Car Sales Tax In New Jersey

Understanding the intricacies of car sales tax is essential, especially when navigating the unique landscape of New Jersey's automotive industry. In this comprehensive guide, we will delve into the specifics of car sales tax in New Jersey, exploring the rates, calculations, and factors that influence this important aspect of vehicle purchasing.

The Landscape of Car Sales Tax in New Jersey

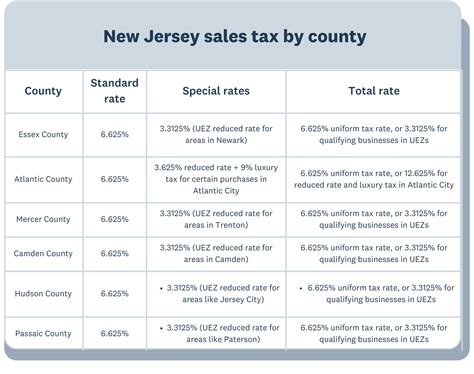

New Jersey, with its diverse population and thriving automotive market, presents a unique set of regulations and considerations when it comes to sales tax on vehicle purchases. Unlike some states, New Jersey’s sales tax structure is not a straightforward, uniform rate. Instead, it involves a combination of state and local taxes, creating a more complex but also more nuanced system.

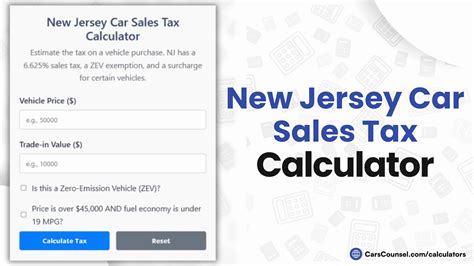

The state of New Jersey imposes a general sales tax of 6.625% on most retail sales, including vehicles. However, this is just the beginning of the story. New Jersey's sales tax system allows for additional local taxes, which can vary significantly depending on the county and even the specific municipality where the vehicle is purchased.

These local taxes, often referred to as municipal user taxes, can add a substantial burden to the overall sales tax liability. For instance, in certain counties, the combined state and local sales tax rate can exceed 8%, making it one of the higher rates in the country.

Calculating Sales Tax: A Step-by-Step Guide

Calculating the sales tax on a vehicle purchase in New Jersey involves a multi-step process. First, you must determine the base price of the vehicle, excluding any optional add-ons or aftermarket modifications. This base price is then subject to the applicable sales tax rate, which is a combination of the state tax rate and the local user tax rate.

For example, let's consider a vehicle with a base price of $30,000 being purchased in a county with a local user tax rate of 1.5%. The calculation would be as follows:

| Base Price | $30,000 |

|---|---|

| State Sales Tax (6.625%) | $1,987.50 |

| Local User Tax (1.5%) | $450 |

| Total Sales Tax | $2,437.50 |

So, in this scenario, the total sales tax owed on the vehicle would be $2,437.50, making the final purchase price $32,437.50.

Factors Influencing Sales Tax

Several factors can impact the sales tax liability on a vehicle purchase in New Jersey. One significant factor is the type of vehicle being purchased. While most vehicles are subject to the standard sales tax rate, certain categories of vehicles, such as electric or hybrid cars, may be eligible for tax incentives or rebates, reducing the overall tax burden.

Another critical factor is the timing of the purchase. New Jersey, like many states, often introduces tax incentives or sales tax holidays to boost economic activity. These periods may offer reduced sales tax rates or even tax exemptions on specific types of purchases. Staying informed about these temporal variations can significantly impact your overall tax liability.

