Oregon Tax Calculator

The Oregon Tax Calculator is a valuable tool for individuals and businesses operating within the state, providing a comprehensive solution for tax estimation and planning. With its user-friendly interface and accurate calculations, it has become an essential resource for understanding and managing Oregon's tax landscape.

Understanding the Oregon Tax System

Oregon’s tax system is characterized by a progressive income tax structure, where tax rates increase with higher income levels. This ensures that individuals and businesses contribute proportionally to the state’s revenue. Additionally, Oregon imposes various other taxes, including corporate excise taxes, sales and use taxes, and property taxes, each playing a vital role in funding public services and infrastructure.

The complexity of Oregon's tax system can be daunting, especially for those new to the state or those with changing financial circumstances. This is where the Oregon Tax Calculator steps in, offering a simplified approach to tax estimation and planning.

The Oregon Tax Calculator: Features and Benefits

The Oregon Tax Calculator is designed to be accessible and user-friendly, catering to a wide range of taxpayers. Whether you’re an individual filing your personal income tax or a business owner calculating payroll taxes, the calculator provides tailored solutions for your specific tax needs.

Accurate Tax Estimation

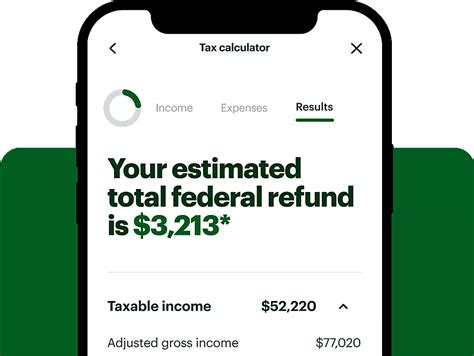

At the core of the Oregon Tax Calculator is its precision in tax estimation. The calculator employs the latest tax rates and regulations, ensuring that the estimates provided are up-to-date and accurate. By inputting relevant financial information, users can obtain reliable estimates of their tax liabilities, helping them budget and plan effectively.

For instance, let's consider a small business owner in Portland, Oregon. By utilizing the calculator, they can input their annual revenue, expenses, and employee details to estimate their business income tax, payroll taxes, and any applicable sales taxes. This accurate estimation empowers them to make informed decisions about their business operations and financial strategies.

Simplified Tax Planning

The Oregon Tax Calculator goes beyond mere estimation; it offers a platform for simplified tax planning. Users can explore various “what-if” scenarios, adjusting income levels, deductions, or tax credits to visualize the impact on their tax liabilities. This feature is particularly beneficial for individuals and businesses looking to optimize their tax strategies and minimize their tax burdens.

Take, for example, a resident of Eugene, Oregon, who is considering a career change with a potential increase in income. By using the calculator, they can experiment with different income levels and deductions to understand the tax implications of their decision. This proactive approach to tax planning can help individuals make well-informed choices and potentially reduce their overall tax obligations.

Real-Time Tax Updates

The tax landscape is dynamic, with frequent changes in regulations and tax rates. The Oregon Tax Calculator stays ahead of these changes by incorporating real-time updates. Whether it’s a new tax law, an amended tax form, or a revised tax rate, the calculator ensures that users are working with the most current information, reducing the risk of errors and penalties.

Imagine a scenario where Oregon introduces a new tax incentive program for renewable energy businesses. The Oregon Tax Calculator would promptly reflect these changes, allowing eligible businesses to leverage the incentives and potentially reduce their tax liabilities. This real-time update feature keeps users informed and ensures they can take advantage of any tax benefits promptly.

