compare prices and consider the convenience of online shopping to potentially save on sales tax.

Future Implications and Policy Considerations

As Orlando’s economy continues to evolve, the sales tax structure may undergo changes to adapt to emerging needs and challenges. Exploring future implications and policy considerations provides valuable insights into the potential direction of sales tax regulations in the city. Let’s delve into some key aspects that may shape the future of sales tax in Orlando.

Potential Sales Tax Rate Adjustments

The sales tax rate in Orlando is subject to periodic reviews and adjustments to meet the changing financial needs of the city and its residents. Here are some factors that could influence future sales tax rate changes:

- Economic Growth: If Orlando's economy experiences significant growth, the sales tax rate may be adjusted to generate additional revenue for public services and infrastructure projects.

- Budgetary Constraints: Conversely, during periods of economic downturn or budget constraints, the sales tax rate could be reduced to provide relief to consumers and businesses.

- Political and Public Opinion: Changes in political leadership and shifts in public opinion can influence the decision-making process regarding sales tax rates. Public pressure for tax relief or infrastructure development could impact future rate adjustments.

Expanding Sales Tax Base and Exemptions

The sales tax base in Orlando may evolve to include new categories of goods and services, while exemptions could be expanded to provide relief to specific industries or consumer groups. Here are some potential developments in this area:

- Digital Economy: As the digital economy continues to grow, sales tax regulations may be extended to online transactions and digital services. This could impact businesses and consumers engaged in e-commerce activities.

- Environmental Initiatives: Sales tax exemptions or incentives could be introduced to promote environmentally friendly products and services, encouraging sustainable practices among consumers and businesses.

- Social Equity: Policy considerations may focus on expanding sales tax exemptions for essential goods and services to support low-income households and vulnerable communities.

The Role of Technology in Sales Tax Administration

Advancements in technology are likely to play a significant role in streamlining sales tax administration and compliance. Here are some ways technology could shape the future of sales tax in Orlando:

- Digital Tax Collection: Online platforms and mobile applications could facilitate the collection and remittance of sales tax, making the process more efficient and accessible for businesses and consumers.

- Data Analytics: Advanced data analytics tools could enhance tax authorities' ability to detect and prevent tax evasion, ensuring a fair and equitable tax system.

- Blockchain and Cryptocurrency: The integration of blockchain technology and cryptocurrency could revolutionize sales tax administration, providing secure and transparent transaction records.

Conclusion: Navigating Orlando’s Sales Tax Landscape

In conclusion, understanding the Orlando sales tax structure is a crucial aspect of financial planning and economic engagement for both residents and businesses. The 9% sales tax rate, composed of state, county, and municipal taxes, funds essential public services and infrastructure, contributing to Orlando’s vibrant economy. For businesses, compliance with sales tax regulations is essential for legal operation and financial stability, while consumers can navigate sales tax strategically to make the most of their purchasing power.

As Orlando continues to evolve, the sales tax landscape may undergo adjustments to meet the changing needs of the city and its residents. By staying informed about sales tax rates, exemptions, and future policy considerations, both consumers and businesses can make informed decisions and contribute to the economic prosperity of Orlando.

What items are exempt from sales tax in Orlando, Florida?

+Certain items are exempt from sales tax in Orlando, including groceries, prescription medications, and some services like legal and accounting. These exemptions provide relief to consumers and support essential needs.

How often do businesses need to remit sales tax in Orlando?

+The frequency of sales tax remittance for businesses in Orlando depends on their sales volume. Monthly, quarterly, or annual remittance schedules are common, with businesses required to remit the collected sales tax to the appropriate tax authorities.

Are there any sales tax holidays in Florida, and how can they benefit consumers?

+Florida occasionally offers sales tax holidays, during which specific categories of goods are exempt from sales tax for a limited time. Consumers can take advantage of these periods to save on essential purchases, especially during back-to-school or holiday shopping seasons.

How does the sales tax revenue collected in Orlando impact the city’s economy and residents’ quality of life?

+Sales tax revenue in Orlando funds essential public services and infrastructure, including education, healthcare, transportation, and public safety. This investment in vital services contributes to the city’s economic growth and enhances the quality of life for its residents.