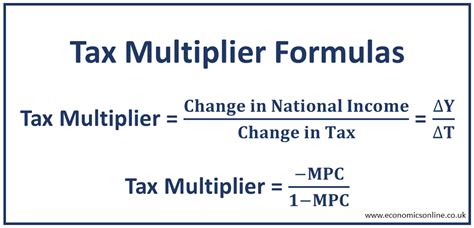

Macroeconomics Tax Multiplier

The tax multiplier is a fundamental concept in macroeconomics, playing a pivotal role in understanding the impact of taxation on economic activity and growth. This concept, often discussed in economic policy debates, offers insights into how changes in tax rates can have cascading effects on various economic indicators. As we delve into the intricacies of the tax multiplier, we'll uncover its definition, significance, and real-world implications, providing a comprehensive understanding of this crucial macroeconomic tool.

Understanding the Tax Multiplier: A Macroeconomic Perspective

At its core, the tax multiplier refers to the change in a country’s aggregate income or economic output that arises from an initial change in taxes. It quantifies the magnitude and direction of the impact that tax changes have on an economy, serving as a critical tool for policymakers and economists to assess the effectiveness of fiscal policies.

The concept of the tax multiplier is closely intertwined with the broader theory of fiscal policy. Fiscal policy, encompassing taxation and government spending, is a primary tool for governments to influence economic activity. When governments adjust tax rates, they aim to achieve specific economic objectives, such as stimulating growth, reducing income inequality, or managing budget deficits. The tax multiplier helps assess the effectiveness of these tax adjustments by quantifying their impact on aggregate demand and, consequently, economic output.

The Mechanics of the Tax Multiplier

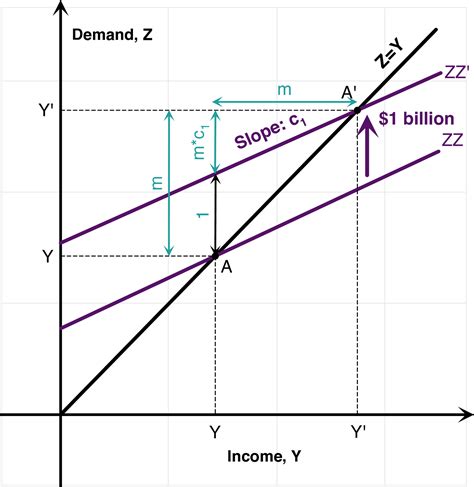

The tax multiplier operates through a series of interconnected economic processes. When taxes are increased, consumers and businesses have less disposable income, leading to reduced spending. This initial decrease in spending can trigger a ripple effect throughout the economy, impacting various sectors and potentially leading to a decline in overall economic activity.

Conversely, a decrease in taxes can stimulate consumer spending and investment, creating a positive feedback loop that boosts economic growth. This dynamic is particularly significant in economies where consumption and investment are key drivers of growth. Understanding the tax multiplier allows economists to predict and manage these feedback loops, guiding policy decisions to achieve desired economic outcomes.

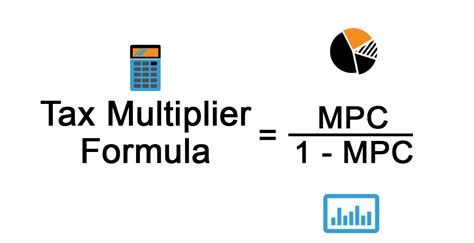

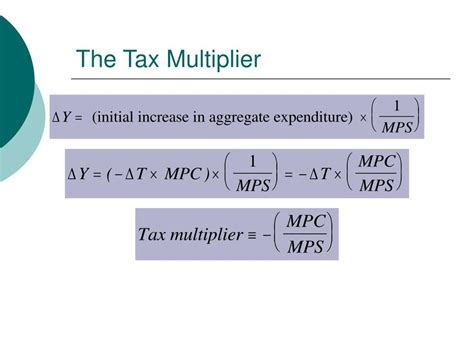

The tax multiplier is calculated using the formula: Tax Multiplier = Change in Aggregate Income / Change in Taxes. This equation highlights the relationship between tax changes and their subsequent impact on aggregate income, providing a quantitative measure of the tax multiplier's effect.

