Mn Tax Return

In the realm of financial obligations, few topics are as crucial yet complex as filing tax returns. For residents of Minnesota, understanding the process and requirements for their Mn Tax Return is essential to ensure compliance and maximize potential benefits. This article aims to provide an in-depth guide, breaking down the intricacies of the Mn Tax Return process, from the initial steps to the final submission, with a focus on clarity and practicality.

Understanding the Mn Tax Return Process

The Minnesota tax return, commonly known as the Mn Tax Return, is a mandatory financial statement that residents and businesses operating within the state must file annually. It serves as a means for the state to collect revenue and distribute it towards essential services and infrastructure development. The process, though complex, is designed to be navigable with the right guidance and resources.

Eligibility and Filing Status

All Minnesota residents with a taxable income above a certain threshold are required to file an Mn Tax Return. The threshold varies based on filing status: single, married filing jointly, head of household, or qualifying widow(er). It’s important to note that even if your income falls below the threshold, you might still need to file if you owe taxes, are entitled to a refund, or are claiming certain credits.

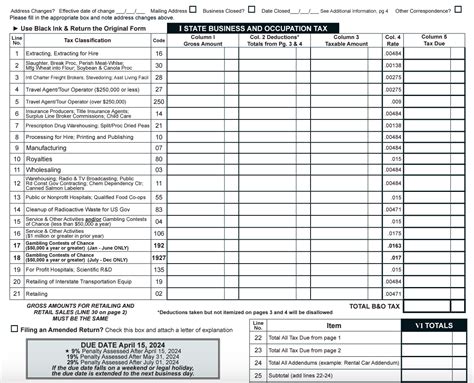

Additionally, businesses operating within Minnesota, including sole proprietorships, partnerships, corporations, and LLCs, are subject to state tax obligations. The specific requirements and forms vary based on the business structure and type of income generated.

| Filing Status | Income Threshold |

|---|---|

| Single | $13,590 |

| Married Filing Jointly | $27,180 |

| Head of Household | $20,350 |

| Qualifying Widow(er) | $27,180 |

Gathering Necessary Documents

Before commencing the Mn Tax Return process, it’s crucial to gather all relevant financial documents. These typically include W-2 forms from employers, 1099 forms for independent contractors and freelancers, interest and dividend statements from banks and financial institutions, and any records of deductible expenses.

For business owners, additional documents might be required, such as profit and loss statements, balance sheets, and records of business expenses. It's essential to maintain organized records throughout the year to simplify the filing process.

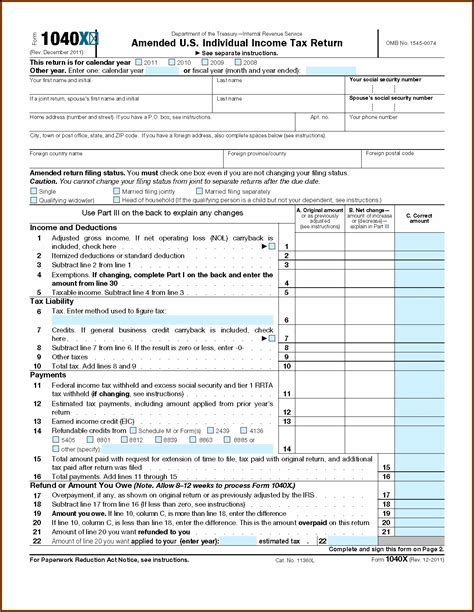

Choosing the Right Tax Form

Minnesota offers various tax forms depending on the nature of your income and filing status. The most common forms include:

- Form 1: For individuals with wages, salaries, tips, or other forms of income.

- Form 1NP: For non-residents with Minnesota-sourced income.

- Form 4: For businesses, including partnerships, corporations, and LLCs.

- Form 4M: For businesses with modified gross income.

It's important to choose the correct form to ensure accuracy and compliance with state regulations. The Minnesota Department of Revenue provides detailed guidelines on their website to assist taxpayers in selecting the appropriate form.

Preparing and Filing Your Mn Tax Return

Once you’ve gathered your documents and chosen the right tax form, the next step is to prepare and file your Mn Tax Return. This process can be completed manually or through the use of tax preparation software.

Manual Preparation

If you choose to prepare your Mn Tax Return manually, you can download the necessary forms and instructions from the Minnesota Department of Revenue’s website. Each form comes with detailed instructions to guide you through the process.

It's crucial to fill out the forms accurately, ensuring that all income, deductions, and credits are accounted for. Any errors or omissions can lead to penalties and delays in processing your return.

Using Tax Preparation Software

Tax preparation software can simplify the process by guiding you through a series of questions and automatically filling out the appropriate forms. These programs often come with built-in error-checking features to help minimize mistakes.

Some popular tax preparation software options for Minnesota residents include TurboTax, H&R Block, and TaxAct. These platforms offer various features, such as import capabilities for financial documents and personalized guidance based on your unique circumstances.

