Maui County Property Tax

Maui County, nestled in the heart of Hawaii, is renowned for its breathtaking landscapes, vibrant culture, and thriving real estate market. As one of the largest counties in the state, Maui County encompasses the islands of Maui, Molokai, Lanai, and Kahoolawe. Property ownership in this tropical paradise comes with a unique set of considerations, including the Maui County property tax system. Understanding this system is crucial for both current and prospective property owners, as it directly impacts their financial obligations and planning.

Unraveling the Maui County Property Tax Landscape

Maui County’s property tax system, like that of many other counties in Hawaii, operates on a biennial assessment cycle. This means that property values are reassessed every two years, with the primary assessment occurring in odd-numbered years. This assessment process is a critical component of the property tax system, as it determines the value of each property and, subsequently, the tax liability for the upcoming biennium.

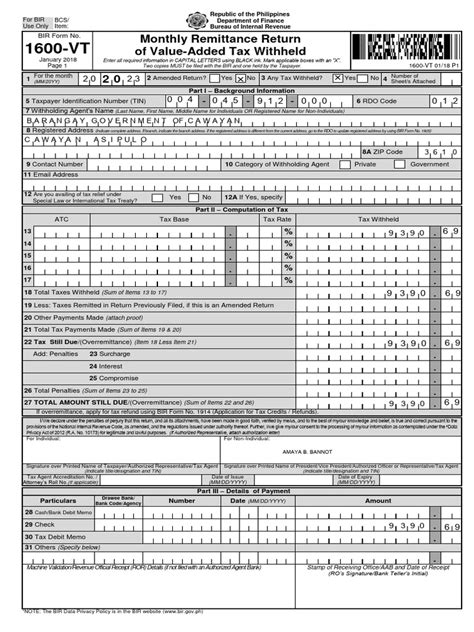

The assessed value of a property is influenced by various factors, including its physical characteristics, location, and market conditions. The County of Maui, through its Department of Finance, utilizes a combination of automated valuation models, market data analysis, and physical inspections to determine these values. Property owners receive a Notice of Assessment each year, which outlines the assessed value of their property and provides an opportunity for review and appeal.

Calculating Property Taxes in Maui County

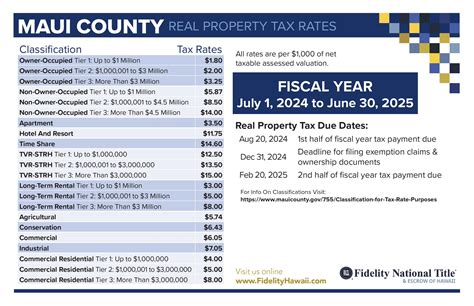

Once the assessed value is determined, the property tax amount is calculated using a straightforward formula. Maui County’s property tax rate is set annually by the Maui County Council, and it is applied uniformly across all properties within the county. For the 2023-2024 fiscal year, the property tax rate is 8.41%, which is among the highest in the state.

The property tax calculation can be expressed as follows: Tax Amount = Assessed Value x Property Tax Rate

For instance, consider a residential property in Maui County with an assessed value of $750,000. Using the 2023-2024 property tax rate of 8.41%, the annual property tax would be calculated as follows: $750,000 x 0.0841 = $63,075

| Property Type | Assessed Value | Property Tax Rate | Annual Tax |

|---|---|---|---|

| Residential | $750,000 | 8.41% | $63,075 |

| Commercial | $2,000,000 | 8.41% | $168,200 |

| Agricultural | $500,000 | 8.41% | $42,050 |

It's important to note that Maui County also offers various tax exemptions and credits, which can significantly reduce the tax liability for eligible property owners. These include the homeowner exemption, which provides a $100,000 exemption on the assessed value of the property for owner-occupied residences, and the veteran's exemption, which offers a $100,000 exemption for qualified veterans.

