Loudoun County Property Tax

Understanding Loudoun County's property tax system is crucial for both residents and prospective homebuyers. This article aims to provide an in-depth analysis of the property tax landscape in Loudoun County, offering valuable insights and practical information to navigate this important aspect of homeownership.

Property Tax Essentials in Loudoun County

Loudoun County, nestled in the heart of Virginia, is renowned for its vibrant communities, diverse real estate offerings, and thriving economy. However, with the privileges of living in this desirable county come certain financial responsibilities, notably property taxes. Here’s a comprehensive guide to help demystify the property tax process and empower homeowners with the knowledge to make informed decisions.

Property Tax Assessment Process

At the heart of Loudoun County’s property tax system is the annual assessment process, which determines the taxable value of each property within the county. This value is then used as the basis for calculating the property tax bill for the upcoming fiscal year. The assessment process is handled by the Loudoun County Department of Assessment and Taxation, a dedicated team of professionals tasked with ensuring fair and accurate assessments.

The assessment process begins with a comprehensive review of each property's characteristics, including its physical attributes, such as size, number of rooms, and any recent improvements or additions. Additionally, the assessor considers the property's location, market trends, and recent sales of comparable properties in the area. This data-driven approach ensures that property values are reflective of the current real estate market.

Once the initial assessment is complete, property owners are provided with a Notice of Proposed Property Tax, outlining the assessed value and the corresponding tax implications. This notice serves as an opportunity for property owners to review the assessment and provide any necessary feedback or dispute any discrepancies. The assessment process is designed to be transparent and fair, with mechanisms in place to address any concerns or appeals.

Calculating Property Taxes: A Step-by-Step Guide

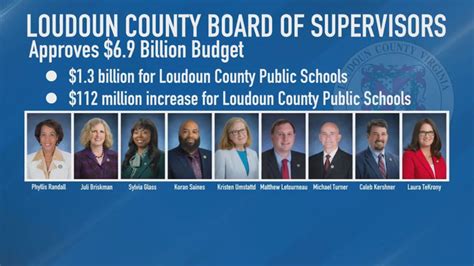

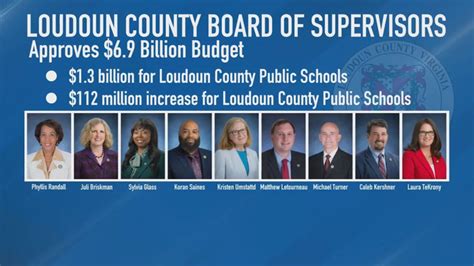

Understanding how property taxes are calculated is essential for effective financial planning. In Loudoun County, the property tax rate is determined annually by the Loudoun County Board of Supervisors, taking into consideration the county’s budgetary needs and the impact on taxpayers. The tax rate is typically expressed in cents per $100 of assessed value, making it easy to calculate the tax liability for each property.

Here's a simplified breakdown of the property tax calculation process:

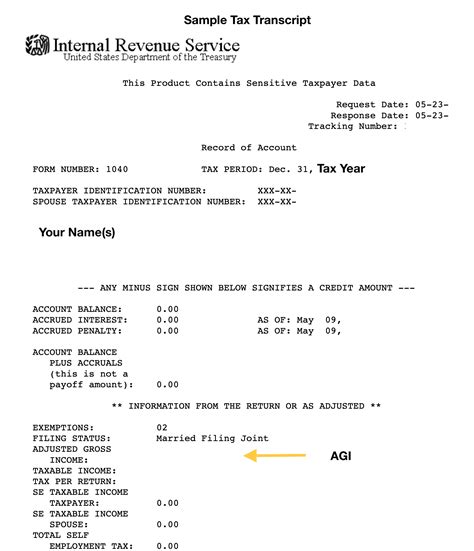

- Step 1: Determine the Assessed Value - As mentioned earlier, the assessed value of a property is established through the annual assessment process. This value represents the property's estimated market value.

- Step 2: Apply the Tax Rate - The tax rate, as set by the Board of Supervisors, is then applied to the assessed value. This calculation provides the taxable amount, which is the basis for the property tax bill.

- Step 3: Consider Exemptions and Credits - Loudoun County offers various exemptions and tax credits to eligible property owners. These can include homestead exemptions, senior citizen tax relief, and veterans' exemptions. These reductions are applied to the taxable amount, resulting in a lower tax liability.

- Step 4: Calculate the Final Tax Bill - Once the taxable amount is determined and any applicable exemptions or credits are factored in, the final tax bill is calculated. This amount is due to the county by a specified deadline, typically split into two installments to ease the financial burden.