Filing Options

Once your Mn Tax Return is prepared, you have several options for filing:

- E-filing: The most common and efficient method, e-filing allows you to submit your return electronically. The Minnesota Department of Revenue provides a secure portal for this purpose, ensuring the safety and confidentiality of your information.

- Mail-in Filing: If you prefer a traditional approach, you can print out your completed forms and mail them to the address specified by the Department of Revenue.

It's important to note that e-filing typically offers faster processing times and the potential for quicker refunds. However, if you're unable to e-file, the mail-in option is always available.

Payment Options and Refunds

When filing your Mn Tax Return, you may have a balance due or be entitled to a refund. The state offers various payment and refund options to accommodate different financial situations.

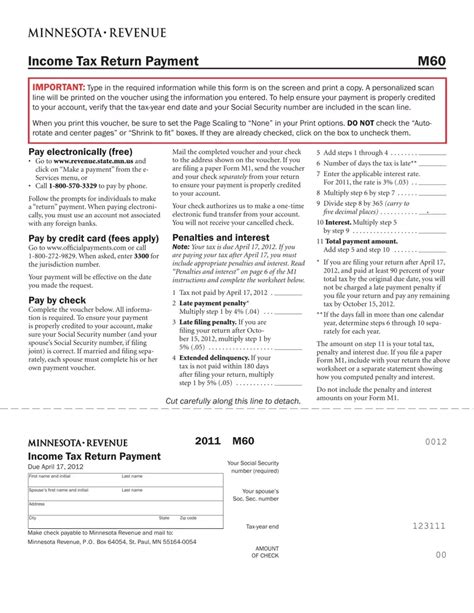

Making Payments

If you owe taxes, you have several payment options:

- Electronic Payment: You can make a secure online payment using a credit or debit card, or directly from your bank account.

- Check or Money Order: These can be mailed along with your return to the address provided by the Department of Revenue.

- Installment Agreement: If you're unable to pay the full amount due, you may be eligible for an installment agreement, allowing you to pay in smaller increments over time.

Receiving Refunds

If you’re due a refund, you have two primary options for receiving your money:

- Direct Deposit: This is the fastest method, as your refund will be deposited directly into your bank account. You'll need to provide your routing and account numbers when filing your return.

- Check by Mail: If you prefer a traditional approach, you can opt to receive your refund by check, which will be mailed to the address on your tax return.

Common Mn Tax Return Pitfalls and How to Avoid Them

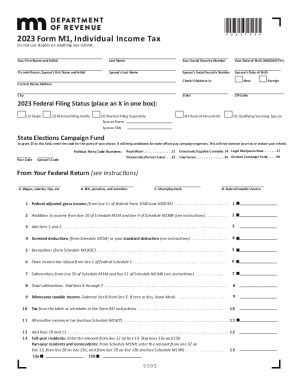

Filing your Mn Tax Return accurately and on time is crucial to avoid penalties and ensure you receive any refunds or credits you’re entitled to. Here are some common pitfalls to watch out for and strategies to avoid them:

Missing Deadlines

The most common mistake taxpayers make is missing the filing deadline. The standard deadline for filing your Mn Tax Return is typically April 15th, but this can be extended under certain circumstances. It’s crucial to mark this date on your calendar and ensure your return is filed promptly to avoid late filing penalties.

Incorrect Social Security Numbers

Another common error is entering incorrect Social Security Numbers (SSNs) for yourself or your dependents. SSNs are unique to each individual and are used to identify taxpayers and track their tax payments and refunds. Entering the wrong SSN can lead to delays in processing your return and may even result in your return being flagged for further review.

Math Errors

Simple math errors can also lead to significant issues when filing your Mn Tax Return. These errors can affect the accuracy of your taxable income calculation, the amount of tax you owe, and any refunds or credits you’re entitled to. Always double-check your calculations and consider using tax preparation software to minimize the risk of errors.

Forgetting to Sign and Date Your Return

Filing an unsigned tax return is not valid. Always remember to sign and date your Mn Tax Return before submitting it. If you’re filing a joint return with your spouse, both of you must sign the return. Forgetting to sign your return can lead to delays in processing and may even result in your return being rejected.

Overlooking Deductions and Credits

Taxpayers often overlook deductions and credits they’re eligible for, which can result in paying more taxes than necessary. It’s crucial to review all potential deductions and credits, such as the Minnesota Working Family Credit, property tax refunds, or education credits. These can significantly reduce your tax liability or increase your refund.