Real-World Applications and Policy Implications

The tax multiplier is not merely a theoretical construct; its practical applications are evident in various economic scenarios. For instance, during economic downturns, governments often consider tax cuts to stimulate consumer spending and boost economic recovery. The tax multiplier comes into play here, helping policymakers gauge the potential impact of such tax cuts on aggregate demand and economic growth.

Similarly, in periods of robust economic growth, governments may opt for tax increases to curb inflationary pressures or to address budget deficits. The tax multiplier analysis aids in assessing the potential trade-offs and effects of such fiscal tightening measures on the overall economy. In both scenarios, the tax multiplier provides a critical lens through which policymakers can evaluate the potential outcomes of their fiscal decisions.

| Scenario | Tax Change | Expected Impact |

|---|---|---|

| Economic Downturn | Tax Cut | Increased consumer spending, potential economic stimulus |

| Strong Economic Growth | Tax Increase | Reduced inflation, potential budget deficit management |

The Tax Multiplier and its Interaction with Other Economic Variables

The tax multiplier’s impact extends beyond its immediate influence on aggregate income and economic output. It interacts with other key economic variables, shaping the overall macroeconomic landscape.

The Multipliers Web: Tax Multiplier and Its Interactions

The tax multiplier is part of a broader network of economic multipliers, including the investment multiplier and government spending multiplier. These multipliers, while distinct, are interconnected, forming a complex web of economic relationships. When governments adjust tax rates, they not only influence consumer spending but also affect investment decisions and government spending patterns, creating a dynamic interplay of these multipliers.

For instance, a tax cut may stimulate consumer spending, leading to increased demand for goods and services. This increased demand can incentivize businesses to invest in expanding production, triggering a positive feedback loop between consumption and investment. The tax multiplier, in this scenario, works in tandem with the investment multiplier to amplify the initial impact of the tax change.

Similarly, tax changes can influence government spending decisions. If tax revenues increase, governments may have more fiscal space to increase public spending on infrastructure, healthcare, or education. This increased government spending, in turn, can stimulate economic activity and further amplify the initial impact of the tax change, highlighting the interconnectedness of the tax multiplier and the government spending multiplier.

| Multiplier | Effect |

|---|---|

| Tax Multiplier | Quantifies the change in aggregate income due to tax changes |

| Investment Multiplier | Measures the impact of investment changes on economic output |

| Government Spending Multiplier | Shows the effect of government spending changes on economic activity |

Case Studies: The Tax Multiplier in Action

The tax multiplier’s principles can be observed in various real-world scenarios, providing valuable insights into its practical implications.

Economic Stimulus Packages: A Test Case for the Tax Multiplier

During the global financial crisis of 2008-2009, many governments implemented economic stimulus packages, often including tax cuts and increased government spending. These measures aimed to boost aggregate demand and stimulate economic recovery. The tax multiplier played a crucial role in assessing the potential impact of these fiscal policies.

For instance, the United States implemented the American Recovery and Reinvestment Act (ARRA) in 2009, which included a mix of tax cuts and increased government spending. The tax multiplier analysis helped economists and policymakers estimate the potential impact of these measures on aggregate income and economic output, providing valuable insights for policy evaluation.

The European Debt Crisis: A Different Tax Multiplier Scenario

In contrast, during the European debt crisis of the late 2000s and early 2010s, many European countries implemented austerity measures, including tax increases and cuts in government spending. The tax multiplier analysis was critical in understanding the potential effects of these fiscal tightening policies.

