Davidson County Property Taxes

Davidson County, located in the heart of Tennessee, is a vibrant and diverse region known for its thriving urban core, Nashville, and its surrounding picturesque landscapes. One of the key aspects that every property owner in Davidson County encounters is the annual property tax assessment and payment process. Understanding how property taxes work, how they are calculated, and what factors influence them is essential for both residential and commercial property owners.

This comprehensive guide aims to delve into the intricacies of Davidson County property taxes, offering a deep dive into the assessment process, tax rates, exemptions, and strategies to manage and potentially reduce your property tax obligations. By exploring real-world examples and providing expert insights, we aim to empower property owners with the knowledge they need to navigate this complex yet critical aspect of home and business ownership.

Understanding Davidson County Property Tax Assessments

Property taxes in Davidson County are an essential revenue source for the local government, funding critical services like schools, emergency response, infrastructure, and community development. The property tax system is designed to ensure that property owners contribute fairly based on the value of their real estate holdings.

The assessment process is a crucial step in determining property taxes. It involves evaluating the value of each property within the county. This is typically done by the Davidson County Assessor's Office, which employs professional appraisers to conduct assessments. These appraisers consider various factors, including:

- Recent sales of similar properties in the area.

- Physical characteristics of the property (size, condition, amenities, etc.).

- Local real estate market trends.

- Any recent improvements or additions to the property.

- Zoning and land use regulations.

Once the assessment is complete, property owners receive a notice of their assessed value, which serves as the basis for their property tax calculation.

Assessment Appeal Process

If a property owner believes their assessed value is inaccurate, they have the right to appeal. The appeal process in Davidson County is designed to ensure fair and accurate assessments. It typically involves the following steps:

- Request for Review: Property owners can request a review of their assessment by contacting the Assessor's Office. This initial step often involves providing evidence to support the claimed value.

- Informal Review: The Assessor's Office will conduct an informal review, which may include a meeting or conference call to discuss the assessment.

- Formal Appeal: If the informal review does not resolve the issue, property owners can file a formal appeal with the Davidson County Board of Equalization. This involves submitting a written appeal with supporting documentation.

- Hearing: The Board of Equalization will schedule a hearing where property owners can present their case. This is an opportunity to provide evidence, expert testimonies, and arguments to support a lower assessed value.

- Decision: After the hearing, the Board will make a decision, which can be further appealed to the Davidson County Chancery Court if necessary.

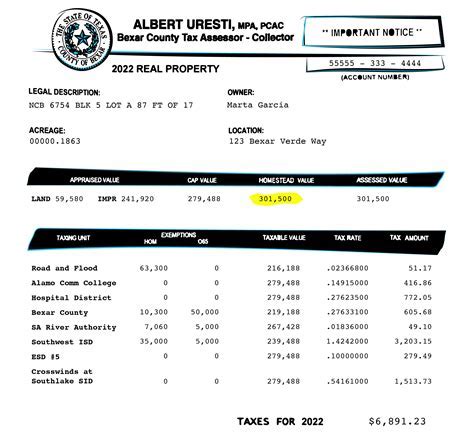

Calculating Property Taxes in Davidson County

Once the assessed value of a property is determined, the actual property tax amount is calculated using a straightforward formula. The basic equation is as follows:

Property Tax = Assessed Value x Tax Rate

While this equation is simple, the tax rate itself can be more complex. Davidson County, like many other jurisdictions, uses a millage rate to determine the tax rate. One mill represents $1 of tax for every $1,000 of assessed value.

For example, if a property has an assessed value of $300,000 and the millage rate is 15 mills, the property tax calculation would be:

Property Tax = $300,000 x 0.015 = $4,500

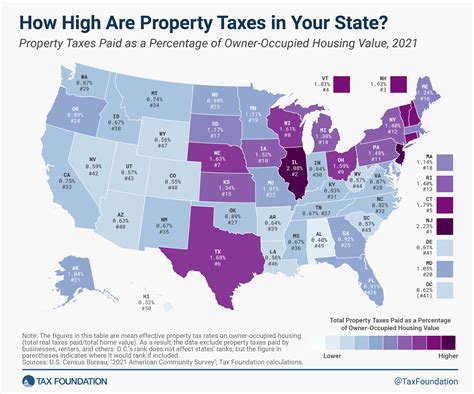

The millage rate can vary based on the type of property (residential, commercial, agricultural, etc.) and its location within the county. It's important to note that the millage rate can change annually, typically set by local government bodies like the county commission or city council.

Tax Rate Factors

Several factors influence the tax rate in Davidson County, including:

- Budgetary Needs: Local government bodies set the tax rate based on the budgetary requirements for the upcoming fiscal year. If more revenue is needed, the tax rate may increase.

- Property Value Growth: As property values increase, the tax base grows, potentially allowing for a lower tax rate to meet revenue needs.

- New Construction: New developments can impact the tax rate, especially if they significantly increase the overall property value in a specific area.

- Economic Factors: Economic conditions, such as recession or rapid growth, can influence tax rates. During economic downturns, governments may opt to reduce tax rates to stimulate the local economy.

