Navigating Your Arkansas Tax Refund: A Treasure Map to Extra Cash

For many Arkansas residents, the arrival of a tax refund signifies more than just a seasonal government refund—it offers an unexpected opportunity to bolster personal finances, pay off debt, or fund future aspirations. Yet, beneath the surface of this seemingly straightforward windfall lies a complex interplay between tax law nuances, state-specific procedures, and strategic financial planning. Proper navigation through the Arkansas tax refund process not only ensures the full receipt of owed funds but can also reveal opportunities for optimization, especially in an environment of fluctuating economic conditions and evolving tax policies. This article functions as a detailed treasure map, guiding taxpayers through each critical step and key consideration to maximize their refund, avoid common pitfalls, and harness their extra cash effectively.

Understanding the Foundations of Arkansas Tax Refunds

Before diving into strategic navigation, it’s essential to comprehend the foundational mechanics of how Arkansas tax refunds are generated, processed, and delivered. State income tax laws, filing procedures, and the role of deductibles and credits combined with the recent legislative shifts all influence the size and timing of refunds. Arkansas’s tax system, based on progressive income brackets, offers both opportunities and challenges: understanding how taxable income is calculated, how credits such as the Low-Income Tax Credit or Governor’s Conservationist Credit apply, and how deductions can influence the taxable base can make a significant difference in ultimate refund amounts. Additionally, the rise of electronic filing and direct deposit methods has streamlined access but also introduced new avenues for errors if not carefully managed.

Key Points

- Accurate filing and awareness of applicable credits can significantly impact refund size.

- Early filing and opting for direct deposit expedite receipt and reduce the risk of delays.

- Strategic review of tax documents pre-submission helps prevent common errors that delay refunds.

- Understanding legislative changes enables better planning for future tax seasons.

- Leveraging your refund through smart financial decisions maximizes the benefit of this cash influx.

1. The Critical Role of Precise and Complete Tax Filing

At the core of securing every dollar owed is the precision in your tax return submission. Arkansas uses Form AR1000 and related schedules to capture income details and relevant credits. Omissions, inaccuracies, or misinterpretations of available deductions can inadvertently reduce your refund or trigger delays. For instance, neglecting to report all sources of taxable income, such as freelance earnings or investment dividends, creates a mismatch that the Arkansas Department of Finance and Administration (DFA) scrutinizes more closely. Conversely, claiming eligible deductions—like property taxes or medical expenses—and credits—including the Arkansas Child Care Credit—can directly increase the refund. Accurate documentation is paramount: possessing W-2s, 1099s, and proof of deductible expenses ensures the return withstands audit risks and expedites processing.

| Relevant Category | Substantive Data |

|---|---|

| Refund Trigger | Accurate income reporting + eligible credits = maximum refund potential |

| Processing Time | Average 7-14 days if filed electronically and enrolled in direct deposit |

| Error Rate | Approximately 15% of refunds experience delays due to errors or incomplete submissions |

