Cabell County Tax Lookup

Welcome to the comprehensive guide on the Cabell County Tax Lookup, a vital resource for residents, businesses, and property owners in the area. In this expert-led article, we will delve into the intricacies of the Cabell County tax system, providing you with an in-depth understanding of how to navigate and utilize the tax lookup tools effectively. By the end of this article, you'll have a clear grasp of the tax assessment process, the online lookup procedures, and the various resources available to manage your tax obligations seamlessly.

Understanding the Cabell County Tax Assessment Process

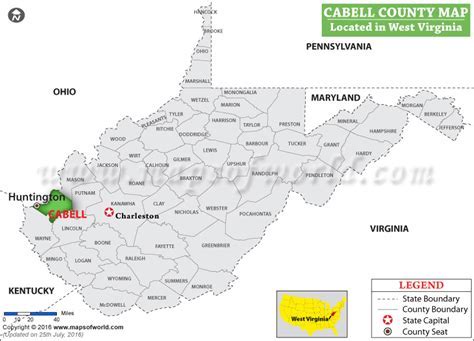

Cabell County, nestled in the beautiful state of West Virginia, boasts a robust and efficient tax assessment system. The process begins with the County Assessor’s office, which plays a crucial role in evaluating and determining the value of properties within the county. This valuation forms the basis for property tax calculations, ensuring fairness and accuracy in the taxation process.

The assessment process involves a thorough examination of various factors, including the property's location, size, improvements, and recent sales data. This data-driven approach ensures that property owners are taxed fairly based on the current market value of their properties. The County Assessor's office utilizes modern technology and advanced assessment techniques to keep up with the dynamic real estate market.

Once the assessment is complete, property owners receive a notice of their assessed value, along with details about their tax obligations. This notice serves as a transparent and informative document, providing clarity on the assessed value, the tax rate, and the expected tax amount. Property owners are encouraged to review these notices carefully to ensure accuracy and to address any concerns or queries with the Assessor's office.

Key Features of the Cabell County Tax Assessment System

- Fair and Equitable Assessment: The County Assessor’s office strives to ensure that all properties are assessed fairly, promoting a sense of trust and transparency among property owners.

- Regular Assessment Updates: Properties are reassessed periodically to account for changes in the market, ensuring that tax obligations remain in line with the current value of the property.

- Online Assessment Tools: The county provides online resources, including interactive maps and search tools, allowing property owners to easily access assessment information and track changes over time.

- Appeal Process: Property owners have the right to appeal their assessed value if they believe it is inaccurate. The County Assessor’s office provides a clear and accessible appeal process, ensuring that property owners can voice their concerns and seek fair resolutions.

| Assessment Type | Frequency |

|---|---|

| Real Property Assessment | Every 3 years |

| Personal Property Assessment | Annually |

Exploring the Cabell County Tax Lookup Tools

Cabell County has developed user-friendly online tools to facilitate easy access to tax information. These tools empower property owners, businesses, and interested individuals to retrieve vital tax data quickly and efficiently. In this section, we will guide you through the process of utilizing the Cabell County Tax Lookup system, highlighting its features and benefits.

Accessing the Tax Lookup Portal

To begin your tax lookup journey, visit the official Cabell County website and navigate to the Tax Lookup page. The portal is designed with a user-friendly interface, making it accessible to individuals with varying levels of technical expertise. Here’s a step-by-step guide to accessing the portal:

- Visit the Cabell County Website: Open your preferred web browser and type in the official Cabell County URL (https://www.cabellcounty.org/).

- Locate the Tax Lookup Link: On the homepage, you'll find a dedicated section for Tax Information. Click on the "Tax Lookup" link to proceed.

- Enter Property Details: The Tax Lookup portal will prompt you to enter specific property information, such as the property address, parcel number, or owner's name. These details help the system retrieve accurate tax data.

- Submit Your Query: After entering the required information, click on the "Search" button to initiate the lookup process. The system will then fetch the relevant tax information based on your query.

Upon successful submission, you'll be presented with a comprehensive overview of the property's tax details. This includes information such as the assessed value, tax rate, tax amount, and payment due dates. The portal also provides additional resources, including links to tax payment options, tax relief programs, and contact information for the Assessor's office.

Advanced Search Features

The Cabell County Tax Lookup portal offers advanced search features to cater to more specific queries. These features allow users to refine their searches and retrieve highly targeted tax information. Some of the advanced search options include:

- Address Search: Users can enter a complete or partial address to retrieve tax information for a specific property.

- Parcel Number Search: For those with access to the unique parcel number, this search option provides a direct lookup based on the assigned parcel identifier.

- Owner Name Search: Property owners or individuals with access to the owner's name can utilize this search feature to retrieve tax details for multiple properties associated with the owner.

- Map-Based Search: The portal integrates an interactive map, allowing users to visually select a property and retrieve its tax information. This feature is particularly useful for individuals unfamiliar with street addresses.

Maximizing the Benefits of the Cabell County Tax Lookup

The Cabell County Tax Lookup system is more than just a tool for retrieving tax information; it’s a powerful resource for property owners and taxpayers. By leveraging the system’s capabilities, individuals can streamline their tax management processes, access valuable insights, and stay informed about their tax obligations.

