No Taxes On Overtime Bill

The "No Taxes on Overtime Bill" is a proposed legislation that has sparked significant interest and debate within the United States, especially among workers, employers, and policymakers. This bill aims to address the financial burdens faced by employees who work extensive overtime hours, by proposing a tax exemption for their overtime earnings. With the potential to impact millions of workers across various industries, understanding the nuances of this bill is crucial. In this comprehensive article, we delve into the details, implications, and potential outcomes of the No Taxes on Overtime Bill, shedding light on its relevance and impact on the American workforce.

The Essence of the No Taxes on Overtime Bill

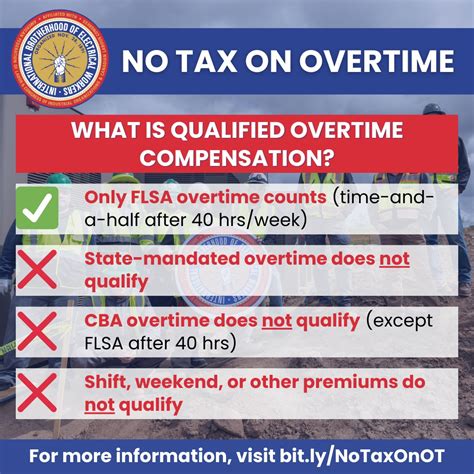

At its core, the No Taxes on Overtime Bill seeks to amend the existing tax structure to provide a financial relief to workers who go above and beyond their regular working hours. The proposal aims to eliminate income taxes on overtime pay, allowing employees to retain a larger portion of their earnings from additional work. This initiative recognizes the dedication and hard work of individuals who choose to work extended hours, often to meet the demands of their jobs or to provide for their families.

The bill, if enacted, would offer a significant boost to the take-home pay of overtime workers, potentially improving their financial stability and overall quality of life. By reducing the tax burden on overtime earnings, the government aims to incentivize individuals to take on more work, thereby stimulating economic growth and productivity. This approach aligns with the broader goal of supporting a thriving and resilient workforce, particularly in industries where overtime is a common occurrence.

Historical Context and Motivations

The concept of tax exemptions for overtime pay is not entirely new. Several states in the US have already implemented similar measures, recognizing the unique challenges faced by workers in various sectors. For instance, California has a long-standing policy of excluding overtime earnings from state income taxes, a move that has garnered support from both workers and employers alike. The success of such initiatives has inspired a broader conversation about the potential benefits of a nationwide tax exemption for overtime.

The motivation behind the No Taxes on Overtime Bill stems from a desire to address income inequality and support those who contribute significantly to the nation's economic growth. Proponents argue that by reducing taxes on overtime pay, the bill can help bridge the wealth gap, especially for middle- and lower-income workers who often rely on overtime to make ends meet. Additionally, the bill aims to encourage a more flexible and adaptable workforce, accommodating the fluctuating demands of different industries.

Industry-Specific Impact and Implications

The potential impact of the No Taxes on Overtime Bill extends across various sectors of the American economy, each with its unique characteristics and challenges. Here’s a breakdown of how different industries might be affected:

Healthcare Sector

In the healthcare industry, overtime work is a common necessity due to staffing shortages and the 24⁄7 nature of patient care. Healthcare workers, including nurses, doctors, and support staff, often put in extensive hours to ensure the well-being of their patients. The No Taxes on Overtime Bill could provide a much-needed financial incentive for these professionals, potentially attracting more individuals to the field and alleviating the strain on healthcare facilities.

For instance, consider a nurse working in a busy urban hospital. With the implementation of the bill, their overtime pay would no longer be subject to income tax, resulting in a substantial increase in their take-home pay. This could not only improve their financial situation but also contribute to reducing nurse burnout, as they feel more valued and appreciated for their dedication.

Retail and Hospitality Industries

The retail and hospitality sectors are known for their high reliance on overtime work, especially during peak seasons and holiday periods. Employees in these industries, such as sales associates, waitstaff, and hotel staff, frequently work extended hours to meet customer demands. The No Taxes on Overtime Bill could provide a significant boost to their earnings, making overtime work more appealing and potentially reducing employee turnover rates.

Imagine a retail store manager who consistently works long hours during the holiday season to ensure a successful sales period. With the tax exemption, they would be able to save more from their overtime earnings, providing a financial buffer for future expenses or investments. This incentive could lead to higher job satisfaction and loyalty among retail and hospitality workers.

Manufacturing and Construction

Overtime work is also prevalent in the manufacturing and construction industries, where projects often require round-the-clock effort to meet deadlines. Workers in these sectors, including machine operators, construction laborers, and project managers, often face physical and mental challenges associated with extended work hours. The No Taxes on Overtime Bill could offer a much-needed reward for their hard work and dedication.

Take, for example, a construction worker involved in a time-sensitive project. By exempting their overtime pay from taxes, they would be able to retain more of their earnings, which could be crucial for covering the costs of specialized equipment or training. This financial relief could also encourage more individuals to enter these skilled trades, addressing the skilled labor shortage in these industries.