The Impact of Property Taxes on the Maui Real Estate Market

Maui County’s robust real estate market is influenced by a myriad of factors, including its unique natural environment, vibrant tourism industry, and, of course, property taxes. The county’s high property tax rate can significantly impact investment decisions and the overall affordability of real estate. Prospective buyers and investors often consider property taxes as a crucial component of their financial planning, especially when comparing properties in different counties or states.

For instance, a recent study by the Maui Association of Realtors revealed that the average sale price of a single-family home in Maui County increased by 18.7% from 2021 to 2022, reaching a record high of $1,430,000. While this surge in property values can be attributed to various factors, including limited inventory and strong demand, the high property tax rate cannot be overlooked as a contributing factor. It influences buyers' decisions and can affect the pace of the market.

Furthermore, the property tax system in Maui County plays a pivotal role in funding essential services and infrastructure projects. Property taxes contribute to the county's general fund, which is used for various purposes, including education, public safety, healthcare, and environmental initiatives. This direct link between property taxes and community development underscores the importance of understanding and managing these financial obligations.

Strategies for Managing Maui County Property Taxes

For property owners in Maui County, effective tax management strategies are essential to optimize their financial obligations. Here are some key approaches to consider:

- Review and Appeal: Property owners should carefully review their Notice of Assessment each year. If they believe the assessed value is inaccurate or excessive, they have the right to appeal. The Maui County Board of Review offers a formal process for such appeals, providing an opportunity for property owners to present evidence and arguments to support their case.

- Exemptions and Credits: Understanding the various exemptions and credits available is crucial. Property owners should ensure they are claiming all applicable exemptions, such as the homeowner exemption or the elderly/disabled exemption. These exemptions can significantly reduce the taxable value of the property, leading to substantial savings.

- Strategic Ownership Structures: For commercial properties or investment properties, considering different ownership structures can impact tax liabilities. Entities such as limited liability companies (LLCs) or partnerships may offer certain tax advantages, particularly when it comes to depreciation and tax deductions. Consulting with a tax professional or accountant can help navigate these complex structures.

- Timing and Financing: The timing of property purchases and sales can influence tax obligations. For instance, purchasing a property late in the assessment cycle may result in a lower assessed value for the first year of ownership. Additionally, financing options can impact tax liabilities, as interest payments on mortgages may be tax-deductible. Working with experienced financial advisors can help optimize these strategies.

It's important to note that the property tax landscape in Maui County is dynamic and subject to change. Property owners should stay informed about any legislative updates or policy changes that may impact their tax obligations. Staying connected with local real estate professionals, tax advisors, and legal experts can provide valuable insights and guidance in navigating this complex system.

Conclusion

Maui County’s property tax system is a critical component of the county’s financial framework, influencing the real estate market and the overall well-being of the community. Understanding this system, from the assessment process to tax calculation and management strategies, is essential for property owners and prospective buyers. By staying informed and proactive, individuals can effectively manage their property tax obligations and contribute to the vibrant and sustainable development of Maui County.

When are property taxes due in Maui County?

+

Property taxes in Maui County are due in two installments. The first installment is due on September 20th, while the second installment is due on March 20th of the following year. It’s important to note that if the due date falls on a weekend or holiday, the payment is considered timely if received by the next business day.

How can I appeal my property’s assessed value in Maui County?

+

To appeal your property’s assessed value, you must first receive your Notice of Assessment. This notice provides detailed information about your property’s assessed value and includes instructions on how to initiate an appeal. The appeal process involves submitting an application to the Maui County Board of Review within a specified timeframe, typically 30 days from the date of the notice. It’s crucial to provide supporting evidence and documentation to support your case.

Are there any tax exemptions or credits available for Maui County property owners?

+

Yes, Maui County offers several tax exemptions and credits to eligible property owners. These include the homeowner exemption, which provides a 100,000 exemption on the assessed value of owner-occupied residences, and the veteran's exemption, offering a 100,000 exemption for qualified veterans. Additionally, there are exemptions for elderly or disabled homeowners and agricultural lands. It’s important to research and understand the eligibility criteria for these exemptions to maximize your savings.