Mn Tax Brackets 2025

As we approach the year 2025, it's essential to stay informed about the tax landscape, especially when it comes to understanding the Minnesota tax brackets. The tax system can be complex, and knowing where you stand within the brackets is crucial for effective financial planning. This comprehensive guide will delve into the specifics of the Minnesota tax brackets for the upcoming year, providing valuable insights to help you navigate your financial obligations.

Minnesota’s Progressive Tax System: An Overview

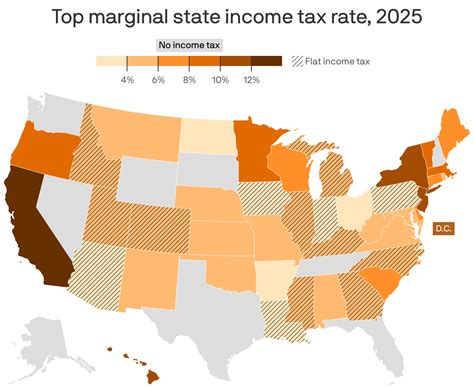

Minnesota operates on a progressive tax system, which means that as your income increases, so does your tax rate. This approach ensures that individuals and families with higher incomes contribute a larger proportion of their earnings towards state revenues. Understanding your tax bracket is vital as it directly impacts the amount of state income tax you will owe.

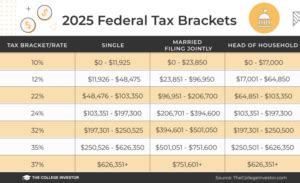

The 2025 Tax Brackets: A Detailed Breakdown

For the tax year 2025, Minnesota has established a series of tax brackets that categorize taxpayers based on their taxable income. These brackets determine the applicable tax rate for each income level. Here’s a detailed breakdown of the 2025 Minnesota tax brackets:

Single Filers

Single individuals are categorized into the following tax brackets based on their taxable income:

| Tax Bracket | Taxable Income Range | Tax Rate |

|---|---|---|

| 1 | 0 - 13,000 | 5.35% |

| 2 | 13,001 - 29,000 | 7.05% |

| 3 | 29,001 - 74,000 | 7.85% |

| 4 | 74,001 - 161,000 | 8.45% |

| 5 | Over $161,000 | 9.85% |

Married Filing Jointly and Qualifying Widowers

For married couples filing jointly and qualifying widowers, the tax brackets are slightly different. Here’s the breakdown:

| Tax Bracket | Taxable Income Range | Tax Rate |

|---|---|---|

| 1 | 0 - 16,000 | 5.35% |

| 2 | 16,001 - 35,000 | 7.05% |

| 3 | 35,001 - 88,000 | 7.85% |

| 4 | 88,001 - 190,000 | 8.45% |

| 5 | Over $190,000 | 9.85% |

Head of Household

Individuals filing as Head of Household have their own set of tax brackets:

| Tax Bracket | Taxable Income Range | Tax Rate |

|---|---|---|

| 1 | 0 - 14,000 | 5.35% |

| 2 | 14,001 - 31,000 | 7.05% |

| 3 | 31,001 - 79,000 | 7.85% |

| 4 | 79,001 - 171,000 | 8.45% |

| 5 | Over $171,000 | 9.85% |

Additional Considerations

It’s crucial to understand that these tax brackets are just one part of the tax equation. Minnesota’s tax system also includes various deductions, credits, and exemptions that can reduce your taxable income and, consequently, the amount of tax you owe. These include standard deductions, personal exemptions, and a range of tax credits for education, property taxes, and more.

Impact on Financial Planning

Knowledge of the Minnesota tax brackets is a powerful tool for effective financial planning. By understanding your tax bracket, you can make informed decisions about your income, deductions, and investments. For instance, if you’re nearing the upper limit of a tax bracket, strategic financial moves could potentially reduce your taxable income and lower your overall tax liability.

Future Outlook and Potential Changes

Tax laws are dynamic and can change from year to year. While the 2025 tax brackets provide a solid framework for current financial planning, it’s essential to stay updated on any legislative proposals or economic shifts that could impact future tax rates and brackets. Keeping an eye on tax reforms can help you anticipate and adapt to potential changes in your financial strategy.

Expert Tips for Tax Optimization

- Consult a Tax Professional: Complex tax situations or significant life changes may warrant professional advice. Tax experts can provide personalized strategies to optimize your tax position.

- Maximize Deductions: Understand and utilize all applicable deductions to reduce your taxable income. This could include deductions for mortgage interest, medical expenses, or charitable contributions.

- Strategic Investment Timing: Consider the timing of investments and financial decisions. Moving certain transactions to a different tax year could impact your tax liability.

- Explore Tax Credits: Take advantage of tax credits that align with your circumstances. These can provide significant reductions in your tax liability.

Conclusion

Understanding the Minnesota tax brackets for 2025 is a fundamental step towards effective financial management. By staying informed about your tax obligations and exploring strategies to optimize your tax position, you can make the most of your financial resources. Remember, tax laws can be complex, so staying updated and seeking professional advice when needed is always beneficial.

How often do Minnesota tax brackets change?

+Minnesota tax brackets are typically reviewed annually and can be adjusted based on inflation and economic factors. It’s advisable to check for updates each year as you prepare your tax returns.

Are there any additional taxes besides income tax in Minnesota?

+Yes, Minnesota has a state sales tax, property taxes, and various other taxes and fees. The income tax brackets specifically refer to state income tax, which is separate from these other tax obligations.

What happens if I exceed the upper limit of a tax bracket?

+Exceeding the upper limit of a tax bracket means you’ll pay the tax rate for that bracket on the income within that range. However, income above that bracket’s upper limit will be taxed at the higher rate of the next bracket. It’s important to plan your finances to avoid a significant jump in tax liability.