Does Michigan Have State Income Tax

Michigan, like many other states in the United States, imposes an income tax on its residents and certain non-residents. The state income tax is a crucial component of Michigan's revenue generation, contributing to the funding of various public services and infrastructure projects. This article delves into the specifics of Michigan's state income tax, including its history, rates, and how it impacts individuals and businesses.

The History of Michigan’s State Income Tax

The concept of a state income tax in Michigan dates back to the early 20th century. The state first introduced an income tax in 1919, but it was repealed just a few years later in 1921. The idea of a state income tax gained traction again in the post-World War II era, as Michigan’s economy and population grew significantly. In 1967, Michigan re-established its state income tax system, and it has been in effect ever since.

The reintroduction of the income tax was a response to the state's need for stable revenue sources to support its expanding public services and infrastructure. It provided a more reliable funding stream compared to other forms of taxation, such as sales tax or property tax.

Michigan’s State Income Tax Rates

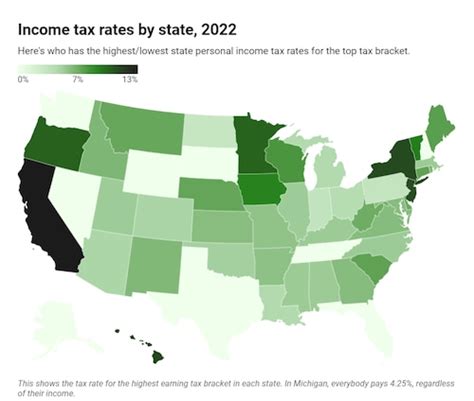

Michigan’s income tax is structured as a flat tax, meaning all taxable income is taxed at the same rate, regardless of the amount earned. As of 2023, the state income tax rate in Michigan is 4.25%. This rate applies to all taxable income earned within the state, including wages, salaries, interest, dividends, and other forms of income.

It's important to note that Michigan's income tax is separate from federal income tax. Individuals and businesses are required to file and pay both state and federal income taxes, each with its own set of rules and regulations.

Taxable Income Thresholds

Michigan has specific guidelines regarding which types of income are taxable and which are exempt. For example, certain types of investment income, such as capital gains, may be taxed differently or have separate thresholds. Additionally, Michigan offers tax credits and deductions that can reduce the taxable income for individuals and businesses, potentially lowering their overall tax liability.

Tax Rates for Non-Residents

Michigan also imposes an income tax on non-residents who earn income within the state. The tax rate for non-residents is the same as for residents, at 4.25%. Non-residents are required to file a Michigan income tax return if they meet certain income thresholds or if they have Michigan-sourced income, such as wages earned while working temporarily in the state.

Impact on Individuals and Businesses

Michigan’s state income tax has a significant impact on both individuals and businesses operating within the state. For individuals, the income tax is a direct deduction from their earnings, impacting their disposable income and overall financial planning. The tax rate, combined with potential tax credits and deductions, determines the net income tax liability for each taxpayer.

Businesses, on the other hand, face a more complex scenario. They must consider the state income tax as part of their overall cost of doing business in Michigan. The tax rate can influence a company's financial strategies, investment decisions, and even its competitive positioning within the market. Additionally, businesses must ensure compliance with Michigan's tax regulations to avoid penalties and legal issues.

Compliance and Tax Preparation

Compliance with Michigan’s state income tax laws is crucial for both individuals and businesses. Taxpayers must accurately report their income, claim appropriate deductions and credits, and file their tax returns by the designated deadlines. Failure to comply can result in penalties, interest charges, and legal consequences.

To navigate the complexities of Michigan's tax system, many individuals and businesses seek the assistance of tax professionals or utilize tax preparation software. These resources can help ensure accurate reporting and compliance with the state's tax regulations.