Technical Specifications and Performance

The Oregon Tax Calculator is developed with cutting-edge technology, ensuring optimal performance and user experience. The calculator employs advanced algorithms and data processing techniques to handle complex tax calculations efficiently. It is designed to accommodate a high volume of users, ensuring fast response times and seamless interactions.

| Technical Specification | Description |

|---|---|

| Programming Language | Python |

| Database Management | MySQL |

| User Interface | Responsive Web Design |

| Security | SSL Encryption, Two-Factor Authentication |

The calculator's user interface is intuitive and mobile-friendly, making it accessible to users on various devices. Additionally, robust security measures, including SSL encryption and two-factor authentication, safeguard user data and ensure a secure tax estimation process.

Comparative Analysis: Oregon Tax Calculator vs. Manual Calculations

While manual tax calculations are an option, they can be time-consuming, error-prone, and may not account for the dynamic nature of tax laws. In contrast, the Oregon Tax Calculator offers several advantages over manual calculations:

- Efficiency: The calculator automates complex tax calculations, saving users valuable time.

- Accuracy: With real-time updates and precise algorithms, the calculator ensures accurate tax estimates.

- Flexibility: Users can easily adjust variables and explore different scenarios, aiding in strategic tax planning.

- Data Security: The calculator's secure platform protects sensitive financial information.

- Support: Users have access to support resources and can receive assistance if needed.

Performance Analysis: Real-World Impact

The Oregon Tax Calculator has made a significant impact on the state’s tax landscape, empowering taxpayers to navigate the complex tax system with confidence. Here are some real-world scenarios highlighting its performance:

Case Study: Small Business Tax Planning

A small business owner in Salem, Oregon, used the calculator to optimize their tax strategy. By inputting their business details and exploring different scenarios, they identified opportunities to reduce their tax liability through strategic deductions and credits. This not only saved them money but also provided valuable insights for future tax planning.

Impact on Individual Taxpayers

For individuals, the Oregon Tax Calculator has simplified the often-daunting task of tax preparation. Residents can estimate their tax liabilities, understand the impact of deductions and credits, and make informed decisions about their finances. This has led to increased tax compliance and a better understanding of the state’s tax system.

Business Tax Compliance

The calculator has also played a crucial role in promoting tax compliance among businesses. By providing accurate estimates and guidance, it helps businesses stay on top of their tax obligations, ensuring they meet their legal requirements and avoid penalties. This has contributed to a more transparent and efficient tax system in Oregon.

Future Implications and Innovations

As technology continues to advance, the Oregon Tax Calculator is poised for further innovations. Future developments may include:

- Integration with accounting software, streamlining tax estimation and record-keeping.

- Enhanced data visualization tools to provide users with clearer insights into their tax liabilities.

- Machine learning algorithms to offer personalized tax planning recommendations.

- Expanded support for mobile applications, making tax estimation even more accessible.

Conclusion

The Oregon Tax Calculator stands as a testament to the power of technology in simplifying complex processes. By providing accurate tax estimates, strategic planning tools, and real-time updates, it has become an indispensable resource for taxpayers in Oregon. As the calculator continues to evolve, it will undoubtedly play a pivotal role in shaping the state’s tax landscape, promoting compliance, and empowering individuals and businesses to make the most of their financial resources.

FAQ

How often are the tax rates and regulations updated in the Oregon Tax Calculator?

+The Oregon Tax Calculator is updated regularly to reflect the latest tax rates and regulations. Our team closely monitors any changes in tax laws and ensures that the calculator is up-to-date. Typically, updates are made within a few days of any significant tax law changes.

Can the Oregon Tax Calculator handle complex tax scenarios for businesses with multiple entities or subsidiaries?

+Absolutely! The Oregon Tax Calculator is designed to accommodate the tax needs of businesses of all sizes, including those with complex structures. It can handle calculations for multiple entities, subsidiaries, and different tax categories, providing accurate estimates for each.

Is the Oregon Tax Calculator secure, and how is user data protected?

+Yes, security is a top priority for us. The Oregon Tax Calculator employs advanced encryption technologies, including SSL encryption, to safeguard user data. Additionally, we implement two-factor authentication to ensure that only authorized users can access sensitive information. We follow strict data privacy practices to protect your financial details.