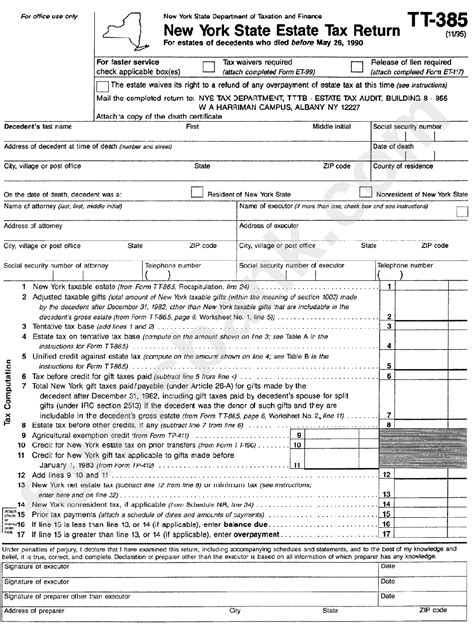

New York Income Tax Forms

New York State's income tax system is a complex yet essential aspect of financial planning and compliance for residents and businesses alike. Understanding the different forms, deadlines, and requirements is crucial for accurate reporting and to avoid potential penalties. In this comprehensive guide, we delve into the world of New York income tax forms, exploring the key documents, their purposes, and the steps involved in a successful filing process.

Navigating the Landscape of New York Income Tax Forms

The New York State Department of Taxation and Finance offers a comprehensive set of forms tailored to various taxpayer profiles, from individuals to corporations. Each form serves a specific purpose, catering to different income types, tax scenarios, and refund processes. This section provides an overview of the most commonly used forms, shedding light on their applications and unique features.

Form IT-201: Resident Income Tax Return

The cornerstone of individual tax filings in New York, Form IT-201 is designed for residents reporting their annual income. It accommodates various income sources, including wages, investments, and business profits. The form guides taxpayers through calculating their taxable income, applying deductions and credits, and determining their final tax liability. Notable features include a section for reporting New York City and Yonkers income taxes, reflecting the state's unique municipal tax structures.

| Form IT-201 | Key Specifications |

|---|---|

| Target Audience | New York State Residents |

| Income Types Covered | Wages, Salaries, Business Income, Investments, etc. |

| Filing Deadline | Typically April 15th of each year |

Form IT-203: Nonresident and Part-Year Resident Income Tax Return

Catering to individuals with complex residency status, Form IT-203 enables nonresidents and part-year residents to report income derived from New York sources. This form is crucial for individuals with ties to multiple states, ensuring accurate reporting of New York-specific income. It accommodates unique tax scenarios, such as income earned while physically present in New York but not considered a resident for tax purposes.

| Form IT-203 | Key Details |

|---|---|

| Target Audience | Nonresidents and Part-Year Residents |

| Income Types Covered | Wages, Salaries, Business Income sourced from New York |

| Filing Deadline | Aligned with the standard tax filing deadline |

Form IT-204: Nonresident and Part-Year Resident Estimated Income Tax Payment Voucher

Designed for nonresidents and part-year residents, Form IT-204 facilitates the payment of estimated taxes throughout the year. It is a crucial tool for individuals with fluctuating income, ensuring compliance with tax obligations. The form provides a systematic approach to calculating and remitting estimated taxes, avoiding potential penalties for underpayment.

| Form IT-204 | Key Specifications |

|---|---|

| Target Audience | Nonresidents and Part-Year Residents |

| Purpose | Payment of Estimated Taxes |

| Payment Schedule | Typically four payments due by specific deadlines |

Form IT-205: Resident Estimated Income Tax Payment Voucher

Similar to Form IT-204, Form IT-205 is tailored for New York residents to make estimated tax payments throughout the year. It is particularly beneficial for individuals with fluctuating income, ensuring they remain compliant with their tax obligations. The form provides a clear structure for calculating and remitting estimated taxes, maintaining a steady tax payment stream.

| Form IT-205 | Key Details |

|---|---|

| Target Audience | New York State Residents |

| Purpose | Payment of Estimated Taxes |

| Payment Schedule | Typically four payments due by specific deadlines |

Form IT-210: Individual Income Tax Refund Claim

Form IT-210 is the dedicated form for individuals seeking a refund of overpaid taxes. It allows taxpayers to claim refunds resulting from various scenarios, such as excess withholding, additional credits, or amended returns. The form guides taxpayers through the process, ensuring a seamless refund journey.

