Independent Contractor Tax Form

Welcome to a comprehensive guide on the world of independent contracting and the crucial tax forms that accompany this unique work arrangement. As an independent contractor, understanding your tax obligations is paramount to ensuring compliance and making the most of your financial situation. This article will delve into the intricacies of the Independent Contractor Tax Form, shedding light on its purpose, significance, and the essential information you need to navigate the tax landscape successfully.

The Role of Independent Contractor Tax Forms

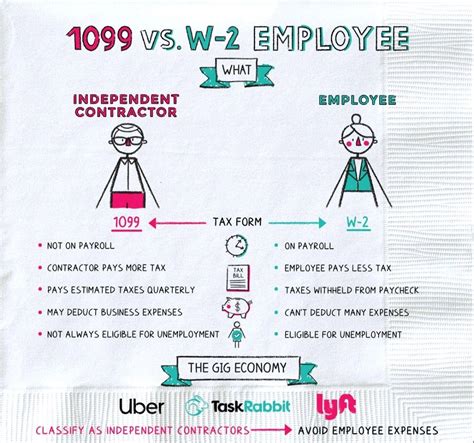

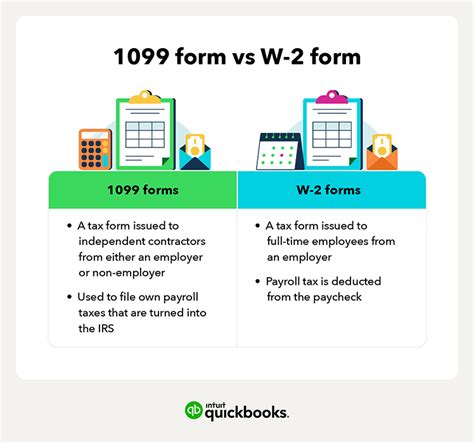

Independent contractors, often referred to as freelancers, consultants, or self-employed individuals, play a vital role in today’s diverse workforce. Whether you’re a graphic designer, writer, software developer, or any other skilled professional offering your services on a project basis, you’re part of a dynamic and growing segment of the economy. And with this freedom and flexibility comes a unique set of tax responsibilities.

The Independent Contractor Tax Form is a crucial document that serves as a bridge between your work as a contractor and your tax obligations. It ensures that you, as the contractor, and the entities engaging your services are both aware of and prepared for the tax implications of your work arrangement. This form is not just a bureaucratic requirement; it's a key tool for managing your finances and ensuring a smooth tax experience.

Understanding the Form’s Purpose

At its core, the Independent Contractor Tax Form aims to capture essential information about your contracting work. This includes details about the services you provide, the entities you work for, and the income you earn from these engagements. By providing this information, you help tax authorities understand your earnings and ensure that the appropriate taxes are paid.

The form also serves as a record-keeping tool. It allows you to keep track of your income sources, making tax preparation and filing more manageable. Additionally, it helps you organize your financial records, which can be beneficial for budgeting, financial planning, and even negotiating future contracts.

Key Information to Include

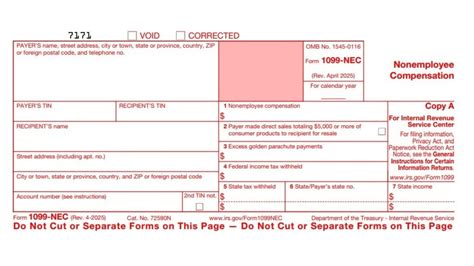

When completing the Independent Contractor Tax Form, accuracy and attention to detail are essential. Here’s a breakdown of the key information you’ll typically need to provide:

- Personal Information: Your full name, address, and contact details, ensuring you can be easily identified and contacted by tax authorities.

- Taxpayer Identification Number (TIN): This is your unique identifier, often your Social Security Number (SSN) or an Employer Identification Number (EIN) if you have one.

- Business Details: A description of your business activities, services provided, and any relevant business licenses or registrations.

- Client Information: Details about the entities you've worked for, including their names, addresses, and contact information. This helps establish the nature and extent of your contracting work.

- Income Details: The total income earned from your contracting work, including any expenses reimbursed by clients. This information is crucial for calculating your taxable income.

