How To Calculate Average Tax Rate

Calculating the average tax rate is an essential skill for individuals and businesses alike, as it provides a comprehensive understanding of one's financial obligations and helps in making informed decisions. The average tax rate represents the percentage of income that is paid in taxes, considering various tax brackets and deductions. In this comprehensive guide, we will delve into the step-by-step process of computing the average tax rate, along with real-world examples and insights to ensure a thorough understanding.

Understanding the Average Tax Rate

The average tax rate is a crucial metric that indicates the proportion of income allocated towards tax obligations. It considers the progressive nature of tax systems, where individuals pay different rates based on their income level. By calculating the average tax rate, individuals can assess their overall tax burden and plan their finances effectively.

Tax Brackets and Marginal Tax Rates

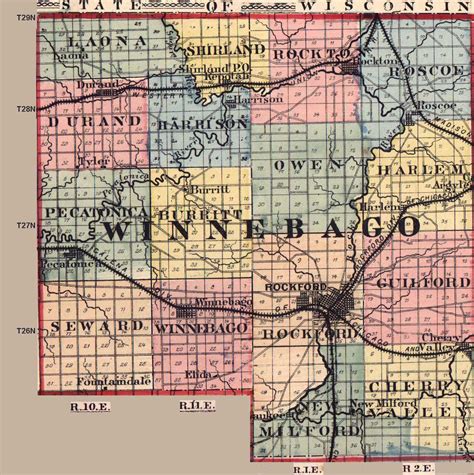

Most tax systems operate on a progressive basis, meaning the tax rate increases as income rises. Taxpayers are categorized into tax brackets, each with a specific marginal tax rate. The marginal tax rate is the rate at which income is taxed in a particular bracket. For instance, in the United States, the 2023 tax brackets for single filers range from 10% for incomes up to 10,275 to 37% for incomes over 214,500.

| Tax Bracket | Marginal Tax Rate | Income Range |

|---|---|---|

| 10% | Up to $10,275 | |

| 12% | $10,276 - $41,775 | |

| 22% | $41,776 - $89,075 | |

| 24% | $89,076 - $170,050 | |

| 32% | $170,051 - $214,500 | |

| 35% | $214,501 - $539,900 | |

| 37% | Over $539,900 |

The Role of Deductions and Credits

When calculating the average tax rate, it’s important to consider the impact of deductions and tax credits. Deductions reduce the taxable income, lowering the overall tax liability. On the other hand, tax credits provide a direct reduction in the amount of tax owed. Both deductions and credits can significantly impact the average tax rate and should be taken into account.

Step-by-Step Guide to Calculating Average Tax Rate

Now, let’s dive into the process of computing the average tax rate. We will use a hypothetical scenario to illustrate each step.

Step 1: Determine Taxable Income

Start by calculating your taxable income. This is the amount of income that is subject to taxation after deductions and adjustments. Let’s say our hypothetical individual, John, has a gross income of 60,000. He has 5,000 in deductions, including contributions to retirement accounts and charitable donations. Therefore, his taxable income is $55,000.

Step 2: Identify Applicable Tax Brackets

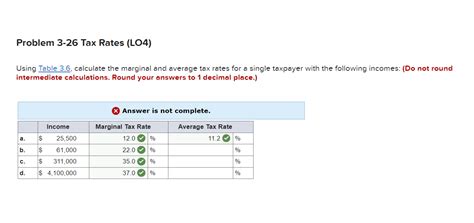

Using the tax bracket information for the current tax year, identify the brackets that apply to your taxable income. John’s taxable income of 55,000 falls into the 22% and 24% tax brackets. The income range for the 22% bracket is 41,776 to 89,075, while the 24% bracket covers incomes from 89,076 to $170,050.

Step 3: Calculate Tax Liability

Next, calculate the tax liability for each bracket. For the 22% bracket, John would pay 22% of the income within that bracket. Since his taxable income is 55,000, we need to calculate the income in the 22% bracket. Subtracting the lower bracket limit (41,776) from John’s taxable income gives us 13,224. Multiply this amount by the marginal tax rate (0.22) to find the tax liability for this bracket: 13,224 * 0.22 = $2,909.28.

