Ohio Sales Tax Login

Welcome to the comprehensive guide on the Ohio Sales Tax Login, a crucial process for businesses operating in the Buckeye State. Navigating the complexities of sales tax compliance is essential for any business, and Ohio's system is designed to ensure fair taxation while providing a user-friendly interface for businesses to manage their tax obligations.

In this article, we will delve into the intricacies of the Ohio Sales Tax Login, covering everything from the initial registration process to the practical steps involved in filing and managing sales tax returns. By the end, you'll have a clear understanding of the system and the confidence to navigate it efficiently.

Understanding the Ohio Sales Tax System

Ohio’s sales tax system is a fundamental component of the state’s revenue generation, with businesses playing a vital role in ensuring compliance. The state imposes a sales and use tax on the sale of tangible personal property, certain digitally provided products and services, and specified services.

The Ohio Department of Taxation, through its Business Tax Services division, is responsible for administering and enforcing the state's sales tax laws. This includes the registration, collection, and remittance of sales tax, as well as the provision of resources and guidance to help businesses understand and comply with their tax obligations.

Sales Tax Registration in Ohio

To begin your journey with the Ohio Sales Tax Login, you must first register your business with the state. This process involves providing essential business information and obtaining a unique identification number, known as the Ohio Vendor Number.

The registration process can be completed online through the Ohio Business Tax Registration System, a secure and user-friendly platform. Here's a step-by-step guide to help you through the process:

- Access the Registration Portal: Visit the official Ohio Business Tax Registration System website and click on the "Register Now" button.

- Create an Account: If you are a new user, you will need to create an account by providing basic contact information and creating a secure password.

- Select Business Entity: Choose the appropriate business entity type from the dropdown menu, such as sole proprietorship, partnership, corporation, or LLC.

- Provide Business Details: Enter your business name, physical address, mailing address, and contact information, including email and phone number.

- Choose Tax Types: Select "Sales and Use Tax" from the list of tax types applicable to your business.

- Review and Submit: Carefully review all the information you have provided, ensuring its accuracy. Once satisfied, click "Submit" to complete the registration process.

Upon successful registration, you will receive your Ohio Vendor Number, which is essential for all future interactions with the Ohio Department of Taxation.

Obtaining an Ohio Sales Tax Login

With your Ohio Vendor Number in hand, you are now ready to obtain your Ohio Sales Tax Login credentials. These credentials will grant you access to the Ohio Business Gateway, a centralized online portal for managing various business tax obligations, including sales tax.

To obtain your login credentials, follow these steps:

- Visit the Ohio Business Gateway: Go to the Ohio Business Gateway website and click on the "Register" button in the top right corner.

- Create a New Account: Provide your personal information, including your name, email address, and create a secure password.

- Enter Business Details: Input your business name, taxpayer ID (your Ohio Vendor Number), and other relevant business information.

- Verify Your Identity: You may be required to verify your identity through a secure process, such as providing a copy of your driver's license or passport.

- Receive Login Credentials: Once your identity is verified, you will receive your Ohio Sales Tax Login credentials via email. These credentials will include your username and a temporary password, which you can change upon your first login.

With your Ohio Sales Tax Login credentials, you can now access the Ohio Business Gateway to manage your sales tax obligations effectively.

Managing Sales Tax Obligations

Now that you have successfully registered your business and obtained your Ohio Sales Tax Login, it’s time to delve into the practical aspects of managing your sales tax obligations.

Collecting Sales Tax

As a business operating in Ohio, you are responsible for collecting sales tax from your customers on taxable goods and services. The sales tax rate in Ohio varies depending on the location of the sale, with a statewide base rate of 5.75%. However, local jurisdictions may impose additional taxes, resulting in a combined rate that can exceed 8% in certain areas.

To ensure accurate tax collection, it's crucial to understand the taxability of different products and services. The Ohio Department of Taxation provides detailed guidelines and resources to help businesses determine the taxability of their offerings. Additionally, businesses should stay informed about any changes in tax rates or regulations to avoid non-compliance.

| Sales Tax Rates | Location | Combined Rate |

|---|---|---|

| 5.75% | Statewide Base Rate | 5.75% |

| 2.25% | City of Columbus | 8% |

| 1% | Franklin County | 6.75% |

| 1.5% | Cuyahoga County | 7.25% |

Once you have collected sales tax from your customers, it's essential to maintain accurate records of these transactions. Proper record-keeping not only helps in filing accurate tax returns but also facilitates audits and ensures compliance with Ohio's sales tax laws.

