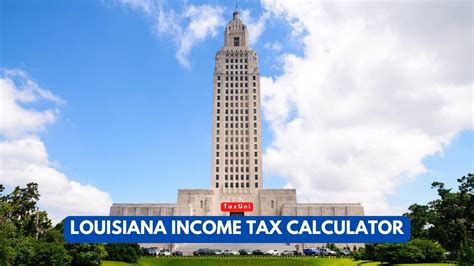

Louisiana Income Tax Calculator

Are you a resident of the beautiful state of Louisiana and looking for a straightforward way to calculate your income taxes? Look no further! In this comprehensive guide, we will delve into the world of Louisiana income taxes, providing you with an expert-level understanding of the tax system and a handy calculator to ease your financial planning.

Understanding Louisiana's Income Tax System

Louisiana, known for its vibrant culture and diverse economy, has a unique approach to income taxation. The state operates on a progressive tax system, which means the tax rate you pay increases as your income rises. This ensures fairness and contributes to the overall well-being of the state.

The Louisiana Department of Revenue (LDR) oversees the income tax process, ensuring compliance and offering resources for taxpayers. Here's a breakdown of the key aspects of Louisiana's income tax system:

Tax Rates and Brackets

Louisiana has six income tax brackets, each with its own tax rate. The rates range from 2% to 6%, with the highest rate applying to the highest income earners. The brackets are as follows:

| Tax Bracket | Tax Rate | Income Range |

|---|---|---|

| 1 | 2% | Up to $12,500 |

| 2 | 4% | $12,501 - $50,000 |

| 3 | 5% | $50,001 - $100,000 |

| 4 | 5.25% | $100,001 - $250,000 |

| 5 | 5.75% | $250,001 - $500,000 |

| 6 | 6% | Over $500,000 |

These brackets are designed to ensure that individuals and families with higher incomes contribute a larger share of their earnings to the state's revenue. It's worth noting that these rates may be subject to change, so it's advisable to check with the LDR for the most up-to-date information.

Taxable Income and Deductions

When calculating your Louisiana income tax, you'll need to determine your taxable income. This is typically your gross income minus any allowable deductions. Louisiana offers various deductions and credits to reduce your taxable income, including:

- Standard Deduction: A fixed amount that you can deduct from your income. The standard deduction for 2023 is $2,500 for single filers and $5,000 for married couples filing jointly.

- Personal Exemptions: You can claim an exemption for yourself and each dependent, reducing your taxable income. The personal exemption amount for 2023 is $4,500.

- Itemized Deductions: If your expenses exceed the standard deduction, you may choose to itemize. Common itemized deductions include medical expenses, charitable contributions, and state and local taxes.

- Credits: Louisiana offers various tax credits, such as the Earned Income Tax Credit and the Child and Dependent Care Credit, which can further reduce your tax liability.

It's important to consult a tax professional or refer to the LDR's guidelines to ensure you're maximizing your deductions and credits.

Filing Options and Due Dates

Louisiana offers several filing options, including online filing through the Louisiana Taxpayer Access Point (LATAP), paper filing, and e-filing with approved software providers. The due date for filing your Louisiana income tax return is typically April 15th, aligning with the federal tax deadline.

However, if you're unable to meet this deadline, you can request an extension. The extension provides an additional six months to file your return, but it's important to note that an extension of time to file does not extend the time to pay any taxes owed.

Louisiana Income Tax Calculator: A Handy Tool

To simplify the process of calculating your Louisiana income tax, we've developed an easy-to-use calculator. This calculator takes into account the state's tax brackets, deductions, and credits to provide an estimate of your tax liability.

By inputting your income, deductions, and any applicable credits, the calculator will calculate your taxable income and the corresponding tax amount. It's a valuable tool to help you plan and budget effectively.

To access the Louisiana Income Tax Calculator, simply follow the link provided below. The calculator is user-friendly and designed to guide you through the process step by step.

Louisiana Income Tax Calculator: https://www.examplecalculator.com/louisiana

Feel free to explore the calculator, input your information, and get an estimate of your Louisiana income tax. It's a great way to stay informed and prepared during tax season.

Maximizing Your Tax Savings: Strategies and Tips

Now that you have a grasp of Louisiana's income tax system and have access to our handy calculator, let's explore some strategies to maximize your tax savings.

Understanding Tax Credits

Louisiana offers a range of tax credits that can significantly reduce your tax liability. Here are some key credits to be aware of:

- Louisiana Earned Income Tax Credit (LA EITC): If you meet the eligibility criteria, you can claim a credit worth up to 30% of the federal Earned Income Tax Credit. This credit is designed to benefit low- and moderate-income individuals and families.

