Sales Tax In Orange County Ca

Understanding sales tax regulations is crucial for businesses and consumers alike, especially in regions like Orange County, California, known for its vibrant economy and diverse population. Sales tax, a key revenue source for local governments, can significantly impact business operations and consumer spending. This article aims to delve into the intricacies of sales tax in Orange County, providing a comprehensive guide to help navigate this complex yet essential aspect of commerce.

The Complex World of Sales Tax in Orange County, CA

Sales tax in Orange County, California, presents a unique landscape, characterized by a combination of state, county, and city-specific regulations. This multifaceted system can pose challenges for businesses and consumers, making it imperative to have a thorough understanding of the applicable rates and rules.

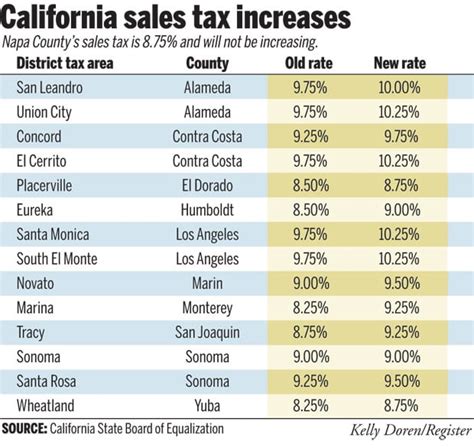

Statewide Sales Tax Rates

California imposes a base sales tax rate of 7.25% on most goods and services. This rate is mandated by the state and applies uniformly across all counties, including Orange County.

| State Sales Tax | Rate |

|---|---|

| California | 7.25% |

However, the state's sales tax system is not a one-size-fits-all approach. California allows local jurisdictions, such as counties and cities, to levy additional taxes, often referred to as local option taxes or add-on taxes.

Orange County’s Local Option Tax

In Orange County, the local option tax rate is 1.25%, bringing the total sales tax to 8.50% for most purchases. This additional tax is a significant contributor to the county’s revenue, helping fund essential services and infrastructure projects.

| Orange County Sales Tax | Rate |

|---|---|

| Local Option Tax | 1.25% |

| Total Sales Tax | 8.50% |

It's important to note that while the county-wide sales tax rate is standardized, individual cities within Orange County may have their own add-on taxes, resulting in slightly varying sales tax rates across the county.

City-Specific Sales Tax Variations

Several cities in Orange County have implemented their own local sales taxes, which can add up to 0.25% to 1% on top of the state and county rates. These city-specific taxes are typically used to fund local projects, such as infrastructure improvements, community services, or specific initiatives.

| City | Local Sales Tax |

|---|---|

| Anaheim | 0.25% |

| Newport Beach | 1% |

| Santa Ana | 0.5% |

| Huntington Beach | 0.75% |

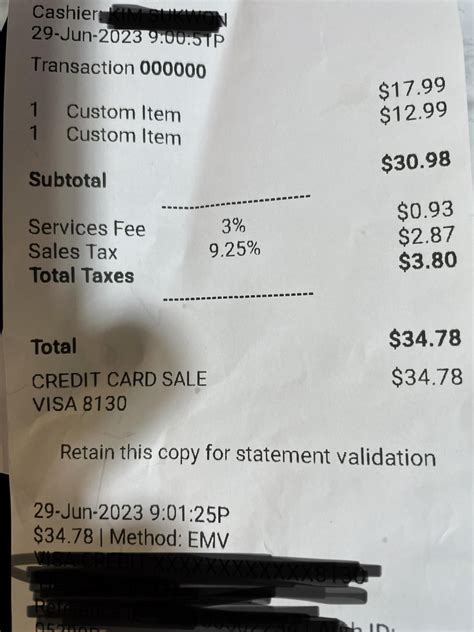

These variations in sales tax rates highlight the importance of businesses and consumers being aware of the specific tax rates applicable to their location. For instance, a purchase made in Anaheim would have a total sales tax of 8.75% (7.25% state + 1.25% county + 0.25% city), while the same purchase in Newport Beach would attract a tax of 9.25% (7.25% state + 1.25% county + 1% city). This can significantly impact the final price of goods and services.

