Olmsted County Property Tax

Property taxes are an essential component of local government finances, providing revenue for vital services and infrastructure. In Olmsted County, Minnesota, property owners play a crucial role in funding these services through their annual property tax contributions. This article aims to delve into the intricacies of Olmsted County's property tax system, shedding light on how it operates, its impact on homeowners, and the factors that influence tax assessments.

Understanding the Olmsted County Property Tax System

Olmsted County, home to the vibrant city of Rochester and a diverse range of residential areas, relies on a comprehensive property tax system to fund its operations. This system is designed to ensure that property owners contribute their fair share based on the value of their real estate holdings. The tax revenue generated is a significant source of income for the county, enabling it to provide essential services such as education, public safety, healthcare, and infrastructure development.

Property Tax Assessment Process

The assessment process in Olmsted County is a critical step in determining the property tax liability of each owner. It involves a thorough evaluation of properties to determine their market value. This value is then used as the basis for calculating the tax amount due. The process is carried out by trained assessors who consider various factors, including:

- Recent sales data of similar properties in the area.

- Physical characteristics of the property, such as size, age, and condition.

- Local market trends and economic conditions.

- Any improvements or additions made to the property.

Assessors aim to ensure fairness and accuracy in their evaluations, adhering to state guidelines and best practices. Property owners have the right to appeal their assessments if they believe the valuation is incorrect or unfair.

Tax Rate Calculation

Once the assessed value of a property is determined, the tax rate comes into play. The tax rate is set by the Olmsted County Board of Commissioners, taking into account the revenue needs of the county and its various departments. The rate is typically expressed as a percentage and is applied uniformly to all properties within the county. For instance, if the tax rate is set at 1.5%, a property with an assessed value of 200,000 would owe 3,000 in property taxes annually.

Tax Due Dates and Payment Options

Property owners in Olmsted County are responsible for paying their taxes by the designated due dates. The county offers various payment methods to cater to different preferences and circumstances. These include online payments, payment by mail, and in-person payments at designated locations. Failure to pay taxes by the due date may result in penalties and interest, and in extreme cases, a tax lien could be placed on the property.

Impact on Homeowners

Property taxes can significantly impact homeowners’ financial planning and overall cost of living. For many, property taxes are a substantial expense, especially for those with high-value properties. In Olmsted County, the median property tax bill for a homeowner is approximately $2,500 per year, although this can vary greatly depending on the property’s value and the specific tax rate in effect.

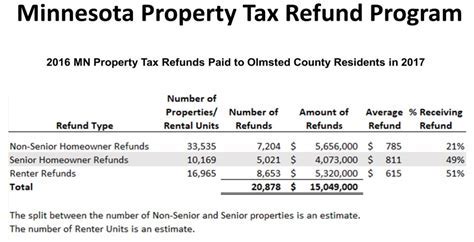

Homeowners have the option to incorporate their property tax payments into their mortgage, making it a part of their monthly housing costs. This approach can provide some financial relief by spreading out the tax liability over time. Additionally, Olmsted County offers tax relief programs for eligible seniors and individuals with disabilities, helping to ease the financial burden of property taxes for these groups.

Factors Influencing Property Tax Assessments

Property tax assessments in Olmsted County are influenced by a range of factors, each playing a unique role in determining the final valuation. Understanding these factors can help homeowners better comprehend their tax liability and potential areas for appeal.

Market Value and Recent Sales

The market value of a property is a critical determinant in the assessment process. Assessors closely monitor recent sales of similar properties in the area, using this data to gauge the current market conditions and the likely value of each property. Properties that have sold recently for higher prices may indicate an increase in market value, leading to a potential reassessment and higher taxes.

Physical Characteristics and Improvements

The physical attributes of a property, such as its size, age, and condition, are taken into account during the assessment. Larger properties or those with unique features may command higher assessments. Additionally, any improvements made to the property, such as additions, renovations, or upgrades, can impact its value and subsequently affect the tax liability. Homeowners should be aware that these improvements may lead to an increase in their tax bill.

Local Market Trends

The local real estate market plays a significant role in property tax assessments. During periods of economic growth and rising property values, assessments may increase, resulting in higher tax bills. Conversely, in a downturn or recession, property values may decrease, leading to lower assessments and potentially reduced tax liabilities.

Tax Relief Programs and Exemptions

Olmsted County offers various tax relief programs and exemptions to support certain groups of homeowners. For example, seniors and individuals with disabilities may be eligible for reduced property taxes based on their income and property value. Additionally, certain properties, such as those owned by non-profit organizations or religious institutions, may be exempt from property taxes entirely. Understanding these programs and exemptions can help homeowners navigate their tax obligations and potentially reduce their financial burden.

Future Implications and Trends

As Olmsted County continues to grow and evolve, the property tax system is likely to undergo changes and adaptations to meet the needs of the community. Several key trends and factors are expected to shape the future of property taxes in the county.

Population Growth and Development

Olmsted County’s population is projected to increase steadily in the coming years, driven by factors such as economic opportunities and the world-renowned Mayo Clinic. This population growth will likely lead to an increased demand for services and infrastructure, putting pressure on the county’s finances. As a result, the property tax system may need to adapt to generate sufficient revenue to support these growing needs.

Economic Factors and Budget Constraints

The economic health of the county and its residents will significantly influence property tax rates and assessments. During periods of economic prosperity, the county may have more financial flexibility, potentially leading to tax rate reductions or additional services. Conversely, economic downturns could result in budget constraints, prompting the county to explore alternative revenue streams or increase tax rates to maintain essential services.

Technological Advances in Assessment

Advancements in technology are expected to play a significant role in the future of property tax assessments. Olmsted County may explore the use of innovative tools and data analytics to enhance the accuracy and efficiency of the assessment process. This could include the utilization of remote sensing technologies, such as aerial imaging, to gather more detailed information about properties, potentially reducing the need for on-site inspections.

Community Engagement and Transparency

Maintaining transparency and engaging with the community is vital for the long-term success of the property tax system. Olmsted County is likely to continue its efforts to educate homeowners about the assessment process, tax rates, and their rights and responsibilities. By fostering an environment of open communication, the county can address concerns and build trust with its residents, ensuring that the property tax system remains fair and equitable.

| Key Takeaways |

|---|

| Property taxes are a significant source of revenue for Olmsted County, funding essential services and infrastructure. |

| The assessment process involves evaluating properties based on their market value, physical characteristics, and local market trends. |

| Tax rates are set by the County Board, and homeowners have various payment options. |

| Property taxes can impact homeowners' financial planning, and relief programs are available for eligible individuals. |

| Future trends suggest population growth, economic factors, technological advances, and community engagement will shape the property tax system. |

How often are property assessments conducted in Olmsted County?

+Property assessments are conducted every year to ensure the accuracy of property tax valuations. This annual review allows assessors to stay up-to-date with market trends and property changes.

What happens if I disagree with my property tax assessment?

+If you believe your property tax assessment is incorrect, you have the right to appeal. Olmsted County provides a detailed appeals process, which typically involves a review by an independent board.

Are there any tax breaks or exemptions for specific types of properties in Olmsted County?

+Yes, Olmsted County offers various tax relief programs and exemptions. For instance, eligible seniors and individuals with disabilities may qualify for reduced property taxes based on specific criteria.