Lee County Property Tax

Property taxes are an essential component of local government revenue in the United States, funding vital services and infrastructure. In Lee County, Florida, property tax assessments and rates play a significant role in the financial health of the community. This comprehensive guide will delve into the intricacies of Lee County property taxes, exploring the assessment process, tax rates, payment options, and strategies for managing these financial obligations effectively.

Understanding Lee County Property Tax Assessments

Lee County, nestled along the breathtaking Gulf Coast of Florida, boasts a vibrant real estate market and a diverse range of properties. The property tax assessment process in Lee County is a critical aspect of the local government's revenue generation strategy, ensuring that each property owner contributes fairly to the community's development and maintenance.

The Assessment Methodology

The Lee County Property Appraiser's Office is responsible for the annual assessment of all properties within the county. This process involves evaluating the fair market value of each property, taking into account various factors such as location, size, improvements, and recent sales data of comparable properties.

The assessed value serves as the basis for calculating the property tax liability. It's important to note that the assessment process is designed to be transparent and fair, with property owners having the right to appeal if they believe their property's value has been misrepresented.

Key Factors Influencing Assessments

- Location: Properties in prime locations, such as beachfront areas or popular neighborhoods, tend to have higher assessments due to their desirability.

- Size and Improvements: Larger properties and those with significant improvements, like additional structures or renovations, often result in higher assessments.

- Market Conditions: The local real estate market plays a crucial role. During periods of high demand and rising property values, assessments may increase accordingly.

- Recent Sales: The appraiser's office closely monitors recent sales of similar properties to ensure assessments are in line with the current market.

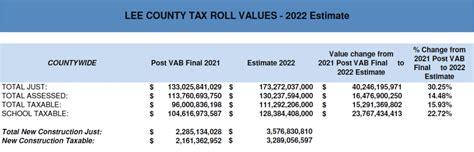

| Assessment Year | Average Assessment Increase |

|---|---|

| 2022 | 5.2% |

| 2021 | 3.8% |

| 2020 | 4.1% |

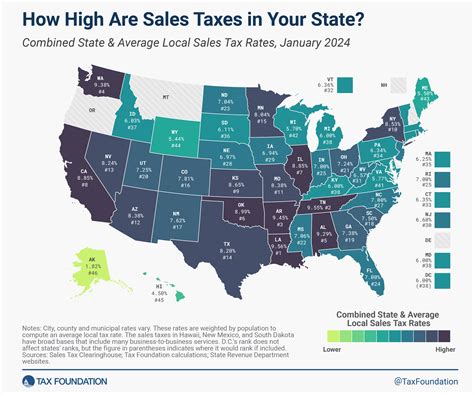

Lee County Property Tax Rates

Once the property's assessed value is determined, the applicable tax rate is applied to calculate the annual property tax liability. In Lee County, the tax rate is expressed as millage rates, where one mill represents $1 of taxation for every $1,000 of assessed value.

Understanding Millage Rates

The millage rate is set by various taxing authorities, including the county government, school district, and special districts. These entities use property taxes to fund essential services like education, public safety, infrastructure maintenance, and more.

For the 2023 tax year, the total millage rate in Lee County is 13.5675 mills, which is composed of the following:

- County Tax Rate: 6.8725 mills

- School District Tax Rate: 5.5000 mills

- Special District Tax Rate: 1.1950 mills

It's important to note that these rates may vary slightly from year to year, as they are subject to changes in local government budgets and voter-approved initiatives.

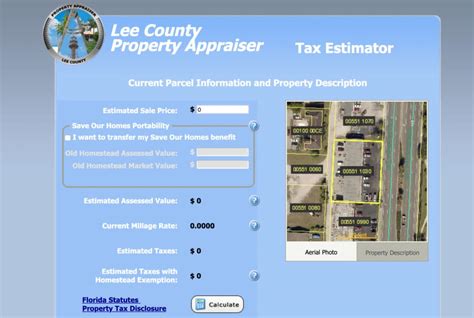

Calculating Property Taxes

To calculate your property tax liability, you can use the following formula:

Property Tax = Assessed Value x Millage Rate

For example, if your property has an assessed value of $300,000 and the total millage rate is 13.5675 mills, your annual property tax would be:

Property Tax = $300,000 x 0.0135675 = $4,070.25

Payment Options and Strategies

Managing property tax payments is a crucial aspect of financial planning for Lee County property owners. Understanding the available payment options and implementing effective strategies can help ensure timely payments and potentially reduce the overall tax burden.

Payment Due Dates

In Lee County, property taxes are due in two installments. The first installment is typically due on November 1st, while the second installment is due on March 31st of the following year.

It's important to note that failing to pay by the due date may result in penalties and interest charges, so staying organized and marking these dates on your calendar is essential.

Payment Methods

Lee County offers a variety of convenient payment methods to accommodate different preferences and circumstances:

- Online Payments: The Lee County Tax Collector's Office provides an online portal where you can securely make payments using a credit or debit card. This method is ideal for those who prefer the convenience of digital transactions.

- Mail-In Payments: You can also mail your property tax payments to the designated address, ensuring that you include the correct remittance voucher and allow sufficient time for processing.

