Georgia State Tax Form

Welcome to our comprehensive guide on the Georgia State Tax Form, a critical document for taxpayers in the state of Georgia. This guide aims to provide an in-depth understanding of the tax form, its requirements, and the process of filing it accurately. Whether you're a seasoned taxpayer or new to the process, this article will equip you with the knowledge needed to navigate the Georgia tax system with confidence.

Understanding the Georgia State Tax Form

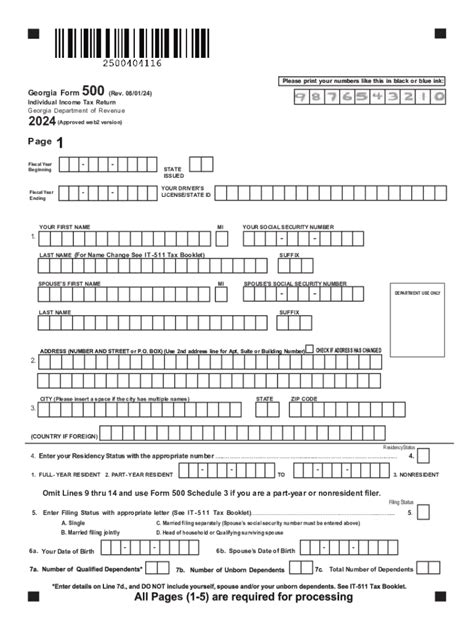

The Georgia State Tax Form, officially known as the Form 500, is an essential document for individuals and businesses operating within the state of Georgia. It serves as the primary means of reporting income, deductions, and credits to the Georgia Department of Revenue (DOR) for state tax purposes. Understanding this form is crucial as it ensures compliance with state tax laws and helps taxpayers maximize their refunds or minimize their tax liabilities.

Key Components of Form 500

Form 500 is a comprehensive document, designed to capture various aspects of a taxpayer’s financial situation. Here are some of the key components you’ll encounter:

- Personal Information: This section requires basic details such as name, address, and social security number, ensuring the DOR can accurately identify and process the tax return.

- Income Details: Taxpayers must report all sources of income, including wages, salaries, business profits, investments, and any other taxable income. The form provides spaces for each type of income, allowing for accurate reporting.

- Deductions and Credits: Georgia offers various deductions and credits to reduce the tax burden. These include standard deductions, itemized deductions for specific expenses, and credits for factors like age, disability, or tax payments made to other states.

- Calculating Tax Liability: The form guides taxpayers through the process of calculating their tax liability. This involves applying the appropriate tax rates and considering any applicable credits or deductions.

- Payment and Refund Information: Taxpayers must indicate whether they owe taxes or are due a refund. If a payment is required, the form specifies the methods of payment accepted by the DOR. If a refund is expected, taxpayers provide their banking details for direct deposit.

Form 500 is designed to be user-friendly, with clear instructions and examples to guide taxpayers through the process. However, it is essential to note that the form's complexity can vary based on individual circumstances, such as the number of income sources, deductions claimed, and tax credits available.

Preparing for the Tax Form

Effective preparation is key to ensuring a smooth and accurate filing process. Here’s what you need to know to get ready for Form 500:

Gathering Necessary Documents

Before you begin filling out the tax form, it’s crucial to gather all relevant documents. This includes:

- W-2 Forms: If you’re an employee, you’ll receive a W-2 form from your employer, detailing your wages, salaries, and any taxes withheld.

- 1099 Forms: These forms are issued for various types of income, including freelance work, interest, dividends, and retirement distributions.

- Business Income Records: If you own a business, you’ll need records of income and expenses, including invoices, receipts, and financial statements.

- Expense Records: Keep records of deductible expenses, such as medical costs, charitable donations, and state and local taxes paid.

- Previous Year’s Tax Returns: Reviewing previous tax returns can help identify any recurring deductions or credits and ensure consistency in your filings.

Understanding Tax Rates and Credits

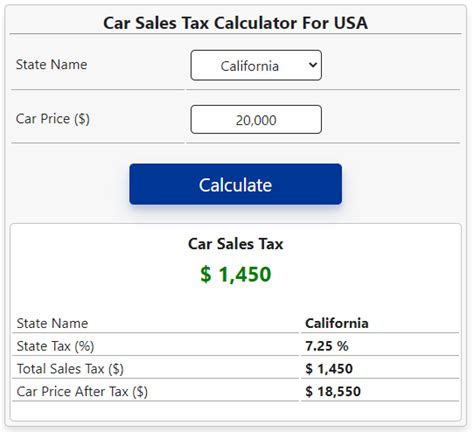

Georgia operates a progressive tax system, meaning tax rates increase as income levels rise. Currently, the state offers six tax brackets, ranging from 1% to 5.75%. Understanding your tax bracket is crucial for calculating your tax liability accurately.