For the 24% bracket, we need to calculate the income above $89,075 (the upper limit of the 22% bracket). Subtract $89,075 from John's taxable income: $55,000 - $89,075 = -$34,075. This negative value indicates that John's income is below the threshold for the 24% bracket. Therefore, his tax liability for this bracket is $0.

Step 4: Sum Up Tax Liabilities

Add up the tax liabilities from each bracket to find the total tax liability. In John’s case, his total tax liability is $2,909.28.

Step 5: Calculate Average Tax Rate

Finally, to find the average tax rate, divide the total tax liability by the taxable income. In John’s case, the calculation is as follows: 2,909.28 / 55,000 = 0.0529, or approximately 5.29%.

So, John's average tax rate for this scenario is approximately 5.29%, indicating that he pays an average of 5.29% of his taxable income in taxes.

Example Scenarios and Variations

Let’s explore a few more scenarios to understand how different factors can influence the average tax rate calculation.

Scenario 1: High Income with Deductions

Imagine Sarah, a high-income earner with an annual income of 250,000. She takes advantage of various deductions, including business expenses and retirement contributions, which reduce her taxable income to 200,000. Using the 2023 tax brackets for single filers in the United States, we can calculate her average tax rate.

Sarah's taxable income of $200,000 falls into the 32%, 35%, and 37% tax brackets. By calculating the tax liability for each bracket and summing them up, we find that her total tax liability is $58,500. Dividing this by her taxable income gives us an average tax rate of approximately 29.25%.

Scenario 2: Low Income with Credits

Consider Mike, a single filer with a modest income of $30,000. He qualifies for several tax credits, including the Earned Income Tax Credit (EITC) and the Child Tax Credit. These credits significantly reduce his tax liability. Let’s calculate his average tax rate.

Mike's taxable income of $30,000 falls into the 10% and 12% tax brackets. However, with the tax credits, his effective tax rate is reduced to 0%. Therefore, his average tax rate is 0%, indicating that he pays no tax on his income due to the credits.

Future Implications and Considerations

Understanding the average tax rate has several implications for individuals and businesses. It allows for better financial planning, as individuals can estimate their tax obligations and make adjustments to their savings or investment strategies. For businesses, it helps in budgeting and forecasting, ensuring compliance with tax regulations.

Additionally, changes in tax laws and economic conditions can impact the average tax rate. It's crucial to stay updated on tax reforms and amendments to accurately calculate and plan for future tax obligations. Consulting with tax professionals or utilizing tax preparation software can provide further guidance and ensure compliance with the latest regulations.

Conclusion

Calculating the average tax rate is a valuable skill that empowers individuals and businesses to make informed financial decisions. By following the step-by-step guide provided in this article, you can accurately determine your average tax rate and understand the impact of tax brackets, deductions, and credits on your overall tax liability. Remember to stay informed about tax laws and seek professional advice when needed to ensure compliance and optimal financial planning.

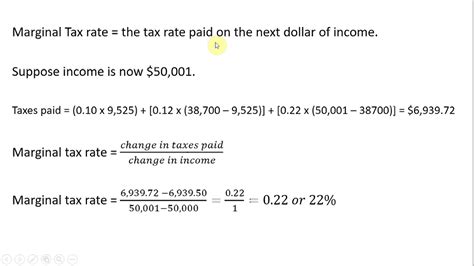

What is the difference between the average tax rate and the marginal tax rate?

+

The average tax rate represents the overall percentage of income paid in taxes, while the marginal tax rate is the rate applied to income within a specific tax bracket. The average tax rate considers the cumulative effect of all tax brackets, whereas the marginal tax rate focuses on a single bracket.

How do deductions impact the average tax rate calculation?

+

Deductions reduce taxable income, which in turn lowers the overall tax liability. As a result, the average tax rate decreases as more deductions are claimed. It’s essential to carefully consider and maximize eligible deductions to minimize tax obligations.

Can the average tax rate be lower than the marginal tax rate?

+

Yes, it is possible for the average tax rate to be lower than the marginal tax rate. This occurs when deductions or tax credits reduce the taxable income to a level where a lower tax bracket applies. In such cases, the average tax rate reflects the effective tax rate after considering all applicable deductions and credits.