Reno Sales Tax

Welcome to the comprehensive guide on Reno's Sales Tax! In this article, we will delve into the intricacies of sales taxation in the vibrant city of Reno, Nevada. As a knowledgeable expert in the field, I will provide you with an in-depth analysis, covering everything from the fundamentals of Reno's sales tax structure to its real-world implications and future prospects.

Understanding Reno’s Sales Tax: A Comprehensive Overview

Reno, often referred to as the “Biggest Little City in the World,” boasts a unique sales tax system that is essential for both residents and businesses to understand. The sales tax in Reno is a vital component of the city’s economy, contributing significantly to its growth and development. In this section, we will explore the fundamental aspects of Reno’s sales tax, including its rates, applicable goods and services, and how it compares to other cities in Nevada.

Sales Tax Rates in Reno: A Breakdown

Reno’s sales tax is composed of a combination of state, county, and city taxes. As of [current date], the total sales tax rate in Reno stands at 8.25%, which is comprised of the following:

| Tax Level | Tax Rate (%) |

|---|---|

| State Sales Tax | 4.6% |

| Washoe County Sales Tax | 1.25% |

| Reno City Sales Tax | 2.4% |

It's important to note that these rates are subject to change, and it is advisable to refer to official sources for the most up-to-date information. The sales tax in Reno applies to a wide range of goods and services, and understanding the specific rates can be crucial for both consumers and businesses.

Goods and Services Subject to Sales Tax in Reno

Reno’s sales tax applies to a vast array of products and services, covering most retail transactions. Here are some key categories that are typically subject to sales tax in the city:

- Retail Sales: This includes tangible personal property sold in stores, online, or through catalogs.

- Food and Beverage: Restaurants, cafes, and food establishments often charge sales tax on their items.

- Services: Various services, such as haircuts, legal advice, and repair services, may be subject to sales tax.

- Vehicle Sales: Sales of new and used vehicles often incur sales tax.

- Lodging and Accommodation: Hotels and other lodging facilities charge sales tax on their room rates.

- Entertainment: Tickets for movies, concerts, and sporting events may be taxed.

- Online Sales: Remote sellers are often required to collect and remit sales tax for transactions with Reno residents.

While these categories provide a general overview, it's essential to consult official resources for a comprehensive list of taxable items and services. Understanding the scope of Reno's sales tax is crucial for businesses to ensure compliance and for consumers to budget effectively.

The Impact of Reno’s Sales Tax on Businesses and Consumers

Reno’s sales tax has a profound impact on both businesses and consumers in the city. In this section, we will explore how the sales tax affects these key stakeholders and delve into the practical implications and considerations.

Business Perspective: Compliance and Strategies

For businesses operating in Reno, sales tax compliance is a critical aspect of their financial operations. Here’s how the sales tax impacts businesses and the strategies they employ:

- Registration and Filing: Businesses must register with the appropriate tax authorities and file sales tax returns regularly. This ensures they comply with tax regulations and avoid penalties.

- Tax Collection and Remittance: Businesses act as tax collectors by adding the applicable sales tax to the selling price of goods or services. They then remit these collected taxes to the relevant tax authorities.

- Pricing Strategies: Businesses may choose to absorb the sales tax or include it in their pricing. Some businesses may offer tax-inclusive pricing to provide transparency to consumers.

- Record-Keeping: Maintaining accurate records of sales and tax collections is essential for businesses to comply with audit requirements and avoid tax disputes.

- Technology Solutions: Many businesses utilize accounting software and tax management tools to streamline their sales tax processes, ensuring accuracy and efficiency.

By implementing effective strategies and staying compliant, businesses can navigate the complexities of Reno's sales tax landscape successfully.

Consumer Perspective: Budgeting and Shopping Decisions

Reno’s sales tax directly affects consumers’ purchasing power and shopping decisions. Let’s explore how consumers are impacted:

- Price Transparency: Consumers benefit from clear pricing, with sales tax included, to make informed purchasing decisions.

- Budgeting: Understanding the sales tax rate helps consumers plan their budgets and allocate funds accordingly.

- Comparison Shopping: Consumers may compare prices across different retailers or consider online options to find the best deals, especially for high-value items.

- Tax-Free Shopping: Some consumers may plan their purchases around tax-free periods or events, such as Reno's Tax-Free Shopping Days, to maximize savings.

- Sales Tax Refunds: Out-of-state visitors may be eligible for sales tax refunds on certain purchases, providing an incentive for tourism and shopping.

By being aware of their rights and understanding the sales tax landscape, consumers can make the most of their shopping experiences in Reno.

Comparative Analysis: Reno’s Sales Tax in Context

To gain a broader perspective, let’s compare Reno’s sales tax rates and structure with those of other cities in Nevada and neighboring states. This comparative analysis will provide valuable insights into Reno’s position within the regional sales tax landscape.