Countries like Greece and Spain, facing significant debt burdens, implemented substantial tax increases to address their fiscal challenges. The tax multiplier helped assess the potential impact of these measures on aggregate income and economic growth, providing insights into the potential trade-offs and challenges associated with fiscal consolidation.

Lessons Learned: The Tax Multiplier’s Impact

These case studies highlight the diverse applications and implications of the tax multiplier. In times of economic crisis, tax cuts can be a powerful tool to stimulate economic recovery, as evidenced by the ARRA in the United States. Conversely, during periods of fiscal consolidation, tax increases can play a critical role in addressing budget deficits, as seen in the European debt crisis.

The tax multiplier's versatility and its ability to provide quantitative insights make it a valuable tool for policymakers and economists. By understanding its dynamics and implications, decision-makers can navigate the complexities of fiscal policy, ensuring that tax adjustments contribute effectively to economic growth and stability.

Future Outlook: The Tax Multiplier’s Role in Shaping Economic Policies

As economies evolve and face new challenges, the tax multiplier’s relevance and applicability are likely to remain significant. In an era of increasing economic complexity and global interdependence, the insights provided by the tax multiplier can guide policymakers in making informed decisions.

The Tax Multiplier in a Changing Economic Landscape

With the rise of digital economies, changing consumption patterns, and evolving tax systems, the tax multiplier may face new challenges and opportunities. For instance, the rise of e-commerce and digital services has led to discussions about the need for new tax policies to address these emerging sectors. The tax multiplier can provide valuable insights into the potential impact of such tax reforms on economic activity and growth.

Additionally, the growing focus on sustainability and environmental concerns has led to discussions about carbon taxes and other eco-friendly fiscal policies. The tax multiplier can play a crucial role in assessing the economic implications of such policies, helping policymakers balance environmental goals with economic growth objectives.

The Tax Multiplier and Policy Innovation

The tax multiplier’s role extends beyond traditional tax policies. As governments explore innovative fiscal measures, such as universal basic income or negative income tax, the tax multiplier can provide a framework for evaluating their potential economic impact. By understanding the dynamics of the tax multiplier, policymakers can design and implement fiscal policies that are not only effective but also resilient to changing economic conditions.

Conclusion: Navigating the Macroeconomic Landscape with the Tax Multiplier

The tax multiplier is a powerful tool in the macroeconomic toolkit, offering insights into the intricate relationship between taxation and economic activity. Its ability to quantify the impact of tax changes on aggregate income provides a critical lens through which policymakers can evaluate and design effective fiscal policies.

As we've explored, the tax multiplier's applications are diverse, from stimulating economic recovery during downturns to managing fiscal challenges during periods of consolidation. Its interactions with other economic variables, such as investment and government spending, further underscore its importance in shaping the broader macroeconomic landscape.

Looking ahead, the tax multiplier's role is poised to remain significant, guiding policymakers in navigating the complexities of modern economies. By leveraging the insights provided by the tax multiplier, decision-makers can ensure that fiscal policies are not only responsive to economic needs but also contribute to sustainable growth and stability.

What is the primary purpose of the tax multiplier in macroeconomic analysis?

+The tax multiplier quantifies the impact of tax changes on aggregate income and economic output, helping policymakers assess the effectiveness of fiscal policies and their potential impact on economic growth.

How does the tax multiplier interact with other economic multipliers?

+The tax multiplier is part of a network of economic multipliers, including the investment and government spending multipliers. These multipliers are interconnected, and their interplay shapes the overall macroeconomic landscape.

What are some real-world applications of the tax multiplier?

+The tax multiplier has been applied in various scenarios, including economic stimulus packages and fiscal consolidation measures. It provides insights into the potential impact of tax changes on aggregate income and economic growth.

How can the tax multiplier guide future economic policies?

+By understanding the dynamics of the tax multiplier, policymakers can design fiscal policies that are responsive to changing economic conditions, whether it’s stimulating growth during downturns or managing fiscal challenges during periods of consolidation.