Colorado Income Tax Calculator

Welcome to the comprehensive guide on understanding and calculating Colorado's income tax. In this expert-level article, we will delve into the intricacies of the Colorado state tax system, providing you with a detailed analysis and practical tools to navigate your financial obligations. Colorado's income tax structure is unique and offers various benefits and considerations for residents and businesses alike. By the end of this guide, you'll have a clear understanding of how to calculate your income tax liability and make informed financial decisions.

The Colorado Income Tax System: An Overview

Colorado’s income tax system operates under a flat tax rate structure, which means that all taxpayers, regardless of their income level, are subject to the same tax rate. This simplifies the tax calculation process and provides a sense of fairness across different income brackets. However, there are additional considerations and tax breaks that can impact your overall tax liability.

The state of Colorado imposes an income tax rate of 4.55% on taxable income. This rate is applicable to both individuals and businesses operating within the state. It's important to note that Colorado's tax system also includes various deductions, credits, and exemptions that can reduce your taxable income and, consequently, your tax liability.

Understanding Taxable Income

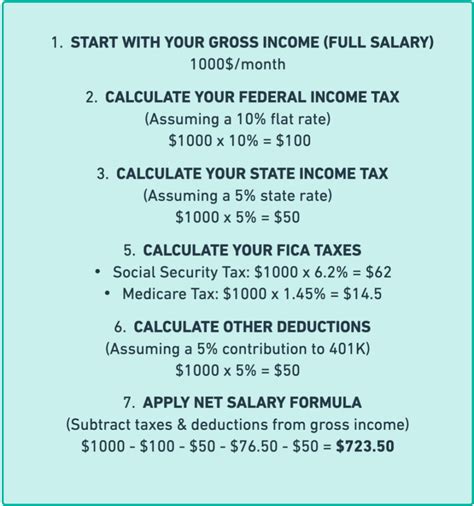

Taxable income is the key component in determining your income tax liability. It represents the portion of your income that is subject to taxation after accounting for deductions and exemptions. In Colorado, taxable income is calculated by subtracting any applicable deductions and exemptions from your total income. This could include deductions for items such as standard or itemized deductions, retirement contributions, and certain business expenses.

For instance, let's consider a hypothetical scenario where an individual named Sarah has an annual income of $60,000. If she qualifies for a standard deduction of $12,000 and has additional deductions of $3,000 for qualified expenses, her taxable income would be calculated as follows:

| Total Income | $60,000 |

|---|---|

| Standard Deduction | $12,000 |

| Additional Deductions | $3,000 |

| Taxable Income | $45,000 |

Calculating Your Colorado Income Tax

Now that we have a basic understanding of the Colorado tax system and taxable income, let’s explore the step-by-step process of calculating your income tax liability.

Step 1: Gather Your Income Information

Start by collecting all the necessary income-related documents. This may include your pay stubs, W-2 forms, 1099 forms, and any additional sources of income such as investment returns or self-employment earnings. Ensure that you have accurate and up-to-date information for the tax year in question.

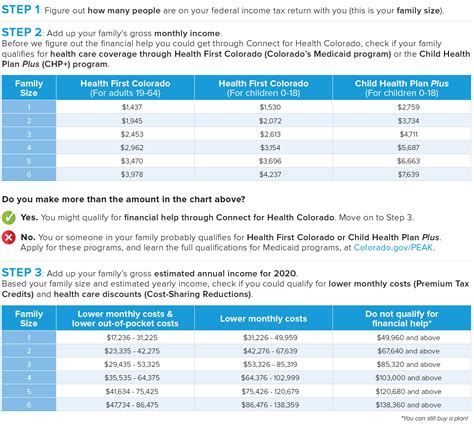

Step 2: Determine Your Filing Status

Colorado’s income tax system recognizes different filing statuses, including Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er). Your filing status will impact your tax liability and may entitle you to certain benefits or deductions. Consult the official Colorado Department of Revenue guidelines to determine your appropriate filing status.

Step 3: Calculate Your Adjusted Gross Income (AGI)

Your Adjusted Gross Income (AGI) is calculated by taking your total income and subtracting any eligible adjustments. These adjustments can include items such as student loan interest, alimony payments, or certain business expenses. Your AGI serves as the basis for calculating your taxable income.

Step 4: Apply Deductions and Exemptions

Colorado allows taxpayers to claim deductions and exemptions to reduce their taxable income. These deductions can include the standard deduction, itemized deductions for qualified expenses, and personal exemptions for yourself and your dependents. Carefully review the available deductions and ensure you meet the eligibility criteria.

For example, if Sarah, from our previous scenario, has two dependent children and qualifies for the standard deduction, her taxable income would be further reduced. Let's assume she claims an additional $4,000 in itemized deductions. Her taxable income calculation would then look like this:

| Taxable Income ($45,000) | |

|---|---|

| Personal Exemptions (2 x $4,000) | $8,000 |

| Itemized Deductions | $4,000 |

| Total Deductions | $12,000 |

| Final Taxable Income | $33,000 |

Step 5: Apply the Flat Tax Rate

With your final taxable income determined, you can now apply the flat tax rate of 4.55% to calculate your income tax liability. Simply multiply your taxable income by the tax rate to find the amount you owe in income tax.