Additionally, Georgia offers a range of tax credits, including the HOPE Scholarship credit, the Angel Tax Credit, and the Georgia Income Tax Credit. Familiarize yourself with these credits to determine if you're eligible and how they can benefit your tax situation.

| Tax Credit | Description |

|---|---|

| HOPE Scholarship Credit | A tax credit available to taxpayers with eligible students pursuing postsecondary education in Georgia. |

| Angel Tax Credit | Offers a tax credit to individuals who invest in qualified angel investment funds. |

| Georgia Income Tax Credit | Provides a credit for various expenses, including childcare, medical expenses, and dependent care. |

Seeking Professional Assistance

If you’re unsure about any aspect of the tax form or have complex financial circumstances, seeking professional assistance is advisable. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), can provide expert guidance and ensure your tax return is accurate and compliant.

Filing the Georgia State Tax Form

Once you’ve gathered your documents and prepared your tax information, it’s time to file your Form 500. Here’s a step-by-step guide to the filing process:

Step 1: Access the Form

The Georgia Department of Revenue provides Form 500 and its accompanying instructions online. You can download the form from their official website or obtain a printed copy from authorized tax preparation locations.

Step 2: Fill Out the Form

Carefully read through the form’s instructions and fill in the required information. Ensure you enter all income sources accurately and claim all eligible deductions and credits. Double-check your calculations to avoid errors.

Step 3: Sign and Submit

Once you’ve completed the form, sign it to verify its accuracy and authenticity. You can then submit the form electronically or by mail, depending on your preference. Electronic filing is generally faster and more secure, but some taxpayers may prefer the traditional mail option.

Step 4: Payment or Refund

If you owe taxes, ensure you make the payment by the due date to avoid penalties and interest. The DOR accepts various payment methods, including credit cards, electronic funds transfer, and checks. If you’re due a refund, you can expect it to be processed within a few weeks of filing.

Step 5: Record Keeping

After filing your tax return, it’s essential to keep a record of your tax documents. The DOR may request additional information or conduct an audit, so having your records readily available is crucial. Consider storing your tax documents in a secure location or using a digital filing system for easy access.

Common Challenges and Solutions

Navigating the Georgia State Tax Form can present challenges, especially for those new to the process. Here are some common issues and practical solutions to overcome them:

Complexity of Form 500

Form 500 can be intricate, especially for taxpayers with multiple income sources or complex financial situations. In such cases, consider seeking professional assistance to ensure accurate filing.

Understanding Tax Rates and Brackets

Georgia’s progressive tax system can be confusing. Stay updated on the latest tax rates and brackets by referring to official DOR publications or consulting tax professionals.

Missing or Inaccurate Information

Always double-check your tax form for missing or incorrect information. Review your calculations and ensure all income sources and deductions are accurately reported. Consider using tax preparation software to minimize errors.

Addressing Audits

In the event of an audit, remain calm and cooperative. Provide the DOR with the requested information promptly. If you’re unsure how to respond, seek guidance from a tax professional who can assist you in navigating the audit process.

Future Implications and Updates

The Georgia tax landscape is subject to change, and staying informed about upcoming changes is crucial. Here’s what taxpayers should anticipate in the coming years:

Tax Reform and Policy Changes

Georgia’s tax policies may undergo revisions in response to economic conditions or legislative decisions. Stay updated on any proposed or enacted tax reforms to ensure you’re prepared for any changes in tax rates, deductions, or credits.

Digital Transformation

The DOR is committed to enhancing its digital services, making tax filing more accessible and efficient. Expect continued improvements in online filing systems and the introduction of new technologies to streamline the tax process.

Community Initiatives

Georgia often launches initiatives to support taxpayers, such as free tax preparation services for eligible individuals or educational programs to enhance tax literacy. Stay connected with your local community and tax organizations to benefit from these initiatives.

Conclusion

Filing the Georgia State Tax Form is a critical responsibility for all taxpayers in the state. By understanding the form’s requirements, preparing adequately, and staying informed about tax policies, you can navigate the process with confidence. Remember, accurate filing not only ensures compliance with state laws but also maximizes your financial benefits. Stay tuned for updates, and don’t hesitate to seek professional assistance when needed.

What is the deadline for filing the Georgia State Tax Form?

+The deadline for filing Form 500 typically aligns with the federal tax filing deadline, which is generally April 15th. However, it’s advisable to check the official DOR website for any updates or extensions, especially during tax seasons impacted by external factors.

Can I file my tax return electronically?

+Yes, the Georgia Department of Revenue encourages electronic filing. It’s a secure, efficient, and convenient way to submit your tax return. The DOR offers online filing through their website, making the process straightforward for taxpayers.

What happens if I miss the tax filing deadline?

+Missing the tax filing deadline can result in penalties and interest charges. It’s crucial to file your tax return as soon as possible to avoid these additional costs. If you’re unable to meet the deadline, consider requesting an extension from the DOR to buy yourself some time.

How can I maximize my tax refund or minimize my tax liability?

+To maximize your refund or minimize your tax liability, it’s essential to claim all eligible deductions and credits. This includes standard deductions, itemized deductions for specific expenses, and tax credits like the HOPE Scholarship Credit or Angel Tax Credit. Additionally, accurate reporting of all income sources is crucial to avoid underreporting penalties.

What should I do if I receive a notice from the DOR regarding my tax return?

+If you receive a notice from the Georgia Department of Revenue, it’s important to respond promptly. Carefully review the notice and gather any supporting documentation requested. If you’re unsure how to respond, consider seeking guidance from a tax professional to ensure you address the issue effectively.