King County Sales Tax Wa

In the vast expanse of King County, nestled amidst the lush greenery and bustling cities, lies a complex web of sales tax regulations that businesses and residents alike must navigate. The King County Sales Tax Waiver, often referred to as the King County Sales Tax Wa, is a critical component of this intricate system, offering relief to certain entities and shaping the economic landscape of the region.

This article delves into the intricacies of the King County Sales Tax Waiver, exploring its historical context, the eligibility criteria, the application process, and the profound impact it has on the local economy. By examining real-world examples and expert insights, we aim to provide a comprehensive guide to understanding and leveraging this essential tax incentive.

Historical Context and Legislative Framework

The history of sales tax waivers in King County is intertwined with the broader narrative of tax policy in the state of Washington. Washington is one of a handful of states in the US that does not levy a general sales tax, instead relying on a combination of other taxes, including a business and occupation (B&O) tax and a gross receipts tax, to generate revenue.

However, in certain situations, businesses in King County and other parts of Washington may be eligible for sales tax waivers or exemptions. These waivers are typically granted to specific industries, organizations, or entities that meet certain criteria, often with the aim of promoting economic development, supporting non-profit activities, or encouraging environmentally conscious practices.

The legislative framework governing sales tax waivers in King County is primarily established by the Washington State Legislature. The specific regulations and guidelines are then implemented and administered by the Washington State Department of Revenue, ensuring a consistent and fair application of the tax code across the state.

Eligibility Criteria: Who Qualifies for the King County Sales Tax Waiver

Understanding the eligibility criteria for the King County Sales Tax Waiver is crucial for businesses and organizations seeking to benefit from this tax incentive. While the exact criteria can vary based on the type of waiver and the specific circumstances, there are several common factors that play a significant role in determining eligibility.

Industry-Specific Waivers

One of the primary ways in which sales tax waivers are granted is through industry-specific exemptions. Certain industries, such as agriculture, manufacturing, and certain types of retail, may be eligible for waivers or reduced tax rates. For example, businesses involved in the production and sale of agricultural products often benefit from reduced sales tax rates, as these exemptions are designed to support the state’s agricultural industry.

Similarly, manufacturers may be eligible for waivers on certain types of equipment or materials used in the production process. This not only helps to reduce the financial burden on these businesses but also encourages investment and innovation in the manufacturing sector.

Non-Profit Organizations

Non-profit organizations, including charities, educational institutions, and religious groups, often qualify for sales tax waivers or exemptions. These waivers are typically granted to ensure that these organizations, which play a vital role in the community, are not unduly burdened by sales tax obligations. By waiving sales tax for non-profits, the state aims to encourage their continued operation and the valuable services they provide.

Environmental Initiatives

In recent years, the state of Washington has introduced sales tax waivers and incentives to promote environmentally friendly practices. This includes waivers for the purchase of energy-efficient appliances, electric vehicles, and other products that contribute to a more sustainable and eco-conscious economy. By offering these incentives, the state aims to encourage consumers and businesses to make choices that benefit the environment.

Economic Development Zones

Sales tax waivers are sometimes implemented in specific economic development zones or targeted areas within King County. These zones may be established to attract new businesses, support existing businesses, or stimulate economic growth in underdeveloped regions. By offering sales tax waivers, the county can incentivize businesses to locate or expand their operations in these zones, thereby contributing to the local economy.

The Application Process: How to Obtain the King County Sales Tax Waiver

For businesses and organizations that meet the eligibility criteria, the next step is to navigate the application process to obtain the King County Sales Tax Waiver. While the process can vary slightly depending on the specific waiver being applied for, there are several common steps that applicants typically need to follow.

Research and Identify Relevant Waivers

The first step is to thoroughly research and identify the specific sales tax waivers that may apply to your business or organization. This involves understanding the various types of waivers available, the eligibility criteria, and the potential benefits each waiver offers. The Washington State Department of Revenue provides extensive resources and guidelines to help applicants navigate this process.