- Expenses: A list of business expenses incurred during the tax year. These can include office supplies, equipment, software, travel costs, and more. Understanding and claiming eligible expenses can reduce your taxable income and save you money.

- Payments Received: A record of all payments received from clients, including the dates and amounts. This ensures accurate reporting and helps prevent underreporting, which can lead to penalties.

- Tax Withholding Information: Details about any taxes withheld by clients on your behalf. This information is essential for understanding your tax liability and ensuring accurate reporting.

The Impact on Your Tax Situation

Completing and submitting the Independent Contractor Tax Form has a direct impact on your tax situation. Here’s how it affects your financial landscape:

Determining Taxable Income

The information you provide on the form helps tax authorities and yourself understand your taxable income. By detailing your income and expenses, you can calculate your net income, which is the amount subject to taxation. This ensures that you’re paying the correct amount of tax based on your actual earnings.

Reducing Taxable Income with Expenses

One of the advantages of being an independent contractor is the ability to deduct eligible business expenses from your taxable income. These deductions can significantly reduce your tax liability. By claiming expenses like office rent, equipment, internet costs, and more, you can lower your taxable income and potentially increase your tax refund.

Avoiding Underreporting and Penalties

Accurate reporting of your income is crucial to avoid underreporting penalties. The Independent Contractor Tax Form helps you keep track of all your income sources, ensuring that you report all earnings accurately. Underreporting can lead to significant fines and legal consequences, so thorough and honest reporting is essential.

Planning for Future Tax Obligations

The form also assists in planning for future tax obligations. By understanding your income and expenses, you can estimate your tax liability for the current year and plan accordingly. This may involve setting aside funds specifically for tax payments, ensuring you’re prepared when tax deadlines approach.

Expert Insights and Best Practices

As an independent contractor, it’s essential to adopt best practices to ensure a smooth tax experience. Here are some expert insights to guide you:

- Keep Detailed Records: Maintain a meticulous record of your income, expenses, and client engagements. This practice simplifies tax preparation and helps you identify potential deductions.

- Understand Tax Deductions: Familiarize yourself with the tax deductions available to independent contractors. These can include home office expenses, health insurance premiums, and more. Consult a tax professional to maximize your deductions.

- Set Aside Funds for Taxes: Consider setting aside a portion of your income specifically for tax payments. This ensures you have the funds available when tax deadlines arrive and helps avoid financial strain.

- Seek Professional Guidance: Tax laws can be complex, especially for independent contractors. Consider consulting a tax advisor or accountant who specializes in self-employment taxes. They can provide tailored advice and ensure you're making the most of your financial situation.

- Stay Informed: Keep up-to-date with tax laws and regulations that affect independent contractors. Tax laws can change, and staying informed ensures you're compliant and taking advantage of any new tax benefits.

Conclusion

The Independent Contractor Tax Form is a vital tool for independent contractors to manage their tax obligations effectively. By understanding its purpose, providing accurate information, and adopting best practices, you can navigate the tax landscape with confidence. Remember, accurate reporting, meticulous record-keeping, and professional guidance are key to a successful and stress-free tax experience.

Frequently Asked Questions

What happens if I don’t file the Independent Contractor Tax Form accurately or on time?

+

Failing to file the form accurately or on time can result in penalties and interest charges. It’s crucial to ensure timely and accurate filing to avoid these consequences.

Can I deduct expenses related to my business as an independent contractor?

+

Yes, independent contractors can deduct a wide range of business expenses. These deductions can significantly reduce your taxable income. Consult a tax professional to identify eligible expenses.

How often do I need to file the Independent Contractor Tax Form?

+

The frequency of filing depends on your income and tax obligations. Generally, you’ll need to file annually, but you may also have quarterly tax obligations depending on your earnings. Consult a tax advisor for guidance.

Are there any specific tax benefits for independent contractors?

+

Yes, independent contractors can benefit from various tax deductions and credits. These include deductions for home offices, health insurance premiums, and more. Stay informed about these benefits to maximize your savings.

What happens if I receive a notice from the tax authorities regarding my Independent Contractor Tax Form?

+

If you receive a notice, it’s essential to respond promptly. Engage a tax professional to assist you in understanding the notice and taking appropriate action. They can help resolve any issues and ensure compliance.