Property Tax Exemptions and Relief Programs

Davidson County offers several exemptions and relief programs to help certain property owners reduce their tax burden. These programs are designed to provide assistance to eligible individuals and entities, ensuring a more equitable tax system.

Homestead Exemption

The homestead exemption is a common relief program offered by many counties, including Davidson. This exemption reduces the assessed value of a primary residence, effectively lowering the property taxes for homeowners. In Davidson County, the homestead exemption provides a reduction of up to $25,000 on the assessed value of a property.

To qualify for the homestead exemption, homeowners must meet certain criteria, including:

- Owning and occupying the property as their primary residence.

- Being a Tennessee resident.

- Filing an application with the Davidson County Trustee's Office by a specified deadline (usually before a certain date in February).

Senior Citizen Exemption

Davidson County also offers an exemption specifically for senior citizens. This exemption provides a reduction in property taxes for homeowners who are 65 years of age or older and meet certain income criteria. The exemption can reduce the assessed value of the property by up to $12,000.

Eligibility criteria for the senior citizen exemption include:

- Being a Tennessee resident.

- Owning and occupying the property as their primary residence.

- Having a combined household income of $32,000 or less (as of 2023 tax year).

- Submitting an application to the Davidson County Trustee's Office by the specified deadline.

Other Relief Programs

In addition to the homestead and senior citizen exemptions, Davidson County offers several other relief programs, including:

- Veterans Exemption: A property tax exemption for qualified veterans, offering a reduction in assessed value based on disability status.

- Agricultural Use Assessment: A program that allows agricultural land to be assessed at its current use value rather than its highest and best use value, benefiting farmers and landowners.

- Disabled Persons Exemption: Provides a reduction in property taxes for individuals with disabilities who meet certain criteria.

Strategies for Managing Property Taxes

Managing property taxes effectively can be a complex task, especially for commercial properties or those with significant assessed values. Here are some strategies that property owners can consider to potentially reduce their tax burden:

Stay Informed About Assessments

Regularly monitoring your property's assessment is crucial. Keep an eye out for assessment notices and compare them with your own research on recent property sales in your area. If you notice a significant increase in your assessment without a corresponding increase in market value, you may have grounds for an appeal.

Conduct Regular Property Assessments

Consider hiring a professional appraiser to conduct an independent assessment of your property. This can provide valuable insights into your property's value and potential areas for improvement. An accurate assessment can help you understand your property's true market value and make informed decisions about improvements or appeals.

Strategic Property Improvements

While improvements to your property can increase its value, they may not always result in a higher tax bill. Some improvements, such as energy-efficient upgrades or accessibility modifications, may be exempt from additional assessments. Research and consult with professionals to understand which improvements can provide both functional and tax benefits.

Utilize Tax Incentive Programs

Davidson County, like many other regions, offers tax incentive programs to encourage certain activities or investments. These programs can include tax breaks for historic preservation, energy efficiency initiatives, or economic development projects. Stay informed about these programs and consider how your property or business might qualify for such incentives.

Consider Tax-Efficient Ownership Structures

For commercial properties or those with multiple owners, the ownership structure can impact tax liability. Consult with tax professionals to explore options such as limited liability companies (LLCs), partnerships, or trusts, which may offer tax advantages based on your specific circumstances.

Conclusion: Navigating Davidson County Property Taxes

Understanding and effectively managing Davidson County property taxes is a complex but essential aspect of property ownership. By staying informed about assessments, utilizing available exemptions and relief programs, and implementing strategic management techniques, property owners can navigate the property tax landscape with confidence.

Remember, while this guide provides a comprehensive overview, it's always advisable to consult with professionals, such as tax consultants or attorneys, who can offer tailored advice based on your unique circumstances. Stay proactive, and your property tax obligations will be a well-managed part of your overall financial strategy.

Frequently Asked Questions

How often are properties reassessed in Davidson County?

+Properties in Davidson County are typically reassessed every four years. However, certain events, such as significant improvements or changes in ownership, can trigger an earlier reassessment.

Can I appeal my property taxes if I disagree with the assessed value?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate. The appeal process involves several steps, including a review by the Assessor’s Office and, if necessary, a hearing before the Board of Equalization.

What is the deadline for applying for property tax exemptions in Davidson County?

+The deadline for applying for most property tax exemptions in Davidson County is typically in February of each year. It’s important to check with the specific department (e.g., Trustee’s Office) for the exact deadline and requirements for each exemption.

Are there any tax incentives for energy-efficient upgrades in Davidson County properties?

+Yes, Davidson County offers tax incentives for energy-efficient upgrades through its Green Incentives Program. This program provides tax breaks for various energy-efficient improvements, such as solar panels, energy-efficient appliances, and weatherization measures. Property owners can claim these incentives by submitting the necessary documentation to the Assessor’s Office.

How can I estimate my property taxes before receiving the official assessment notice?

+You can estimate your property taxes by multiplying the previous year’s assessed value by the current millage rate. However, keep in mind that assessed values and millage rates can change, so this estimate may not be exact. It’s best to use this as a rough guide and await the official assessment notice for a more accurate calculation.