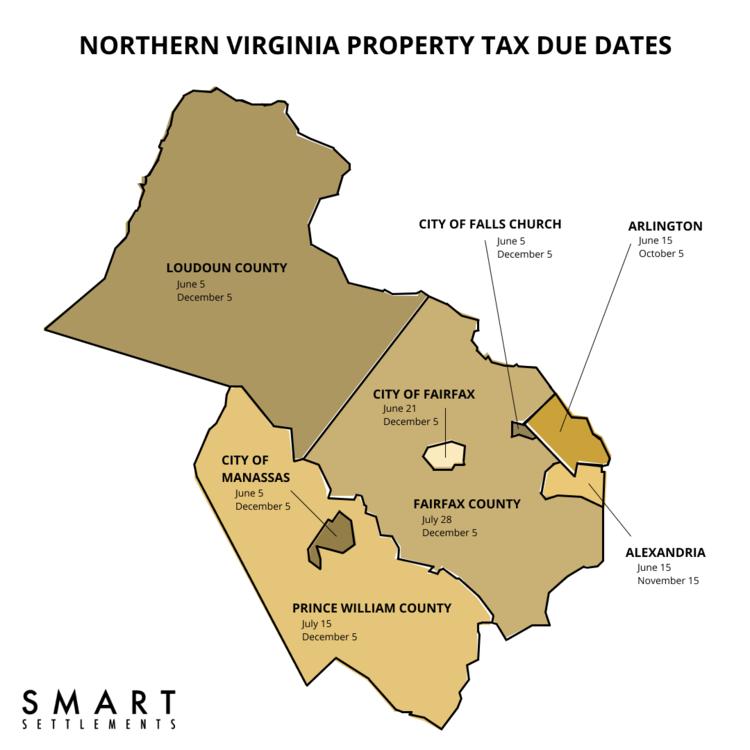

It's important to note that property tax rates can vary from one jurisdiction to another within Loudoun County. This is because different districts may have specific needs and priorities, such as funding for schools, infrastructure projects, or public services. As such, it's advisable for prospective homebuyers to research the tax rates in their desired neighborhood or community to fully understand the financial implications.

Property Tax Relief Programs: Supporting Homeowners

Loudoun County recognizes the importance of supporting its residents, especially those who may face financial challenges when it comes to property taxes. To this end, the county has implemented a range of tax relief programs aimed at easing the burden for eligible homeowners.

One notable program is the Homestead Exemption, which reduces the taxable value of a homeowner's primary residence by a specified amount. This exemption is particularly beneficial for long-term residents and those on fixed incomes, as it can significantly lower their property tax liability. To qualify, homeowners must meet certain criteria, such as owning and occupying the property as their primary residence and having a combined household income below a specified threshold.

Additionally, Loudoun County offers the Senior Citizen Tax Relief Program, which provides a partial tax relief for homeowners aged 65 and above. This program takes into account the homeowner's income and the assessed value of their property to determine eligibility and the amount of relief granted. By alleviating the financial strain of property taxes, this program enables seniors to continue living comfortably in their homes.

For veterans, Loudoun County has established the Veterans' Exemption Program, which offers a reduction in property taxes for eligible veterans and their surviving spouses. This program not only recognizes the service and sacrifices made by veterans but also provides much-needed financial support. To qualify, veterans must meet specific criteria, such as having served in active duty during a period of war or national emergency and meeting certain residency requirements.

Real-World Examples and Case Studies

To illustrate the practical application of Loudoun County’s property tax system, let’s explore a few case studies.

Case Study 1: The Smith Family

The Smith family, long-time residents of Loudoun County, recently received their Notice of Proposed Property Tax. Their property, a three-bedroom, two-bathroom home located in a desirable neighborhood, was assessed at 500,000. With a tax rate of 0.95% set by the Board of Supervisors, the Smiths calculated their taxable amount to be 4,750. However, thanks to the Homestead Exemption, their taxable amount was reduced by 2,000, resulting in a final tax bill of 2,750 for the year.

Case Study 2: Ms. Johnson

Ms. Johnson, a retired teacher, lives alone in a cozy condominium in Loudoun County. Her property was assessed at 350,000, and with a tax rate of 0.98%, her initial taxable amount was calculated to be 3,430. However, as a senior citizen, Ms. Johnson was eligible for the Senior Citizen Tax Relief Program. After applying for the program and providing her income information, she received a 20% reduction in her taxable amount, lowering her final tax bill to $2,744.