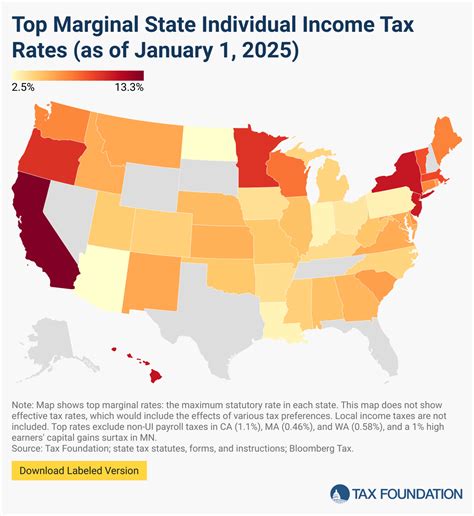

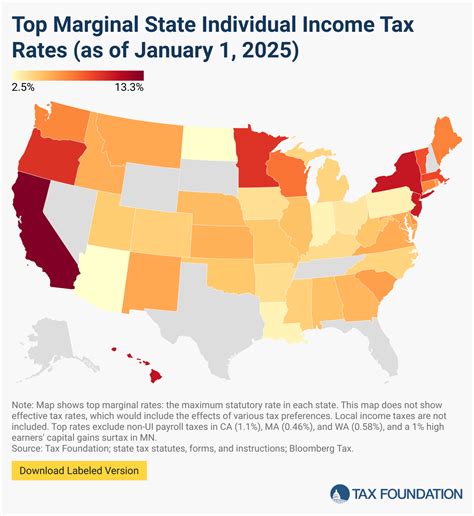

Comparison with Other States

Michigan’s flat tax rate of 4.25% places it in the middle range compared to other states in the United States. Some states have higher tax rates, while others have no state income tax at all. This variation in tax rates can influence individuals’ and businesses’ decisions regarding where to live, work, and invest.

| State | Income Tax Rate |

|---|---|

| California | 1 - 13.3% |

| Florida | 0% |

| New York | 4 - 8.82% |

| Texas | 0% |

| Michigan | 4.25% |

States with higher tax rates often have more extensive public services and infrastructure, while states with no income tax may rely more heavily on other forms of taxation, such as sales tax or property tax.

Future Implications and Considerations

The future of Michigan’s state income tax is subject to ongoing discussions and potential changes. Economic conditions, political factors, and public opinion can all influence the state’s tax policies. While the current flat tax rate provides simplicity and stability, there may be calls for adjustments to address budget needs or competitive positioning.

Additionally, the impact of remote work and the gig economy on state income tax systems is an emerging consideration. As more individuals work remotely or engage in freelance or contract work, determining the appropriate state to tax their income becomes complex. Michigan, like other states, will need to adapt its tax regulations to address these evolving work arrangements.

Potential Tax Reforms

Proposals for tax reform in Michigan have included ideas such as implementing a graduated income tax system, where tax rates increase with higher income levels. Such a system could potentially generate more revenue for the state while reducing the tax burden on lower-income earners. However, these proposals often face political and public debate, as they can impact different demographic groups differently.

In conclusion, Michigan's state income tax is a critical component of the state's revenue system, impacting both individuals and businesses. The flat tax rate of 4.25% provides a stable and predictable revenue stream for the state while allowing taxpayers to plan their finances accordingly. As Michigan continues to evolve economically and socially, the state's tax policies will remain a topic of discussion and potential reform.

What is the difference between Michigan’s state income tax and federal income tax?

+Michigan’s state income tax and federal income tax are separate entities with their own rules and rates. The state income tax is imposed by Michigan, while the federal income tax is levied by the federal government. Each taxpayer must file and pay both state and federal income taxes, each with its own set of regulations.

Are there any tax credits or deductions available in Michigan?

+Yes, Michigan offers various tax credits and deductions to reduce taxable income and potentially lower overall tax liability. These include credits for education expenses, retirement savings, and certain business-related expenses. It’s important to review the specific guidelines and requirements for each credit or deduction.

How does Michigan determine if someone is a resident for tax purposes?

+Michigan considers individuals to be residents for tax purposes if they meet certain criteria, such as maintaining a permanent home in the state or spending a significant amount of time there. The state’s residency guidelines can be complex, and it’s advisable to consult with a tax professional for a precise determination.