| Form IT-210 | Key Specifications |

|---|---|

| Target Audience | Individuals with Overpaid Taxes |

| Purpose | Claiming Tax Refunds |

| Processing Time | Varies, typically 6-8 weeks |

The Comprehensive Guide to Filing New York Income Tax Forms

Navigating the process of filing New York income tax forms can be streamlined with a clear, step-by-step approach. This section provides an in-depth guide, covering essential pre-filing considerations, the actual filing process, and post-filing actions. By following these steps, taxpayers can ensure a seamless and accurate filing experience.

Pre-Filing Preparations

Before embarking on the filing journey, several crucial steps should be taken to ensure a smooth process:

- Gather Necessary Documents: Collect all relevant income statements, including W-2 forms, 1099 forms, and any documentation related to business income, investments, or deductions.

- Understand Your Tax Status: Determine whether you are a resident, nonresident, or part-year resident. This status will dictate the appropriate forms to use.

- Review Previous Returns: Refer to previous tax returns to identify any consistent deductions, credits, or filing strategies that can be applied to the current year's return.

- Estimate Your Tax Liability: Use online tools or tax software to estimate your tax liability based on your income and deductions. This step helps in planning for payment or identifying potential refunds.

The Filing Process

Once pre-filing preparations are complete, it's time to dive into the actual filing process. Here's a step-by-step guide:

- Choose the Right Form: Based on your tax status and income sources, select the appropriate form. Refer to the earlier sections for guidance on choosing between IT-201, IT-203, or other relevant forms.

- Complete the Form: Carefully enter all required information, ensuring accuracy. Double-check income amounts, deductions, and credits to avoid errors.

- Calculate Your Tax Liability: Use the form's calculations to determine your final tax liability. If you owe taxes, prepare to make a payment.

- Payment Options: If you have a tax liability, explore payment options. New York offers various methods, including direct payment, credit/debit card, or payment plans.

- Submit Your Return: Choose your preferred method of submission, whether electronic filing or traditional mail. Electronic filing is often faster and more secure.

Post-Filing Actions

After submitting your tax return, there are a few crucial steps to ensure a smooth post-filing process:

- Record Keeping: Maintain a copy of your filed return, along with all supporting documents. This practice aids in future reference and potential audits.

- Monitor Your Refund Status: If you are expecting a refund, track its progress through the New York Department of Taxation and Finance's online tools. This helps in managing your financial expectations.

- Stay Informed: Keep abreast of any tax law changes or updates that may impact your future filings. The New York Department of Taxation and Finance often provides resources and notifications regarding tax updates.

Expert Insights and Tips for New York Income Tax Filing

Navigating the complexities of New York income tax forms can be simplified with the right strategies and expert advice. This section offers valuable insights and tips from industry professionals to enhance your tax filing experience and ensure compliance.

Maximizing Deductions and Credits

Understanding the myriad of deductions and credits available in New York can significantly impact your tax liability. Here are some key strategies:

- Itemized Deductions: Consider itemizing deductions if your expenses exceed the standard deduction. Common itemized deductions include mortgage interest, state and local taxes, and charitable contributions.

- Tax Credits: Explore various tax credits, such as the Child and Dependent Care Credit, Education Credits, or the Earned Income Tax Credit. These credits can reduce your tax liability directly.

- Retirement Contributions: Contributions to retirement accounts, such as IRAs or 401(k)s, can offer tax advantages. Consult a financial advisor to understand the best strategies for your situation.

Efficient Record-Keeping

Maintaining organized records is crucial for accurate tax filing and potential audits. Consider these practices:

- Digital Storage: Utilize cloud-based storage or dedicated tax software to keep digital records. This simplifies access and retrieval when needed.

- Document Organization: Create a systematic filing system for your tax documents. Categorize by year, income source, and type of document to streamline future reference.

- Secure Storage: Ensure that your physical and digital records are stored securely. This protects your sensitive information and maintains compliance.

Tax Software and Professional Assistance

Navigating the intricacies of New York tax laws can be simplified with the right tools and support. Consider the following options:

- Tax Software: Reputable tax software can guide you through the filing process, offering personalized recommendations and error-checking. Popular options include TurboTax and H&R Block.