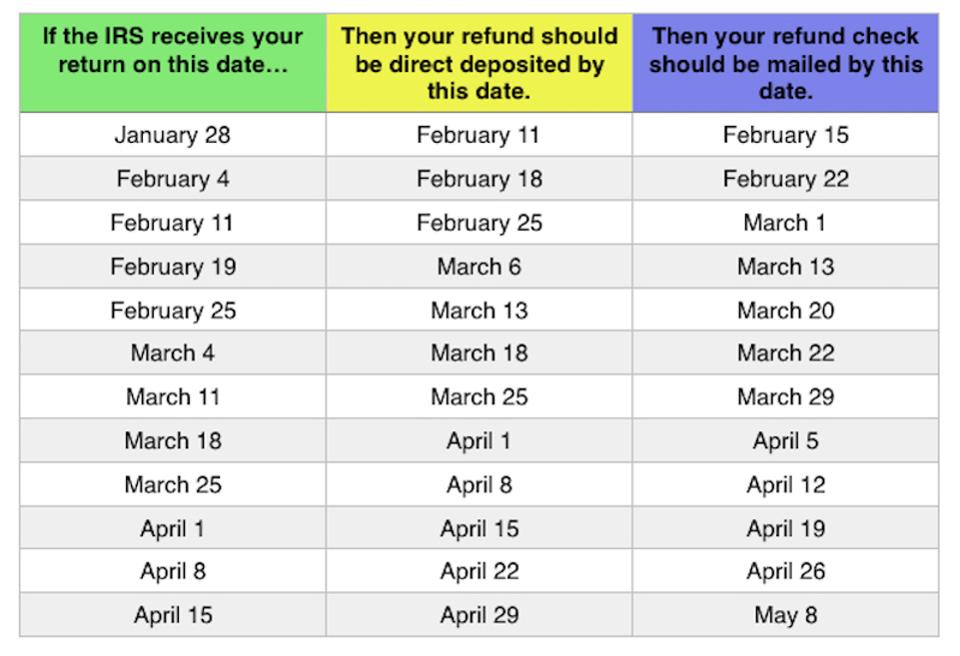

2. The Power of Electronic Filing and Direct Deposit

Opting for electronic filing with direct deposit is not merely a matter of convenience but a strategic move that influences the speed and certainty of receiving your refund. According to the Arkansas DFA, nearly 85% of refunds are processed within a window of one to two weeks when filed electronically, with over 90% delivered through direct deposit channels. This method reduces the risk of lost checks, theft, or postal delays. Additionally, electronic submissions are less prone to clerical errors, as built-in validation tools flag inconsistencies before submission. Taxpayers should ensure their banking information is accurate and active to avoid return delays. The DFA’s online portal provides a secure mechanism for verifying the status of refunds, enabling real-time tracking—a digital compass that keeps you informed on your financial treasure’s journey.

Maximizing Benefits of Digital Delivery

Beyond speed, electronic filing offers opportunities for strategic planning—such as timing your filing to coincide with other financial events or tax planning schedules. Furthermore, signing up for alerts or using the Arkansas DFA’s mobile app can provide proactive notifications, minimizing waiting uncertainty. In an increasingly digital economy, embracing electronic methods aligns not only with efficiency but also with security and control over your refund process.

| Relevant Category | Substantive Data |

|---|---|

| Refund Speed | 85% processed within 14 days electronically |

| Cost Savings | No postage or check-related fees when choosing direct deposit |

| Error Reduction | Validation algorithms reduce common data entry mistakes |

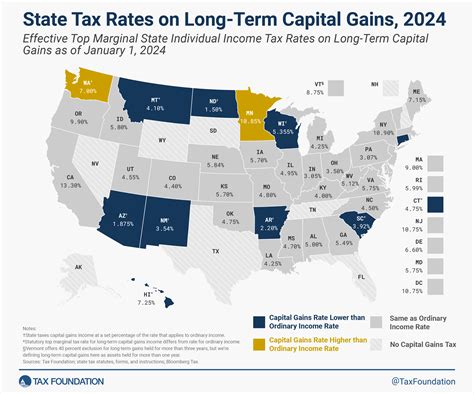

3. Navigating the Legislative Landscape for Optimal Refunds

Tax laws are not static; they evolve with legislative amendments, economic priorities, and political shifts. Recent Arkansas legislation has introduced changes to income brackets, credit eligibility, and deduction limits. Understanding these nuances is vital for strategic planning and refund maximization. For example, the Arkansas Child Tax Credit increased from 50 to 125 per qualifying child in recent years, providing a direct boost for eligible families. Similarly, adjustments to property tax relief programs or vocational credits can significantly influence your tax liability calculations. Staying informed requires monitoring official DFA communications, consulting professional tax advisories, or utilizing updated software that reflects current statutes. Recognizing how specific legislative changes apply to your unique circumstances can unlock additional benefits or identify potential pitfalls before filing.

