Virginia State Tax Form

The Virginia State Tax Form is an essential document for residents and businesses operating in the state of Virginia. It is a crucial process that ensures individuals and entities comply with the state's tax regulations and contribute to the economic development and welfare of the Commonwealth. This article provides an in-depth analysis of the Virginia State Tax Form, covering its significance, key components, filing requirements, and expert insights to guide taxpayers through this essential annual process.

Understanding the Virginia State Tax Form

The Virginia State Tax Form is a comprehensive document designed to collect essential information from taxpayers to calculate and report their state tax liabilities. It serves as a crucial tool for the Virginia Department of Taxation to assess the tax obligations of individuals, businesses, and other entities operating within the state.

The form captures various aspects of a taxpayer's financial activities, including income, deductions, credits, and taxes owed. By providing accurate and detailed information, taxpayers ensure compliance with Virginia's tax laws and contribute to the state's revenue generation. The form's design and structure aim to simplify the tax filing process, making it accessible and straightforward for a wide range of taxpayers.

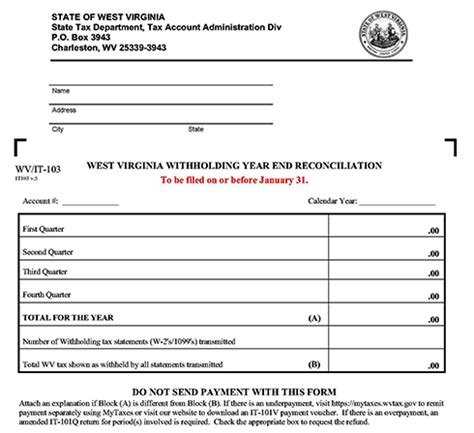

Key Components of the Virginia State Tax Form

The Virginia State Tax Form consists of several sections, each focused on a specific aspect of a taxpayer’s financial profile. Here’s a breakdown of the key components:

- Personal Information: This section collects basic details about the taxpayer, including name, address, Social Security Number, and filing status. It ensures accurate identification and facilitates effective communication between the taxpayer and the Department of Taxation.

- Income Reporting: Taxpayers must report their income from various sources, such as wages, salaries, business profits, investments, and pensions. This section provides a comprehensive overview of the taxpayer's financial earnings throughout the year.

- Deductions and Credits: The form allows taxpayers to claim deductions and credits to reduce their taxable income. Common deductions include standard deductions, itemized deductions for expenses like medical costs and charitable contributions, and tax credits for specific activities or circumstances.

- Tax Calculation: Using the information provided, the form calculates the taxpayer's total tax liability based on Virginia's tax rates and brackets. This calculation considers factors like income level, deductions, and credits to determine the final tax amount owed.

- Payment Information: Taxpayers must provide payment details, including the amount owed and the preferred method of payment. The form accommodates various payment options, such as electronic funds transfer, credit card, or check.

- Signatures and Verification: The final section requires the taxpayer's signature, certifying the accuracy and completeness of the information provided. It serves as a legal confirmation of the taxpayer's compliance with state tax laws.

Each component of the Virginia State Tax Form plays a critical role in ensuring accurate tax reporting and compliance. Taxpayers must carefully review and complete the form to avoid errors and potential penalties.

Filing Requirements and Deadlines

Understanding the filing requirements and deadlines for the Virginia State Tax Form is essential to ensure timely submission and avoid penalties. Here’s an overview of the key aspects:

Who Needs to File

The filing obligation for the Virginia State Tax Form applies to various individuals and entities. Generally, residents of Virginia who have taxable income exceeding a certain threshold must file a state tax return. Non-residents who earned income from Virginia sources, such as business profits or investments, may also have filing requirements.

Additionally, businesses operating in Virginia, including sole proprietorships, partnerships, corporations, and limited liability companies (LLCs), must file state tax returns regardless of their income level. Specific filing requirements may vary based on the type of business entity and the nature of its activities.

Filing Deadlines

The deadline for filing the Virginia State Tax Form typically aligns with the federal tax filing deadline. For most taxpayers, the deadline falls on April 15th of the year following the tax year. However, it’s essential to note that certain circumstances, such as filing an extension or paying estimated taxes, may impact the specific deadline.

For example, if a taxpayer files for an extension, the deadline for submitting the completed state tax return is typically extended to October 15th. It's crucial to stay informed about any changes to the filing deadlines, as they may vary from year to year due to holidays or other factors.

Electronic Filing Options

Virginia offers several electronic filing options to make the process more efficient and convenient for taxpayers. These options include online filing through the Virginia Department of Taxation’s website, using approved tax preparation software, or engaging a professional tax preparer who can submit the return electronically.

Electronic filing offers several advantages, such as faster processing times, reduced errors, and the ability to track the status of the return. It's an accessible and secure method for taxpayers to fulfill their state tax obligations promptly.

Expert Insights and Tips for Accurate Filing

Filing the Virginia State Tax Form accurately is crucial to avoid errors and potential penalties. Here are some expert insights and tips to ensure a smooth and successful filing process:

Gathering Necessary Documentation

Before starting the filing process, it’s essential to gather all relevant documentation. This includes W-2 forms for wage earners, 1099 forms for self-employed individuals, and any other income statements or records. Additionally, taxpayers should collect records of deductions and credits, such as receipts for charitable contributions or medical expenses.