Maximizing Your Mn Tax Return: Strategies and Tips

Filing your Mn Tax Return isn’t just about compliance; it’s also an opportunity to optimize your financial situation. Here are some strategies and tips to help you get the most out of your return:

Take Advantage of Deductions and Credits

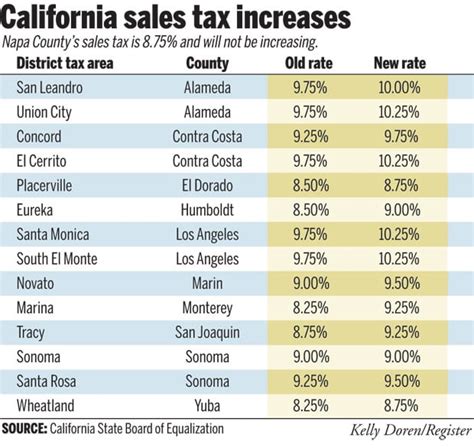

Minnesota offers various deductions and credits that can reduce your taxable income or the amount of tax you owe. These include deductions for medical and dental expenses, charitable contributions, and certain business expenses. Additionally, credits like the Minnesota Working Family Credit and the Property Tax Refund can provide significant savings.

Consider Itemizing Your Deductions

If your itemized deductions exceed the standard deduction amount, it may be beneficial to itemize. Itemizing allows you to deduct specific expenses, such as state and local taxes, mortgage interest, charitable contributions, and medical expenses. However, it’s important to carefully consider whether itemizing is more advantageous than taking the standard deduction, as it can be more complex and time-consuming.

Maximize Retirement Contributions

Contributions to retirement accounts, such as 401(k)s or IRAs, can provide tax benefits. These contributions are typically tax-deductible, reducing your taxable income and lowering your tax liability. Additionally, any growth within these accounts is tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw the funds in retirement.

Review Your Withholding

If you consistently receive a large refund each year, it may indicate that you’re having too much tax withheld from your paychecks. Consider adjusting your withholding allowances using Form W-4 to have less tax withheld, allowing you to keep more of your income throughout the year. However, be cautious not to under-withhold, as this can lead to owing taxes at the end of the year.

Explore Tax-Efficient Investment Strategies

Certain investment strategies can provide tax benefits. For example, investing in tax-advantaged accounts like Health Savings Accounts (HSAs) or 529 Plans can reduce your taxable income and provide tax-free growth. Additionally, considering tax-efficient investment options, such as municipal bonds or index funds, can help minimize the tax impact of your investments.

Seeking Professional Assistance

The Mn Tax Return process can be complex, especially for those with unique financial situations or business income. In such cases, seeking the assistance of a tax professional can be beneficial. A qualified tax advisor or accountant can provide personalized guidance, ensure accuracy in your return, and help you maximize any potential tax savings.

Benefits of Working with a Tax Professional

Tax professionals have extensive knowledge of tax laws and regulations, ensuring your return is filed accurately and compliantly. They can help identify deductions and credits you may be eligible for, provide guidance on complex financial matters, and assist with tax planning strategies to minimize your tax liability in future years.

Additionally, tax professionals can represent you in the event of an audit or tax dispute with the state. They can communicate directly with the Minnesota Department of Revenue on your behalf, alleviating the stress and burden of dealing with tax authorities.

Choosing the Right Tax Professional

When selecting a tax professional, it’s important to choose someone with experience in your specific situation. For example, if you own a business, look for an accountant or tax advisor who specializes in business taxation. If you have complex investments or real estate holdings, consider a financial planner or tax attorney who can provide comprehensive advice.

Always verify the credentials and qualifications of any tax professional you're considering. Look for licensed professionals, such as Certified Public Accountants (CPAs) or Enrolled Agents (EAs), who are held to high ethical standards and must meet continuing education requirements to maintain their license.

Conclusion: Your Mn Tax Return Journey

The Mn Tax Return process is a critical part of financial management for Minnesota residents and businesses. By understanding the requirements, gathering the necessary documents, and choosing the right forms and filing methods, you can ensure a smooth and accurate filing process. Additionally, being aware of common pitfalls and employing strategies to maximize your return can help you navigate the process with confidence and potentially save money.

Remember, the Minnesota Department of Revenue provides a wealth of resources and guidance to assist taxpayers. If you have any questions or concerns, don't hesitate to reach out to their support team or consult with a qualified tax professional. Your financial well-being is an important journey, and taking the time to understand and optimize your tax situation is a crucial step towards achieving your financial goals.

What is the deadline for filing my Mn Tax Return?

+The standard deadline for filing your Mn Tax Return is typically April 15th. However, this deadline can be extended under certain circumstances, such as if you’re unable to file due to a federally declared disaster. It’s important to check the official website of the Minnesota Department of Revenue for any updates or changes to the filing deadline.

Can I file an extension for my Mn Tax Return?

+Yes, you can file an extension for your Mn Tax Return. To do so, you need to file Form M-45, which provides a six-month extension until October 15th. However, it’s important to note that an extension only grants you more time to file your return, not to pay any taxes owed. You must still pay any taxes due by the original deadline to avoid penalties and interest.

How can I check the status of my Mn Tax Return refund?

+You can check the status of your Mn Tax Return refund by visiting the Minnesota Department of Revenue’s website and using their online refund status tool. You’ll need to provide your Social Security Number or Individual Taxpayer Identification Number, as well as your filing status and the exact amount of your expected refund.