Technical Specifications and Calculations

From a technical standpoint, the implementation of the No Taxes on Overtime Bill would require careful consideration and precise calculations to ensure fair and accurate tax exemptions. Here’s a simplified breakdown of how the tax exemption process might work:

| Income Bracket | Overtime Earnings Exemption |

|---|---|

| Up to $50,000 | 100% exemption on overtime earnings |

| $50,001 - $100,000 | 75% exemption on overtime earnings |

| Over $100,000 | 50% exemption on overtime earnings |

These income brackets and exemption rates are hypothetical and subject to change based on legislative decisions. The actual implementation would consider various factors, including the individual's total income, the amount of overtime worked, and the specific industry they operate in.

For instance, consider an individual earning $60,000 annually who works 20 hours of overtime in a month. With a 75% exemption on overtime earnings in their income bracket, they would save approximately $150 on taxes for that month's overtime work. This calculation is based on an assumed overtime rate of 1.5 times the regular hourly rate.

Performance Analysis and Potential Outcomes

The potential outcomes of the No Taxes on Overtime Bill are far-reaching and could have a significant impact on the American workforce and economy. Here’s an analysis of some key implications:

Increased Productivity and Economic Growth

By incentivizing overtime work through tax exemptions, the bill has the potential to boost productivity across various industries. Employees may be more inclined to take on additional hours, leading to increased output and efficiency. This surge in productivity can drive economic growth, particularly in sectors that heavily rely on overtime labor.

Additionally, the financial relief provided by the tax exemption could encourage workers to reinvest their earnings into the economy, further stimulating growth. This positive cycle of increased work, higher earnings, and economic reinvestment could have a substantial impact on the nation's overall economic health.

Addressing Income Inequality

One of the primary motivations behind the bill is to tackle income inequality, especially among middle- and lower-income workers. By exempting overtime earnings from taxes, the bill aims to provide a financial boost to those who need it most. This measure could help narrow the wealth gap, as individuals with higher overtime pay will be able to save or spend more, improving their overall financial well-being.

Workforce Retention and Attraction

The No Taxes on Overtime Bill could play a pivotal role in retaining and attracting skilled workers. By making overtime work more financially rewarding, the bill can enhance job satisfaction and loyalty among employees. This, in turn, can reduce turnover rates, leading to a more stable and experienced workforce. Moreover, the financial incentives may entice more individuals to enter industries where overtime is common, addressing potential labor shortages.

Potential Challenges and Considerations

While the No Taxes on Overtime Bill presents numerous benefits, it also raises some important considerations and potential challenges. These include the need for precise tax exemption calculations to avoid abuse or excessive benefits, as well as ensuring that the bill does not inadvertently discourage regular work hours. Additionally, there may be concerns about the impact on small businesses and the potential for increased administrative burdens.

Future Implications and Policy Recommendations

The future of the No Taxes on Overtime Bill is contingent on a range of factors, including political dynamics, economic conditions, and public opinion. As the bill progresses through the legislative process, it may undergo modifications to address potential challenges and ensure a balanced approach. Here are some key recommendations for policymakers:

- Conduct thorough economic impact assessments to ensure the bill's benefits outweigh potential drawbacks.

- Engage in open dialogue with industry stakeholders, labor unions, and workers to gather diverse perspectives and address concerns.

- Consider implementing gradual rollouts or pilot programs to monitor the bill's effectiveness and make data-driven adjustments.

- Evaluate the potential impact on different income groups and industries to ensure fairness and equity.

- Explore complementary policies to support workers' well-being, such as promoting work-life balance and addressing burnout.

Conclusion

The No Taxes on Overtime Bill presents a compelling opportunity to recognize and reward the dedication of American workers who go the extra mile. By offering tax exemptions for overtime earnings, the bill has the potential to bring about positive changes in the lives of millions of individuals and contribute to a thriving economy. However, careful consideration and ongoing evaluation are necessary to ensure the bill’s success and minimize unintended consequences.

As the legislative process unfolds, the impact of this bill will continue to be a subject of interest and discussion among policymakers, employers, and workers alike. With a balanced approach and a focus on the well-being of the American workforce, the No Taxes on Overtime Bill could pave the way for a more prosperous and resilient nation.

What is the primary objective of the No Taxes on Overtime Bill?

+

The primary objective of the No Taxes on Overtime Bill is to eliminate income taxes on overtime pay, providing a financial incentive for workers who put in extra hours. This initiative aims to support workers, encourage productivity, and address income inequality.

How might the bill impact workers in different industries?

+

The bill’s impact would vary across industries. In healthcare, it could reduce nurse burnout and attract more professionals. In retail and hospitality, it may improve job satisfaction and reduce turnover. For manufacturing and construction, it could address skilled labor shortages.

What are the potential benefits of the bill for the economy?

+

The bill could boost productivity, stimulate economic growth, and address income inequality. By incentivizing overtime work, it may lead to increased output and economic reinvestment, contributing to a healthier economy.