Organizing these documents beforehand simplifies the filing process and reduces the risk of overlooking essential information.

Understanding Tax Brackets and Rates

Virginia’s tax system operates on a marginal tax rate structure, with tax rates increasing as income levels rise. It’s crucial for taxpayers to understand the applicable tax brackets and rates for their income level. This knowledge ensures accurate tax calculations and helps taxpayers maximize their deductions and credits to minimize their tax liability.

Claiming All Eligible Deductions and Credits

Taxpayers should be aware of all the deductions and credits they are eligible for. This includes standard deductions, which provide a basic reduction in taxable income, and itemized deductions for specific expenses. Additionally, Virginia offers various tax credits, such as the Earned Income Tax Credit (EITC) and the Virginia Earned Income Tax Credit (VEITC), which can significantly reduce tax liabilities for eligible taxpayers.

Utilizing Tax Preparation Software or Professional Services

For complex tax situations or those who prefer professional assistance, utilizing tax preparation software or engaging a tax professional can be beneficial. These tools and services offer guidance and support throughout the filing process, ensuring accuracy and maximizing tax benefits.

Tax preparation software provides a user-friendly interface, step-by-step guidance, and the ability to import data from various sources, making the filing process more efficient. Tax professionals, such as Certified Public Accountants (CPAs) or Enrolled Agents (EAs), can provide personalized advice, handle complex tax scenarios, and ensure compliance with state tax laws.

Future Implications and Potential Changes

As tax laws and economic conditions evolve, it’s essential to stay informed about potential changes to the Virginia State Tax Form and the broader tax landscape. Here’s an overview of some future implications and considerations:

Legislative Changes and Tax Reforms

Virginia’s tax laws are subject to legislative changes and reforms. Taxpayers should stay updated on any amendments to tax rates, brackets, deductions, or credits. These changes may impact the filing process and the overall tax liability for individuals and businesses.

Additionally, the state may introduce new tax incentives or initiatives to stimulate economic growth or support specific industries. Staying informed about these developments ensures taxpayers can take advantage of any benefits and adjust their tax strategies accordingly.

Impact of Economic Trends

Economic trends and market fluctuations can influence tax revenues and the state’s fiscal policies. During periods of economic growth, tax revenues may increase, impacting the state’s budget and potentially leading to changes in tax rates or the introduction of new tax measures.

Conversely, economic downturns or recessions can reduce tax revenues, prompting the state to reconsider its tax policies and explore alternative revenue sources. Taxpayers should monitor these economic trends to understand how they may affect their tax obligations and plan their financial strategies accordingly.

Technological Advancements in Tax Filing

The tax filing process is continually evolving with technological advancements. Virginia is likely to embrace digital transformation, introducing new online platforms, mobile applications, and streamlined processes to enhance the filing experience.

These technological advancements can improve efficiency, reduce errors, and provide taxpayers with more accessible and user-friendly tools for tax compliance. Staying updated on these developments ensures taxpayers can leverage the latest technology to simplify their tax obligations.

Conclusion

The Virginia State Tax Form is a critical component of the state’s tax system, ensuring compliance and contributing to the Commonwealth’s economic prosperity. By understanding the form’s components, filing requirements, and expert tips, taxpayers can navigate the process with confidence and accuracy.

Staying informed about legislative changes, economic trends, and technological advancements is essential for taxpayers to adapt their strategies and remain compliant with Virginia's tax regulations. With careful planning, accurate record-keeping, and access to expert guidance, taxpayers can successfully meet their state tax obligations and contribute to the vibrant economy of Virginia.

How do I know if I need to file a Virginia State Tax Form?

+The filing requirement for the Virginia State Tax Form applies to individuals and businesses with taxable income exceeding a certain threshold. Generally, residents with income above the filing threshold must file, as well as non-residents with Virginia-sourced income. It’s advisable to consult the Virginia Department of Taxation’s guidelines or seek professional advice to determine your specific filing obligations.

What are the penalties for late or incorrect filing of the Virginia State Tax Form?

+Late filing or incorrect submission of the Virginia State Tax Form can result in penalties and interest charges. The penalties vary based on the severity of the infraction and may include late filing penalties, late payment penalties, and failure-to-file penalties. It’s crucial to file accurately and on time to avoid these consequences.

Can I file the Virginia State Tax Form electronically, and what are the benefits?

+Yes, Virginia offers electronic filing options for the State Tax Form. Electronic filing provides several advantages, including faster processing times, reduced errors, and the ability to track the status of your return. It’s a convenient and secure method to fulfill your state tax obligations promptly.

Are there any tax credits or deductions specific to Virginia that I should be aware of?

+Yes, Virginia offers various tax credits and deductions to eligible taxpayers. These include the Earned Income Tax Credit (EITC) and the Virginia Earned Income Tax Credit (VEITC), which can significantly reduce tax liabilities for low- to moderate-income earners. Additionally, there may be industry-specific or incentive-based credits and deductions available. It’s essential to stay informed about these opportunities to maximize your tax benefits.

How can I stay updated on changes to the Virginia State Tax Form and tax laws?

+To stay informed about changes to the Virginia State Tax Form and tax laws, it’s advisable to regularly visit the Virginia Department of Taxation’s website, where they publish updates and guidelines. Additionally, subscribing to tax newsletters, following reputable tax publications, and seeking professional advice can ensure you remain up-to-date with the latest developments.