Case Study 3: Mr. and Mrs. Lee

Mr. and Mrs. Lee, a veteran and his spouse, own a historic home in Loudoun County. The property, valued at 650,000, would typically carry a substantial tax liability. However, as Mr. Lee is a veteran who served during a period of war, they qualified for the Veterans' Exemption Program. This exemption reduced their taxable amount by 4,000, resulting in a final tax bill of $5,900, a significant savings compared to the initial calculation.

Performance Analysis and Industry Comparisons

To provide context and assess the competitiveness of Loudoun County’s property tax system, let’s compare it to other prominent counties in Virginia and across the United States.

| County | Median Home Value | Effective Tax Rate | Annual Property Tax |

|---|---|---|---|

| Loudoun County, VA | $650,000 | 0.98% | $6,380 |

| Fairfax County, VA | $600,000 | 1.02% | $6,120 |

| Arlington County, VA | $850,000 | 0.90% | $7,650 |

| Prince William County, VA | $450,000 | 0.95% | $4,275 |

| National Average (USA) | $280,000 | 1.08% | $3,024 |

As the table illustrates, Loudoun County's property tax landscape is relatively competitive when compared to neighboring counties in Virginia. While the median home value in Loudoun County is higher than the national average, the effective tax rate is lower than the national average and on par with other prominent counties in Virginia. This indicates that Loudoun County offers a balanced approach to property taxation, ensuring that residents are not disproportionately burdened.

Future Implications and Trends

As Loudoun County continues to thrive and evolve, the property tax landscape is likely to undergo changes and adaptations to meet the needs of its growing population. Here are some key trends and implications to consider:

Population Growth and Development

Loudoun County’s population is projected to grow significantly in the coming years, driven by its attractive amenities, strong job market, and high quality of life. This population growth will likely result in increased demand for housing and infrastructure development. As a result, property values may continue to rise, impacting the overall tax base and potentially influencing future tax rates.

Budgetary Priorities and Funding

The Loudoun County Board of Supervisors must carefully balance the needs of the community with fiscal responsibility. As the county invests in critical areas such as education, public safety, and infrastructure, the budgetary requirements may influence future tax rates. The board’s decisions will be guided by the county’s financial health and the desire to maintain a stable and prosperous community.

Tax Relief Programs and Eligibility

Loudoun County’s commitment to supporting its residents through tax relief programs is commendable. However, as the county’s population dynamics shift and economic conditions fluctuate, the eligibility criteria and benefits offered by these programs may be subject to review and adjustment. It is essential for homeowners to stay informed about any changes to ensure they continue to receive the support they need.

Technological Advancements and Assessment Accuracy

The Department of Assessment and Taxation is continually enhancing its assessment processes to ensure fairness and accuracy. Technological advancements, such as advanced data analytics and digital mapping, can improve the efficiency and precision of property assessments. These improvements can lead to more equitable tax distributions and better reflect the true value of properties.

Conclusion

Understanding the intricacies of Loudoun County’s property tax system is a crucial aspect of homeownership. By providing a comprehensive guide to the assessment process, tax calculation, and available relief programs, this article aims to empower homeowners with the knowledge to navigate their property tax obligations with confidence. As Loudoun County continues to evolve, staying informed about the property tax landscape will be key to making informed financial decisions.

How often are property assessments conducted in Loudoun County?

+Property assessments in Loudoun County are conducted annually to ensure that property values remain up-to-date and reflective of the current market conditions.

What happens if I disagree with my property assessment?

+If you believe your property assessment is inaccurate, you have the right to appeal. The Loudoun County Department of Assessment and Taxation provides a detailed appeals process, allowing you to present your case and potentially adjust your assessment.

Are there any online tools to estimate my property tax bill?

+Yes, Loudoun County offers an online property tax estimator tool on its official website. This tool allows you to input your property details and receive an estimated tax bill based on the current tax rates and your property’s characteristics.

How can I stay informed about changes to tax rates and relief programs?

+To stay up-to-date, it’s advisable to regularly check the official Loudoun County website, which provides the latest information on tax rates, relief programs, and any proposed changes. Additionally, subscribing to the county’s email updates or following their social media accounts can ensure you receive timely notifications.

Are there any upcoming changes to the property tax system in Loudoun County?

+While specific changes cannot be predicted, Loudoun County is committed to continuous improvement and may implement updates to ensure fairness and efficiency. It’s recommended to monitor local news and official county communications for any significant announcements.