Does Idaho Have State Income Tax

Idaho, nestled in the northwestern region of the United States, boasts a vibrant economy and a unique tax system that sets it apart from many other states. This article delves into the intricacies of Idaho's tax landscape, specifically addressing the presence or absence of a state income tax.

The Idaho Tax Structure: An Overview

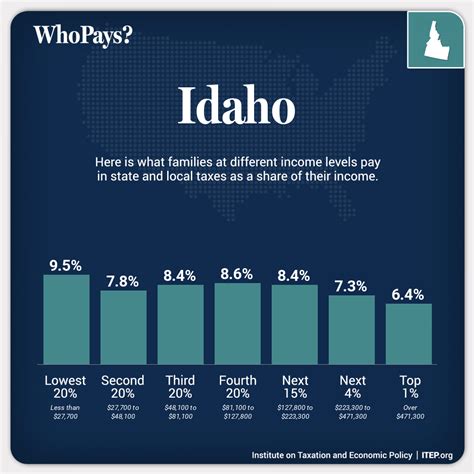

Idaho’s tax system is characterized by a mix of various tax categories, each contributing to the state’s revenue generation. The state’s primary sources of tax revenue include:

- Sales and Use Tax: Idaho imposes a general sales tax rate of 6%, which applies to the sale of tangible personal property and certain services. This tax is a significant contributor to the state's overall tax revenue.

- Property Tax: Property taxes in Idaho are levied on real estate and personal property. The tax rate varies depending on the county and the type of property.

- Corporate Income Tax: Idaho imposes a corporate income tax on businesses operating within the state. The tax rate is currently set at 6.925% for most corporations.

- Excise Taxes: Idaho collects excise taxes on specific goods and services, such as gasoline, cigarettes, and alcoholic beverages.

The Absence of State Income Tax

One of the most distinctive features of Idaho’s tax system is the absence of a state income tax. Idaho is one of only nine states in the U.S. that does not levy a personal income tax on its residents.

The decision to forego a state income tax has had significant implications for Idaho's economy and its residents. On the one hand, it has made the state an attractive destination for businesses and individuals seeking to minimize their tax liabilities. The absence of a state income tax can result in substantial savings for high-income earners and businesses, making Idaho a competitive choice for economic growth and development.

However, it is essential to note that the lack of a state income tax does not mean that Idaho residents are exempt from all forms of taxation. As mentioned earlier, Idaho relies on other types of taxes, such as sales tax and property tax, to generate revenue. These taxes can still impact residents' overall tax burden.

Comparative Analysis with Neighboring States

When comparing Idaho’s tax system to its neighboring states, the absence of a state income tax becomes even more apparent. For instance, Washington, which borders Idaho to the west, has a progressive state income tax with rates ranging from 0% to 9.98%. Oregon, another neighboring state to the west, also has a state income tax with rates up to 9.9%. Idaho’s decision to forego a state income tax sets it apart from these states and influences the tax strategies of individuals and businesses in the region.

| State | State Income Tax Rate |

|---|---|

| Washington | 0% to 9.98% |

| Oregon | Up to 9.9% |

| Idaho | 0% |

The Impact on Idaho’s Economy

The absence of a state income tax has had a profound impact on Idaho’s economic landscape. Here are some key considerations:

Attracting Businesses and Investments

Idaho’s tax-friendly environment has been a significant draw for businesses looking to establish or expand their operations. The lack of a state income tax can result in substantial savings for corporations, making Idaho an attractive location for corporate headquarters and new ventures. This influx of businesses contributes to job creation and economic growth within the state.

Individual Tax Burden

While Idaho residents may not pay state income tax, they are still subject to federal income tax and other state-level taxes. The absence of state income tax can provide some relief for individuals, especially those with higher incomes. However, it is essential to consider the overall tax burden, including sales tax, property tax, and other state-imposed taxes, when assessing the financial implications.

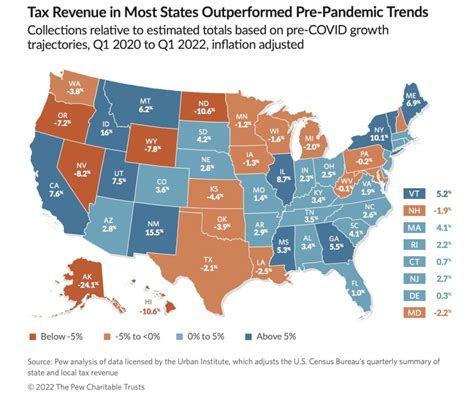

Revenue Generation and State Services

Idaho’s reliance on other tax sources, such as sales tax and property tax, has implications for the state’s revenue generation and the provision of public services. The state’s tax structure may impact the funding available for education, infrastructure development, healthcare, and other essential services. Balancing the need for competitive tax rates with the provision of adequate public services is a delicate task for Idaho’s policymakers.

Conclusion: Navigating Idaho’s Tax-Free Income Environment

Idaho’s decision to forego a state income tax has positioned it as a unique player in the U.S. tax landscape. The state’s tax-free income environment offers advantages and considerations for both businesses and individuals. While it can result in significant tax savings, it is essential to evaluate the overall tax burden and the impact on public services when making financial decisions in Idaho.

As Idaho continues to navigate its tax-free income environment, it is crucial to stay informed about tax policies and their potential implications. Whether you are a resident, a business owner, or an investor, understanding Idaho's tax system is key to making informed financial choices.

Are there any plans to introduce a state income tax in Idaho?

+

As of my last update in January 2023, there were no active proposals or significant movements towards introducing a state income tax in Idaho. The state’s tax system, including the absence of a state income tax, is a well-established and integral part of Idaho’s economic landscape. However, tax policies are subject to change, and it is essential to stay informed about any potential developments.

How does Idaho’s tax system compare to other states in the region?

+

Idaho’s tax system, particularly the absence of a state income tax, sets it apart from many neighboring states. For instance, Washington and Oregon, both bordering Idaho, have state income taxes with progressive rates. Idaho’s tax-free income environment can make it a competitive choice for businesses and individuals seeking tax-friendly locations.

What are the potential benefits of a state income tax for Idaho residents?

+

The introduction of a state income tax could potentially provide additional revenue for Idaho, which could be allocated towards funding public services and infrastructure. However, it would also mean a shift in the tax burden for residents, potentially impacting their financial planning and overall tax obligations.