Filing Sales Tax Returns

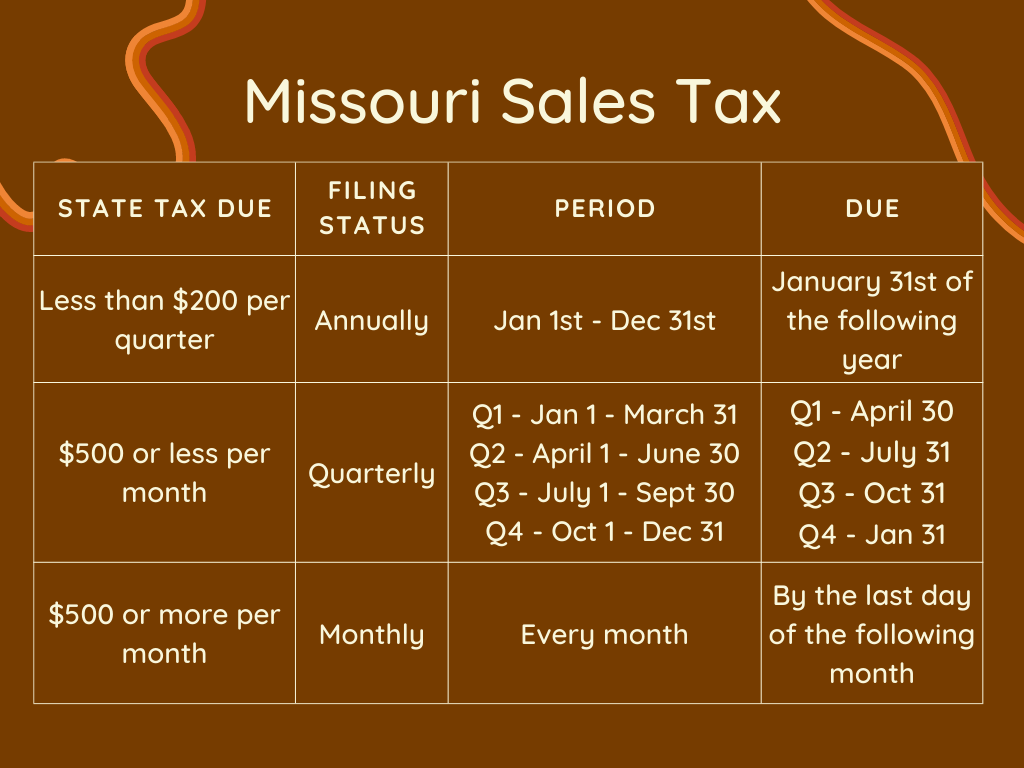

Filing sales tax returns in Ohio is a crucial aspect of managing your tax obligations. The frequency of filing depends on your business’s sales volume and the type of business you operate. Generally, businesses with higher sales volumes are required to file more frequently.

Ohio offers several filing options, including monthly, quarterly, and annual filing. The specific filing frequency for your business will be determined by the Ohio Department of Taxation based on your sales volume and other factors.

To file your sales tax returns, log in to your Ohio Business Gateway account and navigate to the "File Returns" section. Here, you will find a step-by-step guide to help you complete the filing process accurately. You will need to provide detailed information about your sales transactions, including the amount of tax collected, the location of the sale, and any applicable exemptions.

It's essential to file your returns by the due date to avoid late fees and penalties. The Ohio Department of Taxation provides reminders and notifications to help businesses stay on top of their filing obligations.

Remitting Sales Tax Payments

In addition to filing your sales tax returns, you must also remit the collected sales tax to the Ohio Department of Taxation. The due date for remitting sales tax payments aligns with the due date for filing your returns.

Ohio offers various payment methods, including electronic funds transfer (EFT), credit card, and check or money order. To ensure timely payment, it's advisable to use electronic payment methods, which are processed more quickly and provide confirmation of payment.

When making your sales tax payment, ensure that you include your Ohio Vendor Number and the period for which the payment is being made. This information helps the Department of Taxation accurately allocate your payment to your account.