Step 6: Consider Tax Credits

Colorado offers various tax credits that can further reduce your tax liability. These credits are designed to provide relief for specific situations or encourage certain behaviors. Some common tax credits include the Child Tax Credit, Education Tax Credit, and Renewable Energy Tax Credit. Research and identify any applicable tax credits you may be eligible for, as they can significantly impact your overall tax bill.

Filing Your Colorado Income Tax Return

Once you have calculated your income tax liability, it’s time to prepare and file your Colorado income tax return. The filing process can be completed electronically or by mail, depending on your preference and the complexity of your tax situation.

Electronic Filing

Colorado offers an online tax filing system called Colorado e-file, which allows taxpayers to file their returns electronically. This method is secure, efficient, and provides faster processing times compared to traditional paper filing. To use Colorado e-file, you will need to create an account and have your tax information ready. The system will guide you through the filing process, ensuring accuracy and ease of use.

Paper Filing

If you prefer a more traditional approach or have a complex tax situation, you can choose to file your Colorado income tax return by mail. The Colorado Department of Revenue provides tax forms and instructions that you can download or request by mail. Ensure that you fill out the forms accurately and completely, attaching any necessary supporting documents. Remember to keep a copy of your filed return for your records.

Due Dates and Extensions

Colorado’s income tax return due date typically aligns with the federal tax deadline, which is usually April 15th. However, it’s essential to stay updated with any changes or extensions announced by the Colorado Department of Revenue. Late filing may result in penalties and interest charges, so it’s advisable to plan and file your return promptly.

Maximizing Your Tax Benefits

Colorado’s tax system offers various opportunities to maximize your tax benefits and reduce your overall tax liability. Here are some strategies to consider:

- Retirement Contributions: Contributing to qualified retirement plans, such as a 401(k) or IRA, can provide significant tax benefits. These contributions are typically deducted from your taxable income, reducing your tax liability.

- Education Savings: Colorado residents can take advantage of the CollegeInvest 529 Plan, a tax-advantaged savings plan for education expenses. Contributions to this plan may be eligible for a state income tax deduction, making it an attractive option for funding future educational costs.

- Business Ownership: If you own a business in Colorado, you may be eligible for certain tax incentives and deductions. Consult with a tax professional to explore the available options and ensure you maximize your business-related tax benefits.

- Energy Efficiency: Colorado promotes energy efficiency through tax credits. If you invest in energy-efficient upgrades for your home or business, you may qualify for tax credits that can offset your tax liability.

Staying Informed and Seeking Professional Advice

Tax laws and regulations can be complex and subject to frequent changes. It’s essential to stay informed about any updates or amendments to Colorado’s tax system. The Colorado Department of Revenue provides official guidelines and resources to help taxpayers navigate the tax landscape. Additionally, seeking advice from a qualified tax professional or accountant can provide personalized guidance and ensure you make the most of your tax situation.

Common Tax Mistakes to Avoid

To ensure a smooth tax filing process, it’s crucial to avoid common mistakes. Here are some pitfalls to watch out for:

- Incorrect Income Reporting: Ensure that all sources of income are accurately reported. Failure to include all income can lead to penalties and audits.

- Overlooking Deductions and Credits: Be thorough in reviewing all available deductions and credits. Missing out on eligible deductions or credits can result in paying more tax than necessary.

- Late Filing and Payment: Filing your tax return and making payments on time is crucial to avoid penalties and interest charges. Plan ahead and set reminders to ensure compliance.

- Inaccurate Calculations: Double-check your calculations and consider using reliable tax software or professional services to ensure accuracy.

The Future of Colorado’s Tax Landscape

Colorado’s tax system is dynamic and subject to ongoing discussions and potential reforms. While the flat tax rate structure has been a hallmark of the state’s tax system, there have been proposals and debates surrounding tax reforms. Some advocates propose implementing a progressive tax system, where higher income levels are taxed at higher rates, while others argue for maintaining the flat tax structure.

The future of Colorado's tax landscape will likely depend on various factors, including economic conditions, political ideologies, and the state's fiscal needs. Staying informed about any proposed changes and their potential impact on taxpayers is essential for financial planning and decision-making.

Conclusion

Understanding and calculating your Colorado income tax liability is a crucial aspect of financial management. By following the step-by-step process outlined in this guide, you can accurately determine your tax obligations and take advantage of the various deductions, credits, and exemptions available. Remember to stay informed, seek professional advice when needed, and explore the opportunities to maximize your tax benefits.

Can I file my Colorado income tax return online?

+Yes, Colorado offers an online tax filing system called Colorado e-file, which allows taxpayers to file their returns electronically. This method is secure, efficient, and provides faster processing times compared to traditional paper filing.

Are there any tax breaks or incentives for businesses in Colorado?

+Yes, Colorado provides various tax incentives and deductions for businesses. These can include tax credits for research and development, job creation, and investment in renewable energy. Consulting with a tax professional can help identify the specific benefits applicable to your business.

What is the penalty for late filing of Colorado income tax returns?

+Late filing of Colorado income tax returns can result in penalties and interest charges. The penalty for late filing is typically 5% of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25%. Additionally, interest is charged on the unpaid tax at a rate of 3% per quarter.

Can I carry forward losses from one tax year to the next in Colorado?

+Yes, Colorado allows individuals and businesses to carry forward net operating losses (NOLs) from one tax year to the next. The carryover period for NOLs is 20 years, and the amount of the NOL can be used to offset future taxable income. This provision helps taxpayers manage their tax liability in years with fluctuating income.