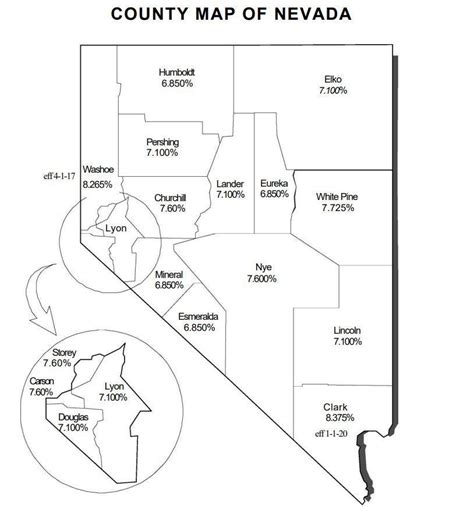

Nevada Sales Tax: A Statewide Overview

Nevada, known for its diverse cities and vibrant economy, has a state sales tax rate of 4.6%, which forms the foundation for local tax additions. Let’s examine how Reno’s sales tax compares to other major cities in the state:

| City | Total Sales Tax Rate (%) | City Tax Rate (%) |

|---|---|---|

| Reno | 8.25% | 2.4% |

| Las Vegas | 8.1% | 1.8% |

| Henderson | 8.1% | 1.8% |

| Carson City | 7.85% | 1.55% |

As seen in the table, Reno's total sales tax rate is slightly higher than that of Las Vegas and Henderson, primarily due to its higher city tax rate. However, it is important to note that local tax rates can vary within counties, so specific locations may have different rates.

Regional Comparison: Reno vs. Neighboring States

Expanding our view beyond Nevada, let’s compare Reno’s sales tax with that of neighboring states. This regional comparison provides a broader context for understanding Reno’s tax environment:

| State | Total Sales Tax Rate (%) |

|---|---|

| Nevada (Reno) | 8.25% |

| California | 7.25% |

| Idaho | 6% |

| Oregon | 0% |

| Utah | 6.85% |

As shown in the table, Reno's sales tax rate is relatively higher than that of some neighboring states, such as Idaho and Oregon. This can have implications for cross-border shopping and tourism, with consumers potentially favoring lower-tax destinations for certain purchases.

Future Outlook: Trends and Potential Changes

As we look ahead, it is essential to consider the future prospects of Reno’s sales tax. In this section, we will explore emerging trends, potential changes, and their implications for the city’s economy and residents.

Emerging Trends in Sales Tax

The world of sales taxation is constantly evolving, and Reno is no exception. Here are some key trends that are shaping the future of sales tax in the city:

- Online Sales Tax: With the rise of e-commerce, the collection of sales tax on online transactions is becoming increasingly important. Reno, like many other cities, is adapting to this trend by implementing measures to ensure compliance.

- Tax Simplification: There is a growing movement towards simplifying sales tax systems, making them more efficient and less burdensome for businesses. Reno may explore ways to streamline its tax processes, potentially benefiting local businesses.

- Tax Incentives: Cities and states often use tax incentives to attract businesses and boost economic growth. Reno could consider offering tax incentives to encourage specific industries or promote economic development.

- Data-Driven Taxation: Advanced analytics and data-driven approaches are transforming tax administration. Reno may leverage technology to enhance tax compliance and improve revenue collection.

Potential Changes and Their Impact

Sales tax rates and regulations can be subject to change, and it is important to consider potential future alterations. Here are some potential scenarios and their potential effects on Reno’s economy and residents:

- Rate Increases: If sales tax rates were to increase, it could impact the cost of living and affect consumer spending. Businesses might face higher tax burdens, potentially leading to adjustments in pricing strategies.

- Tax Reform: Changes to the tax structure, such as simplifying or restructuring tax rates, could impact businesses and consumers differently. A more uniform tax system might enhance transparency and ease of compliance.

- Sales Tax Holidays: Some states implement sales tax holidays, offering temporary tax exemptions on certain goods. Reno could consider such initiatives to boost consumer spending and support specific industries.

- Tax Incentive Programs: Introducing targeted tax incentive programs could attract new businesses and industries to Reno, fostering economic growth and job creation.

Staying informed about potential changes and their implications is crucial for businesses and consumers to navigate the evolving sales tax landscape successfully.

Conclusion: Reno’s Sales Tax Ecosystem

In conclusion, Reno’s sales tax system is a dynamic and integral part of the city’s economic fabric. From its unique rate structure to its impact on businesses and consumers, understanding Reno’s sales tax is essential for navigating the city’s financial landscape. By staying informed and adapting to emerging trends, both businesses and consumers can thrive in Reno’s vibrant sales tax ecosystem.

How often are sales tax rates updated in Reno?

+Sales tax rates in Reno are typically updated annually or as needed. It is advisable to check with official sources or tax authorities for the most current rates.

Are there any tax-free periods in Reno?

+Yes, Reno has designated tax-free shopping days, usually during specific holiday periods. These events offer consumers an opportunity to save on certain purchases.

How can businesses stay compliant with Reno’s sales tax regulations?

+Businesses can stay compliant by registering with tax authorities, accurately collecting and remitting sales tax, and keeping detailed records. Utilizing accounting software and seeking professional advice can also be beneficial.