Income Tax Rate In Alabama

Income tax rates in Alabama are an important consideration for individuals and businesses operating within the state. Alabama's tax system has unique features that set it apart from other states, and understanding these rates is crucial for effective financial planning and compliance. This comprehensive guide will delve into the intricacies of Alabama's income tax structure, providing valuable insights for taxpayers and professionals alike.

Alabama’s Progressive Income Tax System

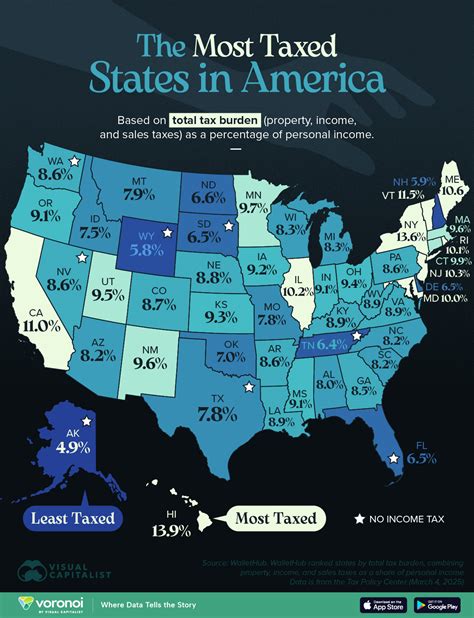

Alabama employs a progressive income tax system, which means that higher incomes are taxed at progressively higher rates. This approach aims to distribute the tax burden fairly across different income levels. The state’s income tax rates are determined by the Alabama Legislature and can be adjusted periodically to reflect economic changes and budgetary needs.

As of my last update in January 2023, the income tax rates in Alabama are as follows:

| Income Bracket (Single Filers) | Tax Rate |

|---|---|

| Up to $5,000 | 2% |

| $5,001 - $10,000 | 3% |

| $10,001 - $25,000 | 4% |

| $25,001 - $30,000 | 5% |

| Over $30,000 | 5% |

For married couples filing jointly, the income brackets and tax rates are doubled. This means that a married couple can earn up to $10,000 without being taxed, and their tax rate progressively increases as their income rises.

Taxable Income and Deductions

Alabama’s income tax applies to various sources of income, including wages, salaries, bonuses, and investment earnings. However, certain types of income are exempt from taxation. For instance, Social Security benefits and certain retirement income are not subject to Alabama income tax. Additionally, taxpayers can claim deductions and credits to reduce their taxable income.

Common deductions include:

- Standard deduction (which varies based on filing status)

- Personal exemptions (for taxpayers and dependents)

- Itemized deductions, such as medical expenses, charitable contributions, and state and local taxes paid

Tax Credits and Incentives

Alabama offers various tax credits and incentives to encourage economic growth and support specific industries. These credits can significantly reduce a taxpayer's liability. Some notable tax credits include:

- The Angel Investment Credit, which provides a credit for investments in qualified startup companies.

- The Film Production Tax Credit, aimed at attracting film and television productions to the state.

- The Historic Preservation Tax Credit, encouraging the rehabilitation of historic properties.

- The Alabama Jobs Act, which offers tax incentives for businesses creating new jobs in the state.

Tax Filing and Payment

Taxpayers in Alabama typically file their income tax returns annually by the federal deadline, usually April 15th. However, this deadline may be extended by the state in certain circumstances. Alabama accepts both electronic and paper filings, and taxpayers can choose to file and pay their taxes online through the Alabama Department of Revenue's website.

For those who owe taxes, payment options include electronic funds transfer, credit card, or traditional methods like checks and money orders. It's essential to ensure timely payment to avoid penalties and interest charges.

Tax Relief Programs

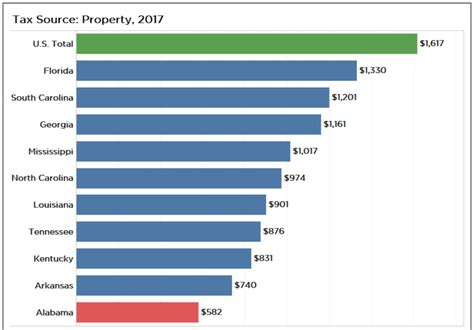

Alabama provides tax relief programs to assist certain taxpayers. For instance, the Disabled Veterans Property Tax Relief program offers a tax credit for qualifying disabled veterans, reducing their property taxes. Additionally, the Homestead Exemption program provides a tax exemption for homeowners over 65 or with disabilities, reducing their property taxes as well.

Future Implications and Potential Changes

Alabama’s tax landscape is subject to change as economic conditions evolve and legislative priorities shift. In recent years, there have been discussions and proposals to reform the state’s tax system, including potential adjustments to income tax rates and the introduction of new tax incentives.

For instance, there have been proposals to:

- Implement a flat tax rate, simplifying the tax system and reducing administrative costs.

- Expand or modify existing tax credits to support specific industries or encourage investment.

- Review and update the tax code to align with modern economic realities and technological advancements.

Staying informed about these potential changes is crucial for individuals and businesses to adapt their financial strategies accordingly. Alabama's commitment to a competitive and fair tax system ensures that taxpayers can plan effectively for the future.

Conclusion

Alabama’s income tax system, with its progressive rates and various deductions and credits, offers a balanced approach to taxation. By understanding the current tax rates and taking advantage of available incentives, taxpayers can navigate the system effectively and optimize their financial position. As Alabama continues to adapt its tax policies, staying updated on these changes will be essential for financial planning and compliance.

Are there any income tax brackets for married couples in Alabama?

+Yes, Alabama offers separate income tax brackets for married couples filing jointly. These brackets are essentially double the single filer brackets, providing a more favorable tax rate for married couples.

What is the deadline for filing income taxes in Alabama?

+The typical deadline for filing income taxes in Alabama is aligned with the federal deadline, which is usually April 15th. However, this deadline may be extended in certain circumstances, so it’s essential to stay informed through official sources.

Are there any tax incentives for small businesses in Alabama?

+Absolutely! Alabama offers a range of tax incentives to support small businesses, including the Alabama Jobs Act, which provides tax credits for businesses creating new jobs. These incentives aim to foster economic growth and attract investment.