Historical Context and Policy Shifts

Over the past decade, Arkansas has gradually expanded its tax relief efforts, partly in response to economic recovery and demographic shifts. For instance, the state’s aggressive attempts to broaden tax credits for low- and middle-income families have translated into larger refunds for qualifying residents. Conversely, periodic tax rate adjustments for higher income brackets can offset gains from standard deductions. These developments underscore the importance of a nuanced approach: a taxpayer’s refund today is the product of current legislation paired with thorough planning that anticipates future legislative trajectories.

| Relevant Category | Substantive Data |

|---|---|

| Recent Legislation Changes | Child Tax Credit increased by 150% since 2018 |

| Tax Bracket Adjustments | Standard Deduction increased by 10% in 2023 |

| Tax Credit Expansion | New credits for renewable energy investments introduced in 2022 |

4. Strategies for Enhancing Your Refund Through Deductions and Credits

Beyond legal compliance, proactive management of eligible deductions and credits can elevate your refund prospects. The Arkansas tax code offers a variety of avenues—such as deductions for charitable contributions, education expenses, or home mortgage interest; and credits like the Earned Income Tax Credit (EITC) and the Child and Dependent Care Credit. Identifying and documenting eligible expenses with meticulous care ensures no opportunity is overlooked. For instance, maximizing deductions for property taxes paid or keeping detailed records of qualifying educational costs can provide substantial benefits. Moreover, considering strategic timing—like bunching deductible expenses into a single year—can further optimize outcomes. Smart tax planning should balance current-year reduction of tax liability with audit penalties, staying within legal parameters while getting maximum refund value.

Case Study: The Impact of Strategic Deduction Bunching

Taxpayers who group deductible expenses—such as medical bills or charitable donations—into a single tax year often surpass the standard deduction threshold, resulting in a larger itemized deduction and, consequently, a higher refund. This practice requires accurate recordkeeping and foresight, but the payoff can be substantial, especially for those with fluctuating income or sizeable one-time expenses. Professional tax advisors often recommend this approach in high-deductible years, or when anticipating legislative changes that could limit certain deductions in the future.

| Relevant Category | Substantive Data |

|---|---|

| Maximum Deduction Increase | Up to $12,950 per individual in 2023 |

| Potential Refund Rise | Typically 10-20% increase in refund when deductions surpass standard thresholds |

| Critical Consideration | Avoiding audit risks by maintaining proper documentation |

5. Post-Filing Actions: Confirming, Tracking, and Next Steps

Filing is only the first stage; verifying receipt and tracking your refund ensures peace of mind. Arkansas offers online portals—such as the Arkansas DFA’s e-Services—for real-time tracking. Once submitted, taxpayers should confirm acknowledgment, then monitor status updates regularly. Any discrepancies or delays beyond the expected processing window warrant prompt contact with DFA representatives. Furthermore, employing financial planning techniques post-receipt—such as depositing supplementary income into high-yield accounts or initiating debt payoff plans—can amplify the benefits of the refund. Staying organized with tax documentation for future filings, especially re-applying overlooked credits or deductions, sustains a cycle of optimized refunds and financial health.

FAQs About Navigating Your Arkansas Tax Refund

How do I check the status of my Arkansas tax refund?

+Visit the Arkansas DFA’s e-Services portal and log in with your details to view real-time refund status. You can also call their dedicated helpline or set up email alerts for updates.

What if my refund is delayed or not received?

+Delays can occur due to errors, mismatched information, or compliance checks. Contact DFA directly to clarify issues, and ensure your banking or mailing details are current for direct deposit or check delivery.

Can I amend my Arkansas tax return if I discover an error?

+Yes, Arkansas allows amendments via Form AR1100-X. Timely amendments can retroactively increase your refund or correct underreporting, but should be submitted promptly with supporting documentation.

Are refunds taxed or subject to offsets?

+Generally, Arkansas refunds are not taxable since they are reimbursements of overpaid income tax. However, if the refund included credits for prior years or other specific circumstances, consult an tax professional for guidance.