Streamlining Tax Payments

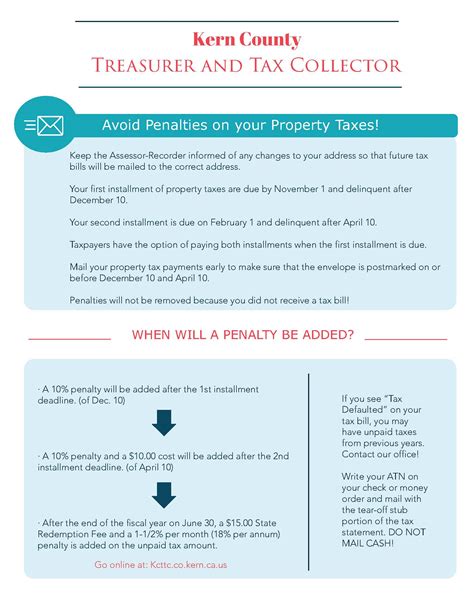

One of the key advantages of the Cabell County Tax Lookup is its integration with online tax payment systems. Property owners can utilize the portal to not only retrieve their tax details but also to make secure and convenient online payments. The system provides various payment options, including credit card, electronic check, and direct debit, ensuring a seamless and efficient tax payment process.

Additionally, the portal sends out timely reminders and notifications for upcoming tax due dates, helping property owners stay on top of their obligations and avoid any late payment penalties. This proactive approach to tax management fosters a positive relationship between taxpayers and the county, promoting timely and accurate tax payments.

Accessing Historical Tax Data

The Cabell County Tax Lookup system serves as a valuable repository of historical tax data. Property owners and researchers can delve into past tax records, tracking changes in assessed values, tax rates, and payments over time. This historical perspective provides insights into the county’s tax trends, market fluctuations, and property value appreciation.

By analyzing historical tax data, individuals can make informed decisions regarding property investments, tax planning, and budget forecasting. The system's ability to provide access to past tax records empowers users to conduct comprehensive research and gain a deeper understanding of the county's tax landscape.

Utilizing Tax Relief Programs

Cabell County offers various tax relief programs to support eligible residents and businesses. The Tax Lookup portal serves as a gateway to these programs, providing detailed information about eligibility criteria, application processes, and the benefits offered. Property owners facing financial hardships or meeting specific criteria can explore these programs to alleviate their tax burdens.

Some of the tax relief programs available in Cabell County include:

- Homestead Exemption: Eligible homeowners can apply for a reduction in their property taxes, providing financial relief for those with limited income or disabilities.

- Senior Citizen Tax Relief: Senior citizens who meet certain age and income requirements may qualify for reduced property taxes, easing the financial burden during retirement.

- Veteran's Tax Exemption: Cabell County recognizes the service of its veterans by offering tax exemptions to honorably discharged veterans, helping them manage their tax obligations more affordably.

Future Implications and Technological Advancements

As technology continues to evolve, Cabell County is committed to staying at the forefront of innovation in tax administration. The county’s leadership recognizes the importance of leveraging technology to enhance the tax lookup and management experience for its residents.

Integrating AI and Machine Learning

Cabell County is exploring the potential of AI and machine learning technologies to further improve the accuracy and efficiency of its tax assessment and lookup processes. By implementing advanced algorithms, the county aims to automate certain tasks, reduce human error, and provide more precise tax valuations.

AI-powered systems can analyze vast amounts of data, including historical tax records, market trends, and real-time property information, to generate more accurate assessments. This technology-driven approach not only benefits the county but also ensures that property owners receive fair and consistent tax valuations.

Mobile App Development

To cater to the increasing demand for on-the-go tax management, Cabell County is considering the development of a dedicated mobile app for its tax lookup and payment services. A mobile app would provide users with a convenient and user-friendly interface, allowing them to access tax information and make payments from their smartphones or tablets.

The app could include features such as push notifications for tax due dates, quick access to payment options, and personalized tax profiles. By embracing mobile technology, Cabell County aims to enhance user experience and encourage timely tax payments, further strengthening its relationship with residents.

Community Engagement and Feedback

Cabell County values community engagement and actively seeks feedback from its residents to improve its tax services. The county regularly conducts surveys and holds public forums to gather insights and suggestions from taxpayers. This feedback loop ensures that the tax lookup and management systems evolve to meet the needs and expectations of the community.

By incorporating user feedback, Cabell County can identify areas for improvement, address common pain points, and implement enhancements that streamline the tax process. This collaborative approach fosters a sense of ownership and trust among residents, promoting a positive tax culture within the county.

How often are properties reassessed in Cabell County?

+Properties in Cabell County undergo reassessment every three years for real property and annually for personal property assessments.

Can I appeal my property’s assessed value?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate. The County Assessor’s office provides a clear appeal process, including guidelines and deadlines for submitting appeals.

Are there any tax relief programs available in Cabell County?

+Yes, Cabell County offers various tax relief programs, including Homestead Exemption, Senior Citizen Tax Relief, and Veteran’s Tax Exemption. These programs provide financial assistance to eligible residents, reducing their tax obligations.

How can I stay updated with the latest tax information and due dates?

+You can stay informed by regularly visiting the Cabell County Tax Lookup portal, subscribing to tax-related email updates, and following the county’s official social media channels for timely notifications.

Is the Cabell County Tax Lookup portal accessible to individuals with disabilities?

+Yes, the Cabell County Tax Lookup portal is designed with accessibility in mind. It complies with web accessibility standards, ensuring that individuals with disabilities can access and utilize the portal effectively.