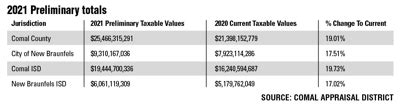

Comal County Tax Appraisal

In the heart of Texas, Comal County stands as a vibrant hub, home to a diverse range of residents and businesses. The Comal County Tax Appraisal process plays a crucial role in this community, impacting property owners and shaping the local economy. Understanding the intricacies of this process is essential for homeowners, investors, and those curious about the financial landscape of this thriving region.

Unraveling the Comal County Tax Appraisal: A Comprehensive Guide

The Comal County Tax Appraisal Office, with its dedicated team, ensures a fair and accurate assessment of property values, contributing to the county’s overall financial health. This guide aims to demystify the appraisal process, offering insights into its mechanics, benefits, and impact on the community.

The Appraisal Process: Step by Step

Each year, the Comal County Tax Appraisal Office undertakes a systematic evaluation of properties within its jurisdiction. This involves a detailed analysis of various factors that influence property values, including:

- Market Conditions: The office closely monitors real estate trends, sales data, and market fluctuations to ensure appraised values reflect the current market reality.

- Property Characteristics: Every property is unique. Appraisers consider factors like size, location, age, improvements, and any special features that might impact value.

- Comparable Sales: To establish an accurate value, appraisers analyze recent sales of similar properties in the area, ensuring a fair comparison.

- Tax Exemptions: Comal County offers various tax exemptions, and the appraisal office plays a crucial role in identifying and applying these benefits to eligible properties.

| Exemption Type | Description |

|---|---|

| Homestead Exemption | Reduces taxable value for primary residences. |

| Over-65 Exemption | Provides relief for seniors based on age and income. |

| Disabled Veteran Exemption | Offers reduced taxes for qualifying veterans. |

Transparency and Appeals: Ensuring Fairness

Comal County prioritizes transparency in its tax appraisal process. Property owners have the right to access detailed information about their appraised value and the factors considered. If a property owner believes their appraisal is inaccurate, a formal appeals process is in place, allowing for a review and potential adjustment.

The Impact on Property Owners

The Comal County Tax Appraisal directly affects property owners through their annual property tax bills. Accurate appraisals ensure that taxes are distributed fairly, with each property contributing its fair share to the county’s budget. This funding supports essential services like education, infrastructure, and public safety.

Economic Implications

Beyond individual property owners, the tax appraisal process has broader economic implications. It influences investment decisions, with accurate appraisals attracting businesses and developers. A well-managed appraisal system can stimulate economic growth, create jobs, and enhance the overall prosperity of the region.

Community Engagement and Education

The Comal County Tax Appraisal Office actively engages with the community, offering resources and educational initiatives to empower property owners. This includes workshops, online resources, and personalized assistance to ensure residents understand the appraisal process and their rights.

Future Outlook and Innovations

As technology advances, Comal County explores innovative solutions to enhance its appraisal processes. This includes utilizing advanced data analytics and digital tools to streamline operations, ensuring efficiency, and maintaining accuracy. The office is also proactive in staying updated with changing market dynamics and legal requirements, adapting its practices to meet evolving needs.

Conclusion: A Vital Community Service

The Comal County Tax Appraisal Office stands as a cornerstone of the community, ensuring a fair and efficient property valuation system. Through its meticulous processes, transparency, and community engagement, the office contributes to the financial stability and prosperity of the region. As Comal County continues to thrive, its tax appraisal practices remain a vital service, shaping the economic landscape and empowering residents and businesses alike.

How often are properties appraised in Comal County?

+Properties in Comal County are typically appraised annually, ensuring that property values are current and reflective of market conditions.

Can property owners request a re-appraisal if they disagree with the assessed value?

+Absolutely! Comal County provides a formal appeals process. Property owners can submit a request for a re-appraisal, providing supporting evidence to challenge the initial assessment.

What resources are available for property owners seeking more information about the appraisal process?

+The Comal County Tax Appraisal Office offers a wealth of resources, including online guides, FAQs, and the option to schedule a consultation with an appraiser. These resources aim to educate and assist property owners throughout the process.