Gather Necessary Documentation

Once you have identified the relevant waivers, the next step is to gather all the necessary documentation and information required for the application. This typically includes proof of eligibility, such as business registration documents, non-profit status, or evidence of participation in an approved economic development zone. Additionally, you may need to provide financial statements, tax returns, or other relevant records to support your application.

Complete and Submit the Application

With all the required documentation in hand, the next step is to complete the application form provided by the Washington State Department of Revenue. The application process may be entirely digital, or it may involve submitting physical copies of documents. Ensure that you carefully read and follow the instructions provided to avoid any delays or rejection of your application.

Await Review and Decision

Once your application is submitted, it will undergo a review process by the Department of Revenue. This review may involve verifying the information you have provided, seeking additional clarification or supporting documents, or conducting further research into your business or organization. The timeline for this review process can vary, but applicants are typically kept informed of the status of their application.

Receive and Implement the Waiver

If your application is approved, you will receive a notification and the necessary documentation to implement the sales tax waiver. This may include specific guidelines on how to apply the waiver to your sales transactions, as well as any ongoing reporting or record-keeping requirements. It’s essential to carefully follow these guidelines to ensure compliance with the terms of the waiver.

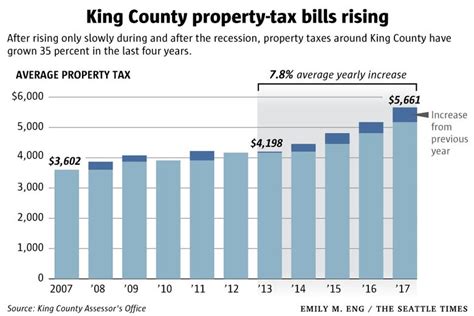

Impact and Benefits: How the King County Sales Tax Waiver Shapes the Economy

The King County Sales Tax Waiver plays a pivotal role in shaping the economic landscape of the region. By offering relief to certain businesses and organizations, the waiver has a direct impact on investment, job creation, and overall economic growth. Let’s explore some of the key ways in which this tax incentive influences the local economy.

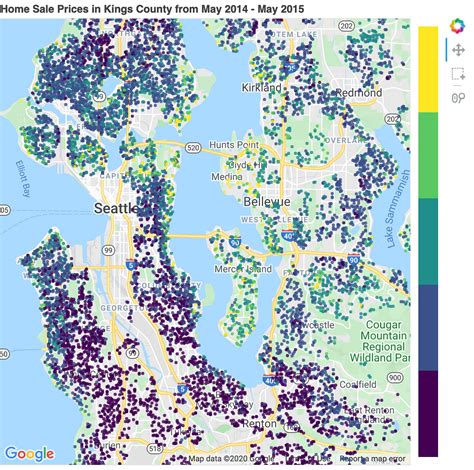

Attracting and Retaining Businesses

Sales tax waivers are a powerful tool for attracting new businesses to King County and retaining existing ones. By reducing the tax burden on eligible entities, the county can make its business environment more competitive and attractive to investors. This, in turn, leads to increased investment, job creation, and economic growth.

For example, consider a manufacturing company that is considering expanding its operations. By offering a sales tax waiver on certain equipment purchases, King County can provide a significant incentive for this company to choose the county as its new location. This not only brings new jobs and economic activity to the region but also contributes to the local tax base through other forms of taxation.

Supporting Non-Profit Organizations

Non-profit organizations, including charities, educational institutions, and community groups, play a vital role in King County’s social fabric. By waiving sales tax for these entities, the county ensures that they can continue to operate effectively and provide valuable services to the community. This, in turn, strengthens the social safety net and enhances the overall well-being of residents.

For instance, imagine a local food bank that relies on donations and grants to operate. By being exempt from sales tax, the food bank can stretch its limited resources further, allowing it to feed more people in need. This not only benefits the individuals receiving assistance but also contributes to the overall health and stability of the community.