- Child and Dependent Care Credit: If you incur expenses for child or dependent care while working or attending school, you may be eligible for this credit. It can help offset the costs of childcare and provide a much-needed tax break.

- Home Energy Tax Credit: If you've made energy-efficient improvements to your home, you may qualify for this credit. It encourages homeowners to invest in sustainable practices and can result in substantial savings.

Be sure to research and understand the eligibility criteria for these credits. They can provide a significant boost to your tax refund or reduce your tax liability.

Strategic Tax Planning

Tax planning is an essential aspect of financial management. By taking a proactive approach, you can optimize your tax situation and potentially save money.

- Maximize Deductions: Review your deductions annually to ensure you're claiming all eligible expenses. Consider itemizing if your deductions exceed the standard deduction.

- Adjust Your Withholdings: If you consistently receive a large tax refund, you may be overpaying throughout the year. Adjust your withholdings to better align with your tax liability, ensuring you have more take-home pay each pay period.

- Take Advantage of Retirement Plans: Contributions to retirement accounts, such as IRAs or 401(k)s, can provide tax benefits. These contributions are often tax-deductible, reducing your taxable income and potentially lowering your tax bracket.

- Explore Investment Opportunities: Certain investments, such as municipal bonds, can provide tax-free income. Consider diversifying your portfolio to include tax-efficient investments.

Consulting with a tax professional or financial advisor can help you develop a personalized tax strategy tailored to your unique financial situation.

Louisiana Income Tax: A Community Effort

Louisiana's tax system is designed to support the state's economy and its residents. By understanding the tax system and taking advantage of available deductions and credits, you contribute to the overall well-being of the community.

The state's revenue is used to fund essential services, such as education, healthcare, infrastructure, and public safety. By paying your fair share of taxes, you're ensuring that these vital services remain accessible to all Louisianans.

Additionally, the state offers various programs and initiatives to assist taxpayers. The LDR provides resources and guidance to help individuals and businesses navigate the tax process, ensuring compliance and fairness.

Stay Informed and Plan Ahead

Taxes are an integral part of our financial lives, and understanding the system can empower you to make informed decisions. By utilizing resources like our Louisiana Income Tax Calculator and staying up-to-date with tax laws and changes, you can take control of your financial future.

Remember, tax planning is an ongoing process. Stay informed about tax deadlines, changes in deductions and credits, and any updates to the tax system. This will help you make the most of your financial situation and ensure compliance with Louisiana's tax laws.

For more information and guidance, be sure to visit the Louisiana Department of Revenue website. They provide a wealth of resources, including tax forms, publications, and answers to frequently asked questions. You can also reach out to their taxpayer assistance team for personalized support.

Frequently Asked Questions (FAQ)

What is the Louisiana Income Tax Calculator, and how does it work?

+The Louisiana Income Tax Calculator is an online tool designed to help taxpayers estimate their state income tax liability. It takes into account factors such as taxable income, deductions, and tax credits to provide an accurate estimate. Users input their relevant information, and the calculator does the rest, providing a personalized tax estimate.

Is the Louisiana Income Tax Calculator accurate, and can I rely on it for my tax planning?

+The calculator is designed to provide an accurate estimate based on the information entered. However, it's important to note that it's an estimate and may not account for all individual circumstances. For precise tax calculations and planning, it's advisable to consult a tax professional or use official tax software.

Are there any specific tax deductions or credits available in Louisiana that I should be aware of?

+Yes, Louisiana offers various tax deductions and credits to help reduce your tax liability. Some notable ones include the Louisiana Earned Income Tax Credit (LA EITC), Child and Dependent Care Credit, and the Home Energy Tax Credit. These credits can significantly impact your tax refund or reduce your tax bill. It's worth exploring these options to maximize your savings.

What happens if I miss the Louisiana income tax filing deadline?

+Missing the income tax filing deadline can result in penalties and interest charges. It's important to file your tax return on time to avoid these additional costs. If you're unable to meet the deadline, you can request an extension of time to file, but keep in mind that an extension does not extend the time to pay any taxes owed.

Where can I find more information and resources related to Louisiana income taxes?

+For comprehensive information and resources, visit the official website of the Louisiana Department of Revenue. They provide tax forms, publications, and detailed guidelines on various tax topics. Additionally, you can reach out to their taxpayer assistance team for personalized support and guidance.

We hope this comprehensive guide has provided you with valuable insights into Louisiana’s income tax system and how to navigate it effectively. Remember, knowledge is power when it comes to taxes, and staying informed can make a significant difference in your financial planning.