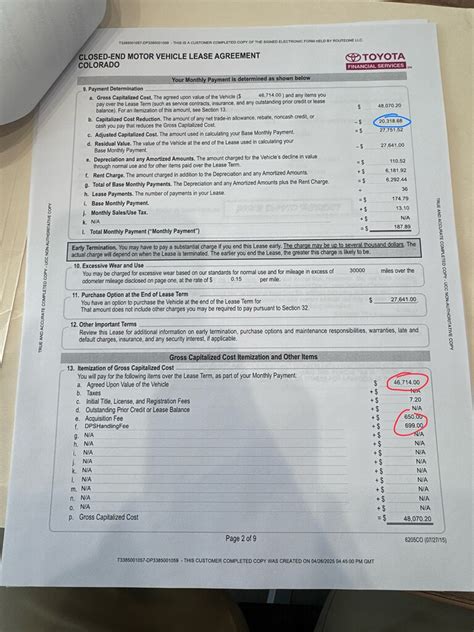

Vehicle Financing and Sales Tax

When financing a vehicle purchase, the sales tax calculation can become more intricate. In New Jersey, the sales tax is typically calculated based on the cash price of the vehicle, not the financed amount. This means that even if you are financing the vehicle over several years, the sales tax is due upfront, often as part of the down payment.

However, it's essential to note that some lenders may offer financing options that include the sales tax in the overall loan amount. This can provide a more manageable payment structure, especially for buyers with limited upfront funds. Always review your financing options carefully and consult with your lender to understand the sales tax implications of your chosen financing path.

Comparative Analysis: New Jersey vs. Other States

In the broader context of the United States, New Jersey’s sales tax system on vehicle purchases is relatively complex. While many states have a uniform sales tax rate, New Jersey’s combination of state and local taxes creates a more dynamic and potentially more challenging environment for buyers.

For instance, a state like California has a uniform sales tax rate of 7.25%, which applies across the state. In contrast, New Jersey's variable rates can lead to significant differences in tax liability depending on the location of the purchase. This variability can make it challenging for buyers to plan their finances accurately, especially if they are purchasing a vehicle in a different part of the state.

Impact on the Automotive Industry

The unique sales tax structure in New Jersey has a notable impact on the automotive industry within the state. Dealers and manufacturers must be well-versed in the local tax laws to provide accurate information to potential buyers. This level of expertise ensures a smoother buying process and can enhance customer satisfaction.

Furthermore, the variability in sales tax rates can influence consumer behavior. Buyers may choose to purchase vehicles in areas with lower tax rates, potentially impacting the revenue of municipalities with higher rates. This dynamic creates an interesting economic balance, with some areas benefiting from a competitive advantage in terms of sales tax.

The Future of Sales Tax in New Jersey

Looking ahead, the landscape of sales tax in New Jersey is likely to evolve. With changing economic conditions and shifts in consumer behavior, there may be calls for reform or standardization of the sales tax system. Such changes could simplify the process for buyers and dealers alike, potentially making vehicle purchases more accessible and understandable.

Additionally, with the growing popularity of electric and alternative-fuel vehicles, there may be increased pressure to adjust tax rates or introduce incentives to promote these environmentally friendly options. Such adjustments could have a significant impact on the automotive market in New Jersey, encouraging a shift towards more sustainable transportation choices.

Conclusion

Understanding the intricacies of car sales tax in New Jersey is essential for anyone considering a vehicle purchase in the state. The combination of state and local taxes creates a unique and potentially complex tax environment. By staying informed about the rates, calculations, and influencing factors, buyers can make more informed decisions and navigate the purchasing process with confidence.

As the automotive industry continues to evolve, the sales tax landscape in New Jersey will undoubtedly play a significant role in shaping consumer behavior and dealer strategies. With the potential for reform and the increasing focus on sustainability, the future of sales tax in New Jersey is an exciting and dynamic area to watch.

What is the average sales tax rate in New Jersey for vehicle purchases?

+The average sales tax rate in New Jersey for vehicle purchases is approximately 6.625%, which includes the state sales tax. However, local user taxes can add to this rate, resulting in a higher overall tax liability.

Are there any tax incentives for purchasing electric or hybrid vehicles in New Jersey?

+Yes, New Jersey offers tax incentives for the purchase of electric and hybrid vehicles. These incentives can reduce the sales tax liability, making these environmentally friendly vehicles more affordable. It’s recommended to check the New Jersey Clean Energy Program for the latest information on incentives.

How often do sales tax rates change in New Jersey?

+Sales tax rates in New Jersey are subject to change based on legislative decisions and economic conditions. While major changes are relatively infrequent, it’s always advisable to check the current rates with the New Jersey Division of Taxation before making a significant purchase.