- Enrolled Agents: These are federally-authorized tax professionals who can represent you before the IRS. They offer expertise in tax preparation and resolution, providing valuable support.

- CPA Services: Certified Public Accountants (CPAs) are licensed professionals who can provide comprehensive tax planning and preparation services. They are particularly beneficial for complex tax situations.

Staying Informed and Up-to-Date

The tax landscape is subject to frequent changes and updates. Staying informed ensures compliance and optimal tax strategies. Here's how:

- Subscribe to Updates: Sign up for email notifications or RSS feeds from the New York Department of Taxation and Finance to receive timely updates on tax law changes.

- Follow Tax News: Stay tuned to reputable tax news sources, such as the IRS website or industry-specific publications, to stay informed about broader tax trends and developments.

- Attend Workshops: Participate in tax workshops or webinars offered by tax professionals or community organizations. These events provide valuable insights and practical tips.

The Impact of New York Income Tax Forms on Financial Planning

New York income tax forms play a pivotal role in shaping financial strategies and planning. Understanding the implications of these forms can help individuals and businesses make informed decisions regarding their finances and tax obligations. This section explores the broader financial impact of New York's tax landscape.

Tax Strategies for Individuals

For individuals, the choice of tax forms and strategies can significantly impact their overall financial well-being. Here are some key considerations:

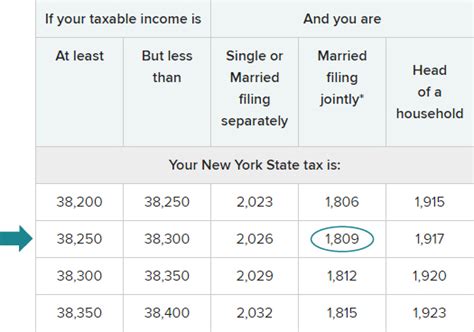

- Income Tax Brackets: Understanding the state's tax brackets can guide income management strategies. Adjusting income levels or timing of income recognition can potentially optimize tax liabilities.

- Deduction Planning: Maximizing deductions, such as the state and local tax deduction, can reduce taxable income. Strategic planning for deductions throughout the year can lead to substantial savings.

- Retirement Planning: Contributions to retirement accounts offer tax advantages. Coordinating retirement savings with other financial goals can enhance overall financial planning.

Corporate Tax Strategies

Businesses operating in New York face unique tax considerations. Here's how they can navigate the corporate tax landscape:

- Corporate Tax Rates: Understanding the state's corporate tax rates and potential incentives can guide business decisions. Optimizing tax liabilities can enhance cash flow and overall financial health.

- Tax Credits and Incentives: New York offers various tax credits and incentives for businesses, such as the Empire State Tax Credit or the Excelsior Jobs Program. Utilizing these incentives can significantly reduce tax burdens.

- Entity Structure: Choosing the right business entity can impact tax obligations. Corporations, partnerships, or LLCs have different tax implications. Consulting with tax professionals can help determine the most advantageous structure.

Long-Term Financial Planning

Integrating tax considerations into long-term financial planning is crucial for individuals and businesses alike. Here's how it can be done:

- Financial Goals: Aligning tax strategies with long-term financial goals, such as retirement planning or business expansion, can optimize overall financial outcomes.

- Investment Strategies: Tax-efficient investment strategies, such as tax-loss harvesting or utilizing tax-advantaged accounts, can enhance returns and reduce tax liabilities.

- Estate Planning: Incorporating tax considerations into estate planning can ensure a smooth transfer of assets while minimizing tax burdens for heirs.

Frequently Asked Questions (FAQ)

What is the deadline for filing New York income tax returns?

+

The standard deadline for filing New York income tax returns is April 15th of each year. However, this deadline may be extended in certain circumstances, such as during a natural disaster or if the taxpayer is outside the country on the filing due date.

How can I estimate my New York state tax liability before filing?

+

You can estimate your New York state tax liability using the state’s online tax estimator tool. This tool takes into account your income, deductions, and credits to provide an estimate of your potential tax liability. It’s a helpful resource for planning and budgeting.

Can I file my New York income tax return electronically?

+

Yes,