Sales Tax Exemptions and Refunds

Ohio’s sales tax system provides certain exemptions and refund opportunities for businesses and consumers. Understanding these exemptions is crucial to ensure you are not overpaying sales tax and to provide appropriate exemptions to your customers.

Some common sales tax exemptions in Ohio include sales to government entities, sales of certain agricultural products, and sales to charitable organizations. Additionally, Ohio offers a sales tax refund program for qualified individuals who make purchases in the state.

To claim sales tax exemptions or refunds, you must follow the specific guidelines provided by the Ohio Department of Taxation. This may involve completing additional forms or providing supporting documentation to substantiate your claim.

Resources and Support for Ohio Sales Tax Compliance

Navigating the complexities of sales tax compliance can be challenging, but Ohio provides a wealth of resources and support to help businesses stay compliant.

Ohio Department of Taxation Website

The Ohio Department of Taxation website is a valuable resource for businesses seeking information and guidance on sales tax compliance. The website offers a wide range of resources, including:

- Detailed explanations of sales tax laws and regulations

- Guides and tutorials on registration, filing, and remittance processes

- Forms and publications relevant to sales tax compliance

- Contact information for various departments within the Department of Taxation

- Announcements and updates on tax changes and deadlines

The website also provides a comprehensive FAQ section, addressing common questions and concerns related to sales tax compliance in Ohio.

Ohio Business Gateway Support

The Ohio Business Gateway, accessible through ohiobusinessgateway.com, offers additional support and resources for businesses managing their sales tax obligations. The gateway provides a centralized platform for accessing various business tax services, including:

- Filing and paying sales tax returns

- Registering new businesses

- Managing tax account information

- Viewing tax payment history

- Accessing tax forms and publications

The Ohio Business Gateway also offers a help desk and live chat support, allowing businesses to receive assistance with technical issues or general inquiries related to sales tax compliance.

Ohio Tax Workshops and Webinars

The Ohio Department of Taxation regularly hosts tax workshops and webinars to provide businesses with in-depth training and guidance on sales tax compliance. These events cover a wide range of topics, including registration, filing, and specific industry-related issues.

Attending these workshops and webinars can be an excellent opportunity to gain practical knowledge, ask questions, and network with other businesses facing similar challenges. The Department of Taxation often announces upcoming events through its website and social media channels.

FAQs

How often do I need to file sales tax returns in Ohio?

+The frequency of filing sales tax returns in Ohio depends on your business’s sales volume and the type of business you operate. Generally, businesses with higher sales volumes are required to file more frequently. Ohio offers monthly, quarterly, and annual filing options. The specific filing frequency for your business will be determined by the Ohio Department of Taxation based on your sales volume and other factors.

What happens if I miss the due date for filing sales tax returns?

+Missing the due date for filing sales tax returns can result in late fees and penalties. It’s important to stay on top of your filing obligations to avoid these additional charges. The Ohio Department of Taxation provides reminders and notifications to help businesses stay informed about upcoming due dates.

Can I file my sales tax returns electronically in Ohio?

+Yes, Ohio offers electronic filing of sales tax returns through the Ohio Business Gateway. Electronic filing is a convenient and secure way to submit your returns, and it provides confirmation of receipt. It’s advisable to file your returns electronically to ensure timely processing and avoid delays.

Are there any sales tax exemptions or refunds available in Ohio?

+Yes, Ohio provides certain sales tax exemptions and refund opportunities for businesses and consumers. Common exemptions include sales to government entities, sales of certain agricultural products, and sales to charitable organizations. Ohio also offers a sales tax refund program for qualified individuals. To claim exemptions or refunds, you must follow the specific guidelines provided by the Ohio Department of Taxation.

What should I do if I have technical issues with the Ohio Sales Tax Login or Ohio Business Gateway?

+If you encounter technical issues with the Ohio Sales Tax Login or Ohio Business Gateway, you can contact the Ohio Business Gateway help desk for assistance. They provide live chat and phone support to help resolve technical problems and ensure you can access the necessary services.

Navigating the Ohio Sales Tax Login and managing your sales tax obligations may seem daunting at first, but with the right resources and guidance, it becomes a manageable process. Remember, compliance with Ohio’s sales tax laws is not only a legal requirement but also a responsibility to your customers and the state. By staying informed and utilizing the available resources, you can ensure a smooth and efficient sales tax management process.