Promoting Environmental Sustainability

Sales tax waivers can also be a powerful tool for promoting environmental sustainability. By offering waivers for energy-efficient appliances, electric vehicles, and other eco-friendly products, King County can incentivize residents and businesses to make more sustainable choices. This not only reduces the environmental impact of the county but also contributes to a more resilient and future-proof economy.

Take, for example, the case of a local business owner who is considering switching to electric vehicles for their delivery fleet. By offering a sales tax waiver on the purchase of these vehicles, King County can make the decision more financially viable for the business owner. This not only reduces the carbon footprint of the business but also contributes to a cleaner, greener environment for all residents.

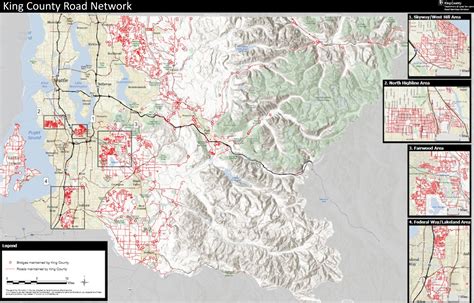

Stimulating Economic Development in Targeted Areas

Sales tax waivers are often implemented in specific economic development zones or targeted areas within King County to stimulate growth and investment. By offering these incentives, the county can encourage businesses to locate or expand their operations in these regions, bringing much-needed economic activity and job opportunities.

Imagine a struggling urban neighborhood that has been designated as an economic development zone. By offering sales tax waivers to businesses that locate in this area, King County can create an attractive environment for investment. This, in turn, can lead to the revitalization of the neighborhood, with new businesses, increased foot traffic, and improved economic prospects for residents.

Conclusion: Navigating the King County Sales Tax Waiver Landscape

The King County Sales Tax Waiver is a critical component of the region’s tax landscape, offering relief and incentives to a wide range of businesses and organizations. By understanding the eligibility criteria, navigating the application process, and recognizing the profound impact of these waivers on the local economy, businesses and residents can leverage this tax incentive to their advantage.

As King County continues to evolve and adapt to changing economic and social landscapes, the role of sales tax waivers and other tax incentives will remain a key factor in shaping the region's future. By staying informed and engaged with these initiatives, businesses and residents can contribute to a vibrant, sustainable, and prosperous King County.

What is the King County Sales Tax Waiver and how does it work?

+

The King County Sales Tax Waiver is a tax incentive offered by the state of Washington to certain businesses and organizations operating in King County. It allows eligible entities to be exempt from or receive reduced rates on sales tax, providing a financial benefit and helping to stimulate economic activity in the region.

Who is eligible for the King County Sales Tax Waiver?

+

Eligibility for the King County Sales Tax Waiver depends on various factors, including the industry the business operates in, its non-profit status, participation in approved economic development zones, and other specific criteria outlined by the Washington State Department of Revenue.

How do I apply for the King County Sales Tax Waiver?

+

To apply for the King County Sales Tax Waiver, you need to research the specific waiver that applies to your business, gather all necessary documentation, complete the application form provided by the Washington State Department of Revenue, and submit it for review and decision.

What are the benefits of the King County Sales Tax Waiver for businesses and the local economy?

+

The King County Sales Tax Waiver offers several benefits, including attracting and retaining businesses, supporting non-profit organizations, promoting environmental sustainability, and stimulating economic development in targeted areas. These benefits contribute to increased investment, job creation, and overall economic growth in the region.

How can I stay updated on the latest developments and guidelines regarding the King County Sales Tax Waiver?

+

To stay informed, regularly visit the Washington State Department of Revenue’s website, where you can find the latest updates, guidelines, and resources related to the King County Sales Tax Waiver. Additionally, consider seeking professional tax advice to ensure you are making the most of this tax incentive.