- In-Person Payments: If you prefer a more traditional approach, you can visit one of the Tax Collector's Office locations and make your payment in person. This option is especially useful for those who prefer immediate confirmation of payment.

Strategies for Effective Payment Management

Here are some strategies to consider when managing your Lee County property tax payments:

- Set Up Automatic Payments: Consider enrolling in the automatic payment program offered by the Tax Collector's Office. This ensures that your payments are made on time without the need for manual reminders, reducing the risk of late fees and penalties.

- Utilize Escrow Accounts: If you have a mortgage, discuss with your lender the option of including property taxes in your monthly payments. This way, the funds are set aside in an escrow account, and the lender pays the taxes on your behalf when they become due.

- Explore Payment Plans: In case of financial difficulties, the Tax Collector's Office may offer payment plans to help you manage your tax obligations. Reach out to their office to discuss your options and ensure compliance with any required arrangements.

- Monitor Tax Bills: Stay vigilant by reviewing your tax bills carefully. Ensure that the assessed value and applicable rates are accurate, and address any discrepancies promptly.

Strategies for Managing Property Taxes

While property taxes are a necessary component of local government funding, there are strategies property owners can employ to manage their tax obligations effectively and potentially reduce their overall tax burden.

Exemptions and Discounts

Lee County offers various exemptions and discounts that can provide significant savings on property taxes. It's essential to explore these options to determine your eligibility and maximize your tax benefits.

- Homestead Exemption: This exemption is available to homeowners who reside in their property as their primary residence. It reduces the assessed value of the property, resulting in lower property taxes. To qualify, you must apply for the exemption and meet specific residency and ownership requirements.

- Senior Exemption: Lee County provides an additional exemption for senior citizens aged 65 and older. This exemption further reduces the assessed value of the property, offering additional savings for eligible seniors.

- Veterans' Discount: Active-duty military personnel and veterans may be eligible for a property tax discount. This discount recognizes the service and sacrifice of those who have served our country and can provide substantial savings on property taxes.

Appealing Assessments

If you believe your property's assessed value is inaccurate or too high, you have the right to appeal the assessment. The Lee County Property Appraiser's Office provides a fair and transparent appeals process to ensure property owners can challenge assessments they deem unfair.

- Review Your Notice: When you receive your Property Appraisal Notice, carefully review the details. Look for any discrepancies or errors in the assessment, such as incorrect square footage, missing improvements, or outdated comparables.

- Gather Evidence: If you identify issues with your assessment, gather supporting documentation to strengthen your case. This may include recent appraisals, photos of your property, or sales data of similar properties in the area.

- File an Appeal: To initiate the appeal process, you must submit a formal request to the Property Appraiser's Office within a specified timeframe. Ensure you provide all the necessary documentation and follow the guidelines outlined in the appeal instructions.

- Attend a Hearing: If your appeal is accepted, you may be required to attend a hearing before the Value Adjustment Board (VAB). Prepare your case and be ready to present your evidence and arguments to support your request for a lower assessment.

Long-Term Financial Planning

Managing property taxes effectively requires a long-term financial planning approach. Here are some strategies to consider:

- Regularly Review Assessments: Stay informed about your property's assessed value by reviewing the annual Property Appraisal Notices. This allows you to identify any significant changes and take appropriate action.

- Monitor Market Trends: Keep an eye on the local real estate market and assess how changes in market conditions may impact your property's value. This awareness can help you anticipate potential assessment increases or decreases.

- Explore Investment Opportunities: Consider investing in improvements or renovations that can enhance your property's value. While this may result in a higher assessment, it can also lead to increased property value and potentially offset the tax burden.

- Seek Professional Advice: Consult with tax professionals or financial advisors who specialize in property tax strategies. They can provide personalized advice and help you navigate the complexities of property tax management.

Conclusion

Understanding and managing Lee County property taxes is a critical aspect of responsible property ownership. By staying informed about assessment processes, tax rates, and available strategies, property owners can effectively navigate their financial obligations and contribute to the vibrant community of Lee County.

Frequently Asked Questions

How can I estimate my property tax liability before receiving the official notice?

+

You can use the formula Property Tax = Assessed Value x Millage Rate to estimate your tax liability. The assessed value is typically available through the Property Appraiser’s Office, and the millage rate can be found on the Lee County website or by contacting the Tax Collector’s Office.

What happens if I miss the property tax payment deadline?

+

If you miss the payment deadline, you may be subject to late fees and interest charges. It’s important to stay organized and plan your payments accordingly to avoid any additional financial burdens.

Can I apply for exemptions or discounts online?

+

Yes, Lee County offers online applications for various exemptions and discounts. Visit the Property Appraiser’s Office website to access the necessary forms and instructions for submitting your application.

How long does the property tax appeal process typically take?

+

The duration of the appeal process can vary depending on the complexity of the case and the volume of appeals received. Typically, it can take several months from the time you submit your appeal to receiving a decision. It’s important to initiate the process promptly to ensure your appeal is considered.

Are there any resources available to help me understand the property tax assessment process in more detail?

+

Absolutely! The Lee County Property Appraiser’s Office provides comprehensive resources and guides on their website. These resources include detailed explanations of the assessment process, tips for appealing assessments, and information on various exemptions and discounts. It’s an excellent starting point for gaining a deeper understanding of property taxes in Lee County.