Exemptions and Special Considerations

The sales tax landscape in Orange County, like any other jurisdiction, is not devoid of exemptions and special cases. Certain goods and services are exempt from sales tax, such as most groceries, prescription medications, and certain types of manufacturing equipment.

Additionally, there are special provisions for certain types of businesses. For instance, remote sellers and marketplace facilitators may be required to collect and remit sales tax based on the destination of the shipment, known as economic nexus. This means that even if a business doesn't have a physical presence in Orange County, it may still need to collect and remit sales tax if it meets certain sales thresholds.

Compliance and Reporting

For businesses operating in Orange County, compliance with sales tax regulations is a critical aspect of their operations. This involves accurate collection, reporting, and remittance of sales tax to the appropriate tax authorities. Failure to comply can result in penalties, interest charges, and even legal consequences.

The California Department of Tax and Fee Administration (CDTFA) is the primary authority responsible for enforcing sales tax laws in the state. They provide resources and guidance to help businesses understand their sales tax obligations, including registration, filing, and payment processes.

Businesses should ensure they are registered with the CDTFA and file their sales tax returns accurately and on time. This often involves maintaining detailed records of sales transactions, including the applicable tax rates and any exemptions or special considerations that may apply.

Impact on Business Operations

Sales tax can have a significant impact on the bottom line for businesses, especially those with a physical presence in multiple jurisdictions. The varying rates across different cities in Orange County can make pricing strategies complex and can impact a business’s competitive position in the market.

From a consumer perspective, understanding sales tax rates is crucial for budgeting and making informed purchasing decisions. Consumers in Orange County should be aware of the varying rates across the county to ensure they are not surprised by the final price at checkout.

Future Outlook

The sales tax landscape in Orange County, and California as a whole, is subject to change. Proposed legislation and economic shifts can impact the rates and regulations surrounding sales tax. Staying informed about these changes is essential for both businesses and consumers to ensure compliance and financial planning.

In recent years, there has been a growing trend towards online sales and remote shopping. This has led to a shift in how sales tax is collected and remitted, with more focus on the destination of the shipment rather than the location of the seller. This trend is likely to continue, and businesses should be prepared to adapt their sales tax strategies accordingly.

Frequently Asked Questions

How often do sales tax rates change in Orange County, CA?

+

Sales tax rates can change annually or even more frequently in response to changing economic conditions or legislative decisions. It’s important for businesses and consumers to stay updated with the latest rates to ensure compliance and accurate pricing.

Are there any online resources to help calculate sales tax in Orange County?

+

Yes, the California Department of Tax and Fee Administration (CDTFA) provides an online Sales Tax Calculator tool. This tool allows users to input the location and type of purchase to determine the applicable sales tax rate. It’s a valuable resource for both businesses and consumers.

What happens if a business fails to collect and remit sales tax accurately in Orange County?

+

Businesses that fail to comply with sales tax regulations can face significant penalties and interest charges. In severe cases, non-compliance can lead to legal action and even business closure. It’s crucial for businesses to stay informed about their sales tax obligations and seek professional advice if needed.

Are there any tax incentives or rebates available for businesses in Orange County?

+

Yes, Orange County and some of its cities offer various tax incentives and rebates to attract and support businesses. These incentives can include tax breaks for specific industries, job creation programs, or infrastructure investment initiatives. Businesses should explore these opportunities to reduce their tax liabilities and boost their bottom line.

How can consumers in Orange County verify the sales tax rate for a specific purchase?

+

Consumers can verify the sales tax rate by checking the receipt provided by the retailer. The sales tax should be clearly stated, including the state, county, and city-specific rates. If there are any concerns or discrepancies, consumers can contact the retailer or refer to the CDTFA’s Sales Tax Calculator for verification.