North Carolina Tax Rate

When it comes to understanding the tax landscape of a state, delving into its tax rates is crucial. North Carolina, nestled in the southeastern region of the United States, boasts a unique tax structure that influences both its residents and businesses. This article aims to provide an in-depth analysis of North Carolina's tax rates, offering a comprehensive guide to its income, sales, and property taxes, along with insights into how these taxes impact the state's economy and its residents' financial planning.

Income Tax in North Carolina: A Comprehensive Overview

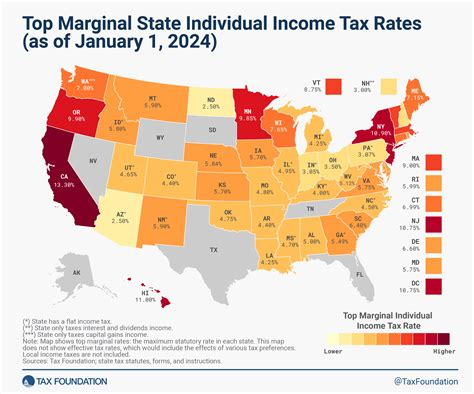

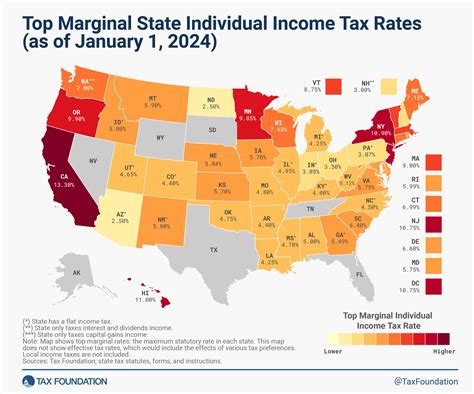

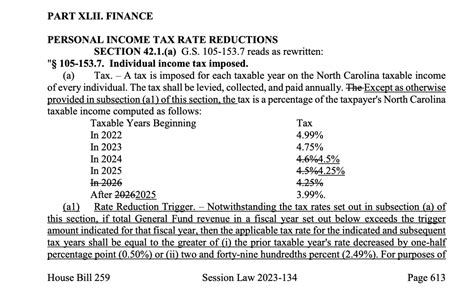

North Carolina operates a progressive income tax system, meaning that higher incomes are taxed at progressively higher rates. This approach ensures that the tax burden is distributed equitably across income levels. As of the 2023 tax year, the state’s income tax rates range from 5.25% to 5.75%.

| Tax Bracket | Tax Rate |

|---|---|

| First $3,000 | 5.25% |

| $3,000 to $15,000 | 5.5% |

| $15,000 to $25,000 | 5.65% |

| Over $25,000 | 5.75% |

It's important to note that North Carolina offers a standard deduction of $20,000 for married couples filing jointly and $10,000 for single filers. Additionally, there are various tax credits and deductions available to reduce the overall tax liability, such as the Child and Dependent Care Credit, the Education Credit, and the North Carolina Earned Income Tax Credit.

Impact on Residents’ Financial Planning

The progressive income tax system in North Carolina can significantly influence residents’ financial strategies. For instance, individuals with higher incomes may consider tax-efficient investment options or retirement plans to minimize their tax liability. Moreover, the availability of tax credits and deductions provides an opportunity for taxpayers to optimize their financial positions.

Sales Tax: A Snapshot of North Carolina’s Consumption Tax

North Carolina levies a general state sales and use tax on the sale or lease of tangible personal property and certain services. The base sales tax rate in the state is set at 4.75%. However, this rate can vary based on local taxes, resulting in a combined sales tax rate ranging from 6.5% to 7.5% across different jurisdictions.

| County | Local Sales Tax Rate | Combined Sales Tax Rate |

|---|---|---|

| Buncombe | 2.25% | 7.0% |

| Durham | 1.50% | 6.25% |

| Wake | 2.25% | 7.0% |

| Mecklenburg | 2.25% | 7.0% |

Notably, certain items are exempt from sales tax in North Carolina, including prescription drugs, non-prepared food items, and certain manufacturing equipment. Moreover, the state offers a sales tax holiday annually, typically in August, during which specific items are exempt from sales tax, providing a relief period for consumers.

Economic Impact of Sales Tax

The sales tax in North Carolina plays a significant role in the state’s revenue generation, contributing to various public services and infrastructure projects. However, it also influences consumer behavior, as higher sales tax rates can discourage spending, especially on larger purchases. On the other hand, the tax holiday periods can stimulate consumer spending, providing a boost to the local economy.

Property Tax: Assessing North Carolina’s Real Estate Landscape

Property taxes in North Carolina are primarily assessed and collected at the county level, with each county setting its own tax rates. The state does not have a standard property tax rate, and the rates can vary significantly from one county to another. On average, the effective property tax rate in North Carolina is around 0.77%, which ranks lower than the national average.

| County | Effective Property Tax Rate |

|---|---|

| Wake | 0.93% |

| Mecklenburg | 0.81% |

| Guilford | 0.71% |

| Buncombe | 0.85% |

Property tax assessments are based on the property's appraised value, which is determined by the county tax assessor's office. The tax rate is then applied to the assessed value to calculate the annual property tax bill. Notably, North Carolina offers several property tax exemptions and credits, such as the homestead exemption and the veteran's exemption, which can reduce the tax burden for eligible homeowners.

Impact on Real Estate Market

The property tax landscape in North Carolina can influence both residential and commercial real estate markets. Lower property tax rates can make an area more attractive to potential buyers and investors, potentially driving up property values. Conversely, higher tax rates might discourage investment and affect the affordability of housing in certain regions.

Conclusion: Navigating North Carolina’s Tax Landscape

Understanding North Carolina’s tax rates is crucial for individuals and businesses considering a move to the state or planning their financial strategies. The state’s progressive income tax system, combined with its sales and property tax structures, provides a balanced approach to revenue generation while offering opportunities for tax optimization. As the state continues to evolve, its tax policies will play a pivotal role in shaping its economic landscape and attracting new residents and businesses.

What are the income tax rates for North Carolina in 2023?

+The income tax rates for North Carolina in 2023 range from 5.25% to 5.75%, depending on the taxpayer’s income bracket.

Are there any tax credits available in North Carolina for homeowners?

+Yes, North Carolina offers several property tax exemptions and credits, including the homestead exemption and the veteran’s exemption, which can reduce the tax burden for eligible homeowners.

When is the sales tax holiday in North Carolina, and what items are exempt during this period?

+The sales tax holiday in North Carolina typically occurs in August, and it provides an exemption on certain items like school supplies, clothing, and electronics. The specific dates and eligible items may vary each year.